Summary:

- Adobe’s exceptional diversification and breakthrough innovations enable the company to serve an extensive customer base. The latest products and features are more AI-powered, thus increasing value for customers.

- The company has demonstrated excellent capital allocation, with management’s strategic decisions around growth drivers over the decade leading to outstanding financial results.

- My valuation analysis suggests the stock is undervalued.

SeanShot

Investment thesis

Adobe (NASDAQ:ADBE) has demonstrated stellar financial performance over the last decade, mainly thanks to its focus on innovation, a strong brand, and a diversified product portfolio, together with striving to maximize customer satisfaction. The management has a proven track record of strategic solid decision making, which enabled the company to deliver stellar financial performance, and consensus estimates suggest this growth will last for the next decade. My valuation analysis also suggests the stock is undervalued, making it a compelling investment opportunity.

Company information

Adobe is a global software company that provides a wide range of products and services to creative professionals, businesses, and individuals. The company was founded in 1982 and is headquartered in USA.

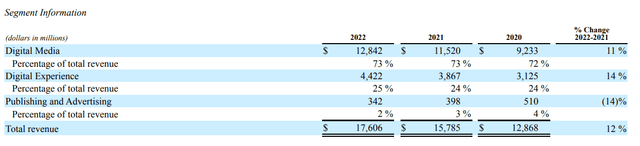

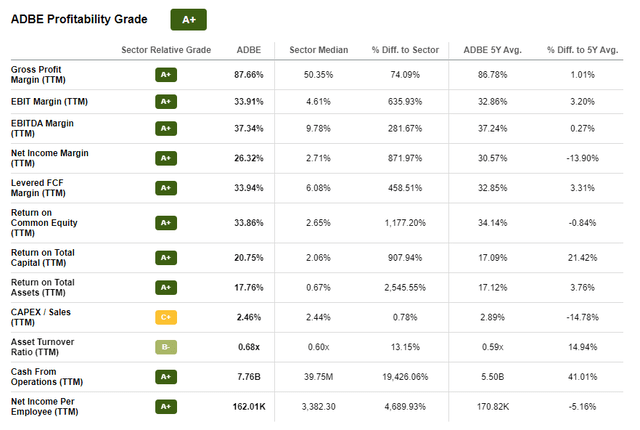

The company generates a major part of its revenues from the software-as-a-service [SaaS] model, with subscription sales representing more than 90% of the total. The company disaggregates its revenues into three segments: Digital Media, Digital Experience, and Publishing & Advertising.

Digital Media includes the company’s flagship applications such as Acrobat, Photoshop, and Flash Player. The Digital Experience business includes web analytics solution Omniture, which the company acquired in 2009. Publishing & Advertising represents Adobe Advertising Cloud offerings.

The company generates more than 40% of sales outside the Americas.

Financials

Adobe’s financial performance over the last decade demonstrates a strong market position and competitive advantage.

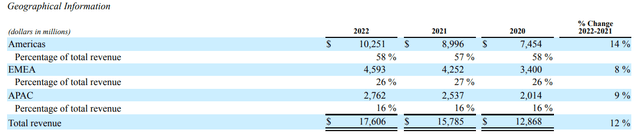

Revenue grew at a 17.7% CAGR from about $4 billion in FY 2013 to over $17 billion in FY 2022. The impressive gross margin of 85.5% expanded further over the decade to 87.7%. Other profitability metrics, including levered free cash flow [FCF] margins, are also best-in-class.

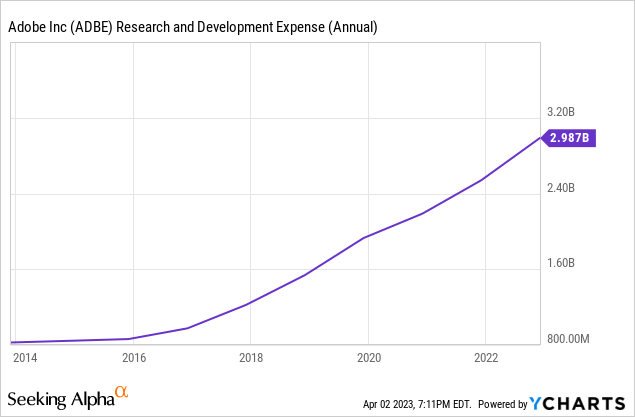

The company’s primary driver of success has been a solid commitment to innovation, resulting in a portfolio of cutting-edge products. We can see the extent of commitment to innovation via its financials. The most apparent metric here would be a ratio of research and development [R&D] expenses to revenue, which has been growing in line with the topline and increased more than threefold over the decade.

