Summary:

- Adobe faces significant challenges from competitors like Canva and Figma, as evolving content needs are impacting its growth and market positioning.

- Revenue growth has decelerated, and despite strong margins, Adobe’s valuation appears inflated compared to peers like Microsoft.

- AI initiatives like Firefly have yet to significantly boost revenue, raising concerns about Adobe’s future growth prospects.

- Given the high valuation and uncertain market position, I downgrade ADBE stock to a ‘Sell’ ahead of its third-quarter earnings report.

David Tran/iStock Editorial via Getty Images

Adobe (NASDAQ:ADBE) is set to report its third-quarter results on Thursday, September 12th, a little more than a month before its annual Max event.

What was once a smooth-sailing hyper growth story, has turned into a complex, highly competitive and rapidly transforming landscape.

With the rise of competitors like Canva and Figma, and the changing needs of content users, Adobe’s positioning as a professional software company is becoming less lucrative.

The long list of challenges is already showing in Adobe’s numbers, but aren’t necessarily reflected in its valuation.

Let’s dissect Adobe’s complex setup heading into earnings.

Recapping Adobe’s Post-Pandemic Ride

Like many other tech companies, Adobe shares rose to all-time highs during the pandemic, as the surge in demand from remote work, combined with the stock market’s frothiness, has resulted in record growth and record valuations.

Coming out of the pandemic, like most of its peers, Adobe wasn’t able to escape the inevitable margin contraction and growth deceleration phase, but in Adobe’s case, it wasn’t that meaningful, which meant Adobe’s management didn’t need to go through big rounds of layoffs and cost cuts.

In hindsight, this seems like a double-edged sword, because unlike companies that were essentially forced to get fit, like Meta (META), companies that didn’t go through a major decline seem to have not been able to reignite their spark.

Investors were hoping that Firefly, Adobe’s proprietary AI model, will do just that. As I wrote in my previous article, Adobe was initially viewed as an AI leader and early beneficiary, but failure to achieve meaningful contribution to revenues has led to growing uncertainty.

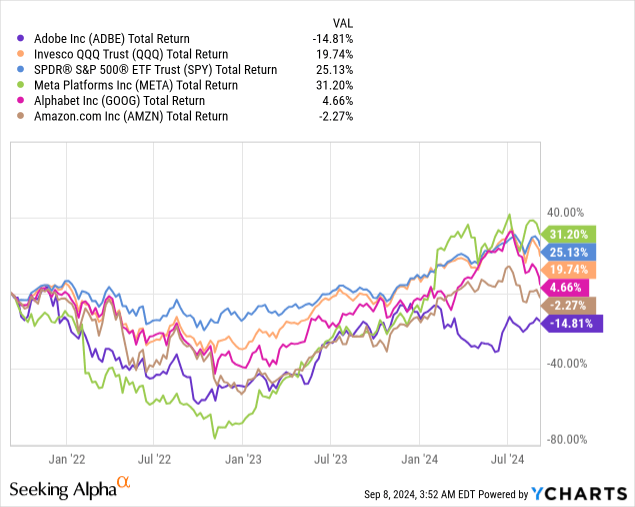

With Adobe material underperformance over the past three years, questions about its future follow. Let’s try to answer them.

Failing To Capture Meaningful Content Pillars Amid Rising Competition & The AI Risk

So many times investors skip the simplest yet most important questions. In our case, understanding the digital content landscape is key. Today, there are two major transformative trends in digital content.

One is social media and social media advertising. These are two content categories that require constant iterations and easy collaboration between designers and marketers. In my view, Adobe isn’t capturing a meaningful portion of this market, as it loses to the likes of Canva, and to solutions offered by the social media platforms themselves.

The second is the rise of the amateur designer. As solutions become more and more approachable, it’s becoming much easier to create digital content of decent quality. Such solutions are acquiring more and more customers, being that there’s a much larger pool of people to go to. With Adobe Express, the company is trying to appeal to this cohort, but it’s far from being as easy as Canva or Figma.

