Summary:

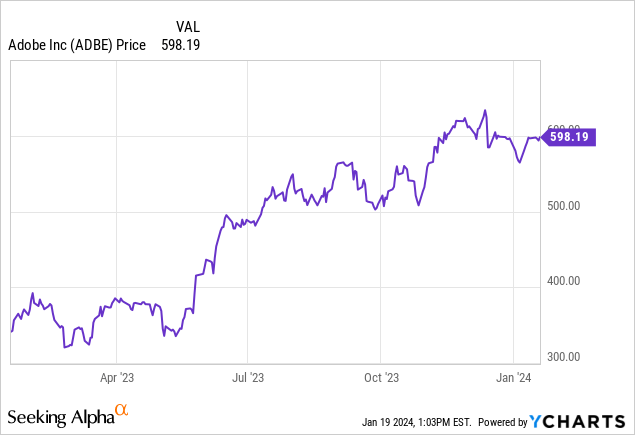

- Adobe’s share price has increased by over 70% in the past year, driven in part by excitement over its new AI tool, Firefly.

- The company’s vast suite of software products, subscription model, and impressive revenue growth justify its premium price.

- Adobe’s Document Cloud is also growing twice as fast as DocuSign, despite being at a similar scale.

- Pro forma operating margins near 50%, plus consistent low-teens growth rates, help to secure continued gains for this stock.

SOPA Images/LightRocket via Getty Images

The adage that “software is eating the world” has never been more true than in the age of generative AI. The prospect of automation and simplifying previously difficult tasks has created tailwinds in many areas of software, even those that are not thought to be directly related to AI.

Adobe (NASDAQ:ADBE) is one such beneficiary. The creative software suite has seen its share price rally by more than 70% over the past year. And while it’s fair to express caution over the stock’s expanding valuation multiple, I also think there are a number of solid growth drivers that justify a premium price here.

As a large-cap software company worth nearly $300 billion in market cap, we clearly can’t expect Adobe to produce the outstanding gains that riskier, earlier-stage investments might provide. But while market volatility continues in the tech space, with investors currently punishing the direct AI stocks (C3.ai (AI) and Palantir (PLTR)), alongside EV plays, Adobe presents a safer, more consistent, and more profitable alternative.

I am bullish on Adobe stock. Here, in my view, are the core elements of the bull case for this company:

- Vast suite of software products to cater to all creative needs. From flagship core products like Photoshop and Acrobat to newer tools like Firefly, Adobe’s far-ranging suite of software products suits both individual and enterprise needs.

- Subscription model generates impressive recurring revenue. Adobe made the switch to a SaaS model several years ago, and the company now generates over $15 billion in ARR – or roughly three-quarters of its annual revenue.

- Growth at scale. Adobe continues to generate mid-to-low teens revenue growth, despite already generating ~$20 billion in annualized revenue – something very few software companies are able to achieve. It’s worth noting that some of Adobe’s competitors in some of its vectors, like DocuSign (DOCU), are growing at a much slower pace despite being at a much smaller scale.

- Rich operating margins and “Rule of 40.” Adobe generates 45%+ pro forma operating margins on top of its low-teens growth, putting the company firmly above the vaunted “Rule of 40” territory.

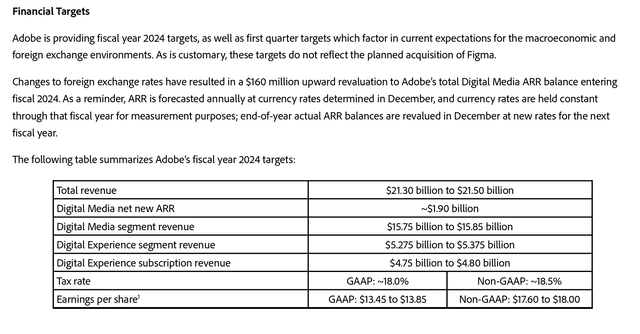

Of course, these strengths don’t come cheap. For the next fiscal year FY24 (the year for Adobe ending in December 2024), the company has guided to pro forma EPS to $17.60-$18.00, representing 11% earnings growth; on $21.3-$21.5 billion in revenue, or 10% y/y midpoint revenue growth.

Adobe FY24 guidance (Adobe Q4 earnings release)

At current share prices near $600, Adobe’s forward P/E ratio is 33.6x; substantially richer than the S&P 500 for just 11% earnings growth. I’d argue, however, the nascent opportunities in Firefly (the company’s AI product), plus the security of its recurring-revenue base that comes in at a near-90% GAAP margin, affords Adobe a sizable premium.

Stay long here and ride the upward wave.

