Summary:

- Adobe Inc. is a leading creative software provider with a strong balance and consistent revenue growth, supported by a solid short-term catalyst through the use of new ‘Firefly’ AI products.

- However, the company’s focus on driving long-term growth through capital-intensive M&A and over-reliance on the creative cloud suite represent lost market opportunities claimed by newcomers Canva and Autodesk.

- With a price target of $566.63 signaling a 7% overvaluation, we recommend a HOLD position for Adobe stock until their organic growth prospects become clearer and investors temper their expectations.

JHVEPhoto/iStock Editorial via Getty Images

Written by Elaine Lan in association with Dylan Horton.

Adobe Inc. (NASDAQ:ADBE), with its unparalleled command in creative software, faces a horizon where the effects of economic trends, technological innovation, and competitive dynamics shapes its journey forward.

But until this competitive dynamic plays out and investors temper their heavy expectations for the company, we recommend a HOLD position on Adobe Inc stock.

Adobe Inc. is a Creative and Design Software Market leader, holding a significant 49% market share in a rapidly evolving industry. While Adobe’s innovation, particularly with AI in products like ‘Firefly,’ positions it for future growth, increasing competition from Autodesk and Canva and a potential (but less likely) advertising revenue drop warrant a more cautious approach. Our 12-month price target for Adobe is $566.63, reflecting these nuanced factors and a heavy market premium with a 7% overvaluation.

Historical Summary

Adobe Inc. is a premier global software company renowned for its pioneering solutions tailored to various design professionals. From graphic designers and illustrators to photographers and video editors, Adobe’s software suite facilitates seamless collaboration and optimizes workflows, serving individual creatives and comprehensive design teams.

As the dominant force in the Creative and Design Software Market, Adobe commands an impressive 49% market share in an industry valued at $10.7 billion. This sector’s high barriers to entry amplify Adobe’s competitive advantage.

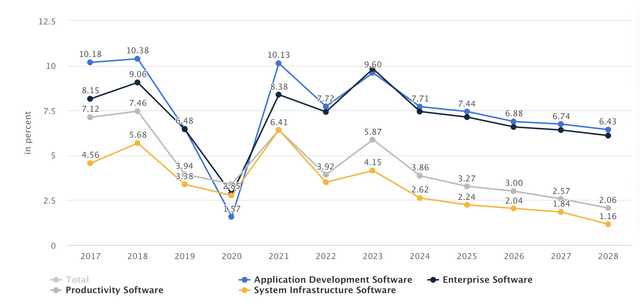

Yet, it’s essential to highlight the industry’s modest growth trajectory, with an expected compound annual growth (CAGR) of 6.8% from 2022 to 2028. While higher than other software markets, this modest growth predates an existing market-wide slowdown for application software, meaning further emphasis will have to be placed on Adobe’s ability to grow its current market share.

Delving into the competitive landscape, Adobe faces notable competition from companies like Autodesk and Canva, which hold 18.9% and 7% of the CAD software market share, respectively.

Autodesk is widely recognized for its architecture, engineering, and construction solutions, potentially positioning it for robust growth in the construction software segment. Meanwhile, Canva’s user-friendly interface and diversified design tools make it an emerging favorite among amateur designers and businesses, showcasing its adaptability and potential for future expansion. Both competitors, in their distinct ways, bring value to the market–Autodesk with its specialized software capabilities and Canva with its simplicity and broad reach–challenging Adobe’s dominance and driving innovation.

While Adobe’s speciality will always remain in the business of providing software services to designers and artists, it’s become unclear whether or not this is a sustainable field. As more competition from Autodesk for industrial software and Canva for beginner design software makes it harder for the company to pivot into these segments, Adobe will need to further solidify its emphasis on growth through acquisitions, which could hurt the company in the long run.

Historically, Adobe has showcased formidable financial momentum, reflecting an average YoY revenue growth of $1.9 billion over the past five years. This steady ascent and minimal fluctuations reinforce Adobe’s consistent growth pattern and dominance in its core segments. Data indicates a solid average YoY revenue growth of 17%, affirming the company’s reputation for reliable, high-caliber income.

