Summary:

- Adobe continues to exceed guidance while showing strong profitability.

- Wall Street appears concerned about slowing growth rates, but may be missing the bigger picture.

- I highlight ADBE’s strong balance sheet and mature capital allocation strategy.

- I outline the clear path to forward double-digit returns.

Majorching/iStock via Getty Images

Adobe (NASDAQ:ADBE) has languished amidst general volatility in the software sector, as investors have grappled with the reality that generative AI might prove to be more of a headwind than a tailwind for seat-based pricing models. The lack of enthusiasm might present a buying opportunity, with ADBE representing a deeply entrenched and highly profitable operator supported by a strong balance sheet. The stock is not obviously cheap on a price to earnings basis, but the magic of operating leverage may allow for stellar bottom-line growth for years to come. The stock looks attractive given the visible path to market-beating returns – stay long here.

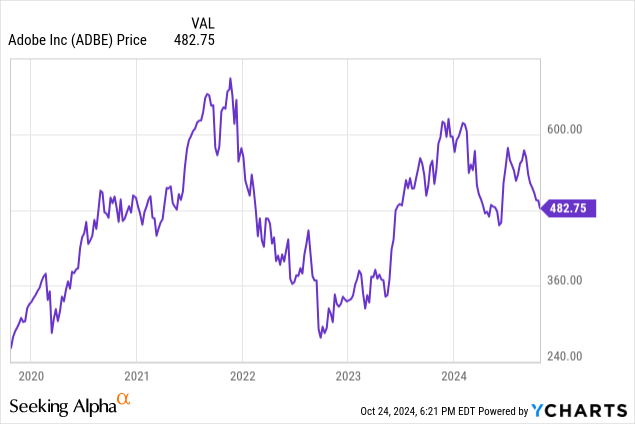

ADBE Stock Price

I last covered ADBE in August where I stuck by the stock after it had continued to rally. The stock has proceeded to give up all its gains since I upgraded the name in May, and now trades at the same level it did 4 years ago.

This high-quality stock has historically commanded a high-quality premium – the recent underperformance has made it a real deal.

