Summary:

- Adobe is focusing on generative AI, introducing features like Firefly and Generative Fill to enhance its product offerings and user experience.

- The company’s partnership with Google’s Bard expands Firefly’s reach and potential for increased user engagement.

- Despite slowed revenue growth, Adobe’s resilient non-GAAP operating margin and current valuation suggest long-term potential for success in the AI landscape.

gorodenkoff

Investment Thesis

Adobe (NASDAQ:ADBE) has demonstrated its dedication to embracing generative AI and fostering creativity among artists and content creators. Particularly, in the last month, the management announced a new AI feature called Generative Fill, powered by Firefly in Photoshop (beta), which will be available to the public in 2H CY2023.

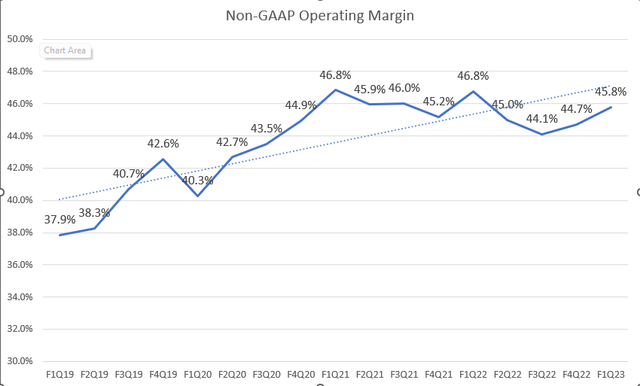

Although ADBE’s subscription revenue has been decelerating since FY2021 (accounting for 94% of total revenue in 1Q FY2023), the company has initiated a growth turnaround plan by exploring different monetization possibilities. These options include treating generative AI as a value-added service or adopting a standalone subscription model. In addition, the company has achieved a consistent expansion on non-GAAP operating margin over the past four years, from 38% in 1Q FY2019 to 46% in 1Q FY2023.

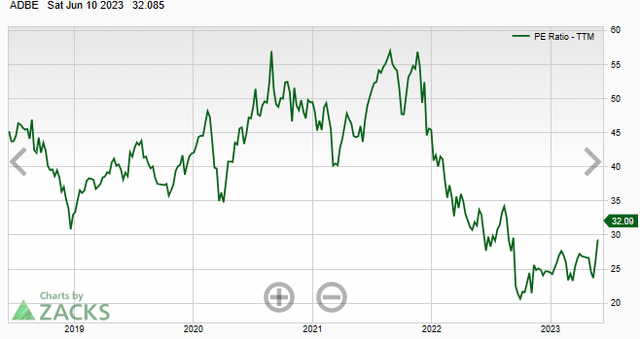

Despite a recent 32% rally due to the AI optimism, the stock is currently trading at 32x P/E TTM, which is lower than the 5-year average of 40x. Therefore, I’m bullish on ADBE in the long run as the financial impact of those AI features takes time to materialize. I’ll highlight a few major recent announcements in terms of the company’s AI initiatives.

Firefly – A Text-to-Image AI Tool

Firefly, Adobe’s generative AI engine, is currently available in Photoshop (beta), Adobe Express, and on the website page. This provides users with the opportunity to effortlessly create and edit their projects by simply describing them. According to the Adobe Blog, Firefly’s launch in March marked one of the most successful beta launches in the history, generating over 70 million images within the first month. This AI-driven tool relies on a model that leverages hundreds of millions of photos, allowing it to generate both images and text effects based on provided descriptions. In MoffettNathanson’s Inaugural Technology, Media, and Telecom Conference, the management stated:

“If you’re Nike, for example, what are you going to want your teams to use? You’re going to want them to use a commercially viable model that was trained in the right way, which you can talk about Firefly, plus all the assets that Nike has, right, that hopefully are stored in Creative Cloud or in our AEM system.”

Therefore, with a focus on incorporating AI into Adobe’s products and services, I believe Firefly will consist of multiple AI models in the future that will serve various use cases. This is particularly relevant in today’s self-media-driven society, including millions of business owners and influencers on TikTok and YouTube Shorts, where the demand for such capabilities is rapidly growing.

Additionally, I think what makes Firefly stand out from other generative AI tools is its distinctive feature. Firefly will provide the capability to generate images that are safe for commercial use, without infringing on copyrighted materials. The management continued:

“They wanted to be a commercially viable asset that has — we have kind of credentials that can show that it can be used. If they want to sell it or if they want to put it on and have it being add on Instagram or whatever else, there are signals in the market that the commercial viability of assets is going to matter, just like you can’t use a copyrighted image on Google necessarily on Instagram.”

If Firefly can efficiently generate copyright-free images that can be directly used in ongoing projects, I see a comparative advantage for this feature in the future. With the increasing demand for AI capabilities from individuals and enterprises, Firefly can serve as a time-efficient AI tool, allowing users to train and improve models using their own content.