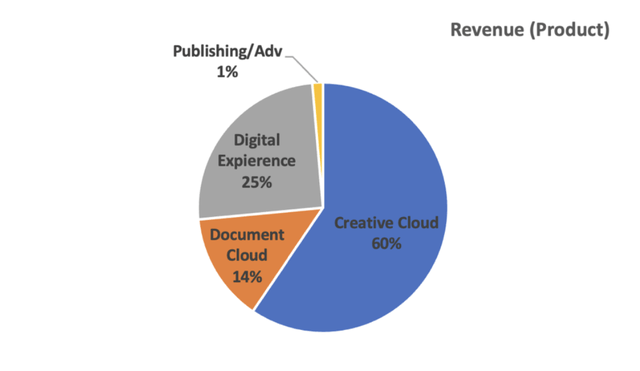

However, a glance beneath the surface reveals potential vulnerabilities. Adobe’s revenue streams are significantly anchored to a handful of its flagship offerings, notably within the Creative Cloud suite, which accounts for 60% of its total revenue. While these products have been historical revenue pillars, an over-reliance could introduce risks, especially amidst shifting market landscapes or emerging competition.

With regards to the Creative Cloud, there is a light of hope however.

Adobe recently unveiled its ‘Firefly’ AI product, marking its foray into generative AI. Seamlessly integrated with Photoshop, ‘Firefly’ operates on a distinctive credit system. Its launch, which saw significant media coverage, indicates potential positive revenue implications and widespread market interest. This endeavor’s initial success is mirrored in a subtle subscription price increase of 10%.

This combination of a dominant market position and a significant potential for AI driven growth has led Adobe’s shares to command a significant premium.

As of writing, shares are currently trading at a price-to-earnings (P/E) ratio of 50.85x, a notch far above the industry norm of 39.85x. This elevated P/E has raised concerns about overvaluation, which have been substantiated in our subsequent modeling.

Catalysts:

Gazing into the future, there is however more optimism surrounding Adobe’s financial outlook.

While the management has forecasted a 10% sales growth, the company’s proven growth trajectory, averaging around 17% YoY, suggests a high possibility of outperforming these projections.

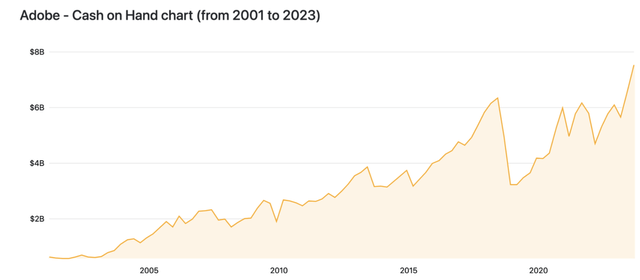

As indicated by its growing cash reserves, the company’s financial strength will also provide a solid foundation for future growth and strategic initiatives. The company’s cash has notably increased by over 100% in the past five years, suggesting a strategic capital accumulation. The steady decline in losses on marketable securities over the same period further reinforces Adobe’s strategic financial positioning. By liquidating securities and increasing cash liquidity, Adobe is fortifying its balance sheet. This move typically precedes periods of accelerated activity such as mergers and acquisitions, research and development investments, or expansion into new markets.

Historically, similar patterns of cash accumulation have preceded Adobe’s acquisitions, like those of Marketo and Magento in 2018, which catalyzed company expansion and revenue growth. While it is too early to tell yet if Adobe is looking to make another strategic acquisition, it is certainly a significant possibility keeping in mind the company’s previously long history of transformative M&A.

On the competitive side, Adobe’s integration of advanced software and artificial intelligence into its services sticks out as another major catalyst for growth.

