Summary:

- Adobe stock has continued to disappoint as its AI growth inflection has yet to demonstrate its full potential.

- Management’s underwhelming guidance suggests patience is needed as Adobe navigates near-term monetization headwinds.

- Adobe’s solidly profitable business model and relative attractiveness underscore my conviction in its bullish thesis.

- Notwithstanding the well-funded AI startups keen to disrupt Adobe, it remains well-positioned to benefit from the AI growth prospects.

- I argue why I’m more than willing to catch ADBE’s falling knife, even though it suffered a post-earnings hammering last week. Here’s why you should consider it, too.

Justin Sullivan/Getty Images News

Adobe: Underperformance Is Justified

Adobe Inc. (NASDAQ:ADBE) investors must have felt disappointed, as the leading software company for creative professionals didn’t provide sufficient optimism for buyers to return with conviction. As a result, ADBE has continued to suffer from a valuation de-rating, underperforming its software peers (IGV) and the tech sector (XLK) in general. In my previous Adobe article, I argued why the market seemed too pessimistic about the company’s ability to benefit from the AI growth inflection. Given its fundamentally strong business and market share dominance, its robust financial profile should underpin its ability to outcompete cash-burning AI startups. Despite that, ADBE’s underwhelming performance against the S&P 500 (SPX) (SPY) suggests management’s execution hasn’t been good enough to validate its AI monetization thesis, as execution risks have risen.

In Adobe’s fiscal fourth-quarter earnings release, the market reacted negatively to its quarterly scorecard, sending the stock into a post-earnings tailspin. As a result, ADBE gave up the gains it accrued since early November 2024, revisiting lows last seen in June 2024. Adobe’s underwhelming guidance is in contrast to the solid performances delivered by the leading enterprise SaaS companies such as ServiceNow (NOW) and Salesforce (CRM). Hence, the market is likely increasingly concerned whether the efforts by the leading and well-funded pure-play AI companies like OpenAI and its peers could have hindered Adobe’s near-term growth prospects. As a reminder, OpenAI has launched its Sora text-to-video AI model publicly as it attempts to reshape the rapidly evolving Generative AI landscape in view of more intense competition from Anthropic, Meta AI (META), and xAI, to name a few.

Adobe: Still Awaiting The AI Growth Inflection

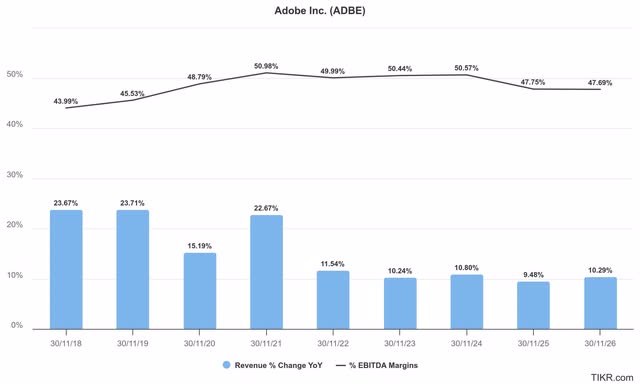

Adobe estimates (TIKR)

Given the tepid outlook offered by management, Wall Street downgraded Adobe’s revenue and adjusted EPS estimates, reflecting higher execution risks. In addition, Adobe’s pre-COVID revenue growth rates aren’t expected to be repeated, suggesting a much slower structural growth momentum moving ahead (as seen above). Concerns were also raised about Adobe’s relatively flat net new ARR for its Digital Media segment in FQ4. Although Adobe expects to achieve 11% YoY growth in ARR for FY2025, investors are likely baking in higher execution risks, given the less favorable near-term dynamics afflicting its AI monetization.

Accordingly, management indicated that the company is still navigating the changes to its pricing strategies, even as it contemplates tiered subscription plans. In addition, it remains focused on balancing the tradeoffs between adoption and monetization in its AI offerings, even as Firefly has accumulated more than 16B generations.