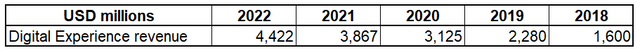

Apart from in-house R&D, the company also successfully implements a strategy of acquisitions. This also helps the company to innovate and improve its offerings to customers and achieve a higher reach of a different audience. For example, in 2018, Adobe acquired Magento and Marketo. These acquisitions helped the company to expand its e-commerce offerings contributing to overall topline growth. Both Magento and Marketo contributed to Digital Experience segment growth, which demonstrated substantial revenue increase over the last 5 years, the moment since these two acquisitions occurred. The segment grew 176% over the past 5 years, meaning an impressive CAGR of 23%.

Compiled by author based on ADBE 10-K

Other recent notable acquisitions included Workfront in late 2020 in Figma in 2022. Since those are relatively recent acquisitions, at the moment, we have yet to have an opportunity to analyze the trend of how they affect the company’s financials. But, here, I want to emphasize that Adobe continues to expand its addressable market and reach through these acquisitions. The company is striving to win new clients and make their experience with Adobe’s products more comprehensive, which is a very good sign for improving shareholder wealth over the long run.

From a balance sheet perspective, the company is also strong since there are enough liquid assets to cover short-term obligations, and the long-term leverage level is also relatively low. Given the company’s strong cash flows and management’s conservative approach to leverage, I expect the balance sheet to remain sound over the long term. Adobe does not pay dividends but repurchases shares – in FY 2022, share buybacks represented 46% of gross profit.

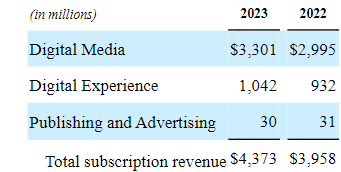

The company’s latest earnings announcement of March 15, 2023, was also positive. Adobe delivered beats both in terms of revenue and EPS. The top line of $4.66 billion represents a 9% YoY growth. The company demonstrated sales growth across all geographies and segments, except for Publishing & Advertising, which softened insignificantly.

Adobe latest 10-Q

The flagship Digital Media Segment demonstrated low double digits percentage increase of 10.6% YoY while Digital Experience delivered an impressive 22.5% YoY growth.

Management’s outlook for the upcoming quarter is positive, with a revenue guidance of $4.75 billion, representing an 8% growth YoY and 2% growth sequentially. EPS is expected to be flat QoQ but to grow YoY by an impressive 13%. This is a very positive sign, especially given the tight macro environment.

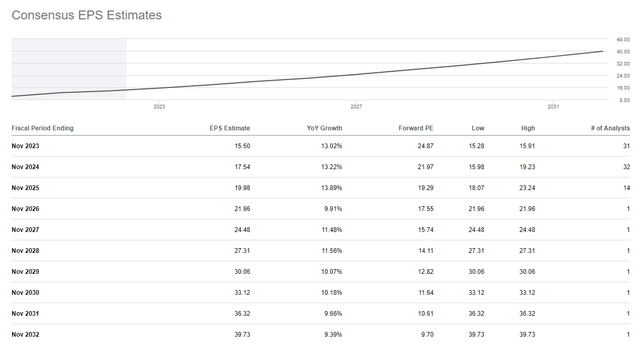

Long-term consensus earnings estimates are also very positive with revenue expected to more than double over the next decade and EPS to expand significantly.

I am also very optimistic about Adobe’s long-term prospects given the company’s commitment to product innovation and improvement of customers’ experience. The company’s latest Financial Analyst Q&A Conference, “Summit 2023”, took place on March 21. During the event, Adobe revealed new products and features, including innovative generative AI capabilities. These new products include the Firefly family of generative AI models, which enables users to create and edit images in real-time using natural language prompts or Adobe’s Creative Cloud tools. This new technology will significantly improve the efficiency of content creation. Moreover, users can take advantage of automated workflows that integrate AI capabilities across Adobe’s product portfolio.

Overall, I like the company’s pace of introduction of new features and the extent of integration between products. I am highly convinced that these product developments will strengthen the company’s market position and positively affect its financials in the long run.

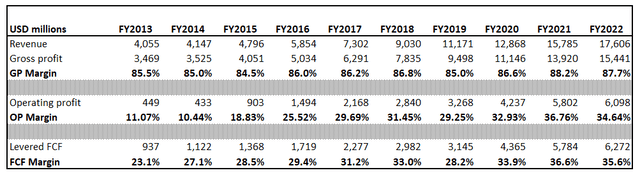

To summarize my financial analysis, Adobe’s current financial performance, near-term outlook, long-term historical performance, and consensus earnings forecasts suggest that the management quality is of a rockstar level and will likely continue increasing shareholders’ wealth in my view.

