Summary:

- AMD stock is a no-brainer buy for long-term value investors for 2025, despite weak technical indicators and recent Wall Street downgrades.

- AMD’s data center revenue is expected to drive significant growth, mirroring Nvidia’s trajectory from 1.5 years ago, with margins set to rise due to high OPM in data centers.

- Recent Wall Street downgrade looks to be a reaction to share price decline rather than fundamentals. Market share concern is less critical given rapid growing AI demand.

- AMD’s valuation is compelling, trading at an 18% discount to Nvidia despite comparable 50+% earnings growth in 2025. My DCF model estimates a fair value of $163 for AMD. Strong Buy.

JHVEPhoto

Investment Thesis

Advanced Micro Devices (NASDAQ:AMD) has come down to a highly attractive level following the share price pullback since 3Q24 results. Technically speaking, AMD’s chart looks very weak. However, to medium-long term value investors, owning AMD at the current level could be a no-brainer trade. While weaker-than-expected 4Q guidance and subsequent Wall Street downgrades have weighed on AMD’s share price, I believe these are merely short-term factors that don’t undermine the long-term growth story of AMD. I believe the current share price level offers an attractive buying opportunity for medium-term value investors. Strong Buy.

Technically, AMD’s chart doesn’t look good. AMD’s share price has broken below its 10-day, 50-day and 200-day SMAs indicating a very bearish trend in share price. 14-day RSI is also weak at 33.5, but it is approaching the oversold territory. Referencing to long-term trend, AMD has fallen below $133 support level and looked to retest the low in early Aug of $122 from technical analysis perspective.

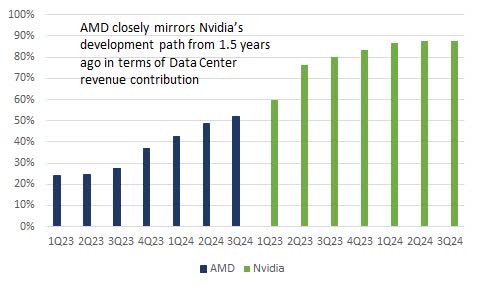

While AMD looks technically weak, when I look at AMD’s fundamentals, I see a reflection of where Nvidia (NVDA) was 1.5 years ago. In 1Q23, Nvidia’s data center segment contributed 60% of its revenue, driven by surging demand for AI-focused GPUs to support massive generative AI workloads. By 3Q24, this contribution had grown significantly, accounting for 88% of Nvidia’s total revenue. In contrast, AMD joined the AI-GPU race a little late and therefore its data center only accounted for 52% of total revenue in 3Q24. However, a clear growth trajectory has already been seen, where AMD’s data center revenue jumped 107% YoY in 9M24. I believe this only marks the beginning of a super growth cycle, similar to what we saw in Nvidia 1.5 years ago, as MI350 and MI400 series are planned for release in 2H25 and 2026.

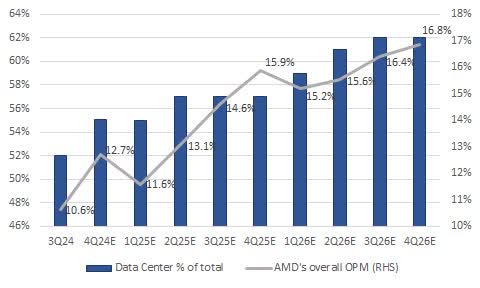

Margins set to rise on growing data center sales. Data center was having the highest OPM of 29% vs client 15% and gaming 3% in 3Q24. As a result of the strong growth in data center revenue, AMD’s overall OPM is expected to rise. I estimate AMD’s OPM to reach 16.8% in 4Q26E from 10.6% in 3Q24.

A concern raised by Wall-Street in recent downgrades was that AMD may lose market share due to intense competition from Nvidia and a growing customer preference for cloud custom chip from Marvell Technology and Broadcom. While competition in the AI-GPU market is undeniably fierce, I believe the primary focus at this early stage of AI development should be on overall market growth. With AI demand growing rapidly, I think concerns about market share looks less critical.

