Summary:

- Adobe’s FY2024 saw strong financial performance with revenue up 11%, adjusted EBIT up 16%, and adjusted EPS up 25%. Yet, the stock price dropped 27% over the past year.

- The disruption from AI-driven text-to-image/video tools impacts the lower-end segment of the content creation market, but Adobe’s position in the high-end market remains resilient due to customization needs.

- AI integration in Adobe’s core products in Document Cloud, including AI Assistant and Generative Summary, entrenches its dominant market position and competitive advantage.

- The recent pullback has presented an opportunity to buy a wonderful company at a discount to peers and historical norms.

mesh cube/iStock via Getty Images

Investment Thesis

Adobe’s (NASDAQ:ADBE) FY2024 proved to be a strong year for the company. Revenue grew 11%, adjusted EBIT rose 16% (adjusting for Figma’s failed merger transaction costs), and adjusted EPS grew 25%. Adjusted EBIT margin increased to 36% from 34% while net debt remained stable at -$3.4 billion (more cash than debt on the balance sheet).

On the product front, Adobe integrated AI functionalities in their core products such as AI Assistant and Generative Summary in Acrobat in addition to text-to-image and video-to-image functionalities in their Creative Cloud apps.

I believe Adobe has a competitive advantage in leveraging generative AI, especially through its products in the Document Cloud segment. Acrobat has a very strong position in document management. Functionalities such as AI Assistant and Generative Summary should entrench its position in this segment. Why would anybody upload a PDF to another AI service to analyze it when you can do it directly inside Acrobat? These functionalities should also enable Adobe to raise prices for its products so that they reflect the value the company generates for its customers.

Why then, is the share price down 27% over 1 year? My take is that the market expects Adobe’s products in its Creative Cloud segment to be disrupted by the rapidly developing AI technology. If you believe, as I do, that it won’t, the current pullback has presented you with an opportunity to buy a wonderful company at a fair price.

The Only Constant Is Change

The general consensus seems to be that AI technology will disrupt Adobe’s business model. Especially in Adobe’s largest segment, Creative Cloud (i.e. content creation tools). More specifically, text-to-image/video technology makes the creative process much less time-consuming, in addition to being much easier to use relative to conventional tools. Even I can produce a high-quality image in a few seconds free of charge.

I believe that the market expects new software firms, such as OpenAI, to take market share from incumbent players such as Adobe by utilizing text-to-image/video technology.

I admit that it is true, to an extent. The Large Language Model (LLM) technology is not unique to OpenAI. Several other players, such as Alphabet, Meta, and Anthropic, have developed their own LLM. All of these players are keen to license their technology to software content creators such as Adobe. As a matter of fact, Adobe licenses Microsoft Azure OpenAI services for their Acrobat AI Assistant. Adobe has also integrated text-to-image/video functionality in, for example, their Firefly product. So, while it’s true that new software firms can provide easy-to-use text-to-image design tools, Adobe can as well.

As part of the research for this article, I developed images using the free versions of ChatGPT, Gemini, Canva, and Adobe. The text I used was “Create an image of a cat chasing mice over a field”. I now have four quality pictures that I couldn’t have produced myself without this technology.

I believe these text-to-image tools can disrupt the lower part of the market, i.e. consumers and small businesses with one or a few employees. Before this technology came out, I would most likely have needed to outsource the creation of these images OR purchase some Adobe-like software for a monthly fee to create these images.

It is here I believe Adobe is losing market share. The company alluded to that in its most recent earnings conference call when an analyst asked about why the company has guided to decelerating growth in FY2025 despite being so bullish on its pace of innovation:

…we’re executing on both the proliferation play at the bottom with Express and Acrobat… so the business is going through a change as it relates to the lower end.

The company is tackling the problem by further offering its products in different tiers. My take on this is that Adobe will offer products with fewer functionalities cheaper or even free of charge to the lower end of the market to defend and win back market share from emerging competition.

In the higher end of the market, the customers are more demanding and require additional features that Adobe has developed for decades to cater to their needs. The quality of the images produced by text-to-image technology is high but can be unreliable and hard to customize without more advanced tools. The generated image can certainly work as an initial draft, from which the creative continues to customize it using established creative software tools such as Adobe’s tools.