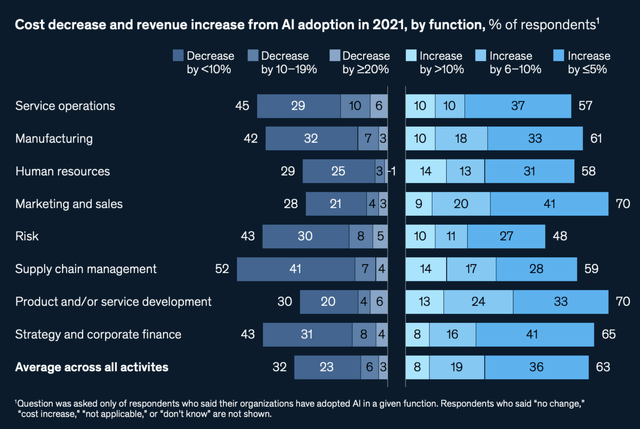

The use of AI across Adobe’s platforms can drive substantial improvements in efficiency, customer retention, and profitability. Technologies like Adobe Sensei not only enhance the functionality of Adobe’s suite of products through intelligent automation and predictive insights but also contribute to reduced operating expenses. Adobe Fresco provides digital artists with a responsive and natural painting and drawing environment, harnessing the latest advancements in touch and stylus inputs. Adobe Aero, on the other hand, empowers creatives to design immersive augmented reality experiences with ease, democratizing access to AR technology. Simultaneously, the expansion of the Adobe Document Cloud suite marks a strategic enhancement of Adobe’s offerings in the fast-growing remote collaboration space.

Survey research shows these cost savings can lead to improved profit margins, as business save around 5-10% with the automation of more laborious design tasks. This opportunity for efficiency, when coupled with Adobe’s consistent pricing strategy, will reinforce the brand’s reputation for quality and innovation to attract new leads.

Despite an increasingly competitive environment, the development of AI tools such as Adobe Fresco and Adobe Aero represents Adobe’s commitment to maintaining its technological edge and preserving market share.

By continuously enhancing its product suite, Adobe is not just catering to the current needs of digital creatives but is also shaping the future of digital artistry and design. This could prove critical in reversing a lagging market growth trend, with the company claiming a measly 2% market growth between 2017 to 2022. As countless TMT companies have similarly been catalyzed with new products following the growth of AI, it’s safe to assume that Adobe will also carry a similar potential for growth with its new suite.

Valuation:

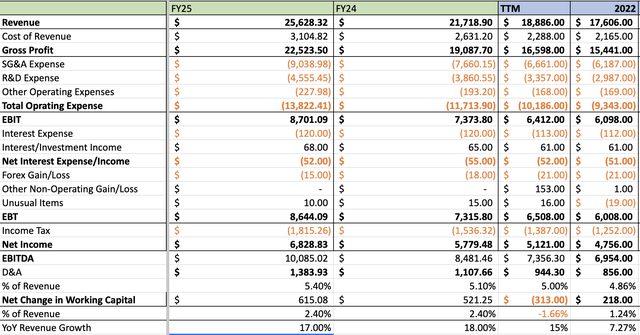

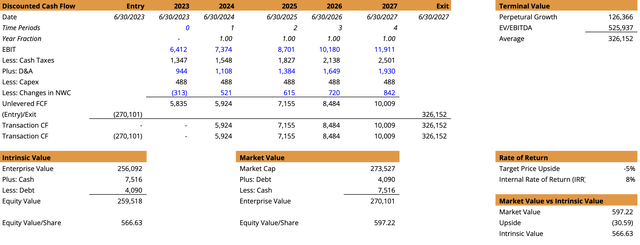

In modeling Adobe, we used detailed set of income statement projections that ultimately fed into a DCF. You can download and edit copies of the projections at this link.

Our initial projections anticipate revenue growth of 17% YoY, with a steady increase in EBITDA and net income, highlighting the company’s current growth trend and ability to enhance profitability over time with newer technology. For FY2027, we project a robust EBITDA of $13.84 billion, reflecting Adobe’s operational efficiency and innovation-driven growth.

For the DCF in particular, we used a perpetual growth rate of 1% and a WACC of 9% to determine a fair equity value. The DCF analysis, tempered by Adobe’s strong historical performance and future revenue projections, suggests an intrinsic value of $566.63 per share. This value is supported by Adobe’s significant gross profit margins and a consistent trend in reducing operating expenses as a percentage of revenue, as evidenced in the projections.

Phi Fiscal / Adobe 10K / Template: CFI

Upon consolidating the financial metrics, Adobe’s P/E ratio of 50.85x and P/S ratio of 13.6, as of November 2023, are justified by its future earnings potential. The company’s operating margin has shown remarkable stability, and the increase in ROE to 34.79% underscores Adobe’s effective capital utilization.

