Summary:

- Despite brand power and high-profit margins, ADBE stock has fallen 50% from highs.

- Adobe continues to generate double-digit topline growth and reward shareholders with share repurchases.

- Growth is expected to continue in the upcoming year in spite of a tough macro backdrop.

- The stock trades at a market multiple in spite of faster growth rates.

gorodenkoff/iStock via Getty Images

Brand name stocks tend to sustain notable premiums, but does that apply to tech stocks as well? Adobe (NASDAQ:ADBE) is a brand that everyone knows and uses every day, but the stock has still been hit hard amidst the crash in tech stocks. The company remains highly profitable and is buying back stock – a lever that becomes more effective as the stock price languishes. ADBE maintains a net cash balance sheet and can likely sustain double-digit growth for many years. Investors looking for a profitable tech stock with secular growth may find ADBE attractive at current levels.

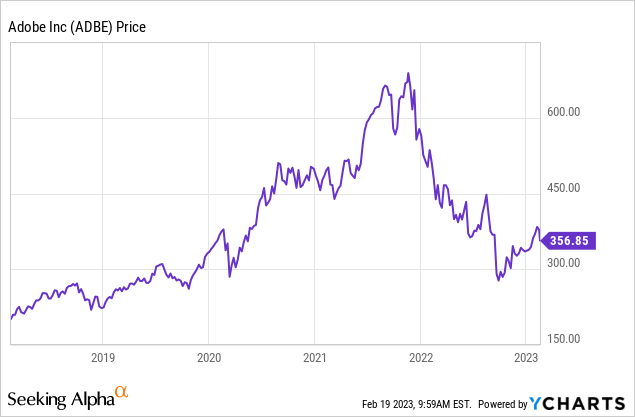

ADBE Stock Price

After peaking near $680 per share in late 2021, ADBE has since fallen around 48%.

I last covered the stock in September where I discussed why the stock was still a buy in spite of difficult third-quarter results and a surprisingly expensive Figma acquisition. The stock has since returned 15% but remains buyable after solid fourth-quarter results.

ADBE Stock Key Metrics

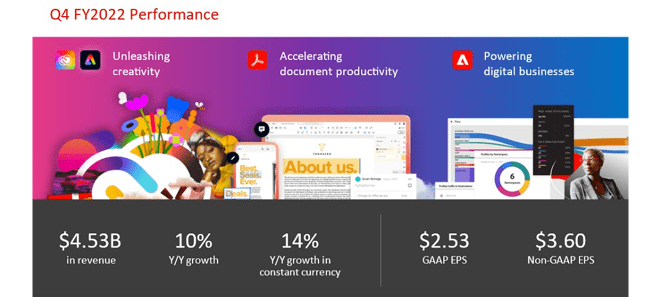

In its most recent quarter, ADBE delivered double-digit revenue growth (14% in constant currency) with non-GAAP earnings growing 12.5% to $3.60 per share. That bottom-line strength came even as its GAAP income tax rate rose over 600 bps to 22.4%.

2022 Q4 Presentation

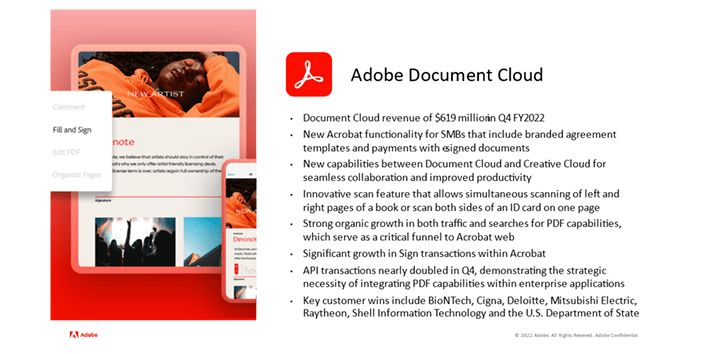

The top-line growth was highlighted by strength in Document Cloud, which grew by 16% (19% constant currency) to $619 million. That is a comparable growth rate to that of DocuSign (DOCU) in spite of a similar revenue base.

