Summary:

- Adobe stock fell 9.1% after its Q3-2024 results, mainly due to slightly lower-than-expected guidance, but the drop seems overdone.

- Despite the guidance miss, ADBE beat revenue and EPS expectations, showing strong operational performance and cash flow growth.

- The valuation is now reasonable, implying attainable FCF per share growth over the next decade, making Adobe a long-term buy.

JHVEPhoto

Adobe (NASDAQ:ADBE) stock fell by 9.1% in after-hours trading after reporting its Fiscal Q3-2024 results. However, the digital media and design software stock likely didn’t deserve to fall by that much. The main reason for the fall was the lower-than-expected guidance, but it was hardly a miss. Now, you have a growing industry-leading company that’s back to a reasonable valuation, and that suggests long-term upside from here. As a result, I rate the stock as a Buy. If ADBE stock falls more in the future, I’d be willing to change the rating to a Strong Buy.

A Quick Overview Of Adobe’s Earnings Results And What Caused The Drop

Adobe’s Q3-2024 results beat both revenue and EPS expectations. Revenue of $5.41 billion beat estimates by $40 million and grew 11% year-over-year, while non-GAAP EPS of $4.65 beat estimates by 11 cents. Meanwhile, cash flow from operations reached $2.02 billion, up from $1.87 billion in the same quarter last year, remaining performance obligations at the end of the quarter were at $18.14 billion, and the firm bought back 5.2 million shares in the quarter. So far, so good.

The Guidance Miss

Here’s the part investors didn’t like. For Fiscal Q4 2024, Adobe forecasted revenue of $5.5 to 5.55 billion — $5.525 billion at the midpoint. That missed analysts’ estimates for $5.6 billion in revenue. Also, non-GAAP EPS is forecast at $4.63 to $4.68 — $4.655 at the midpoint. However, analysts were expecting EPS guidance of $4.67.

Essentially, the revenue guide was 1.34% lower than expected, and the EPS guide was 0.32% lower than expected.

Analysts Worry About Slowing Growth

In the earnings call, Wolfe Research analyst Alex Zukin asked the following question regarding net new Digital Media ARR guidance, as he was concerned because the Q4 guide is the lowest it has ever been sequentially:

The quarter itself, particularly on the Digital Media ARR looked very strong. It looked unseasonably strong because you haven’t grown net new ARR sequentially in the 3Q, I think, in almost four years. So maybe just comment like what drove this unseasonable strength. Is it pricing, AI traction, and particularly the Document Cloud net new ARR? But at the same time given all the product momentum you went through in the script, it’s a bit confusing to understand why the Q4 guide is the lowest it’s ever been sequentially for Q4 on net new Digital Media ARR, which I think makes people a little nervous about maybe the go-forward, the next year performance. And so maybe just address this dichotomy because it looks kind of seasonally a little bit different than what we’re used to. And I think it’s weighing on the stock after hours.

Adobe gave a response, and part of the response came from David Wadhwani, the President of the Digital Media Business. He stated that the early closure of some deals boosted Q3 at the expense of Q4, affecting the sequential growth pattern.

In terms of the specifics on timing, Q3 was a little stronger than you expected, and for a good reason given seasonality. I think a lot of that can be explained by a few deals that would have historically just closed in Q4, closing earlier than expected in Q3, and that changed the dynamic in terms of the linearity that you would typically see between Q3 and Q4.

Before that, he stated that the combined performance of Q3 and Q4 has met Adobe’s expectations, and they are on track for a strong second half of the year.

Is The Drop Justified?

I think Adobe handled that question well, so I don’t see any problems there. Thus, we’re now back to the main issue of the lower-than-expected guidance. Did such a small miss warrant a 9.1% drop? Probably not, but maybe the valuation was just too high before. I don’t really care about that, though, because we’re looking at what the price is now, not if was too high before. Now, the valuation is reasonable, which I’ll get into below.

Adobe’s Valuation Has Now Become Reasonable

I’ll be valuing Adobe using a reverse DCF calculator that I’ve created. Essentially, it calculates an implied growth rate that the market is expecting, and then you can decide if the stock can exceed that implied growth rate (which would make it undervalued) or not (which would make it overvalued). A more comprehensive guide can be found here.

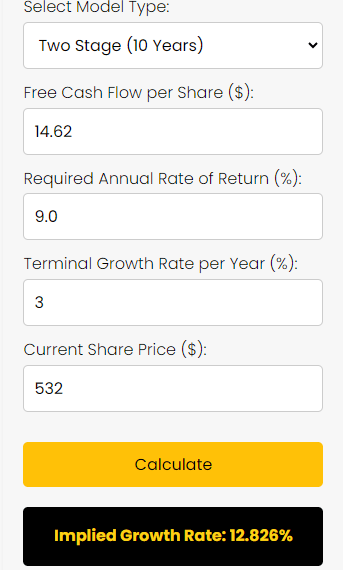

Here are the valuation inputs:

- FCF per share: $14.62, which I manually calculated after the earnings report

- Cost of equity (taken from Finbox, which calculates it using the CAPM model): 9%

- Terminal growth rate: 3%

- After-hours share price: $533

I used a 3% terminal growth rate for a few reasons. First, global GDP growth is estimated at around 3% for the next few years, and that seems like a reasonable growth rate in perpetuity. But besides that, if we assume the Fed’s 2% inflation rate goal is achieved, Adobe’s pricing power (which can easily be proven by its very high and stable ~88% gross profit margin) could allow it to at least raise prices that slightly outpace inflation.