This is even more critical considering the possibility AI will reduce the need for professional designers, by far Adobe’s most important customer cohort. If AI-based solutions will make designers much more productive, it seems reasonable to expect there will be less of them, and many of Adobe’s contracts are seat-based.

In addition, more and more needs are being answered without the need for professional designers, which is another pressure driver.

Diving Into The Numbers

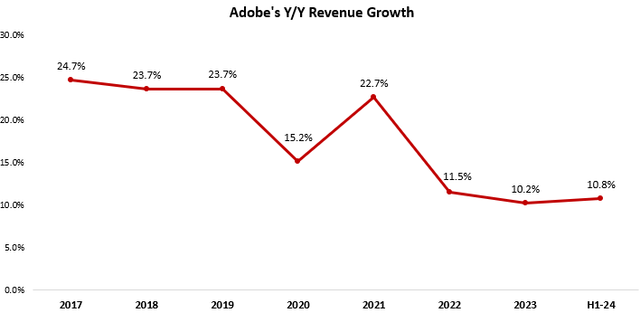

Talking about struggles is nice, but let’s look at the actual numbers. Adobe’s revenue growth decelerated from mid-twenties to low double-digits since 2022, making it an average mature software company.

Created by the author using data from Adobe’s financial reports.

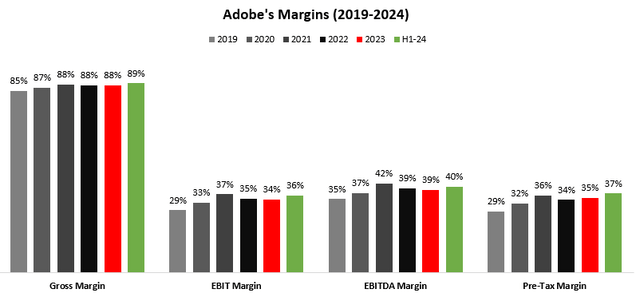

Meanwhile, margins are holding up extremely well, even though the company is investing heavily in AI, reflecting an internal focus on efficiency and ROI.

Created by the author using data from Adobe’s financial reports.

Overall, I think it’s quite clear that Adobe isn’t in any kind of trouble, it’s just not the same enviable hyper-growth company it used to be, and that’s normal.

Preparing For The Third-Quarter Print

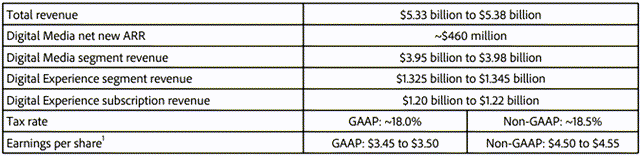

Adobe is expected to report revenues of $5.37 billion, up 9.8% Y/Y. That would mark three consecutive quarters of growth deceleration. As typical for Adobe, consensus numbers are slightly below the high-end of management guidance, leaving room for a decent beat.

In terms of earnings, adjusted EPS estimates are at $4.53, while GAAP EPS is at $3.5, both in line with the mid-point of management guidance.

Notably, the gap between adjusted net income and the GAAP figure remains in the 30% range, a topic which we’ll revisit under the valuation section.

All in all, I don’t see much room for a big surprise in numbers, considering consensus is in line with guidance, which in Adobe’s case has plenty of visibility into its results.

Therefore, I expect commentary about AI progress, and industry strength to more important in terms of determining the stock’s direction in the near term.

On the AI front, there are some reports suggesting Firefly is gaining traction, while driving demand for Adobe Express, Lightroom, and several other products. I think that at this point investors want to hear a revenue number, rather than another discussion about the number of photos generated or something in that area.

Regarding the industry, we’re hearing from many SaaS companies, including key competitors like Salesforce (CRM), that the industry environment isn’t ideal. There seems to be caution from customers, both because they are waiting to see how AI changes things, and because the economic environment isn’t quite strong.