Q4 download

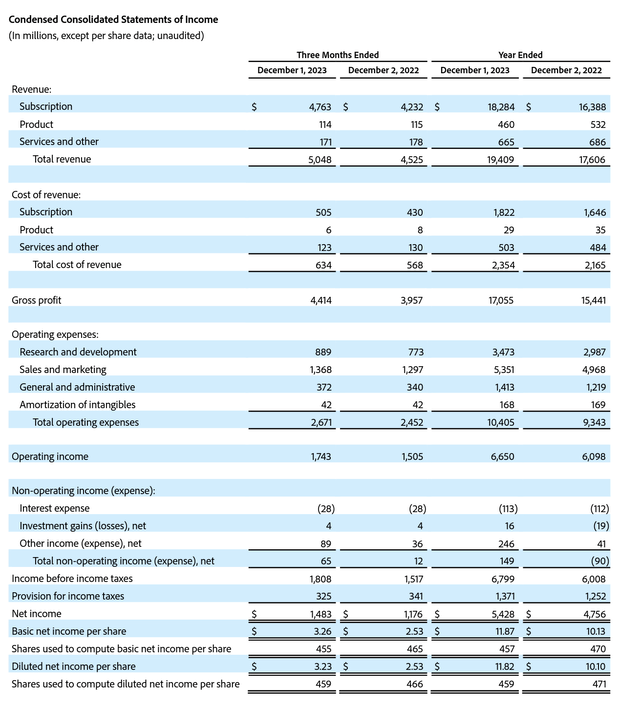

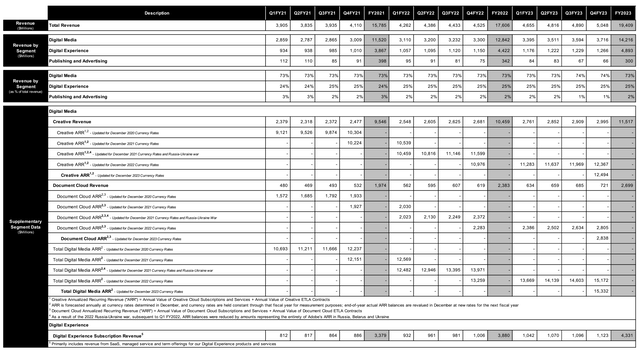

Let’s now go through Adobe’s latest quarterly results in greater detail. The fiscal Q4 (November quarter) earnings summary is shown below:

Adobe Q4 results (Adobe Q4 earnings release)

Adobe’s revenue grew 12% y/y to $5.05 billion, ahead of Wall Street’s expectations of $5.02 billion (+11% y/y). Underlying subscription revenue, meanwhile, jumped 13% y/y and now represents 94% of Adobe’s total revenue.

The chart below showcases Adobe’s ARR growth. On a constant-currency basis leveraging prior-year accounting rates, Adobe, added $569 million of net-new ARR in the quarter to end at $15.2 billion of ARR (now $15.3 billion at current rates), up 14% y/y.

Adobe ARR trends (Adobe Q4 earnings release)

Two products are worthy of mention. The first, of course, is Adobe Firefly – the company’s generative AI tool. Using text prompts, this product can now generate beautiful custom images. Firefly can also edit or enhance images, again using easy text commands. Taken from Adobe’s marketing page:

Firefly was one of the big drivers behind sustained ARR adds. Per David Wadhwani’s (Adobe’s president of digital media) remarks on the Q4 earnings call:

Business highlights include strong digital traffic, resulting from product innovation, social engagement, and our continued product-led growth efforts which drove record new commercial subscriptions in the quarter.

The general availability of our generative AI Firefly models and their integrations across Creative Cloud drove tremendous customer excitement with over 4.5 billion generations since launch in March. The release of three new Firefly models, Firefly Image two model, Firefly Vector model, and Firefly Design model, offering highly differentiated levels of control with Effects, Photo Settings, and Generative Match.”

Another key highlight is Adobe’s Document Cloud, a direct competitor to DocuSign. Document Cloud revenue grew 17% y/y in the quarter (outpacing total company) and added $171 million of net-new ARR in the quarter, leading to 23% y/y total ARR growth to $2.84 billion.

We note that Adobe is taking market share from DocuSign, generally thought to be the pure-play leader in the e-sign space. DocuSign grew billings and revenue by only 5% y/y and 9% y/y in the most recent quarter, respectively.

Profitability results also continued to be stellar. DocuSign’s pro forma operating margin rose 170bps y/y to 46.4%. The company notes that it has moderated its investments in R&D and sales and marketing (on a GAAP basis, total opex grew only 9% y/y, lagging revenue growth by three points). DocuSign’s “Rule of 40” score tops most software companies at a staggering 58 (the sum of 46% pro forma operating margins plus 12% revenue growth). DocuSign’s pro forma EPS of $4.27 also grew 19% y/y, and smashed Wall Street’s $4.14 consensus with 3% upside.

Key takeaways

Adobe is a classic “high price for high quality” software stock, but the fact that it continues to grow in many of its software verticals – taking market share from pure-play competitors and enjoying tailwinds from generative AI products – makes it highly likely for Adobe to retain its premium valuation. There’s further upside ahead here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.