Summary:

- AdTheorent is a programmatic ad platform that utilizes machine learning for ROI optimized ad campaigns.

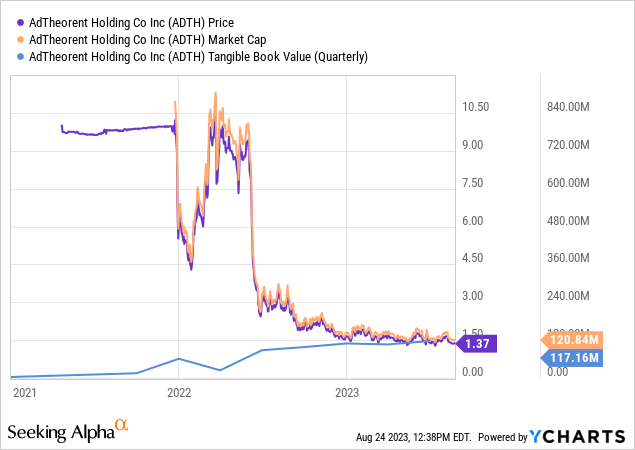

- Growth was negative in Q2, and the company is now trading at tangible book value.

- Macro headwinds are present, but the balance sheet is solid, and there is no hype around the name whatsoever.

Saksit Sangtong/iStock via Getty Images

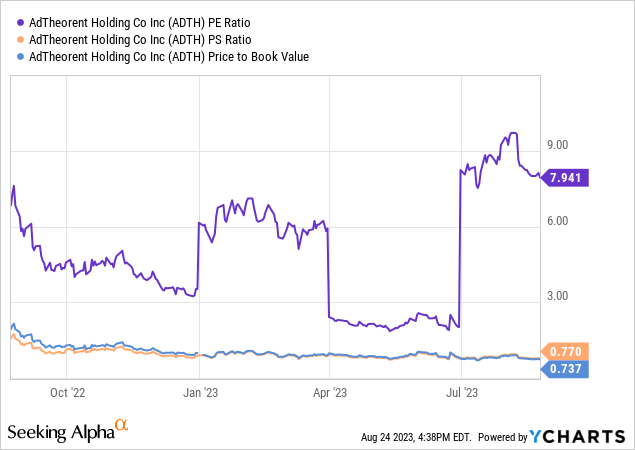

AdTheorent Holding Company (NASDAQ:ADTH) (ADTHW) is a digital media business that touts specialization in programmatic advertising and machine learning. The company went public via SPAC merger back in late 2021 and after a highly volatile first six months of trading, it’s been a slow drip down to tangible book value over the last year:

In this article, we’ll explore what exactly the company does, assess Q2 earnings, look at balance sheet health and a few valuation metrics to consider.

Programmatic Advertising

As a programmatic ad platform, AdTheorent acts as a middleman in the buying and selling of digital ad impressions. In an analog advertising world, ad buying has historically been done through direct publisher/advertiser relationships or through the use of advertising agencies. In a digital world, advertisers (and agencies) have a greater ability to focus buys toward more of a targeted audience rather than buying a publisher or piece of content.

For instance, rather than buying a specific channel or program on network television through a sales representative that may cast a wider net, an advertiser can directly use software with aggregated ad inventory to curate a more precise target with digital programmatic ads. In theory, this form of advertising reduces impression waste and leads to better outcomes for the ad campaign.

AdTheorent’s Differentiation

I mention impression waste reduction as a “theory” because it is not always true that programmatic ad buying achieves this. Back in June, the Association of National Advertisers published the results of a study that indicated as much as 21% of the impressions served during the study’s data collection ended up on “Made For Advertising,” or MFA, websites that lacked any return on spend.

The study concluded that fixing this problem can lead to as much as $20 billion in efficiency gains if the ad industry can weed out the bad actors in the space. In a blog post response to the ANA study, AdTheorent CEO Jim Lawson went into great detail on why the company’s offering is different.

AI is a giant buzzword in the 2023 commercial zeitgeist, but for the past 11 years we have been using and operationalizing advanced machine learning to reduce and eliminate waste in order to drive smart media buying for advertisers.

Simply put, AdTheorent’s system uses machine learning to bid impressions that are optimized specifically for ROI depending on whatever KPI the ad buyer designates in the campaign. This means AdTheorent’s platform is designed to eliminate the kind of impression waste the ANA study highlighted and it verifies that performance through log level data transparency with the clients.

What is also very interesting is the fact that AdTheorent doesn’t use cookies. This is good because Google (GOOG) is phasing out cookies in the Chrome browser. In my view, AdTheorent could be well positioned to take market share from suppliers who aren’t yet prepared for life after cookies.

Q2 Earnings

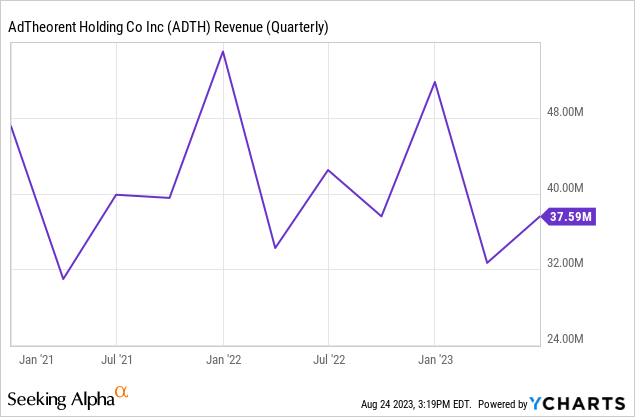

There’s a bit of a “what’s the catch” feel to ADTH from where I sit and we need not look much further than the company’s recent earnings performance to see some potential issues. In Q2, revenue fell 11.5% from the prior year period to $37.6 million.

