Summary:

- AMD delivered strong Q2 2024 results, beating revenue and earnings expectations, with a 9% YoY revenue increase and 18% YoY operating income jump.

- AMD provided better-than-expected guidance for Q3, particularly highlighting an increase of approximately $500 million in AI-related business outlook.

- Despite these robust earnings, I maintain a cautious stance on AMD’s commercial momentum due to significant competitive challenges.

- There is growing skepticism among investors regarding the AI hype, a sentiment that could potentially impact AMD’s growth trajectory in the Data Center segment.

- All things considered, I reiterate a “Sell” rating for AMD, anticipating a potential double-digit decline in share price from its current trading level of over $130.

JHVEPhoto

Advanced Micro Devices (NASDAQ:AMD) (NEOE:AMD:CA) delivered a solid set of Q2 2024 results, beating Wall Street expectations for both revenue and earnings: revenue for the June quarter increased 9% YoY, while operating income jumped 18% YoY. Additionally, AMD’s guidance for Q3 came in better than expected, with the outlook for AI-related businesses increasing by about $500 million. Despite the solid earnings report, I argue that AMD’s commercial momentum should be viewed with cautious optimism, acknowledging the significant competitive headwinds. In addition, there is increasingly scepticism among investors that the buzz around AI may be overhyped and the tangible, near-term financial benefits of CAPEX investments from companies such as Microsoft (MSFT), Amazon (AMZN), Google (GOOG) and Meta (META) are missing. This sentiment is likely to affect AMD’s growth trajectory in the Data Center segment. Following AMD’s Q2 earnings, I reiterate a “Sell” rating and see potential for double-digit share price downside compared to AMD’s current trading price of >$130.

For context, since the start of the year, AMD shares have underperformed the broader market: YTD, INTC stock is down about 10%, compared to a gain of approximately 12% for the S&P 500.

AMD Reports Solid Earnings …

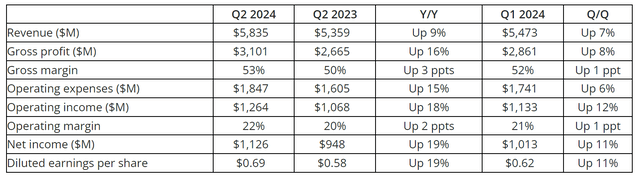

AMD reported earnings for Q2 on July 30th, and delivered an overall solid set of results, beating Wall Street estimates on topline and earnings: During the period spanning from April through end of June, the semiconductor giant generated $5.84 billion of sales, up 7% QoQ / 9% YoY, and topping estimates of about $5.74 billion. On a segment basis, Data Center revenue grew 21% QoQ, with a strong performance of MI300 DC GPUs being a key sales driver. In the Client, Gaming, and Embedded segments, revenue increased by 9%, 30%, -2% QoQ, respectively.

On a group level, gross margin came in at 53.1% (up 3 ppts. YoY), which was overall quite consistent with guidance and management expectations, while operating expenses were $1.84 billion, slightly above Wall Street estimates (+$100 million). Operating income was reported at $1.26 billion compared to $0.95 billion for the same period one year earlier (operating margin at 22%, up 2 ppts. YoY). Lastly, Earnings Per Share were $0.69, compared to $0.5-0.6 expected.

… With A Slightly Better Than Expected Outlook

In addition to Q2 earnings, AMD management also provided estimates of Q3 results: According to management, revenue is expected to come in between $6.4 billion and $7.0 billion, with a midpoint of $6.7 billion exceeding Wall Street estimates of $6.61 billion by about $300 million. In addition, gross margin is guided to approximately 53.5%, which suggests a 50 basis point expansion QoQ. Lastly, assuming a projected $1.9 billion of operating expenses, operating income is expected at $1.7 billion

The better than expected guidance looks to be mostly supported by a continuing strong performance from the Data Center business, driven by MI300 and DC CPUs. Indeed, AMD slightly increased AI-related revenue guidance for FY 24 from $4 billion to $4.5 billion. At the same time, management warned on slower-than-expected recovery in the Embedded business; and also the Gaming segment remains a headwind, with revenue expected to decline double digits QoQ into 3Q24.

