Summary:

- Adobe reported its Q3 results which beat expectations.

- The company is capturing strong demand for AI capabilities across its creative media ecosystem.

- The introduction of “Generative credits” as a pricing tool can add to top line and earnings momentum.

- We are bullish on Adobe as an AI winner.

CommerceandCultureAgency/DigitalVision via Getty Images

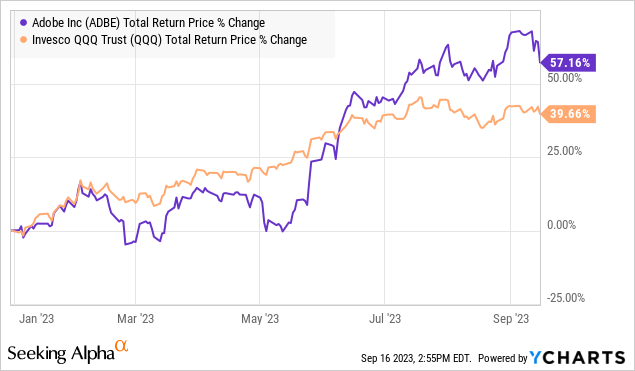

Adobe Inc. (NASDAQ:ADBE) reported its latest quarterly results, beating revenue and earnings estimates amid a growth resurgence. This year’s story has been the launch of several AI capabilities integrated across the entire cloud ecosystem, driving a new user demand.

Adobe is finding success in monetizing a growing number of its creativity solutions and productivity tools, which we believe is still in the early innings in terms of new AI potential. Adobe is already very profitable and we can highlight the introduction of “Generative credits” as a powerful pricing tool that should be positive for margins going forward.

What we like about the stock is its high-quality profile with rock-solid fundamentals. We last covered ADBE following its Q2 report back in June, calling it our “favorite AI stock“. In many ways, the current earnings trends have strengthened that conviction as a very bullish backdrop that can push shares higher.

ADBE Q3 Earnings Recap

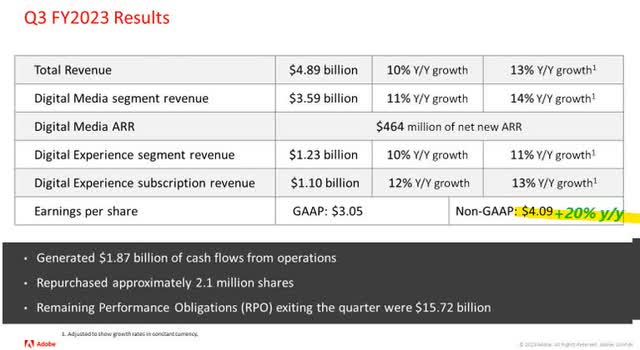

ADBE Q3 EPS of $4.09, came in $0.11 ahead of estimates, and also up 20% from the period last year. Revenue of $4.9 billion was another quarterly record for the company, up 10.4% year-over-year. The adjusted operating margin at 46.3% compares to 44.1% in Q3 2022.

Beyond the solid headline figures, our take is that the underlying numbers are even stronger. “Digital Media” revenue was up 14% on a constant currency basis, with the segment’s subscription annual revenue reaching $464 million, well above the guidance set at the end of Q2 closer to $410 million.

Total remaining performance obligations (RPO) at $15.7 billion, climbed from $15.2 billion sequentially from last quarter. This metric aggregates the value of all contracts that have not yet been fulfilled. The understanding here is that customers are adding features and expanding spend on the platform, which is a good read on the growth runway amid high retention rates.

source: company IR

Within Digital Media, the Creative Cloud group has been a strong point. This category includes some of the flagship software like “Photoshop”, “Premier”, and “Illustrator” which have captured a strong market response for AI features. Specifically, “Firefly” is the generative AI tool that has been downloaded by more than three million users.

A key point here is that this side of the business is being embraced by corporate customers. Adobe’s wins this quarter included deals with major companies like Amazon.com, Inc. (AMZN), Take-Two Interactive (TTWO), and Paramount Global (PARA) cited in the press release.

When looking at Adobe as a whole, even more impressive is the momentum in the productivity side of the product portfolio. Document Cloud, for example, which includes Acrobat and PDF saw a 15% increase in revenue this quarter. Management cited a “significant growth in monthly active users across the web”. Experience cloud has also been a strong point highlighting the breadth of the ecosystem beyond the creativity tools.

source: company IR

In terms of guidance, the company is targeting Q4 revenue between $4.975 and $5.025 billion. If confirmed, the midpoint estimate represents an increase of 10% y/y. Q4 Digital Media ARR forecast at $520 million, up 12% compared to Q3 highlights the AI impact, capturing demand for new subscriptions. Similarly, a Q4 EPS target between $4.10 and $4.15, would push the full-year earnings per share toward $15.93, up 16% from 2022 and also well above the initial target closer to $15.30 at the start of the year.

