Summary:

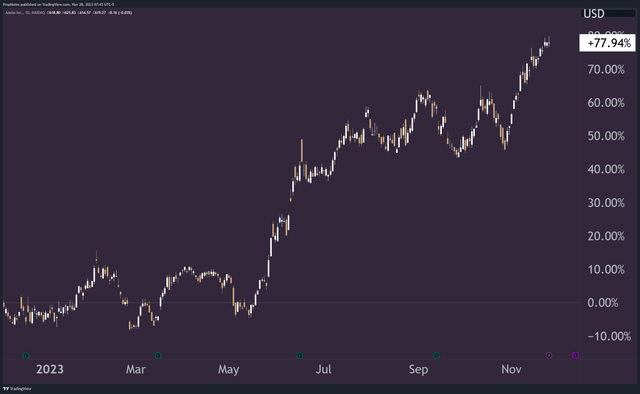

- One year ago, our article accurately predicted the rise of Adobe’s stock, which has since increased by over 77% since December 1st, 2022.

- The stock has outperformed many other major tech companies in 2023’s significant rally.

- Today, things have changed. We examine where the stock is now and why we think trimming your stake here is the right course of action.

- If you’re looking to enter the stock for the first time, you’re likely better off waiting for better prices.

- We downgrade Adobe to a “Hold”.

sburel/iStock via Getty Images

Almost exactly one year ago, we wrote an article titled “Adobe: Buy The Dip In This Excellent Compounder“. It’s the only article we’ve published on the company (NASDAQ:ADBE) in our time writing for Seeking Alpha, and it’s one of the most accurate calls we’ve made since we began.

Today, the stock is up more than 77% since we wrote about it, in one of the biggest mega-cap tech rallies we’ve seen this year, beating out the likes of AAPL, GOOG, AVGO, NOW, NFLX, and more:

TradingView

Today, we come bearing a new message: It’s time to trim.

Why? That’s what we’ll be exploring in today’s article.

Let’s jump in.

Where We Are So Far

In case you missed our first article, here’s a quick summary of our logic to get you up to speed.

1. Adobe is a Compounder:

- Adobe is a compounder with favorable demand dynamics. Over the five years prior to writing, its revenue had grown by 18% CAGR, and net income had surged by an impressive 23% CAGR.

2. Supply-Side Strength:

- Adobe’s supply of shares had decreased over the last five years prior to writing, indicating responsible share count management. This, when combined with the strong potential demand for shares, contributed to our perception of the company’s status as a compounder with favorable long-term potential.

3. Investment Opportunity:

- Market conditions at the time presented an attractive entry point for investors. The stock was oversold and heavily discounted, with technical indicators like RSI suggesting an opportunity for a rebound.

- The stock was also trading at a very ‘cheap’ historical valuation.

4. Concerns and Risks:

- We voiced some concerns in our article about the interest rate cycle, potential post-pandemic service demand pullback, and potential issues around the company’s $20 billion acquisition of Figma.

- However, overall, we found the company’s prospects, in aggregate, to be quite attractive.

What Has Happened Since

Since our article, there have been a number of developments. Let’s go through our previous points one by one in order to see where our thesis lies now.

First, let’s take a look at the demand side.

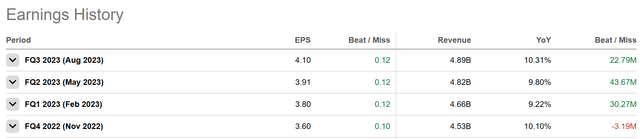

When it comes to earnings, the company has reported 4 strong quarters over the last year:

Seeking Alpha

While the company did miss on revenues slightly in Q4 22, it’s beaten on all other metrics since then. YoY Revenue growth has been steady right around 10%, and EPS has jumped from 3.40 to 4.10 from 22Q3 to 23Q3, which is growth of 20% YoY.

The results have been solid (as we anticipated), so there’s nothing really new to report on this front.

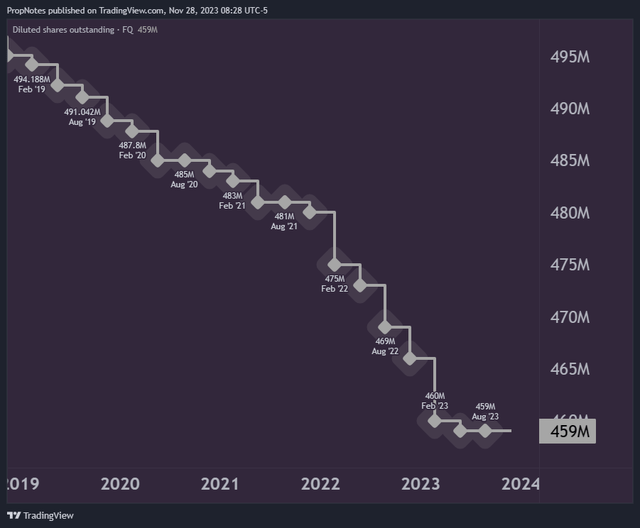

Second, let’s take a look at the supply side of shares.