In the past, Adobe was able to rise above macro downtrends, and it’ll be interesting to see how management describes the current situation.

ADBE Stock – Investment Decision & Valuation

With every company, the valuation part is the last step in my analysis. Meaning, I start by evaluating the company’s business strengths, competitive advantages, growth prospects, and risks. Then, if the company fits my criteria as a top-tier market-beating growth story, I finally get to valuation.

Surprisingly, Adobe doesn’t pass the first stage so easily. Yes, it’s a capital-light, high-margin business, with a history of resiliency and market-beating growth. However, I’m quite suspicious about the company’s growth prospects going forward.

As I said, I think that Adobe is losing market share in key categories of digital content, which are also the ones that are growing the fastest and where I see plenty of opportunities ahead.

With that in mind, the company’s very high relative valuation is making it even more tough to be bullish.

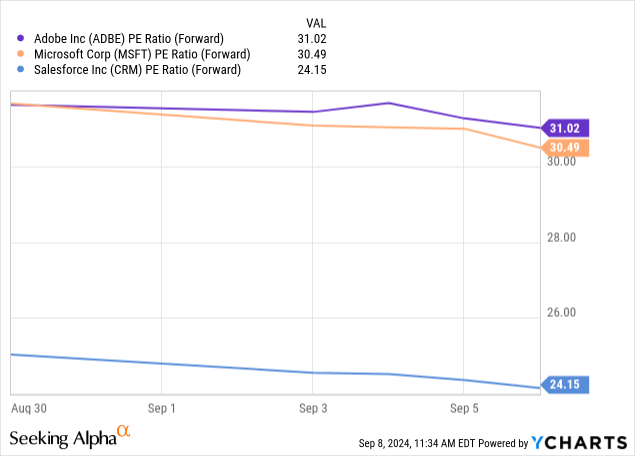

When you look at the above graph, which depicts the forward PE ratios of three of the most successful B2B SaaS companies, you might get the sense that Adobe is fairly valued, trading at a multiple that’s only slightly higher than Microsoft, and is 13% below its 5-year average.

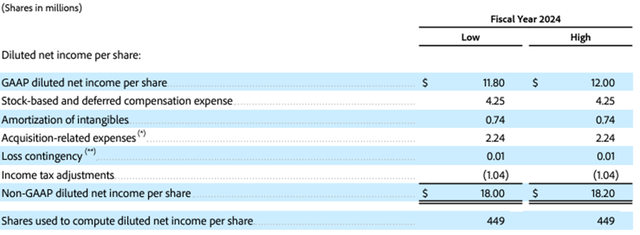

However, this is solely because the figures in the graph are based on adjusted metrics, which, in the case of Adobe, inflate its EPS number by 52%.

On a comparable basis, Adobe is actually trading at a 46x P/E, which is more than 50% higher than Microsoft’s, while the latter is expected to grow faster. Even if you exclude amortization, acquisition, and loss contingency expenses, Adobe would be trading at a 39x P/E, based on management’s guidance.

As you can see, adjusting out stock-based compensation is making Adobe’s valuation appear much more attractive than it actually is, especially when compared to companies that aren’t doing a similar adjustment.

On relevant metrics, Adobe is trading at a multiple that’s nearly double the market average, and I don’t think it’s close to being justified.

Conclusion

Adobe is set to report its third-quarter results this Thursday. Heading into the print, expectations seem beatable, but I find it unlikely that a small beat would drive a significant reaction.

I expect management commentary about AI adoption and the market environment to be critical in the near-term, but questions about Adobe’s long-term prospects will remain.

On a comparative basis, I find Adobe’s high valuation unjustified, considering the uncertain positioning of the company in the changing digital content landscape.

Therefore, I downgrade Adobe to a ‘Sell’.

Note: When I rate a company a Sell it means that if I had it in my portfolio, I would sell it. It doesn’t mean that I recommend it as a short.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.