Regarding the manual FCF per share calculation, here’s how I got it (just to show you that the figure is relatively reliable, as it’s not updated on most financial websites yet). I took the $2.02 billion in cash from operations in Q3 and subtracted the $57 million in CapEx to get $1.964 billion in free cash flow. To that, I added the FCF from the previous 3 quarters and got $6.55 billion in TTM free cash flow. I then used the 448 million outstanding share count provided in Adobe’s Q3 report and divided the $6.55 billion by that figure to get $14.62.

The Valuation

Looking at the screenshot below, we can see that the market is currently pricing in that ADBE will see its FCF per share increase by 12.826% per year for the next 10 years and then grow 3% per year after that in perpetuity.

ADBE Stock Reverse DCF (Author)

That seems very reasonable to me, especially considering that Adobe’s free cash flow is expected to grow to $10.73 billion by Fiscal 2026 (ending in November), per analyst estimates on simplywall.st. That’s 2.25 years away, and the 2.25-year CAGR from a base of $6.55 billion would be about 24.5%.

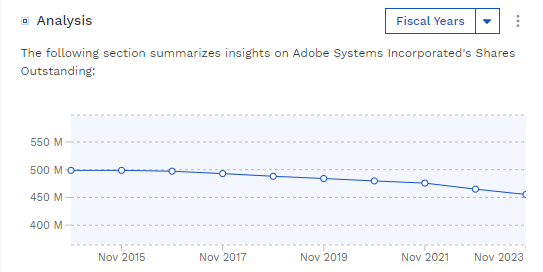

It’s possible that these estimates can be revised downward, but probably not by much, considering the very small guidance miss. Also, the 24.5% CAGR doesn’t include the positive effect of share repurchases, so consider that as well. For reference, Adobe’s levered FCF for the past five years comes in at 16.75%. The per-share amounts should be slightly higher due to the stock’s falling share count over the years, which you can see below.

ADBE Stock Shares Outstanding (Finbox)

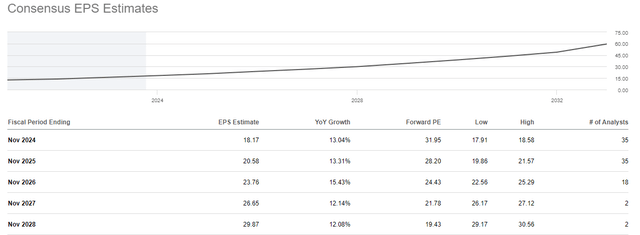

Additionally, analysts expect low-to-mid-teens EPS growth from Adobe in the next few years, helping prove my belief that the stock can meet the implied growth rate of 12.826%.

ADBE EPS Expectations (Seeking Alpha)

What Happens If You Adjust FCF For Stock-Based Compensation?

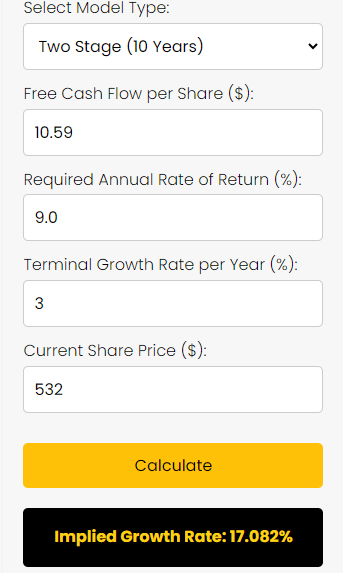

In my last article, I went a little hard on Palantir (PLTR) for its high stock-based compensation, so I didn’t want to leave it out of this article. If you deduct the trailing-12-month’s SBC of $1.819 billion from the $6.55 billion in FCF, you’ll get $4.731 billion ($10.59 per share) of what I call “real” free cash flow.

In this case, the implied growth rate jumps to 17.082%, but honestly, this still seems achievable to me based on the future free cash flow estimates. Still, let’s be real. Lots of people don’t bat an eye at SBC, and they value stocks based on adjusted figures anyway, so do with that information what you wish.

ADBE Reverse DCF With SBC Removed (Author)

The Takeaway

Adobe reported solid earnings that beat both revenue and EPS estimates. However, the stock fell in after-hours trading by over 9%, even though it only missed revenue and EPS guidance by 1.34% and 0.32%, respectively. Additionally, while the Q4 net new Digital Media ARR guidance seemed weak to analyst Alex Zukin, the company reassured investors that the reason for that is due to deals that were recognized in Q3, which normally would have been recognized in Q4.

After reading through the earnings report, I’ve come to the conclusion that the small guidance miss did not warrant a 9.1% drop. Now, the stock is trading at what I believe to be a reasonable valuation that implies 12.826% free cash flow per share growth for the next 10 years (17.082% if you remove SBC) and 3% per year after that. Based on the firm’s historical growth and future growth expectations, it could exceed or meet these implied growth rates. When I see an industry leader trading at a reasonable price, I become bullish for the long term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ADBE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.