Summary:

- Adobe’s stock dropped 13% post-earnings as strong Digital Media ARR and backlog growth in 4Q FY2024 were offset by weaker-than-expected revenue guidance for FY2025.

- Revenue growth continues to show YoY deceleration, despite strong demand for GenAI-related products.

- The margin outlook remains healthy, though there are no clear signs of expansion.

- The company achieved 85% YoY growth in FCF, driven by lower trade receivables and higher accrued expenses, rather than earnings growth.

- The stock is currently trading at a non-GAAP P/E fwd of 26.8x after the post-earnings selloff, presenting an attractive buying opportunity.

JHVEPhoto

What Happened

Adobe (NASDAQ:ADBE)(NEOE:ADBE:CA) was punished after reporting a mixed 4Q FY2024 earnings result, with the stock dropping nearly 13% the next trading day. While I understand the frustration around the weak revenue outlook, I think the market’s reaction was overdone.

There were a few bright spots. I had predicted a YoY decline in net new Digital Media ARR, but it actually came in stronger. On top of that, ADBE’s 4Q total backlog growth picked up slightly, which shows there’s still steady demand coming through.

On the negative side, even with a decent earnings outlook, ADBE’s forward revenue guidance came up short, with the high end of its guidance for 1Q FY2025 and FY2025 missing market expectations.

In my earlier analysis of ADBE’s 3Q FY2024 earnings, I maintained a “hold” rating because I didn’t see any clear signs of a revenue acceleration. Since then, the stock has declined 11.7%, significantly underperforming the S&P 500 by nearly 19%. Based on its FY2025 revenue outlook, further deceleration in revenue growth is expected compared to prior consensus expectations of a growth rebound. However, I believe this guidance is likely conservative and achievable, as we saw in the last quarter. Meanwhile, I believe the current valuation already reflects this outlook. Therefore, I’m upgrading the stock to a “buy”.

Muted Revenue Outlook in FY2025

The company model

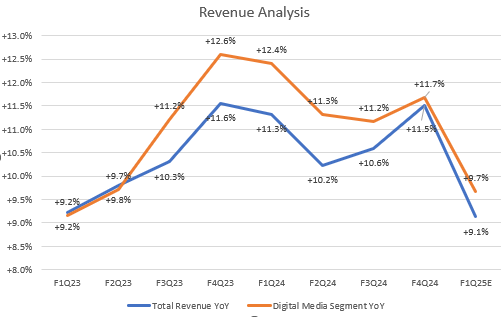

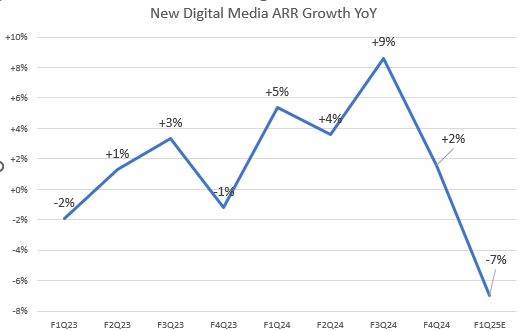

ADBE topped its revenue consensus for 4Q FY2024, achieving double-digit YoY growth driven by strong performance in the Digital Media segment. The company had previously issued a weaker-than-expected 4Q outlook, including a guided -3% YoY decline in new Digital Media ARR for the quarter. At the time, management attributed this guidance to a demand pull-forward. As shown in the chart below, the company was able to achieve 2% YoY growth.

The company model

However, ADBE has once again issued a cautious revenue outlook, projecting continued growth deceleration in FY2025. Based on the midpoint of its 1Q FY2025 revenue guidance, ADBE is expected to achieve single-digit YoY growth of 9.1%. The guided 11% YoY growth in Digital Media ARR for FY2025 implies a 6% decline in new Digital Media ARR. Given this outlook and the below-consensus revenue guidance for 1Q FY2025, I forecast that new Digital Media ARR growth in 1Q FY2025 will fall below 6%.

During the 4Q FY2024 earnings call, the management noted that the FY2025 revenue outlook factored in an approximately $200 million revenue headwind from unfavorable currency.