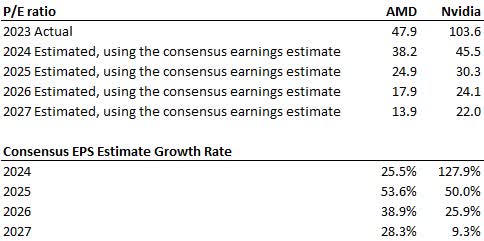

AMD’s valuation is highly attractive. With its share price approaching a 52-week low, AMD is currently trading at 38.2x FY24 P/E. While this remains at a premium compared to the sector median of 26.3x, AMD’s superior FWD long-term EPS growth CAGR (3-5 years) of 41.7% vs sector median of 15.3% could be a strong justification. In comparison, Nvidia’s forward EPS growth CAGR stands at 38.2%, yet it trades at a much higher 45.5x P/E, highlighting AMD’s deep undervaluation. Our DCF model estimates a fair value of $163 suggesting 29% upside from current level.

AMD is Technically Weak…

I am not a technical guy, as you can see from my background. However, the technical matrix can provide me with some ideas of where the share price is heading to in the near term. AMD’s share price has broken below the 200-day moving average trend line since Oct. With shorter term moving average (10-day & 50-day MA) breaking below longer-term moving average trend lines (100-day & 200-day), this indicates a bearish trend in share price. The 14-day RSI is also weak at 33.5 but is approaching the oversold territory of 30, suggesting a potential rebound in the short term. From a longer-term support level perspective, the share price has recently broken below the $133 support level. Technically, the next support level would be the low in Aug of $122. We haven’t seen any meaningful turnaround in technical indicators yet. AMD is unlikely to be favored by short-term investors at the moment.

AMD is technically weak (Fastbull)

… But Fundamentally AMD resembles Nvidia from 1.5 years ago

AMD’s current position in the AI-GPU market closely mirrors Nvidia’s development path from 1.5 years ago. Nvidia officially announced its Hopper H100 Tensor Core GPU in Mar 2022 with shipment beginning in 4Q22. At that time, data center revenue accounted only 53% of the total. This ratio rose steadily to 88% in 3Q24 (3QFY25) with the release of H200 series. With Blackwell series beginning shipment this quarter, the importance of data center revenue is expected to grow even further.

AMD closely resembles Nvidia’s development path from 1.5 years ago (AMD and Nvidia’s 10-Q)

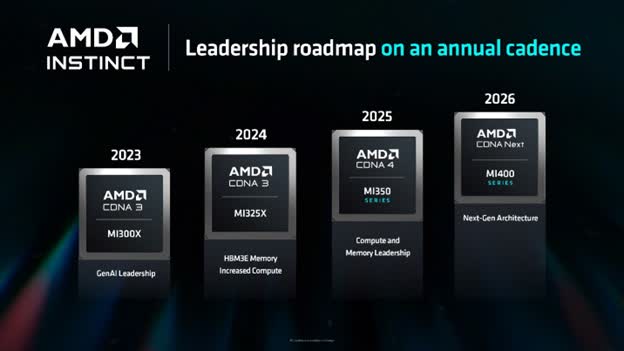

Similarly, AMD officially announced its Instinct MI300 series in Dec 2023, with shipment starting in Jan 2024. By then, the data center revenue % of total increased to 52% in 3Q24 from 37% in 4Q23. The MI325X was released in Jun 2024 and revenue is expected to be booked in 1Q25 according to AMD. Looking ahead, the next-generation high-performance accelerator MI350 and MI400 series based on CDNA 4 and CDNA “Next” architecture are expected to be announced in 2H25 and 2026. Therefore, it is reasonable to assume a similar upward trend in data center revenue contribution in AMD as Nvidia in 2025, 2026 and 2027.

