Summary:

- Adobe’s Q3 results were strong, with 11% Y/Y revenue growth and significant profitability increases, driven by AI product roll-outs in Digital Media.

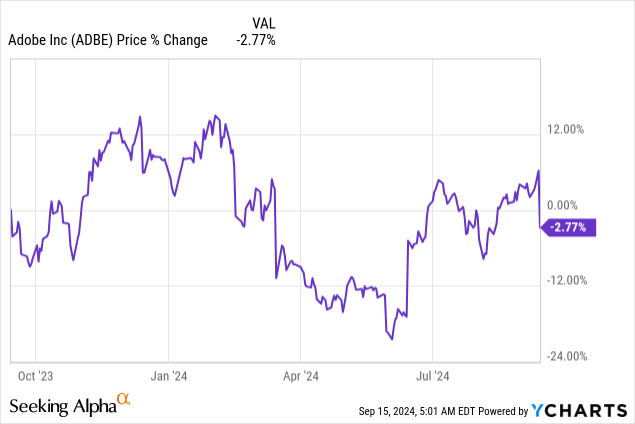

- Despite solid performance, Adobe’s Q4 revenue outlook missed analyst expectations, causing a 9% drop in share price on Friday.

- Adobe’s subscription-based, high-margin business model ensures continued profitability and growth. All major profitability metrics point upward in the long term.

- Adobe’s valuation remains attractive at a P/E ratio of 26X, suggesting revaluation potential compared to the company’s historical valuation average.

J Studios

Shares of Adobe (NASDAQ:ADBE) crashed 9% on Friday after the software maker submitted a weaker-than-expected revenue outlook for the current quarter. Overall, Adobe’s third-quarter results were overall solid as the company continues to scale its AI offers and sees strong momentum in its biggest segment, Digital Media. Adobe also benefited from a 1 PP revenue acceleration compared to the prior quarter and increased its profitability at double-digits on both an operating and net income basis. Shares are not totally cheap, but cheaper than last week, nonetheless, which is why I recommend investors to buy the drop here.

Previous rating

I rated shares of Adobe a buy in July – Adobe: A Generative AI Software Play – as the software company rolled out new products, including in AI, that indicated the potential for user productivity improvements, and because Adobe was seeing solid top-line momentum. This momentum continued in the third fiscal quarter, and I don’t believe the revenue outlook for the fourth fiscal quarter was really that bad. Adobe generated strong profitability in the last quarter and investors, in my opinion, are dealing with a dip buying opportunity following the Q3 earnings release.

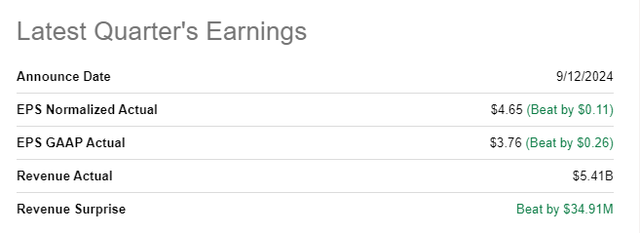

Adobe beat estimates

The software maker reported better results on both the top and bottom line for its third fiscal quarter: it achieved adjusted earnings of $4.65 per share on $5.4B in revenue. The EPS figure beat the consensus estimate by $0.11 per share, while the top line came in $35M ahead of the average prediction.

Strong core business results for Q3, improving profitability

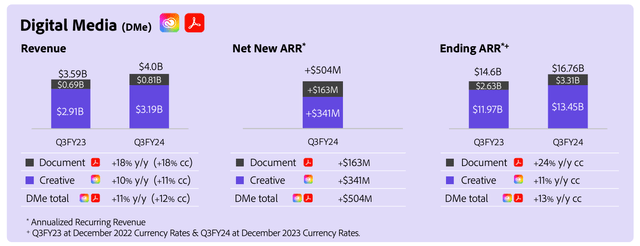

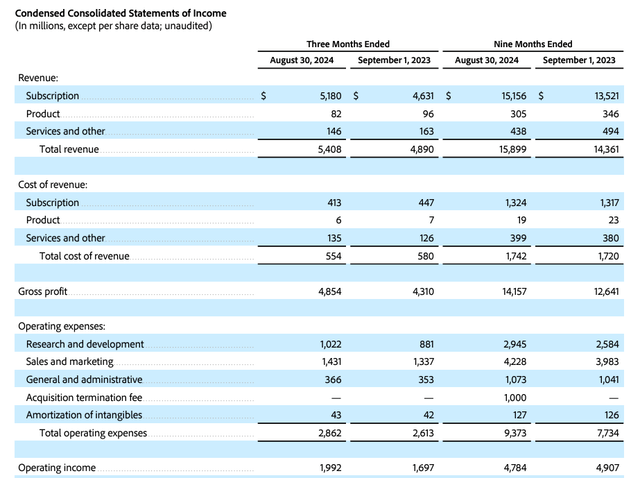

Adobe reported strong financial results for its third fiscal quarter, indicating continual momentum in the firm’s core Digital Media segment. In the third fiscal quarter (which ended August 30, 2024), Adobe generated $5.41B in revenues, showing 11% year-over-year growth. This growth represented a 1 PP acceleration compared to the previous quarter, chiefly due to business expansion in the Digital Media business.

Digital Media comprises Adobe’s Creative and Document business which are crushing it, in part due to the roll-out of new AI-specific products such as the introduction of AI assistants in Adobe Acrobat and Reader. As a result, Digital Media revenue increased 11% year-over-year. Both segments are also seeing considerable momentum in net new annual recurring revenues, as Adobe captures revenues mainly through a subscription-based business model. Total subscription revenues hit $5.18B in Q3’24, representing a revenue share of 96%.