Adobe Launches Generative Credits

As mentioned, an important development this quarter is the rollout of generative credits within the subscription strategy. The idea here is that every Adobe user within the existing pricing plans receives access to a limited number of “generative fills” and the more advanced AI transformations every month. This is done in part to prioritize the computing processing power but also to maximize the monetization of the technology.

Here is management’s explanation during the earnings conference call:

Generative Credits are tokens that enable customers to turn text-based prompts into images, vectors and text effects with other content types to follow. Free and trial plans include a small number of monthly fast Generative Credits and will expose a broad base of prospects to the power of Adobe’s generative AI, expanding our top-of-funnel.

Paid Firefly, Express and Creative Cloud plans will include a further allocation of fast Generative Credits. After the plan-specific number of Generative Credits is reached, users will have an opportunity to buy additional fast Generative Credit subscription packs.

Adobe is essentially offering a free trial to its most prized feature as an extra to the base product. Power users who receive the most value in the features and require the functionality on a regular basis have the option to purchase additional credits as an add-on to their regular packages.

Here we can draw a parallel to the strategy that has proven to be very lucrative in the world of video games through extra downloadable content. The expectation is that average revenue per user and overall spending within the ecosystem climb. The result is that AI becomes an incremental growth driver and accretive to earnings as users realize the potential.

ADBE Shares Look Attractive

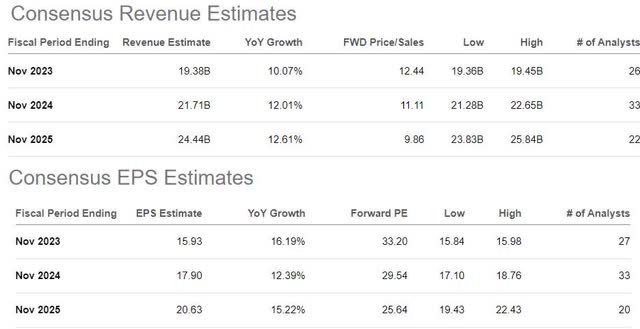

The bullish case for Adobe is that this newfound AI momentum is just getting started, representing an operating and financial tailwind over the long run. According to consensus, the forecast is for annual top-line growth of around 12% for the next two years, while earnings trend a bit higher in the 14% range through 2025.

Seeking Alpha

Adobe has proven to be an earnings juggernaut, beating the consensus estimates every quarter over the past four years. Simply put, it’s hard to bet against Adobe and we’d argue that there is an upside to the consensus estimates with the possibility that the market is a bit too conservative.

Seeking Alpha

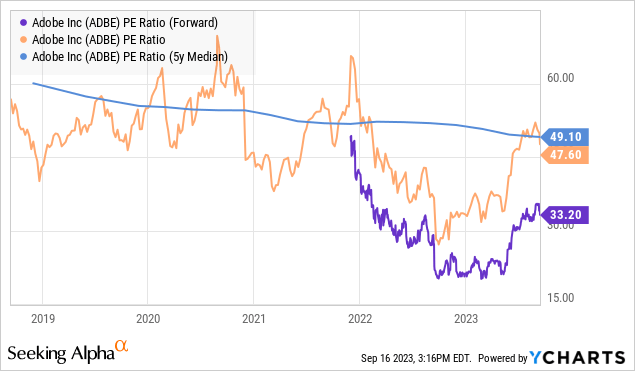

At the same time, the biggest change in the stock since it reached an all-time high near $700 back in late 2021 was the reset of its valuation premium lower. From historically trading at a P/E of around 50x, there is a case to be made that shares are undervalued here at 33x on a forward P/E basis or even 30X into fiscal 2024. If AI is the game-changer for Adobe we believe it is, the long-term outlook and growth potential are stronger today and can justify a higher premium.

ADBE Stock Price Forecast

We rate ADBE as a buy with a price target of $720 over the next year, representing a 40x multiple on the current consensus fiscal 2024 EPS of $17.90. This is an upgrade from our previous target of $625, considering the potential of the new Generative Credits to further accelerate earnings through firming margins.

The way we see it playing out is that the next couple of quarters coming in strong should be enough for the market to lift forward estimates. We also expect positive guidance by Adobe looking ahead toward next year from the Q4 earnings report expected to be released in December.

In terms of risks, keep in mind that Adobe remains exposed to the volatile macro environment. A deterioration in consumer spending, pressuring the global growth outlook, would open the door for weaker-than-expected results. Monitoring points for the company include the RPO and segment ARR as key financial metrics.

Seeking Alpha

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.