In addition, as I mentioned previously, Adobe has integrated text-to-image/video capabilities into their own products, which means the whole creative process could be done inside Adobe’s product suite.

To summarize, while I do believe that there is disruption happening inside the content creation market, it’s at the lower end of the market. This will have an impact on Adobe’s topline growth rate going forward. I believe it will be fairly limited, but there is obviously the risk that it could spread to the mid- and high-end segment of the market. Currently, I do not foresee that happening unless there is another revolution in the development of the technology.

Adobe’s Markets

I did some research on Adobe’s markets in my previous Adobe article here. In this piece, I’m going to use the figures Adobe presents in its Investor Meeting material, as I had a hard time finding relevant figures on the web. I’m always a bit wary of using the company’s management’s own material, as they are obviously biased to show a large market with high-growth rates. With the lack of better data, I’m going to go with the company’s figures, however.

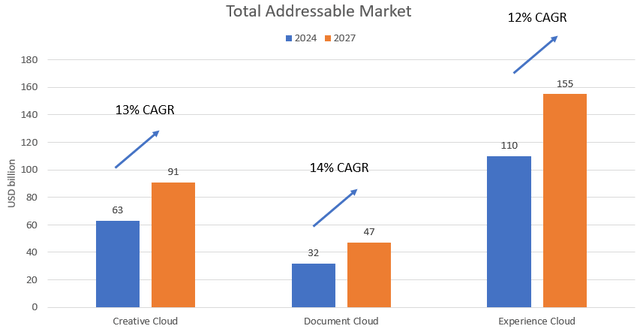

Below are a few key stats on the sizes of Adobe’s total addressable markets (TAMs) across their three segments. I believe the company has aggregated several end markets to get to the final figures.

For example, in Adobe’s Document Cloud segment, the company operates in several different niches such as e-sign and document management which have most likely been consolidated in the Document Cloud market below.

The different markets are large when aggregated and showcase strong growth rates of 12-14%. I am a bit worried that Adobe only guided for about 9% growth in FY2025 while the company expects its markets to grow faster with the exception of the Document Cloud segment. The segment grew about 18% in FY2024 and will grow faster than the market if it continues. On the flip side, it means that Creative Cloud would grow only 7% in FY2025, a significant deceleration compared to the 10% growth in FY2024.

Total Addressable Market (Adobe Investor Meeting 2024)

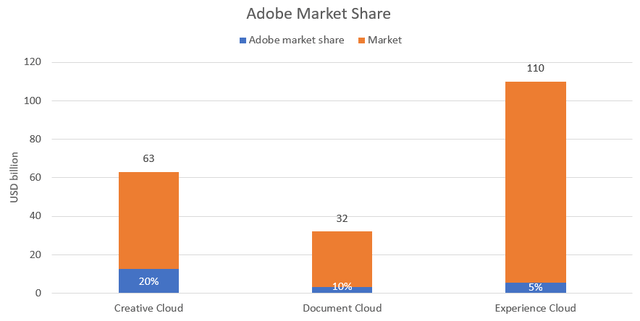

Below I show Adobe’s market shares. Adobe controls about 20% of the aggregated Creative Cloud markets. The company appears to be losing market share in 2025 as it is growing slower than the market on average. In Experience Cloud, the same dynamics seem to be unfolding. The silver lining is that Adobe is growing faster than the market in the Document Cloud segment if current growth trends and market expectations hold.

Adobe’s Market Shares (Adobe Investor Meeting 2024)

The Business

I have a framework that I work through to better understand the business model of the company I’m analyzing. In Adobe’s case, I would argue that the business is of very high quality. Below I’ll go through the framework I use. Please see my previous article here if you want to read about the reasoning behind some of these conclusions.

- Revenue profile:Recurring revenues ~95%

- Cash conversion: Over 100% (of EBITDA)

- Margins: Consistent EBIT margins of over 30%

- Balance sheet: Strong (more cash than debt)

- Company growth rate:Moderate growth of ~10% p.a.