When we last took a look at this metric, shares had gone from 500 million shares outstanding to 469 million shares outstanding in the 5 years between 2018 and the end of 2022; an average of 6.2 million shares bought back per year.

In the last 4 quarters, ADBE’s share count has dropped further to 459 million shares outstanding:

TradingView

This pace of buybacks was faster than in previous years, which indicates that more and more cash is going towards buying back shares to reward shareholders.

So, if anything, there’s progress on the buyback front.

Third, we mentioned a number of risks that were hanging over the stock, like the Figma acquisition, the continued rate cycle, and a lingering post-pandemic service demand slump.

We’re pleased to say there’s been progress on all three fronts.

First, the Figma acquisition has proven a bit of a challenge due to antitrust concerns, but management remains bullish. They said the following on the Q1 conference call:

Given the recent news reports, I wanted to provide an update on the process and timing of our pending acquisition of Figma … We are preparing for integration as we work through the regulatory process. From the outset, we have been well prepared for all potential scenarios while realistic about the regulatory environment. We have completed the discovery phase of the U.S. DOJ second request and are prepared for next steps, whether that is an approval or a challenge.

Adobe remains confident in the facts underlying the case. And based on current process timing, we believe the transaction continues to be on track for a close by the end of 2023.

It goes without saying that our Q1 success demonstrates that we continue to be ruthlessly focused on executing against our immense opportunities, independent of this combination.

In other words, they think the deal will go through, but even if it doesn’t, Adobe is doing well and should see continued opportunities for growth.

Second, the rate cycle appears to be coming to an end. The dollar has slumped recently on increased betting that we have seen our last cut.

A less tight rate environment should lead to increased economic risk-taking, which should benefit Adobe’s lines of business as well as the company’s valuation.

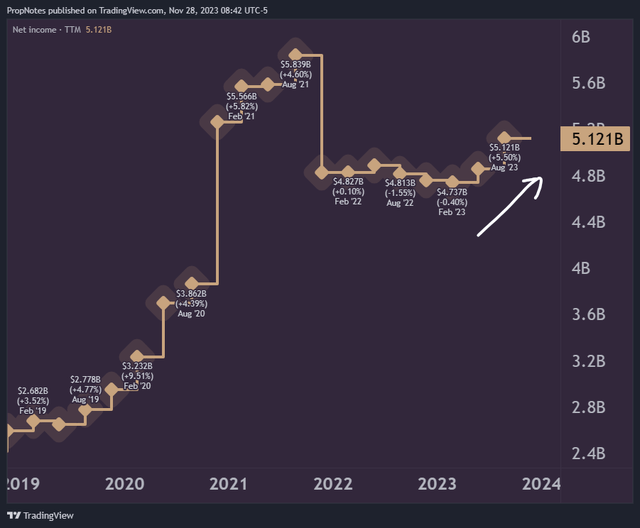

Finally, Adobe’s financial results prove that the post-pandemic slump was temporary.

TTM net income is re-accelerating, which is exactly what one would want to see from an investor standpoint:

TradingView

This is key, as other companies, like PayPal (PYPL) have struggled to gain positive momentum following a pandemic sugar rush.

So, looking at Adobe from a top-down perspective, the company seems to be in better shape than ever – Why is it time to trim?

Why It’s Time To Trim

This all comes down to our fourth point from the beginning of the article – the timing.

When we first published on Adobe, there were a number of issues and risks, but it was clear that the core business was strong, management was sound, and the stock had simply been beaten up due to its high multiple, combined with a faster-than-usual hiking cycle.

The stock was oversold and looked primed for a ‘Buy’.

However, fast forward a year, and the situation has changed completely.

