Summary:

- AMD’s recent underperformance is due to competition and market skepticism, but I believe it remains undervalued and poised for growth in 2025.

- AMD’s competitive AI Accelerator GPU roadmap and market share gains against Intel in CPUs highlight its strong fundamentals and growth potential.

- Financials show robust data center revenue growth and improving operating leverage, suggesting AMD’s margins will improve significantly in 2025.

- Trading at a lower P/E ratio than peers, AMD is undervalued with a potential 27% upside, making it an attractive investment opportunity.

JHVEPhoto

Introduction

2024 has been a year for thematic trends like Generative AI & Semiconductors, with Nvidia (NVDA), Broadcom (AVGO) and Taiwan Semiconductor Manufacturing (TSM) up by a whopping 180%, 108%, and 98% YTD, respectively. However, there have been greater dispersions across the semiconductor industry across returns. Not all stocks have benefited from a surge in valuations, which has led to some interesting idiosyncratic trends.

Advanced Micro Devices (NASDAQ:AMD), in particular, has been an underwhelming stalwart this year. Since hitting its all-time high of $220 in March, its shares have plummeted by an eye-watering 40%, making it an underperformer, down 8% YTD, compared to the S&P 500 (SPX), up 27.5%.

However, I continue to be bullish on AMD and believe it is undervalued right now given AMD’s competitive product cadence in the AI Accelerator GPU Markets against Nvidia, continuous market share gains against Intel in AI PC, Server and Desktop CPU Markets, stabilization of the embedded segment and attractive valuations, which would make AMD an attractive investment in 2025 if Mr. Market re-rates the stock again.

Why AMD underperformed the market this year

The recent drop could be explained by two major factors. First was the downgrade from BofA, citing concerns over an increasingly competitive AI market from Nvidia and growing preference for hyperscalers to purchase application-specific integrated chips (ASICs) from Broadcom and Marvell Technology (MRVL), which would limit AMD’s market share gain potential.

Furthermore, BofA expected AI PC market recovery to remain muted in early 2025 due to the inventory corrections cycle.

The final nail in the coffin was Amazon’s executive comment, which claimed sluggish demand for AMD’s AI accelerators from customers on the AWS platform. As a result, the market has started questioning AMD’s competitiveness, causing a broader sell-off.

Nevertheless, I am convinced that these fears are over-exaggerated. First of all, AMD was quick to dispel Amazon’s claim as “Not accurate”. Furthermore, AMD continues to work closely with customers, including OpenAI, Meta, Microsoft, Oracle and IBM, to provide AI LLM training or cloud computing services. Most recently, AMD CFO Jean Hu was confident about the company exceeding its original $5 billion AI Accelerators revenue guidance in 2024 during the Barclays Technology Conference. As a result, I failed to see any significant signs of slowdown trends in the revenue of the AI accelerator from AMD.

Overall, I believe that the current market sell-off and Wall Street’s short-sightedness offer long-term investors a compelling opportunity to accumulate shares at an attractive price.

AMD is becoming increasingly competitive in the AI Accelerator Market

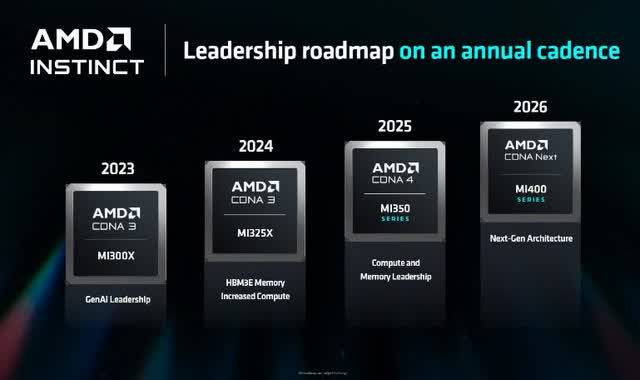

AMD Instinct GPU Product Roadmap (Investors Presentation )

Similar to Nvidia, AMD follows a One-year cadence on its AMD Instinct GPU Roadmap. For instance, the MI300X was launched in 2023, followed by the recent launch of the MI325X series in Q4 2024, which has already started shipments to customers. Looking ahead, the MI350X GPU is expected to debut in H2 2025, featuring a whole new architecture CDNA 4, followed by MI400X, which will start shipments by 2026.