AMD’s leadership roadmap on an annual cadence (AMD)

Margins will expand as data center grows

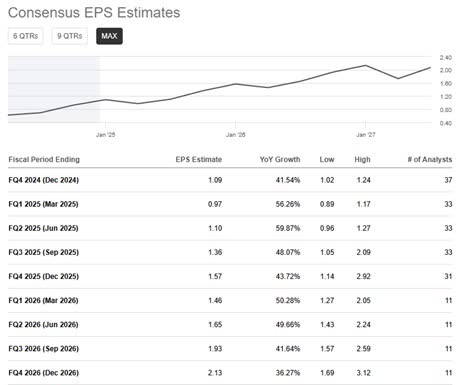

Data center is a key profit generator for AMD. Its OPM was high at 29% in 3Q24, the highest among various business segments. To visualize the margin expansion, I assume data center revenue contribution to climb steadily from 52% in 3Q24 to 62% in 4Q26E and data center OPM to remain at 29%. This drives OPM up from 10.6% in 3Q24 to 16.8% in 4Q26E. This explains the strong expected EPS growth of 40-60% YoY in the coming quarters in 2025 while revenue is only projected to grow 20+% YoY each quarter.

AMD data center revenue % of total vs AMD’s overall OPM projections (AMD’s 10-Q)

Consensus EPS estimates (Seeking Alpha)

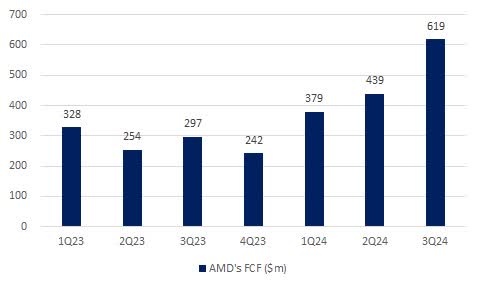

Free cash flow has seen a noticeable improvement in 3Q24

To long-term value investors, I believe cash flow is far more important than earnings. AMD has delivered a noticeable improvement in FCF in 3Q24, reaching $619 million (excluding non-recurring payments related to acquisitions) compared to $439m in 2Q24 and $297m in 3Q23. Based on this, I project AMD’s FCF to reach $2.1 billion in 2024, almost doubling from 2023. This is a highly positive signal reflecting improving financial heath and long-term growth prospects for AMD following the ramp up of the MI300 series. With AMD’s earnings being forecast to grow 40-50% YoY in the next few quarters on the back of MI325X and later generations in the years to follow, I would expect AMD’s FCF to rise further.

AMD’s quarterly FCF (AMD’s 10-Q)

Wall Street Downgrades on Concerns about Market Share Loss

Bank of America has recently downgraded AMD from a Buy to Neutral and lowered the price target from $180 to $155. The rationale for this downgrade was AMD’s ongoing competition from Nvidia in the AI semiconductor market. It believes Nvidia’s advanced technology and dominant market share pose challenges for AMD’s growth in the sector. Additionally, major cloud services providers are showing a growing preference for customized chips from suppliers like Marvell Technology and Broadcom. This may limit AMD’s ability to expand market share.

However, I, personally, disagree with this view. First, intense competition with Nvidia is not something new, and it is well-known by the investor community. AMD, as a late entrance, will undoubtedly face challenges in catching up with Nvidia in the AI-GPU race. Second, regarding the concern over cloud service providers favoring customized chips, I think it is less relevant at this early stage of the AI-era when demand is still growing rapidly.

Lisa Su, CEO of AMD, highlighted during an AI event in Oct 2024 that AI demand has exceeded AMD’s expectations. She projected that the market size for AI data center GPUs will grow by more than 60% a year and reach $500bn by 2028 from $45bn in 2023. This presents a massive business opportunity for all AI-GPU manufacturers. You may say this forecast is a lot more optimistic than other research houses. However, this reflects Lisa’s confidence in the rapid growth and widespread adoption of AI technologies. Therefore, concerns about AMD’s market share appear premature.