Structural Outlook May Still Be Overhyped

Although I acknowledge solid earnings and a slight guidance raise on FY 2024 outlook, I view AMD’s commercial upside as overhyped compared to what markets are pricing – pointing to a 100x PE multiple on FY 2024 GAAP earnings. Most importantly, I highlight that the semiconductor industry is highly competitive: In fact, on AI-Specific Hardware investors should not ignore that NVIDIA is still the market leader, with its A100 and H100 GPUs being the preferred choice for AI workloads across major cloud providers and enterprises. Moreover, on top of the hardware leadership, NVIDIA’s CUDA platform has become the industry standard for AI and machine learning development. The extensive ecosystem of tools, libraries, and community support around CUDA makes it difficult for competitors to displace NVIDIA’s entrenched position in the enterprise market, creating a substantial barrier for AMD to gain significant market share. On a structural level, despite the buzz around AI, investors should also consider that there is growing skepticism among institutional investors about the tangible, near-term financial benefits. This sentiment is likely to impact AMD’s commercial momentum in the Data Center segment, as expectations may be tempered by a demand for more quantifiable outcomes and standardized measures of success in AI deployments. Shifting perspective to CPU, the broader recovery in the server segment is promising; however, AMD has experienced some wallet-share losses to GPUs in previous quarters, as competitive pressures from Intel and other emerging players cannot be overlooked. Thus, overall, I suggest that AMD’s ability to sustain its growth trajectory in this segment amidst fierce competition is uncertain. And in any case, to enhance its market position, AMD must continue to innovate, invest in ecosystem development, and strategically position its products to offer compelling alternatives to competitors. On that note, R&D is costly and there may be upside to AMD’s research efforts, with the company spending only about $1.6 billion in R&D per quarter, vs. $2.7 billion for NVIDIA and $4.2 for Intel.

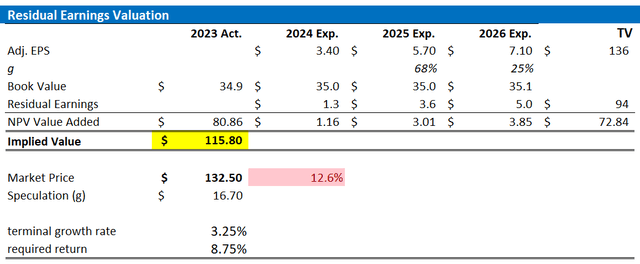

Valuation Update: Still Double-Digit % Downside

Following AMD’s Q2 earnings, I continue to view the residual earnings model as the most appropriate framework for valuing AMD shares, and I tweak my assumptions: Given a slightly better than expected outlook since my last coverage of AMD in April, I raise my EPS projections through 2026 by approximately 10%. Consequently, I now anticipate that AMD’s EPS for 2024 will likely fall within the range of $3.3 to $3.6, while I am updating my EPS forecasts for 2024 and 2025 to $5.7 and $7.1, respectively. At the same time, I maintain a terminal EPS growth rate of 3.25% beyond 2026, as well as my cost of equity assumption at around 8.75%. Based on these revisions, I now calculate a fair implied share price for AMD at $116 per share. On that note, I highlight that although my update target price increased from $101 previously, I still see potential for double-digit downside compared to AMD’s current trading price of >$130.

Refinitiv; Company Financials; Author’s Calculations

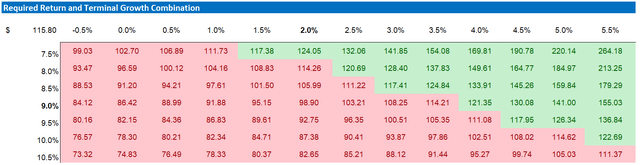

Below is also the updated sensitivity table.

Refinitiv; Company Financials; Author’s Calculations

Investor Takeaway

Advanced Micro Devices reported strong Q2 2024 results, exceeding Wall Street expectations for both revenue and earnings. Revenue for the June quarter increased by 9% year-over-year (YoY), while operating income surged by 18% YoY. Additionally, AMD provided better-than-expected guidance for Q3, particularly highlighting an increase of approximately $500 million in AI-related business outlook. Despite these robust earnings, I maintain a cautious stance on AMD’s commercial momentum due to significant competitive challenges. Indeed, the recent sell-off in Intel shares is just another proof-point of the enormously competitive nature of the semiconductor industry — cash flows and moats that protect them may break down quickly. There is growing skepticism among investors regarding the AI hype, a sentiment that could potentially impact AMD’s growth trajectory in the Data Center segment. All things considered, I see an ongoing “Hype-deflation” cycle for AMD, and I reiterate a “Sell” rating for AMD, anticipating a potential double-digit decline in share price from its current trading level of over $130.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.