Summary:

- AdTheorent’s Q3 earnings show an 8.8% increase in revenue, a 4.8% increase in gross profit, and a 32% increase in adjusted EBITDA year over year.

- The company’s self-service platform saw a 28% increase in revenue and a 57% increase in advertiser count.

- Based on the Q3 earnings, we believe the stock continues to be undervalued.

- The next results will be crucial for AdTheorent, as it expects most of the full-year Adjusted EBITDA in Q4.

Andrii Yalanskyi

AdTheorent (NASDAQ:ADTH) is a digital media and advertisement company that is currently trading at all-time lows. Since our last article on AdTheorent, the stock has published their Q3 2023 earnings. While the stock price only moved sideways since our last article, the latest release reaffirms our buy-rating for the stock. We have talked extensively about the company’s history and the balance sheet in our last article. In this article we want to focus on the updates in the Q3 earnings. If you haven’t read our last article, check it out on our profile.

Recap of our last article

In our last article we explained how the stock suffered from the general downtrend in SPAC stocks and the macroeconomic uncertainties in the advertisement industries. We concluded that the stock is undervalued, since the company is debt-free and trading under tangible book value while having a profitable operating business. Due to remaining uncertainties for the advertisement industry, we also concluded that it is important to look out for revenue trends for AdTheorent and also other companies that are doing business in the advertisement industry.

The Q3 earnings in numbers

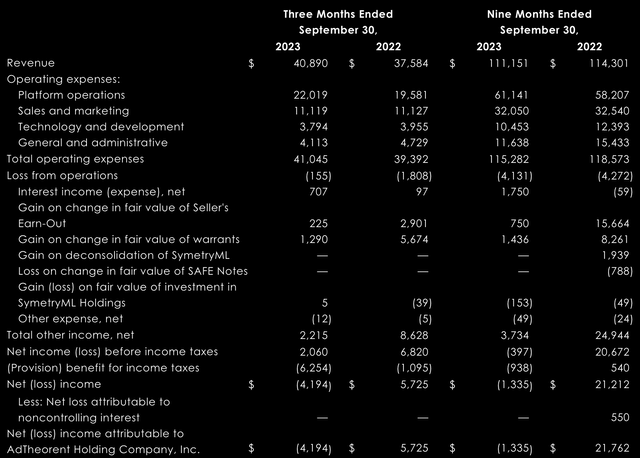

AdTheorent Q3 2023 earnings

For the third quarter of 2023 the company reported following numbers:

- Revenue of $40.9m – a 8.8% increase Y/Y

- Gross profit of $18.9m – a 4.8% increase Y/Y

- Adjusted EBITDA of $4.7m – a 32% increase Y/Y

The company’s reported numbers were either at the upper-end of their outlook given in Q2 2023 or, in case of Adjusted EBITDA, even surpassed their outlook.

AdTheorent reported further growth of their self-service platform, reporting a 28% Q/Q revenue increase and 57% advertiser count increase for their self-service platform.

For the balance sheet on September 30, 2023 the company reports a slight decrease in stockholders’ equity from $161.7m to $160.3m. However the stock is still trading at levels quite a bit under the company’s book value.

For the last quarter of 2023 AdTheorent gave an outlook:

- Revenue in the range of $55.0 million to $57.0 million.

- Adjusted Gross Profit of at least 64% of revenue.

- Adjusted EBITDA in the range of $10.0 million to $11.5 million.

In general, we are pleased with the company’s Q3 results as they met or exceeded expectations. We continue to believe that absent of any meaningful negative impact the stock remains undervalued at current prices. The positive trends in Q3 reaffirm our believe.

The Advertising Industry

While the advertisement industry still experiences macroeconomic pressures, companies in general continue to report small improvements compared to prior quarters. With some companies, like Fox and Alphabet, reporting decent improvements in ad revenue in their latest earnings reports, some other companies in the space continue to report flat or slightly decreasing advertisement revenues for the latest quarter.

In general it is safe to say that growth in the industry continues to face pressures, with a total recovery still not being in sight for most industry players. Over the long-term however, most experts still forecast high-single digit yearly grow for the industry.

A big upcoming change for the digital advertising industry as a whole are Google’s plans to end third-party cookies for their browsers. If successful, this will mean a change in advertisers’ targeting capabilities and the need for alternative targeting and tracking approaches like the ones AdTheorent is offering. We continue to believe that the cookie ban might be a meaningful catalyst for AdTheorent’s business.

Q4 2023 – Make or break

With Q4 traditionally being the strongest quarter for any advertising company, results for the next quarter are very important for AdTheorent. With a revenue outlook in the range of $55m to $57m the company expects to make around a third of the full-year revenue in just this one quarter.

With an increased focus on their self-service platform and the increase in onboarded advertisers throughout the year, we expect those investments to show meaningful impact in Q4. A successful integration to the self-service platform should have positive impact on the company’s scalability and profitability going forward.

We are closely following the events leading up to the Q4 release and the release itself. With the company forecasting most of their Adjusted EBITDA of the year to fall into Q4, we expect a strong quarter. If the company fails to meet or exceed their Q4 outlook by a big margin, we would reconsider our buy-rating for the common stock.

We are also closely following general advertising industry results for Q4 2023. Since AdTheorent is being largely affected my macroeconomic impacts, a recovery for Q4 2023 or, on the other hand, weaker-than-expected revenues for the quarter could have meaningful consequences for the company.

We are also looking forward to any possible announcement of returning capital to shareholders in their full-year release, preferably in the form of share repurchases.

Conclusion

With Q3 being on the upper-end of expectations, we continue to believe that the common stock is undervalued at current prices. With investments into their self-service platforms and strong machine-learning capabilities we believe the company is well positioned to scale in coming quarters. With Q4 being the most important quarter for the company, we are closely following the events of the current quarter. Based on the results for Q4 we will again revisit our rating on the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADTH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.