Lisa Su, AMD CEO, projects AI data center GPU market to reach $500bn by 2028 (AMD)

With my long experience as a bulge bracket sell-side analyst, I believe that these downgrades are reactive. AMD’s share price has fallen to $130, while most target prices remain in the $180-200 range. Wall Street analysts are taking market share concerns as an excuse for their earnings/rating adjustments, I believe.

Attractive Valuation Warranting a Strong Buy

With the share price approaching a 52-week low, AMD’s FY24 P/E has also come down to a highly attractive level of 38.2x. While this is still a premium over the sector median of 26.4x, its upcoming superior earnings growth of 54% in FY25 could be a strong justification. If we compare to Nvidia’s FY25/26 P/E of 30x, AMD is trading at a discount of 24.9x despite comparable estimated EPS growth of c.50%.

AMD vs Nvidia on P/E & EPS growth (Seeking Alpha)

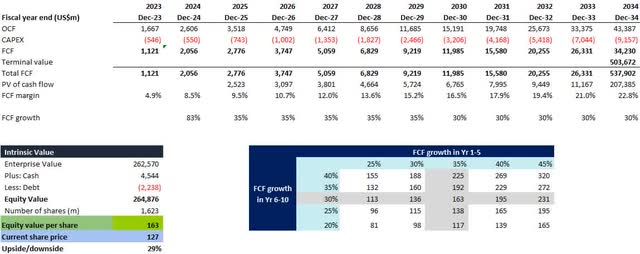

My DCF model estimates a fair value of $163 for AMD, based on a free cash flow (FCF) growth assumption of 35% for 2025-29E, 30% for 2030-34E, a terminal growth of 3% and a WACC of 10%. The FCF growth assumption in the first 5 years is aligned to consensus EPS FWD Long-Term Growth (3-5Y CAGR) of 42%, though I have intentionally assumed a slightly lower growth for conservatism. The 30% FCF growth assumptions beyond 2030 is grounded in the belief that AMD’s FCF margin will eventually return to double digits and reach 20+% in 2034E. This estimate is not demanding as Nvidia’s FCF yield was high at 50% in 9M24. Therefore, I firmly believe AMD is currently undervalued. AMD’s strong earnings growth profile in 2025-27 has not been fully recognized by the market.

AMD’s DCF valuation (Analyst’s estimate)

Key Downside Risk

AI slow-down poses a potential risk to my Strong Buy rating on AMD. While AMD’s AI-GPU sales are expected to grow as AI demand increases, a slowdown in AI adoption or reduced AI infrastructure capex by customers could lead to downward adjustments in AMD’s earnings growth projections. Competition from peers would also become more prominent as demand slows.

AMD doesn’t own fabrication facilities and depends on TSMC as its primary foundry partner for GPU and CPU manufacturing. As a result, any delays, production issues or supply chain disruptions at TSMC could affect AMD’s new chips releases and potentially impact earnings projections.

Conclusion

Beside Intel, AMD is one of the worst performing large cap semiconductor stocks in 2024. With the share price falling 14% YTD to $127, not far from the 52-week low of $122, I believe it’s about time to buy into the name despite weak technical indicators. Given the strong fundamentals in 2025, I believe AMD is a no-brainer buy for value investors.

I understand why investors preferred Nvidia in 2024 given its strong topline and earnings growth. However, AMD will catch up in 2025 upon the delivery of MI325 series AI GPU beginning in 1Q25. AMD is estimated to grow at a superior earnings growth in 2025, 54% YoY, on 27% topline growth and decent margin expansion. This comes higher than Nvidia’s EPS growth of 50%, but AMD is trading at an 18% discount to Nvidia in terms of FY25 P/E. Strong Buy.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.