Valuation

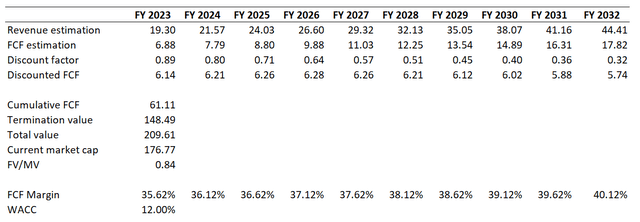

As I mentioned above, ADBE does not pay dividends, so I use a discounted cash flow [DCF] approach with multiples analysis for valuation. I also refer to third parties’ fair value estimations to cross-check my analysis.

To derive the company’s fair value with DCF, I need to outline the main assumptions. First of all, I need a sound discount rate for future cash flows, and I use a WACC provided by Gurufocus here, which is 11.39% at the moment but to be conservative, I round it up to 12%. For future cash flows, I use last year’s FCF margin of 35.62% and expect it to expand 50 basis points each year. I expect revenue growth to be in line with earnings consensus estimates which suggest about a 9% topline CAGR between FY 2023 and FY 2032.

After incorporating all assumptions together I arrived to a conclusion that fair value is about 16% higher than the current market capitalization which means the stock is undervalued.

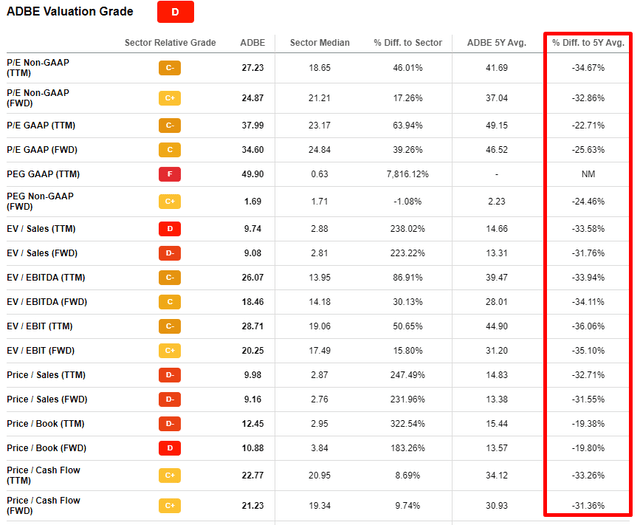

From valuation ratios perspective Seeking Alpha Quant ratings suggest the stock is significantly overvalued given the overall “D” grade. But, in my opinion, it is fair that a unique profitability star like Adobe is trading with a significant premium compared to peers. Here I would like to emphasize that in multiples analysis it would be more reasonable to compare Adobe’s current valuation ratios with the company’s recent averages. This comparison suggests that the stock is currently trading significantly below historical multiples.

Morningstar Premium suggests that ADBE’s fair price is $425 per share, which indicates a 10% upside potential from the last close. Argus Research is little bit more conservative with a 12-month target price at $410 meaning a 6% upside potential.

Risks to consider

While Adobe has a proven track record of strong financial performance and future outlook looks bright as well, investment in ADBE is not without risks.

Adobe operates in a highly competitive market. As a result, new industry standards and frequent new product releases can lead to pricing pressure and affect the company’s ability to retain customer loyalty. The company’s success, therefore, depends on its ability to innovate by improving existing products and bringing new products and services to the market. Failure to do so could result in a market share loss, adversely affecting the company’s financial performance.

Adobe’s strategy of growth via acquisition also poses the company to risks. Acquisition costs including the investment value itself may not generate expected benefits. When Adobe acquires a new company it usually enters new markets where the company has limited experience. This leads to potential tax and legal issues which can bring unexpected costs. In acquisitions there are also significant risks related to the successful integration of businesses which include retention of key personnel and aligning internal processes of the acquired company together with Adobe’s best practices.

Since Adobe is a software company, it also faces cybersecurity risks. In case customer data is lost, this will not only undermine the company’s reputation but could also lead to adverse effects like losing customers or litigation.

Bottom line

In summary, the stock is a strong buy for long-term investors. My analysis suggests that Adobe has a very strong track record of success, and this is supported by the latest above-the-consensus financials together with a positive near term outlook. The management’s ability to deliver new features and products to the market, either developed in-house or acquired in M&A deals, is impressive. I have high conviction about the company’s long-term bright future, and my valuation analysis suggests the stock is undervalued with a double-digit percentage upside potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.