ADBE Stock Key Metrics

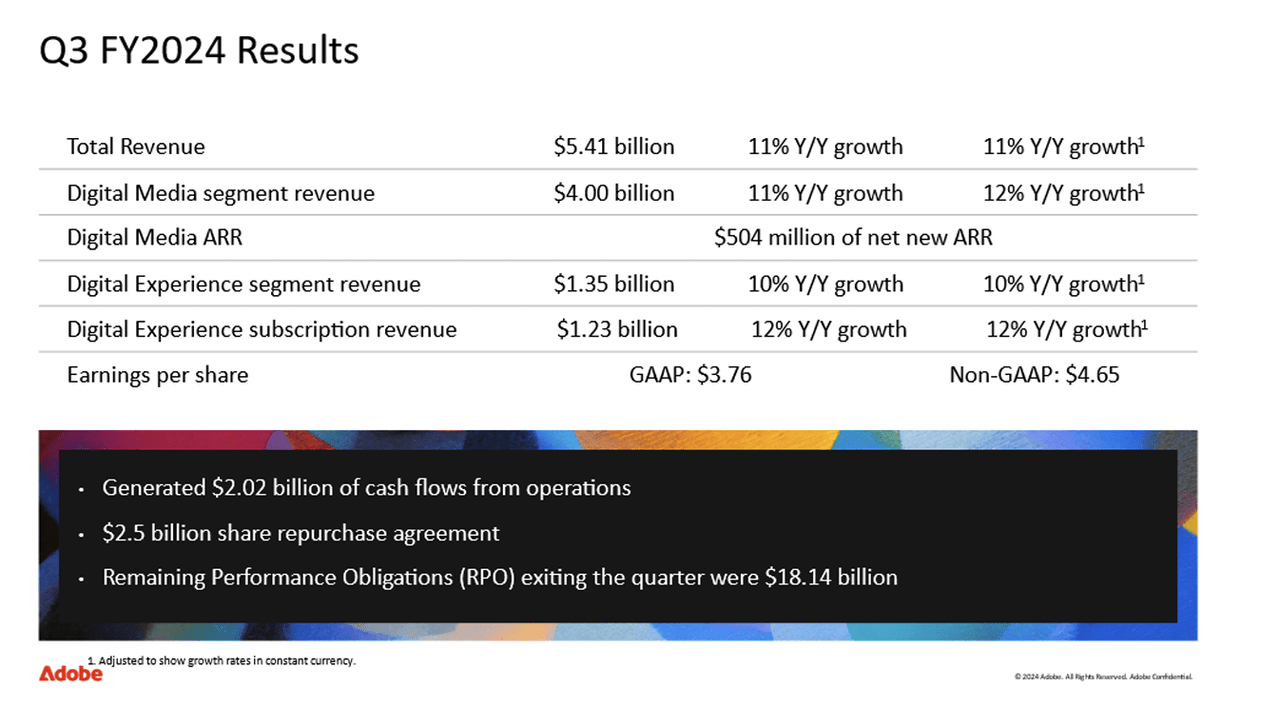

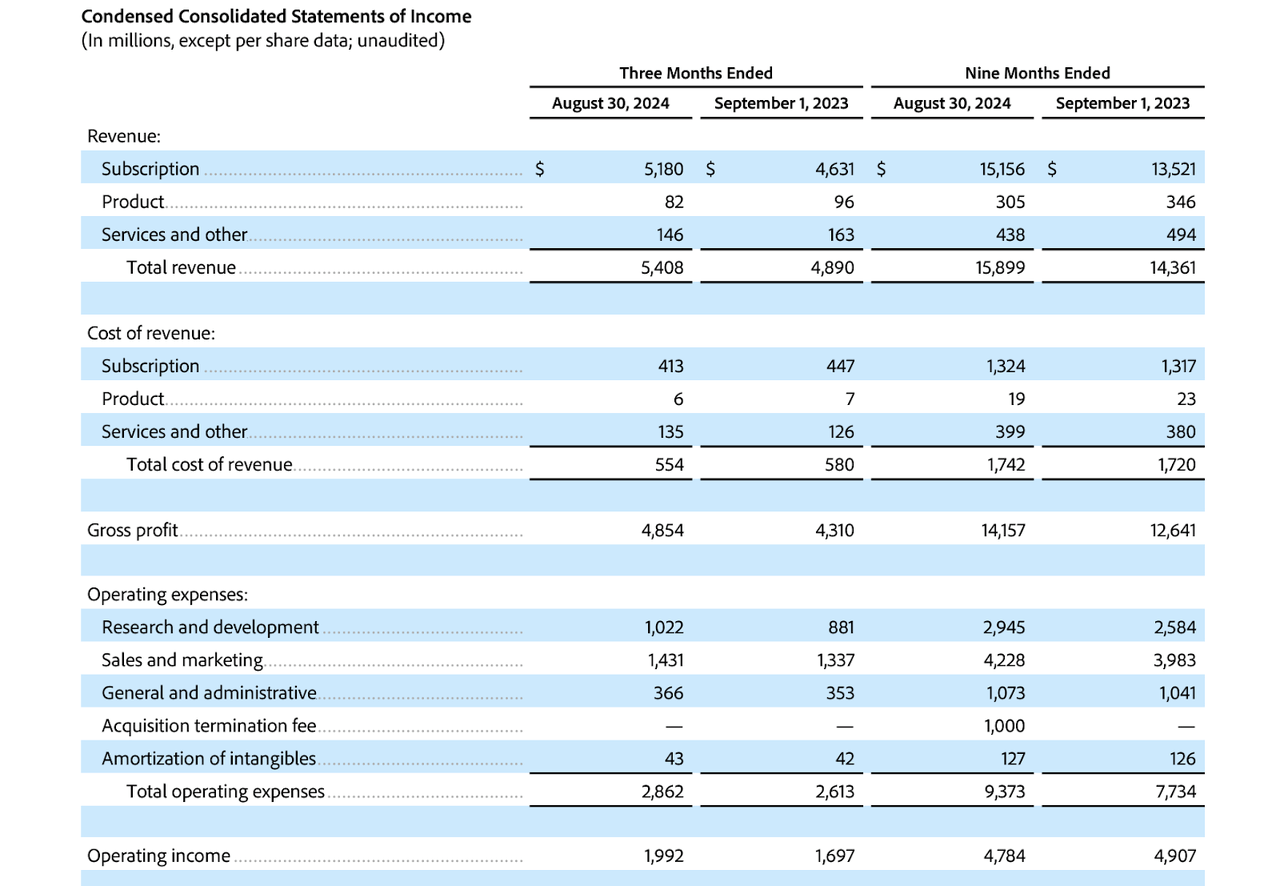

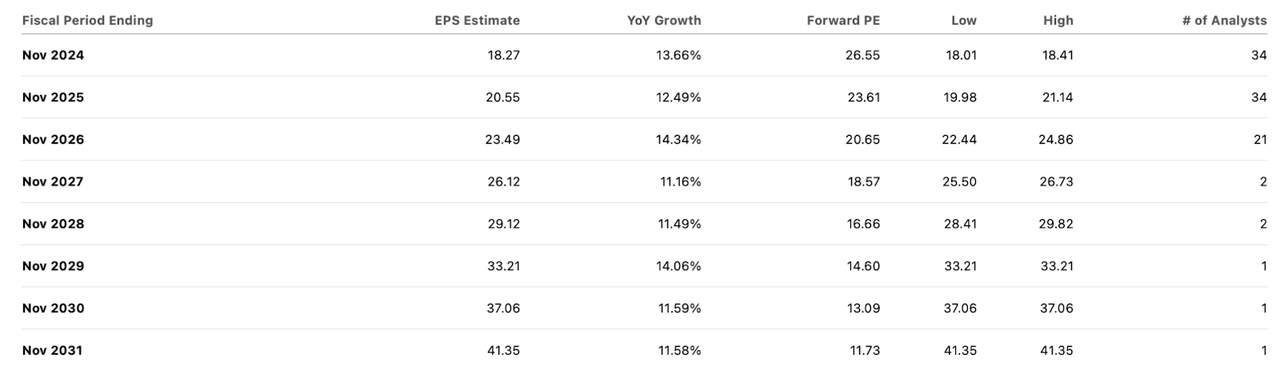

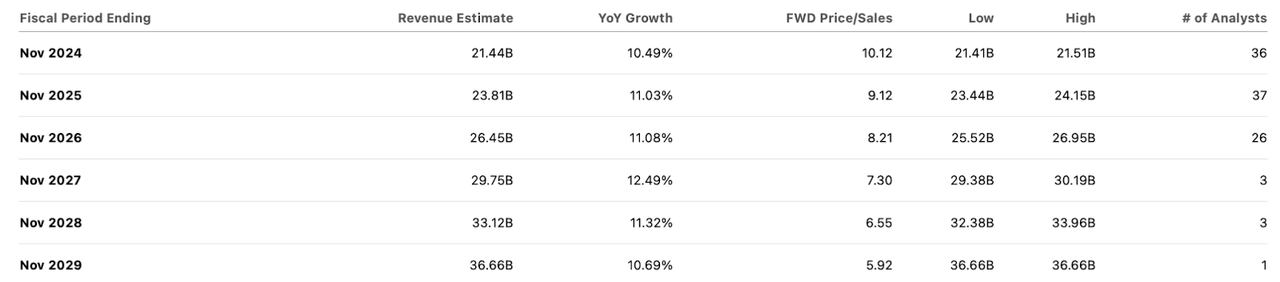

In the most recent quarter, ADBE delivered revenue growth of 11% YoY to $5.41 billion, exceeding guidance of between $5.33 billion to $5.38 billion. Non-GAAP EPS of $4.65 also exceeded guidance of between $4.50 and $4.55.