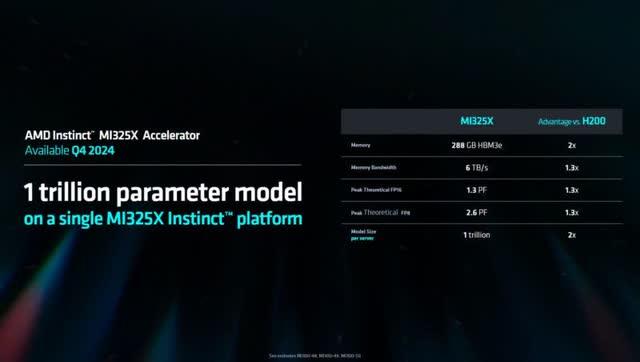

MI325X vs Nvidia H200 Performance Comparison (Investors Presentation )

AMD’s GPUs are also getting increasingly competitive against Nvidia. For instance, the MI325X GPU has substantially improved its memory capacity and bandwidth, featuring 256GB of HBM3E with a throughput of 6 TB/s, which offers 30% higher bandwidth and 80% more capacity than Nvidia’s Hopper H200 GPU. Furthermore, MI325X offers 30% better computational capabilities than H200 on theoretical peak FP16 and FP8.

The MI325X is anticipated to be shipped to customers with OEM suppliers such as Dell, HPE, Lenovo, and Supermicro commencing in Q1 2025. As such, I believe the growth of AMD’s data center revenue momentum will continue accelerating in 1H 2025 after accounting for shipments of Mi325X GPUs.

MI350X GPUs (Investors Presentation)

Looking ahead, The MI350 series, based on AMD’s CDNA 4 architecture and TSMC’s 3nm process, is expected to debut in mid-2025, offering a 35x improvement in inferencing performance compared to the MI300 series, with each accelerator featuring up to 288GB of HBM3E memory.

Aside from the GPU Hardware itself, AMD is making significant progress in catching up with Nvidia on AI infrastructure. For example, AMD is making some progress in catching up with Nvidia’s CUDA software with its ROCm software and plans to continue its development of its UALink (A coherent memory interconnect for high-speed, low-latency communication across servers in AI data centers), which would directly compete with Nvidia’s proprietary NVLink and NVSwitch fabric. Finally, AMD’s recent acquisition of ZT System would allow for better rack-scale systems deployments on AI LLM training.

According to AMD’s CEO Lisa Su, the AI GPU Market will be a $500B market as of 2028. While that might seem an aggressive number, assuming that the AI GPU Market reaches around $450B in 2028, Nvidia continues to take up the lion’s share (90%), and AMD gets the remaining 10%. This would imply a potential $45 billion in data center revenue for AMD in 2028. AMD’s data center revenue in Q324 was $3.5 billion, and TTM’s revenue was around $11 billion. This would imply a 40-42% CAGR for AMD’s data center revenue for the next 4 years.

Overall, by focusing on the fundamentals, I believe that AMD’s AI development continues progressing well thanks to its robust product cadence from the Instinct GPU series, ROCm software scaling, and UALink fabric developments. I think AMD benefits from cloud customers like Microsoft, OpenAI, and Meta (1.5 million MI300X deployments), who aim to reduce their reliance on Nvidia’s GPU and seek an alternative supplier from Nvidia.

Thus, I believe that BofA’s downgrade on AMD based on the invisibility of AI Accelerators development is not well justified.

AMD is gaining market share from Intel in the Server & AI PC CPUs

Aside from GPUs, I think AMD will reap dividends next year in the CPU markets thanks to Intel’s struggles and better product offerings with its EPYC Server CPUs and Ryzen PC CPUs.