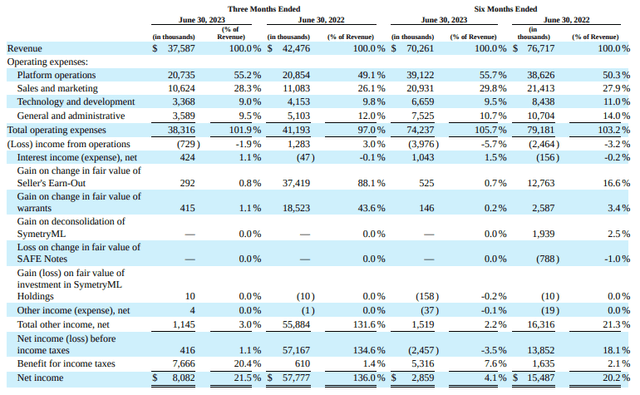

The company did guide some softness during the Q1 call and cited macroeconomic pressure that is hurting marketing spend budgets for AdTheorent’s clients. Specifically, the retail and healthcare customers had delays in campaign timing. The company reported a quarterly loss from core operations that was offset by gains from interest and other income.

Q2 Performance (AdTheorent 10-Q)

During the call, the company noted large sequential gains in self-service revenue and connected television revenue, which came in at 75% and 92%, respectively. Gross margin dipped slightly from the previous year but was still 64% of revenue. Leadership attributed the small margin squeeze to introductory pricing for first-time customers and the increased cost of connected TV inventory. Despite what I think can be viewed as a disappointing quarter, the company remained optimistic for the remainder of the year:

And although Q2 revenue was below our internal expectations by approximately $1 million, we are encouraged by the positive trends in bookings and our pipeline opportunities. At this point in the year, our pace for bookings in the second half exceeds the same time last year, up nearly 8% year-over-year, and our pipeline shows strong double-digit growth with more opportunities in advanced stages. These indicators support our confidence in achieving our full year outlook.

The company recently launched a self-service platform function that will allow ad clients with in-house media buyers to interact with the product on their own. However, the overwhelming majority of the company’s revenue still comes from its managed service business line and the two segments were not broken out in the last report.

Balance Sheet and Valuation

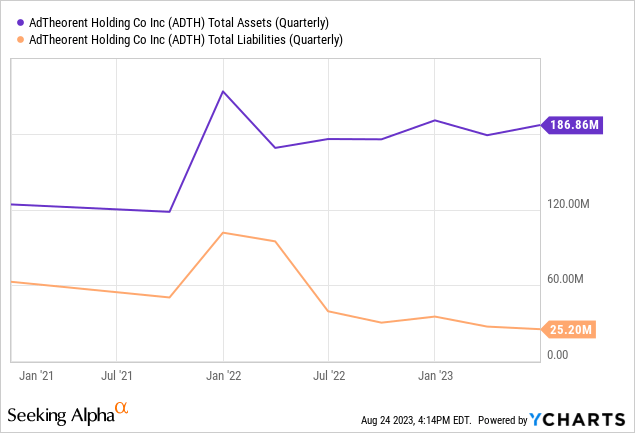

From both a balance sheet and valuation perspective, there’s quite a bit to like after what has likely been a brutal selloff for longer term holders. AdTheorent is currently sitting on a sizeable $73.1 million hoard of cash and equivalents.

In aggregate, AdTheorent has $186.9 million in total assets, of which $125.6 million are current with most of the rest being represented by goodwill. Total liabilities are just $25.2 million. $17.2 million of that is current, with most of the rest being lease liabilities that amount to about $1.4 million annually through 2027. However, the company’s New York headquarters lease is the only office lease by the company that has commitments beyond 2025. There is also $2.2 million in warrant liability through the company’s ADTHW shares. The expiration of the warrants isn’t until the end of 2026 and the exercise price is $11.50 per share.

Valuation-wise, AdTheorent gets a B+ grade from Seeking Alpha and has some really attractive multiples, especially against sector peers. The company trades well under book, at a 0.8x sales multiple, and a PE ratio of 8. From where I sit, ADTH is either a really interesting opportunity after an 85% selloff or it’s a value trap.

Risks

As an advertising platform, AdTheorent’s revenue growth and profitability face headwinds if the economy enters a recession. During slowdowns, marketers historically cut spending. It’s reasonable to assume ad spending cuts throughout the broader economy would have a negative impact on AdTheorent’s business, and we’re already seeing signs of that from Q2 earnings results.

Another very legitimate risk in my opinion is the rise of subscription-based content monetization models. We’ve seen through the rise of platforms like Patreon, Substack, and even to a degree Rumble (RUM) that publishers are increasingly hedging the ad-based model and opting for a more direct relationship with their audiences. That’s a potential headwind for the advertising industry more broadly but programmatic ad sellers are likely not insulated from any larger move toward a subscription-based online content model.

Final Thoughts

I actually like this company down here. For investors who have a high risk tolerance and a level of comfort with small caps, I think you can do a lot worse than longing ADTH at a 25% discount to book value. For a company that utilizes machine learning and has a real functioning product that generates revenue in the market, there is absolutely no hype whatsoever with this name from where I sit. I like that. Especially considering the froth we’re currently witnessing in other AI-linked equities. I’m personally keeping positioning somewhat small compared to my other holdings. But I think ADTH is worth a speculative buy.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADTH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.