- Market growth: High expected market growth

- Market position: Dominant player in its niches

- Cyclicality: Acyclical

- Asset-light: Capex as a percentage of sales have been between 1-3%

- Pricing power: Moderate

- Mission critical: Moderate

- Product stickiness: Moderate

- Switching cost: Low

- Share of wallet: Low

- Product portfolio: Moderately diversified

- Customer concentration: Low

- Disruption risk: High

I won’t delve too deeply into these in this article except for disruption risk which I went over extensively earlier. Disruption risk is always present in the technology sector but in Adobe’s case, it’s a very tangible near-term risk.

Adobe is significantly undervalued

The valuation in this article is tackled from a few different perspectives to get a holistic view on the value of the company.

Historical Valuation

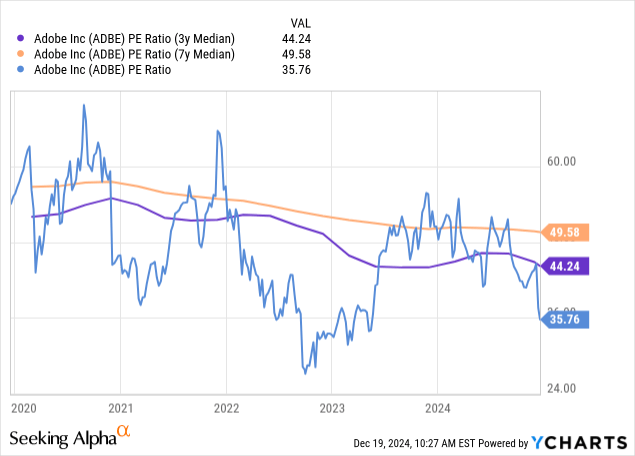

Let’s start with the current valuation compared to historical norms. The company is currently trading at ~36x earnings which is 19% and 28% below its 3-year and 7-year medians. If we adjust the earnings for the costs that arose due to the failed M&A transaction of Figma, the earnings multiple is about 31x. This is already 31% and 38% below the historical norms.

Adobe is significantly undervalued compared to its history.

Multiples Approach

The second valuation methodology is the multiples approach, i.e. the valuation of Adobe based on the valuation multiples of a similar peer group.

The multiples considered here are P/E, P/FCF, EV/Sales, EV/EBIT, and PEG. The peers are Salesforce (CRM), DocuSign (DOCU), Autodesk (ADSK), Oracle (ORCL) and SAP (SAP).

All of the peers are software companies. Some do business in a single niche while others are active in several different markets. For example, DocuSign and Autodesk focus on the e-signature and creative software markets respectively, and compete with Adobe in only these segments. Salesforce, Oracle, and SAP compete with Adobe in the CRM segment. They also are active in several other segments where Adobe doesn’t operate. My point is that it’s not entirely an apples-to-apples comparison.

The multiples for the software companies can be seen in the table below. A few descriptive comments about the table:

- The figures/calculations are from Seeking Alpha

- The max/min is the range around the median in percentage terms

- Adobe is included at the top for comparison purposes

- Adobe’s multiples are excluded from the group statistics (median, max, and min)

- The multiples are shown on a non-GAAP basis

- The multiples are shown for the TTM period except PEG which is shown for the FWD period

- When the TTM multiple is distorted the FWD multiple is used (only in one instance)

- The companies are sorted by size except for Adobe which is at the top

| Company | Market-cap ($ million) | P/E | P/FCF | EV/Sales | EV/EBIT | PEG |

| Adobe | 195,800 | 24.0x | 24.9x | 9.0x | 24.9x | 1.44x |

| Oracle | 462,600 | 28.0x | 48.5x | 10.0x | 32.5x | 2.41x |

| Salesforce | 322,700 | 34.8x | 27.2x | 8.7x | 43.9x | 2.15x |

| SAP | 289,700 | 49.7x | 37.1x | 7.8x | 33.1x | 3.60x |

| Autodesk | 62,900 | 35.4x | 47.8x | 10.7x | 46.4x | 1.78x |

| DocuSign | 18,700 | 26.9x | 21.1x | 6.2x | 20.5x | 0.94x |

| Median | 34.8x | 37.1x | 8.7x | 33.1x | 2.15x | |

| Max | 43% | 31% | 23% | 40% | 156% | |

| Min | -23% | -43% | -29% | -38% | -41% |

Adobe trades below the peer group on all metrics except EV/Sales where it trades roughly at the same multiple. Across the metrics, Adobe trades 31% below the peer group’s multiples (the median of the differences between Adobe’s and the peer group’s multiple).