Therefore, despite a market valuation that currently exceeds our intrinsic value by approximately 7%, the financial modeling underscores Adobe’s capacity to sustain its market leadership and growth trajectory. Based on our analysis, the recommendation is to hold Adobe shares, with a calculated price target of $566.63, reflecting the company’s promising financial future balanced against a currently heavy market premium.

Risks:

Adobe Inc.’s enviable market position and financial success are not without their vulnerabilities, which manifest as a spectrum of systematic and non-systematic risks.

Systematic risks are exemplified by a cautious macroeconomic backdrop as the Federal Reserve continues to hold rates steady for early 2024. While this does have the possibility to tighten corporate spending and subsequently advertising budgets, the industry as a whole seems to be relatively unaffected. Advertising markets are still expected to have a CAGR of 4.6% FY24, which should keep revenue growth steady precluding any major market drops or recessions.

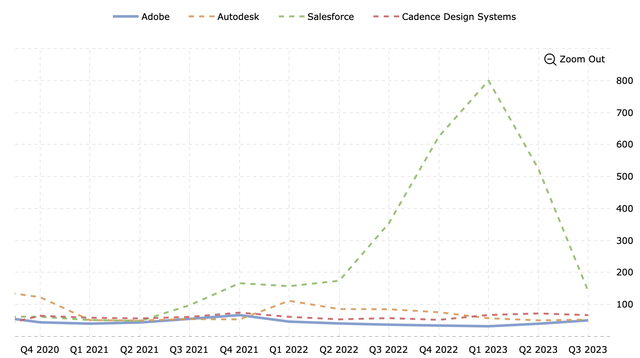

Where investors should pay attention, however, is in the companies non-systematic risks. Competitive pressures are intensifying with the presence of emergent players like Canva and Autodesk, whose high growth trajectories already trump Adobe’s own valuation. Although Canva does not currently trade publicly, it was valued at 23x forward revenue during its last 2021 funding round when compared to Adobe’s own 12x. Zooming out to the market, although Adobe does command a 7% premium, investors’ expectations for the company’s growth potential as a design firm are muted as evidenced by the lagging P/E multiples.

Historical P/E Ratios for Adobe’s Peers (MacroTrends)

Zooming back in to the competitive landscape, Autodesk’s incursions into sectors such as construction and Canva’s burgeoning appeal among amateur designers represent lost opportunities to grow Adobe’s current market share. When combined with the company’s existing focus on driving growth through capital-intensive inorganic M&A, it becomes apparent that the road ahead for Adobe in diversifying its product portfolio is rocky.

The company has seemed to acknowledge it’s over-reliance on the Creative Cloud suite, which accounts for 60% of its revenue, by gearing up for another acquisition and consolidating its current acquisition of Figma, although the latter has fallen through due to antitrust concerns. Despite Adobe’s large balance sheet, it remains to be seen whether management can fully execute on its vision to diversify Adobe’s product portfolio and generate more organic growth. While a failure to do so won’t spell an immediate end for the company, it will seal its fate in a current market with lagging opportunities.

The technological and innovation front, though a stronghold for Adobe, is also not impervious to risks. The company’s strategic pivot towards generative AI, embodied by the ‘Firefly’ AI product, underscores its commitment to cutting-edge technology. However, this move also brings with it the risks associated with the adoption of new technologies, including potential product obsolescence from new competitors offerings.

While Adobe’s integration of AI focuses on more experienced design professionals, competitors like Canva seek to undercut Adobe’s market share by using the same technology to target newer designers who are already 7% more likely to use AI. Although it is too early to predict any societal-wide shifts in AI adoption, it is safe to assume that Adobe’s current products related to this technology could further benefit from an increased demographic alignment.

Conclusion

Adobe’s historically large market position and solid financial performance paint a picture of a company at the forefront of digital creativity and innovation. However, an increasingly competitive landscape with newcomer Canva and Autodesk along with an unclear trajectory for organic growth overshadow the companies valuation. With a price target of $566.63 signifying an overvaluation of 7%, we recommend a HOLD position for Adobe Inc. stock.

For investors, the key here will be to balance the optimism surrounding Adobe’s strategic direction with the pragmatic considerations of risk and valuation. Although the company carries a strong position regardless of its choices with AI, expectations for growth may be overstated when considering the rockier competitive and regulatory environment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.