However, Adobe needs to ascertain “commercial safety” while shipping its products quickly to compete more effectively with the leading AI startups. As they evolve their offerings to potentially gain deeper access to Adobe’s traditional design and creative stronghold, they have the financial wherewithal to sustain a prolonged market share battle with Adobe. Hence, I believe the market is justified to have reflected a higher level of disruption risks for Adobe’s business model, as management has yet to demonstrate its ability to achieve a “hockey stick” growth inflection through its AI offerings.

ADBE Stock: Reasonable When Adjusted For Growth

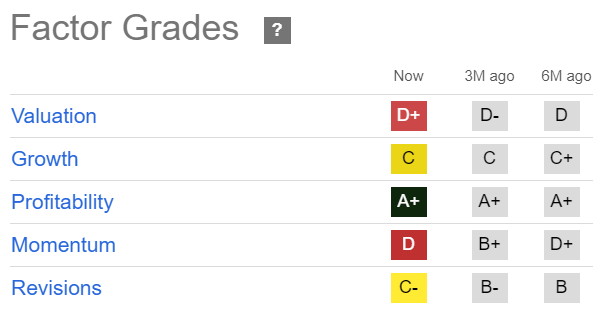

ADBE Quant Grades (Seeking Alpha)

ADBE’s “D+” valuation grade suggests it’s still valued at a premium relative to its tech sector peers, necessitating solid execution to justify its valuation. However, it’s also clear from its “C” growth grade that Adobe isn’t expected to post the breathtaking growth metrics that it delivered in its pre-COVID years, as enunciated previously.

While the company remains solidly profitable (“A+” profitability grade), investors have not been interested in returning to the stock (validated by its “D” momentum grade). Despite that, ADBE’s forward adjusted PEG ratio of 1.47 suggests an almost 25% discount against its tech sector median, indicating relative undervaluation.

Is ADBE Stock A Buy, Sell, Or Hold?

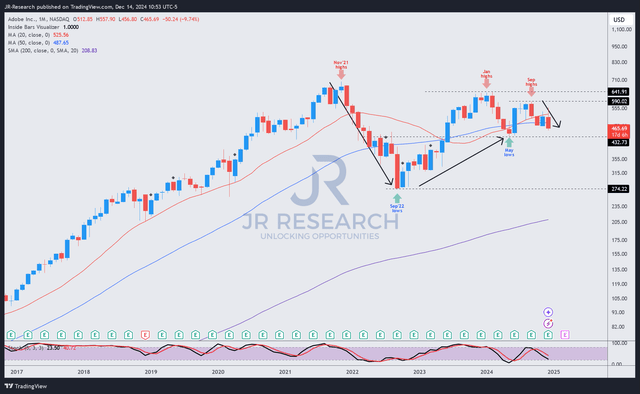

ADBE price chart (monthly, long-term) (TradingView)

When viewed with a longer-term lens, ADBE’s price action remains in an uptrend bias, although it has struggled for traction since bottoming in May 2024. However, the de-rating from its November 2021 highs found robust buying support in late 2022, which was also subsequently defended by dip-buyers in May 2024. Hence, I assess that ADBE’s long-term bullish bias hasn’t been decisively reversed by its valuation de-rating, notwithstanding its premium valuation.

It’s clear that Adobe’s execution hasn’t been promising (“C-” earnings revision grade), behooving caution. While Adobe bulls could suggest that management might be more conservative with its outlook, given the rapidly evolving GenAI dynamics, I believe investors are justified to demand more assurances from management.

ADBE is still priced for growth. Hence, the possibility of further disappointment could weigh on its already well-battered sentiments. The post-earnings pullback could also threaten to untether its May 2024 bottom, potentially leading to a steeper retracement moving ahead.

However, I remain confident of Adobe’s ability to manage an improved FY2025. Its guidance suggests that FQ4 could have seen the worst of its net new ARR performance. Furthermore, the introduction of tiered pricing in 2025 and the anticipated cross-selling opportunities across its cloud services could bolster its recovery prospects. While ADBE’s near-term selling intensity was challenging to experience, it also affords a long-term dip-buying opportunity for investors confident that its May 2024 bottom should hold firmly.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE, NOW, CRM, META, IGV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!