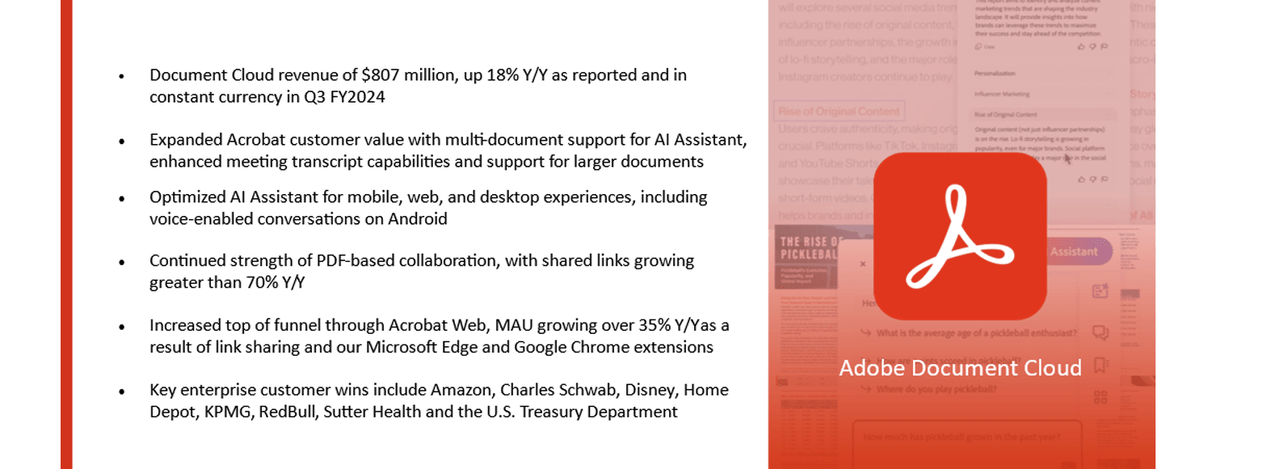

The Document Cloud segment remains the fastest growing segment, growing 18% YoY in the quarter. Notably, the company scored some key enterprise customer wins including Amazon (AMZN), Disney (DIS), and the U.S. Treasury Department. It is notable that this segment has a higher revenue run-rate than that seen at e-signature competitor DocuSign (DOCU) yet is sustaining materially faster growth. While not an apples-to-apples comparison, I suspect that ADBE is taking share in the e-signature market.

The company ended the quarter with $7.5 billion of cash versus $6.6 billion of debt, representing a strong net cash balance sheet. I expect ADBE to take on material net leverage over time.

