Summary:

- Adobe’s strong brand and comprehensive software suite are attractive, but pricing and competition raise concerns.

- The recent focus on Customer Experience with AI tools shows promise but needs to translate to faster revenue growth.

- I am neutral and suggest a wait-and-see approach until management clarifies their growth strategy and the impact of CX initiatives on financials.

Justin Sullivan

Investment Thesis

Adobe’s (NASDAQ:ADBE) strong brand, comprehensive software suite, and recurring revenue model are attractive. However, high costs and competition raise concerns. Their recent focus on Customer Experience with AI tools like GenStudio shows promise but needs to translate to faster revenue growth. While the stock holds long-term potential, a wait-and-see approach is recommended until management clarifies their growth strategy and the impact of CX initiatives on financials.

Therefore, I’m initiating my coverage with a Neutral in the short term until I feel more confident that management is taking ownership of the future of the company.

Operations

The good, the bad, and the ugly:

The Good: Despite a one-time Figma deal fee ($1 billion), Adobe reported a decent first quarter.

The Bad: Management failed to reiterate its full-year outlook for net new annual recurring revenue during their last earnings call. The CEO’s optimistic “feel good” remarks contrasted with unclear guidance for Q2, leading to a confusing earnings call. Additionally, forecasts for Q2 are expected to be lower. In my opinion this might translate into a push to back-load revenue expectations for the end-year quarters which could be a risky move.

“So again, I look at the quarter and I feel really good, both about the product delivery as well as the way monetization is turning out. I mean, it’s clear, I guess, a little bit from sort of what we’ve seen that expectations were perhaps a little higher, both in terms of what we would guide for Q2, but I’m really optimistic about what we have done.”

The Ugly: Following the lackluster earnings call, Adobe’s 2024 Summit with over 10,000 attendees, including Shaquille O’Neal, failed to impress investors. While details about AI investments were presented, much of the information was already anticipated, and the event did not generate significant positive momentum for the stock price.

Management Evaluation

Shantanu Narayen joined Adobe in 1998, leveraging his product development experience gained from co-founding the photo sharing app Pictra at Apple. Over the years, he rose through the ranks, eventually becoming CEO in 2007. Employee sentiment towards his leadership remains positive, reflected in his high approval rating which sits at 93% on Glassdoor and employee recommendation rate at 86%.

In 2021, Adobe welcomed a new CFO, Dan Durns. He brings experience from the semiconductor industry, having served as CFO of Applied Materials (AMAT) before succeeding John Murphy upon his retirement.

Glassdoor Rating (Glassdoor.com)

My rating for Adobe’s management is: “Meets expectations”.

Adobe’s leadership has a strong track record. They successfully transitioned the company to a SaaS model, capitalized on the digital content boom, and made strategic acquisitions that solidified their position. This focus on recurring revenue has been a key driver of their success story.

However, recent events raise concerns about their ability to maintain this momentum, especially with the AI revolution. The lackluster earnings call and underwhelming Adobe Summit left investors, including myself, unimpressed. To regain confidence, they need to demonstrate a clear path to becoming a leader in the AI revolution or even leadership change.

Financials

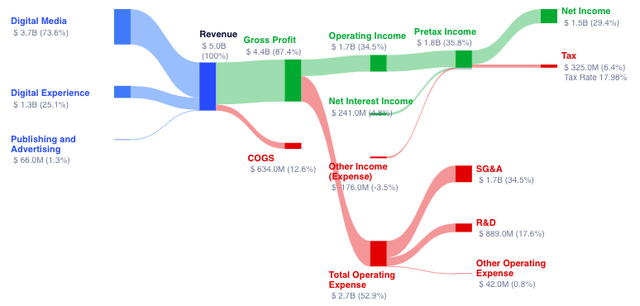

Adobe’s financials present a mixed picture. Revenue growth is positive, with their largest segment (Digital Media) experiencing a 12% year-over-year (YoY) increase, fueled by an impressive 18% growth in Document Cloud. Their second-largest segment, Digital Experience, also saw a 10% YoY increase. However, net income dipped significantly from $1.2 billion a year ago to $620 million in Q1, partly due to the one-time Figma termination fee.