2022 Q4 Presentation

The company repurchased 5 million shares in the quarter and ended the year with 15.7 million in repurchased shares. Investors may be justified in finding the company’s autopilot share repurchase program to have been a poor use of capital over the past several years, but the buyback becomes more important after this slide in the stock price. The company ended the quarter with $6 billion of cash versus $3.6 billion in debt.

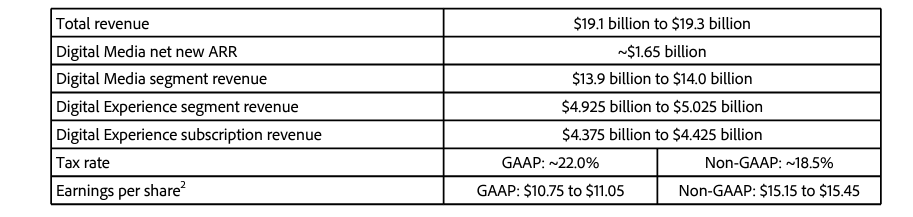

Looking ahead, ADBE has guided for around 9% revenue growth in the next fiscal year. Guidance for up to $15.45 in non-GAAP earnings per share reflects 12.7% YOY growth.

2022 Q4 Presentation

That guidance does not incorporate any impact from the pending Figma acquisition. On the conference call, management noted that they expect the first quarter to be the weakest, with growth improving throughout the year and finishing with a very strong fourth quarter. The reliance on strong back-end results may place some risk to the given guidance given the tough macro environment. Nonetheless, management believes that ADBE benefits from having a wide breadth of product offerings, as “single product companies are going to come under a lot of scrutiny.” Management believes that customers want to choose market leaders like ADBE for their digital investments, a trend that may become more pronounced under tough macro conditions.

Is ADBE Stock A Buy, Sell, or Hold?

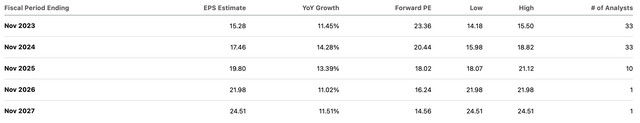

Prior to the crash in tech stocks, ADBE commanded rich premiums relative to the broader market. That premium has all but evaporated, with ADBE now trading at around 23x forward earnings – that is a market multiple in spite of double-digit projected earnings growth over the next several years.

Given the company’s strong profit margins and commitment to return capital to shareholders, the stock looks like exactly the kind of stock that should work in this environment. I could see ADBE returning to a 2x price-to-earnings growth ratio (‘PEG ratio’), implying a 28x earnings multiple by next year, and a stock price of $489 per share.

What are the key risks? Growth has slowed for many tech stocks due to the macro environment, but in ADBE’s case some of that slowdown may be due to the law of large numbers. It is possible that top-line growth is about to stagnate in the single-digit range from here on forward. ADBE has best-in-class profit margins, with 45% non-GAAP net margins in the past year. While I expect operating leverage, it is also possible that ADBE is earning more than its fair share and will instead see margin contraction. That may lead to a significant re-rating downwards as the multiple can only be justified under the assumption of earnings growing faster than revenues. Finally, the current macro backdrop makes forecasting very difficult, it is possible if not likely that the company misses on its guidance, something that is atypical for the company and unlikely to be easily forgiven by Wall Street. As discussed with subscribers to Best of Breed Growth Stocks, the best way to take advantage of the tech stock crash is by investing in a portfolio of undervalued tech stocks. ADBE fits right in as a highly profitable name with secular growth.

Disclosure: I/we have a beneficial long position in the shares of DOCU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks Portfolio.

Growth stocks have crashed. The time to buy is when there is blood on the streets, when no one else wants to buy. I have provided for Best of Breed Growth Stocks subscribers the Tech Stock Crash List, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!