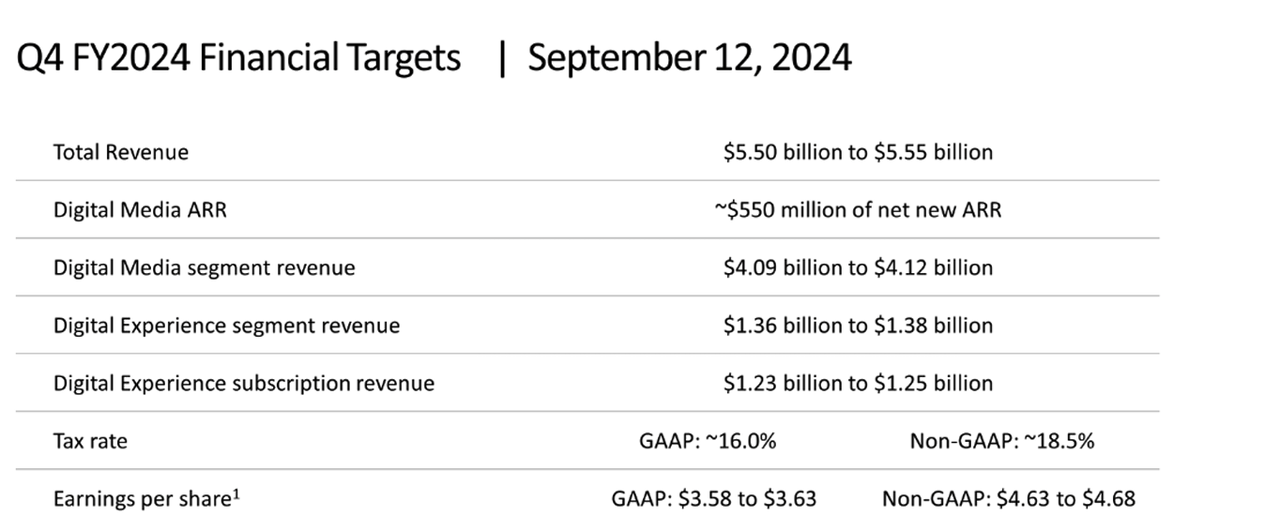

Looking ahead, management has guided for the upcoming quarter to see up to $5.55 billion in revenue and $4.68 in non-GAAP EPS (versus consensus estimates of $5.54 billion and $4.67 for revenue and non-GAAP EPS, respectively).

On the conference call, management tried to remain upbeat about their positioning in the current landscape, citing their still-strong growth in remaining performance obligations, which grew 15% YoY to $18.14 billion. Current RPO grew 12% YoY and indicates double-digit growth ahead. However, investors were likely expecting more and, in my opinion, management failed to give an appropriate response as to whether investors should be expecting an acceleration in growth rates moving forward, especially given that guidance implies the opposite. Management even cited the fact that Cyber Monday slipping into the first quarter would be potentially a factor affecting growth, but such an explanation does not bode well given expectations for consistent secular growth. Investors appeared to have voted with their money, as the stock dipped double-digits following the print.

While I have no rebuttal regarding growth concerns, I instead take a different perspective – perhaps investors are focusing too much on top-line growth and less on the cash flow story. ADBE is widely seen as one of the strongest teams in terms of execution, as they boast among the highest profit margins (apparently without sacrificing on employee satisfaction). We can see below that operating income grew at a 17.3% clip, materially faster than the 11% top-line growth rate due to operating leverage.

I expect ADBE to potentially show greater operating leverage moving forward, as it bears reminding that this is a firm already spending around $10 billion annually on R&D and S&M. If and when ADBE decides to restrict their variable costs, the company would be able to show strong bottom-line growth even as top-line growth slows. For example, a 5% top-line growth rate could lead to roughly 11% bottom-line growth assuming stable variable costs.

Is ADBE Stock A Buy, Sell, or Hold?