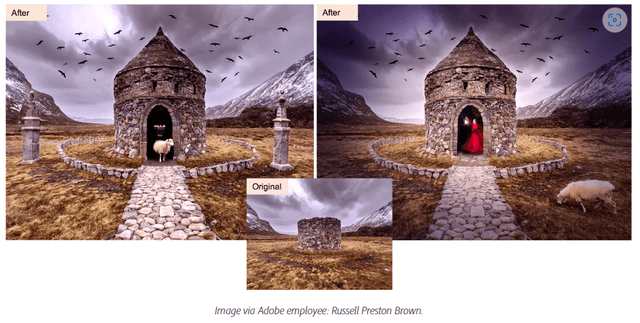

Generative Fill – A New Enhanced AI Feature

Furthermore, ADBE announced a Generative Fill feature in Photoshop, demonstrating how text-driven interaction can help users to enhance accessibility and reduce the time required to achieve desired outcomes. Ultimately, this advancement aims to simplify content creation and make it more user-friendly for broad-based individuals. The management explained:

“It actually literally just anything you select, you can fill it with anything you can imagine. And it makes it completely integrated into the asset you’re working with, but it’s also a non-destructive asset, which what that means is that you can save it as a layer and you can manipulate that layer without changing the whole thing.”

I believe that improving user experience can result in less customer turnover and higher Net Dollar Retention (NDR). The easier accessibility can help users fully leverage the capabilities of Adobe’s tools, reducing the need for alternatives and enhancing overall user satisfaction and retention.

Google Bard Integration

Additionally, Adobe will be partnering with Google (GOOG) (GOOGL)’s Bard to bring Firefly to a wider audience, creating an opportunity to further boost user engagement. Users will be able to continue their creative journey seamlessly in Adobe Express. Firefly will enhance and showcase text-to-image capabilities within Bard, allowing users of all skill levels to describe their creative ideas using their own words and generate Firefly images directly within Bard. I believe this integration differentiates Firefly from other generative AI tools in the market, which offers users a more intuitive creative experience.

Slowed Growth but Resilient Margins

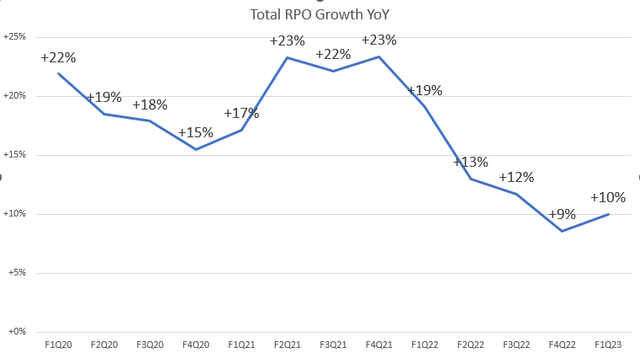

Let’s look at ADBE’s recent financial performance. Instead of focusing on revenue growth, it can be insightful to analyze the company’s current contract backlogs, Remaining Performance Obligations (RPO), as a key metrics to gauge its future revenue potential. RPO refers to the backlog of contracts that a company will fulfill in the future. These obligations can be converted into future billings, ultimately contributing to revenue generation. We notice that ADBE’s total RPO growth started to decelerate since 4Q FY2021, with the growth rate slowing from 23% YoY to just 10% in 1Q FY2023. This deceleration indicates that the company may be facing challenges in securing new deals from users. This may explain why Adobe is placing a significant focus on generative AI, introducing many new AI-driven features to enhance its existing product family.

However, it’s worth noting that ADBE has consistently maintained a strong non-GAAP operating margin, indicating the company’s operational efficiency even during a period of growth slowdown. This suggests that once the revenue reaccelerates, ADBE has the potential to significantly boost its earnings growth due to the margin expansion effect. From the 1Q FY2019 to 1Q FY2023, the company has experienced a significant margin expansion, with its non-GAAP operating margin increasing from 38% to 46%. As mentioned earlier, these AI features will take time to impact subscription backlogs and achieve monetization, which will ultimately boost the company’s earnings growth.

Valuation

ADBE is currently trading at 32x P/E TTM, which is slightly lower than MSFT (MSFT)’s 34x. However, when comparing the P/E multiple to its 5-year average, it appears relatively cheaper. If we consider the consensus for non-GAAP EPS in CY2023, the P/E is 28x, which is lower than MSFT’s 33x and the software industry average of 45x. Therefore, despite a 32% rally from last month, the stock is not currently trading at a premium multiple like many other AI-related stocks that have seen significant increases due to recent AI optimism. However, for the stock’s valuation multiple to expand further, a growth acceleration in its earnings would be necessary to justify it.

Conclusion

In sum, Adobe has made a significant move in incorporating generative AI into its products and services, particularly with the introduction of Firefly. This creative AI engine offers text-driven interaction and the ability to generate images free from copyright concerns, making it a popular tool for content creators. Moreover, the partnership with Google’s Bard further expands the reach of Firefly, opening doors for increased user engagement. While ADBE’s revenue growth has shown signs of deceleration, its resilient non-GAAP operating margin reflects operational efficiency and the potential for earnings growth once revenue picks up. The stock’s current valuation, trading below its 5-year average, indicates it may not be overpriced, despite a recent rally. Therefore, with a strategic focus on generative AI and an emphasis on monetization, I believe Adobe positions itself for long-term success in the evolving AI landscape.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.