Adobe Revenue Segments (GuruFocus.com)

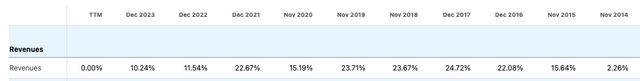

Adobe’s history of inorganic growth through acquisitions raises questions. While the Figma deal faced some skepticism, it could have offered long-term value by bringing in a strong UI/UX client base. However, this acquisition also highlights the challenge of accelerating stagnant revenue growth, which has remained below 20% for the past two years.

Revenue Growth over the years (seekingalpha.com)

Additionally, the recent $25 billion share buyback program raises concerns. It suggests they haven’t identified a project or an acquisition with the potential to reach their previous growth rate at over 20%.

On the positive side, I do not see any red flags in their financials. Adobe boasts a low-debt structure and an ROE relatively high for the Software industry. This strong financial health provides flexibility for future investments that could reignite revenue growth and propel them back above the 20% mark.

Corporate Strategy

After missing out on Figma’s strong User experience (UX) / User Interface (UI) user base. Adobe is sending a clear message this year that they are doubling down on the CX journey with their new “Compression” strategy. This strategy was a major talking point at their recent 2024 Summit.

The strategy aims to:

- Unify CX teams: braking down silos between different Adobe applications and streamline efforts.

- The creation of “Customer Journey Analytics” which is an AI power assistant to automate tasks across Adobe applications, boosting efficiency. This will be particularly useful for marketing campaigns and institutional clients.

- Lastly, I believe this will give Adobe a deeper user insight and gain a more comprehensive understanding of customer journeys.

The true highlight of the 2024 Summit was arguably the unveiling of Adobe GenStudio (actually introduced in September 2023). This is an “all-in-one” hub that leverages generative AI to streamline content creation, addressing bottlenecks from the initial point of developing a concept to the final approval of the project. Major clients including the like of IBM (IBM) and Pfizer (PFE) were promoted at the Summit as already finding value in GenStudio, particularly within their supply chain management.

While Adobe advancements in CX and content creation are positive steps. It remains to be seen if they’ll significantly accelerate revenue growth. Focusing primarily on enhancing existing offerings for current clients within the Digital Experience segment might not be enough to stay ahead of competitors in the rapidly evolving AI revolution.

| Focus | Strengths | Weaknesses | Target Users | Pricing Model | |

| Adobe | Creative Suite, Document Management | Document editing, industry standard, document cloud integration. Involved in the entire CX journey. | Subscription model. pricing can be expensive and include more applications than needed. Steeper learning curve | Professional Designers including photographers and media project managers. Students | Subscription based with various plans |

| DocuSign (DOCU) | e-Signatures | Integration with multiple platforms. Secure e-Signatures. | lacks more applications and has a very specific niche market. | Business of all sizes. Attracts legal professionals and real estate agents | Subscription based |

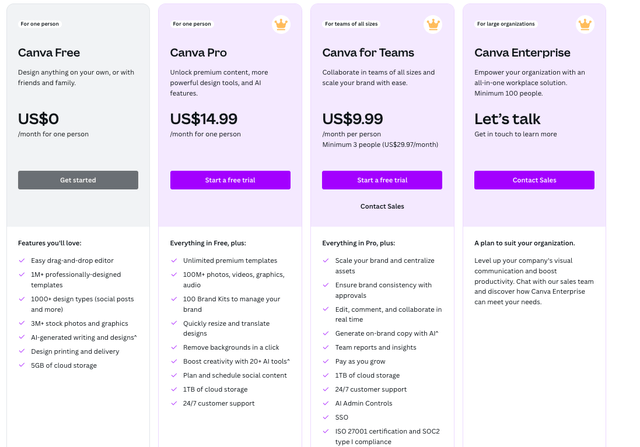

| Canva | Graphic Design, Presentations | User-friendly interface, large template library, freemium plans. | Limited features compared to Adobe. Free plan has its own limitations. | Small businesses, social media managers, educators, and individuals | Various plans: Free Plan, Pro Plan, and Enterprise Plan. |

| Figma | UI/UX Design | Powerful tools for prototyping, and collaboration | Lacks features for the entire CX journey | UX/UI designers and product management teams | Subscription with various plans |

| Webflow | Website Design and Development | Code friendly, CMS integration, web designs | Requires some coding knowledge for advanced customization | Attracts web designers, developers, and businesses | Subscription based with various plans |

| Miro | Whiteboard Collaboration | Project management tools, real time collaboration | Visual collaboration not for documents | Attracts businesses of all sizes, teams from all industries | Freemium model and enterprise plans. |

I’ve created a table (see above) that illustrates Adobe’s competitive landscape.