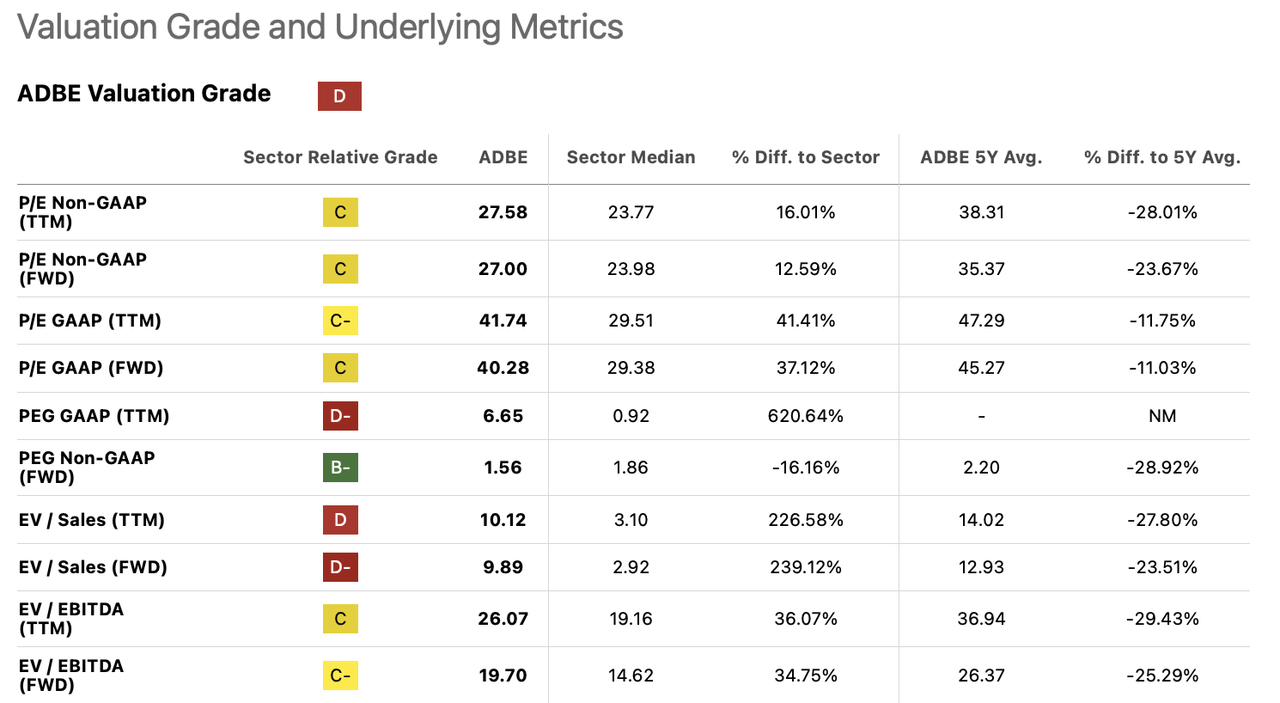

That observation is important as we analyze the valuation. As of recent prices, ADBE traded at around 27x earnings, which on the surface might not scream “bargain.”

Moreover, the stock traded at around 10x sales, which would place it among the more richly valued names in the software sector on a growth-adjusted basis.

It is worth noting, however, that ADBE trades at a large discount to its 5-year average multiples.

I point that out not to imply that ADBE might trade back to those levels (looks unreasonable) but to hammer home the notion that ADBE has shed a lot of its historic premium. The stock might appear to trade richly relative to peers on a P/S basis, but a lot of that is due to it already having highly mature profit margins in addition to still sustaining above-market growth rates. Moreover, management appears to be quite mature with regard to capital allocation, as evidenced by the $7 billion of share repurchases versus $5 billion of cash from operations in the past quarter.

A 26x earnings multiple looks reasonable for a firm earning recurring revenues alongside mid-single-digit top-line growth and consistent profit margins. That multiple might even be conservative given the net cash balance sheet and full return of cash to shareholders via share repurchases. Yet even without assuming multiple expansion, I can see the name delivering double-digit returns between top-line growth and the earnings yield, even if top-line growth ends up underperforming consensus estimates. If the company manages to drive operating margins even higher, then that could allow for further upside (or offer a margin of safety in the event long-term valuations trend lower).

ADBE Stock Risks

It is possible that ADBE is disrupted by more nimble competitors, perhaps aided by generative AI. It is possible that generative AI improves rapidly to a point that renders their products obsolete and unnecessary. The stock valuation is not that cheap – notice that I have not explicitly implied significant multiple expansion upside, if any. The fear of potential disruption might lead the stock to trade at even lower valuation multiples in the future, though the aforementioned share repurchases program may be able to take advantage of such a result.

ADBE Stock Conclusion

ADBE might not look so compelling at first glance, with growth rates looking pressured and valuations looking rather normal. However, this is a highly predictable business with a loyal customer base, and that setup may provide for a “soft landing” as growth rates inevitably slow down. I like the strong balance sheet and committed share repurchase program, as they help to support healthy valuation multiples. I reiterate my buy rating for the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!