Total Backlogs Shows Resiliency

The company model

Nevertheless, ADBE’s underlying demand remains strong, as its total RPO grew 16% YoY, showing slight sequential acceleration from the prior quarter. Total RPO, or backlog represents the remaining contract value that the company will recognize as revenue in the future. During the earnings call, management highlighted the introduction of several GenAI models in their key products, which boosted productivity and drove significant demand in FY2024.

By calculating its 4Q FY2024 bookings value (adding the QoQ change in total RPO to total 4Q revenue), we can get a 13.5% YoY growth in total bookings. This suggests that the muted revenue outlook is not likely driven by a slowdown in demand.

Margin Outlook Is Healthy

The company model

Despite a weak revenue guidance, the company projects a better-than-expected EPS outlook, reflecting stronger operational efficiency in FY2025. The 1Q FY2025 non-GAAP operating margin is expected to be 47%, showing slight sequential improvement due to seasonality, though still lower YoY.

While the company doesn’t provide specific profit margin guidance, we can estimate it based on my non-GAAP EPS consensus (high end of the guidance) and guided 439 million diluted shares for 1Q FY2025. I believe the margin trend remains healthy, though it does not suggest clear expansion in the near term. Non-GAAP EPS growth is projected at 11.4% YoY. The bottom line is that the margin and earnings outlook align with historical trends but lack a potential inflection point to excite investors.

Strong FCF Growth in 4Q

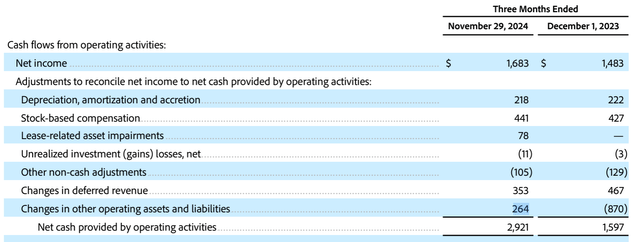

ADBE reported an 85% YoY increase in FCF for 4Q FY2024, driven by strong growth in OCF. However, this growth was not primarily due to improved earnings.

If we dig a little deeper, we can see that the strong OCF came from a positive contribution from “changes in other operating assets and liabilities.” On the balance sheet, this was mainly due to a significant drop in “Trade receivables” in Current Assets and a big jump in “Accrued expenses” under Current Liabilities.

These changes suggest that the company received more on-time payments from customers and delayed cash payments for expenses already recognized on the income statement. It’s possible that these changes could partly reverse in 1Q FY2025, which may put some pressure on its OCF outlook.

Valuation

After a nearly 13% post-earnings selloff, the stock is currently trading at a relatively cheap valuation. On a GAAP TTM basis, ADBE’s P/E has largely reset. Its non-GAAP P/E fwd is currently at 26.8x, nearly 24% below its 5-year average and in line with the sector average, according to Seeking Alpha.

As previously mentioned, ADBE has consistently delivered double-digit earnings growth in the past and is projecting nearly 11% YoY non-GAAP EPS growth in FY2025. While its EV/sales multiple looks less attractive given the lack of a revenue growth rebound, its P/E suggests a relative bargain in the current market, where valuations are above trend, driven by the GenAI frenzy. We can see that the Nasdaq 100 Index is trading at a 28.3x P/E fwd. Therefore, I upgraded ADBE to buy as the stock is also approaching to an oversold condition.

Conclusion

In summary, I believe the 13% pullback has already priced in the weak revenue outlook for FY2025. We saw similar weak guidance last quarter, but the company still managed to beat expectations. ADBE continues to show strong bookings, driven by new GenAI-related features. Most importantly, integrating Firefly into GenStudio will scale up content production capabilities, helping ADBE reach more enterprise customers. Additionally, margins remain resilient, supporting a double-digit EPS growth in FY2025. While the lack of revenue growth acceleration may justify a lower valuation, the selloff has made the stock’s multiple even more attractive. Since the current stock price is 12% below my last rating, I believe the stock is now justified as a “buy.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.