According to the multiples approach, Adobe is significantly undervalued.

Cash Flow Model

The third valuation methodology is a cash flow model or more precisely the discounted cash flow model (‘DCF’).

Assumptions of the model are listed below:

- 10% sales growth during 2024-2034E

- 4% as the terminal growth rate

- Return on equity that equals 10% as I assume that that’s the best alternative rate of return one could earn by investing, for example, in an S&P 500 index fund

- WACC equals the return on equity as net debt is slightly negative

- EBIT margin of 35% throughout the forecast period and terminal year

- Capex is modeled as 2% of sales

- Depreciation as 30% of PP&E and intangible assets

- Net working capital as -20% of sales.

- Shares outstanding decreases by 3.5% in FY2025 and 1.5% per year thereafter

- In the bear/bull case, I have adjusted the sales growth rate by +/-2.0% and EBIT margins by +/-2.5% during the forecast period. The terminal year sales growth is adjusted by +/-1.0% and EBIT margins by +/-2.5%.

The DCF model produces a share price of about $450 per share. It’s in line with what the market is currently valuing Adobe at as of this writing. The bull and bear case produces share prices of $641 and $324 respectively, which is 42% above and 28% below the current share price.

According to the DCF model, Adobe is fairly valued, and the expected return is 10.1%.

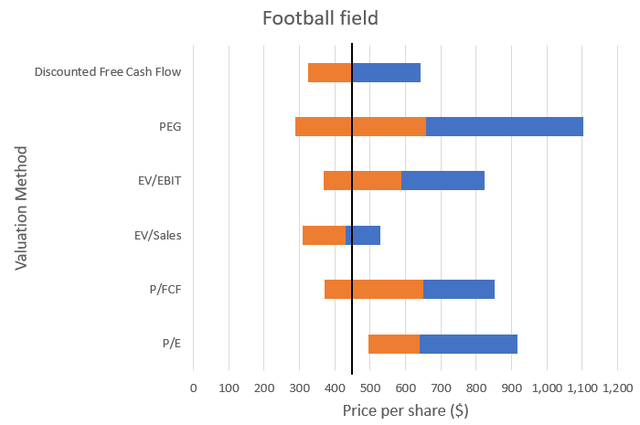

Football Field

Putting it all together in a football field, we see that Adobe is significantly undervalued on all metrics except on EV/Sales and the DCF model according to which it is fairly valued. The black line represents Adobe’s current share price of about $450.

Football field summary of valuation approaches (SeekingAlpha, company financial statements)

Shares outstanding

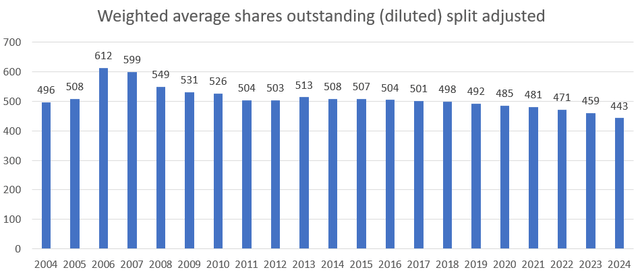

I always consider management’s capital allocation abilities before making a purchase decision. I’m a big fan of management that reduces shares outstanding by share repurchases as it indicates that the company generates excess cash, is in a good financial position, and ultimately increases earnings per share. Adobe has $17.7 billion left of their $25 billion share buyback authorization and I expect them to continue repurchasing shares over the next few years.

Weighted average shares outstanding (Company financial statements)

Conclusions

Considering Adobe’s high quality and defensive business model in addition to being significantly undervalued according to the valuation methodologies applied here, I rate Adobe as a strong buy.

It comes down to having conviction in Adobe’s ability to defend its current market position in the creative software market in addition to leveraging the disruptive LLM technology to its benefit. I believe no other firm is as well positioned to do this as Adobe.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.