Further, Adobe significantly improved its profitability in the third quarter, driven by more enterprise clients taking up subscription offers. New and improved products such as Adobe Firefly and various AI offers continue to make the Adobe platform a magnet for creators, which is also resulting in higher operating income. The software maker generated $1.99B in operating income in Q3’24, showing a year-over-year increase of 17%. At the same time, Adobe’s net income went up 20% year-over-year to $1.68B.

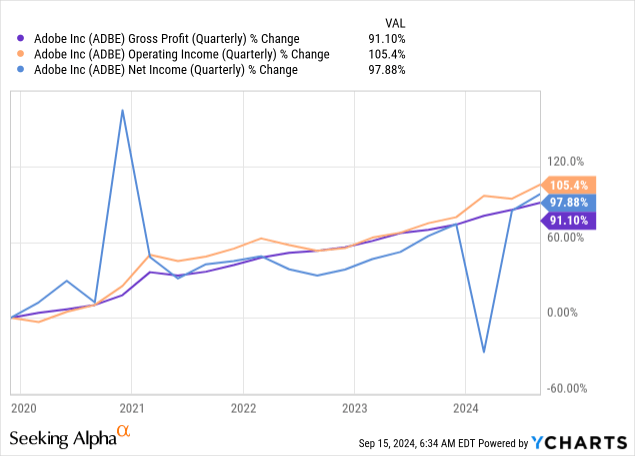

Adobe’s main profitability metrics are growing, mainly because the company is doing such a great job scaling its high-margin subscription offers. In the last five years, all major earnings figures – gross profits, operating income, and net income – have drastically improved, and the trends continue to point upward.

Poorly received outlook for Q4

Adobe projects its fourth-quarter revenue to fall into a range of $5.50-5.55B, which came in below the analysts’ average prediction of $5.61B in revenue. The guidance for the current fiscal quarter (Q4) was largely the reason, in my opinion, for the negative price reaction to Adobe’s earnings report last week. Considering that Adobe is projected to generate $21.4B, I believe the $85M miss in terms of Q4 revenue guidance should not hold the stock back for long.

Adobe’s valuation

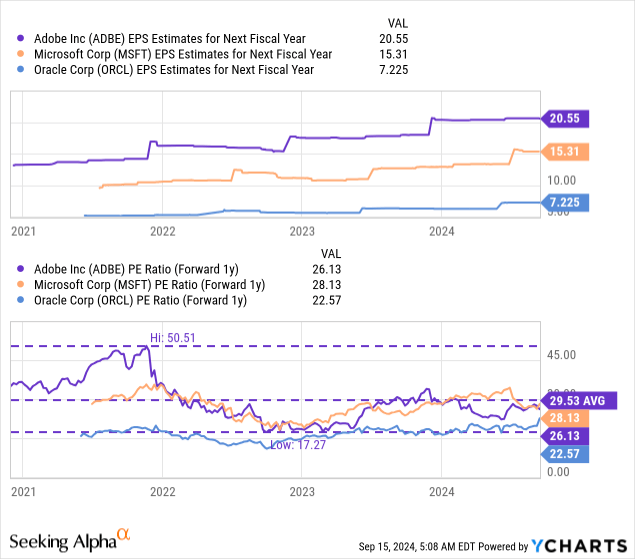

Adobe is not necessarily expensive, considering that the company is running a highly profitable, subscription-based software platform at scale. Adobe is currently valued at a price-to-earnings ratio of 26X, based off next year’s earnings, which compares against a P/E ratio of 28X for Microsoft (MSFT) and 23X for Oracle (ORCL). Both rivals are also highly profitable software companies offering business productivity tools.

The industry group price-to-earnings ratio is 26X, while the 5-year average price-to-earnings ratio for Adobe is 30.0X. I believe Adobe could return to its 30X P/E valuation average, considering that it is highly profitable and currently in the early stages of scaling its AI offers. Content creators are going to continue to gravitate to Adobe’s creative tools, especially in Digital Media, which should translate into growing subscription revenue growth.

A 30X P/E ratio, based off a consensus estimate of $20.55/share, calculates to a fair value in the neighborhood of $617. This implies about 15% upside revaluation potential, but my fair value estimate does not consider an acceleration of Adobe’s top line and growing subscription uptake due to AI offers. I also believe that the drop-off last Friday creates a unique buying opportunity for investors that have the desire to invest into an AI software play for the long term.

Risks with Adobe

Adobe reported strong financial Q3 results, but there are risks. One risk is the potential erosion of its profitability and margins in case other business software companies offer better and more efficient creator tools with the help of AI. Start-ups now also have the opportunity, leveraging the strength of AI, to compete with large, well-funded software platforms like Adobe or Microsoft.

Final thoughts

In my opinion, investors overreacted to Adobe’s fourth-quarter revenue outlook as the guidance only missed the average prediction by $85M… which is hardly a sum to obsess over considering that the software maker is set to achieve somewhere around $21B in revenues this year. I continue to like that the overwhelming majority of the company’s revenues comes from subscriptions, and Adobe operates a high-margin business model. As a result, Adobe is widely profitable and its long-term (and short-term) profitability metrics all point upward. Shares of Abode also used to be more expensive in the past, and the recent drop-off is a buying opportunity for investors. In fact, I believe the best time to buy is often the time when investors panic and are fearful. In my opinion, this is one of such opportunities.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.