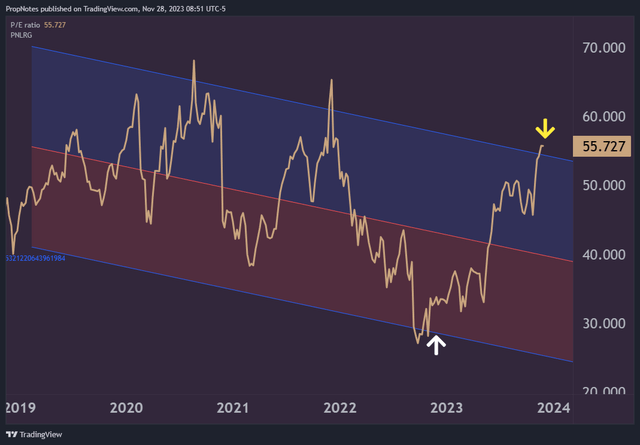

Far from being a ‘deal’, Adobe’s multiple now trades above and outside the company’s 5-year historical P/E valuation regression & deviation:

TradingView

This is in sharp contrast to where the stock was when we first wrote about it. You can see our initial article in white, with the present point in time in yellow above.

This indicates that the stock has now become extremely valued in the opposite and expensive direction and could be due for a pullback in towards long-term average pricing.

Additionally, the stock’s pricing may have gotten ahead of itself.

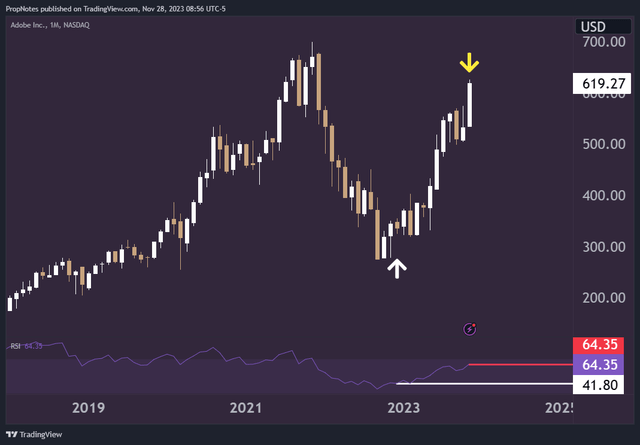

In our first article, we talked about how the stock was oversold on higher timeframes, reaching an RSI of 40 that hadn’t been seen in the decade prior:

TradingView

Recently, the stock’s rally has begun to approach the ’70’ mark, which is an indication of an overbought asset.

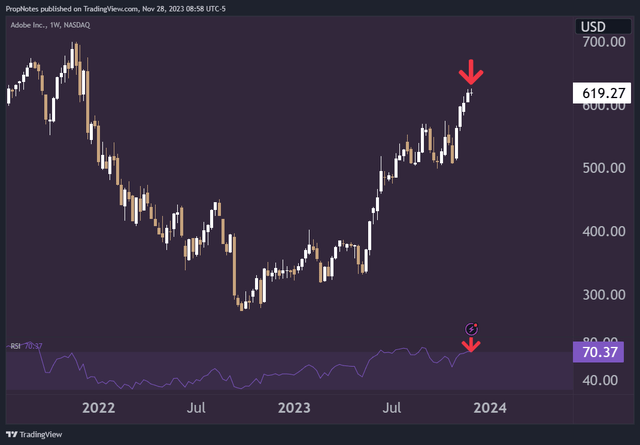

This reading is even more extreme when you zoom in to view the stock from a weekly perspective. The stock is overbought and appears ready to correct lower from a technical perspective:

TradingView

Thus, while the fundamentals may be improved, it appears more than priced in.

Risks

There are some risks with this thesis.

For one, things in motion tend to stay in motion. All of the factors that we’ve laid out show that the company is of high quality. Companies like this can go further and faster than one expects. For proof of this, simply look at other companies in the same high-growth category, like NVIDIA (NVDA).

Another risk is that of a quick win in the Figma case. A win there should bolster the stock and unlock lots of business synergies.

Finally, as you’ve likely noticed, our language in this article has mentioned “trimming” a number of times. This is because we think the best path forward for investors, due to the quality of the underlying company, is to trim some of a position here while aiming to buy back the stock in the future at a better price.

We think the opportunity will present itself for this occasion, but doing so runs the risk that the company will not present a material discount to today’s price in the short term. That would lead to higher transaction costs as well as a higher cost basis should one panic buy back in at a higher price.

Both of these outcomes would be sub-optimal.

As you can see, there are some risks to our thesis having to do with trimming here. That said, it seems like the best thing to do, on balance, to keep risk and reward in line.

Summary

All in all, Adobe is a great company. The fundamentals have never been stronger, and the company is de-risked substantially from the last time we visited it.

However, the recent price more than bakes this reality. At the present multiple, we think trimming a position and waiting to buy it back at a better spot is the most sensible thing to do.

Good luck out there.

Cheers!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.