Despite its position as a creative software powerhouse, Adobe faces challenges in maintaining its lead. While their comprehensive suite caters to the entire customer experience (CX) journey, this “one-stop-shop” approach can be a double-edged sword. It creates a strong barrier to entry but might also lead to stagnant revenue growth if not managed strategically.

Their impressive track record of acquisitions (close to 60 since going public) has historically fueled revenue growth but missing out on Figma raises concerns about future acquisitions and their ability to achieve high growth.

Adobe faces several challenges and risks:

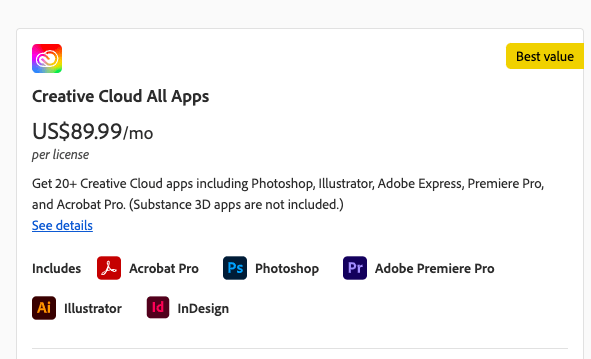

- Pricing: Creative Cloud subscriptions, which Adobe’s core solution, can be a significant cost barrier dissuading individuals and small businesses. Further their packages may offer more bundle services than what is needed for basic use. Other alternatives, like Canva’s “freemium” model offer a compelling alternative for basic design needs.

Adobe Pricing (adobe.com) Canva Pricing (Canva.com)

2. Software Complexity: Adobe vastness of their software suite can create a steep learning curve, overwhelming new users compered to new user-friendly alternatives, like DocuSign’s e-signature or the basic templates on Canva. In my opinion, Adobe should offer improved user onboarding experiences catering to different skill levels.

3. Targeted Competition: Several players are offering targeted solutions that are both user-friendly and affordable. For example, Canva focuses on design simplicity with a freemium model. DocuSign specializes in e-signatures, and Midjourney offers AI-powered creative tools at a lower price point. Additionally, a growing threat to Adobe Creative Suite is open-source software.

Valuation

Adobe’s currently trades at around $500.

Using a conservative 11% discount rate ((r)). This represents a rate of return that an investor expects to receive considering time value and inherent risk of that investment. To calculate it, I used a 5% rate for time value and because Adobe is a large cap company I used the 6% average market premium.

Then, using a simple two staged DCF calculator I reversed the formula to obtain its implied Free Cash Flow (FCF) growth rate which is 22%.

$500 = sum^10 FCF (1 + “X”) / 1+r) + TV FCF (1+g) / (1+r)

*I also added Book Value in the calculation

For comparison, Adobe 5-year average FCF growth rate is 21.7%. That is, the market still believes at this point that Adobe can keep growing at the same rate as it has done over the last 5 years. However, when I look at Adobe’s current FCF growth rate for the TTM is just over 3%. For a “Buy rating”, I require clearer strategies from management to achieve this level of growth to above 20% which is also closely tied to revenue growth.

Table with SA Growth rate (Seekingalpha) Table with SA Growth rate (Seekingalpha.com)

I believe there will be an increase in volatility leading up to the next earnings report in mid-June. Given the lack of clarity during the last earnings call, I also believe earnings may be backloaded, potentially impacting the stock price.

In the near term and observing the technicals of the stock I expect Adobe’s stock price to trade within a range of $490 to $525. A significant drop to around $470 or a break above $575 would warrant a revaluation of my investment thesis.

Takeaway

Despite its strong brand and comprehensive software suite, Adobe faces challenges including pricing and slowing user growth leading to stagnant revenues for the last two years. While initiatives like AI-driven CX tools show potential, I remain doubtful of their impact on revenue growth. With a sound financial position but a need for clear strategies on pricing, user experience, and AI integration, Adobe’s recent buyback program suggest a focus on “quick” shareholder returns over finding high-growth ventures.

Therefore, I’m starting my coverage of Adobe with a Neutral stance awaiting clearer growth strategies and the impact of CX initiatives on financials.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.