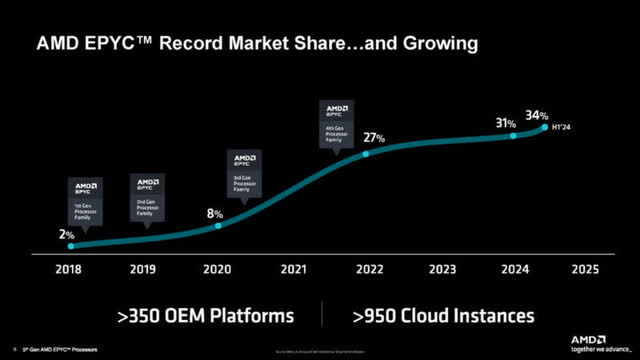

AMD Server CPU Market Share (Investors Presentation)

As we can see, AMD has been making inroads in the X86 Server Market Share, reaching around 34% in 2024, compared to just 2% in 2018 when Lisa Su started becoming the CEO of AMD. AMD’s EPYC Server CPU has been widely adopted by hyperscalers, including AWS, Microsoft Azure, Oracle, Meta and Google Cloud.

The recent launch of AMD Zen 5 EPYC Turin CPUs could offer up to 192 Cores and 384 Threads. According to AMD, AMD EPYC 9965 servers CPU could deliver up to 4X faster time to results on business applications, 3.9X speed for HPC applications, and up to 1.6X the performance per core in virtualized infrastructure, compared to the Intel Xeon 8592 CPUs, underscoring strong product capabilities.

In my opinion, AMD stands to benefit from another server upgrade cycle not only from hyperscalers but also from traditional corporates looking to upgrade their servers to meet the current generative AI demand, general computing, and foundational critical workload needs. This includes enterprise virtualization, database management, ERP system management, storage, etc., which will also create additional demand for AMD’s EPYC CPUs and provide more growth catalysts for AMD in the future.

While some investors fear a potential Arm-based processors takeover in the Windows CPU space, I believe AMD will benefit from enterprise customers’ high switching costs away from x86 applications due to the duopoly of AMD & Intel in the x86 space. As most Windows applications are still running X86 applications on Windows Server that are not easily portable to Arm, it would be difficult for traditional enterprises to switch to Arm-based processors without the fear of compromising potential performance efficiency and application usage. This creates some sticky economic moat for AMD, at least for enterprise customers.

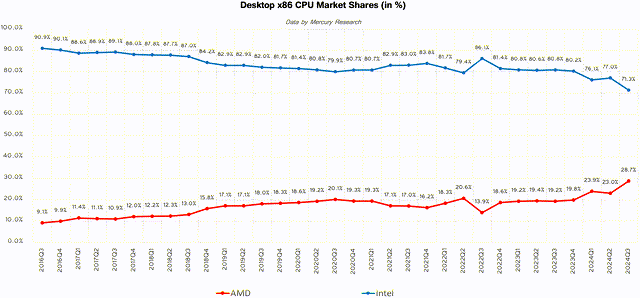

AMD vs Intel x86 Desktop Market Share (Tom’s hardware & Mercury Research)

On the PC side, AMD is slowly expanding its presence. According to Tom’s Hardware and Mercury Research, on the desktop side, AMD’s market share was up 5.3% QoQ to 28.7% in Q3 2024, the highest in 5 years. Whereas on the mobile laptop side, AMD’s market share was up 2% QoQ to 22.3% in Q3 2024, but still shy of the 24.8% record held in Q2 2022.

Looking forward, while I still believe Intel will command more than half of the PC CPU market share, there is still a high possibility for AMD’s PC market share to reach above 30-40% for the next few years, given AMD’s strong performance efficiency for its Ryzen AI CPUs and its Zen 5 architecture.

For instance, its latest Ryzen AI Pro 300 Series could offer 50 TOPS for Microsoft Co-pilot+ applications and 75% better performance efficiency than Intel Lunar Lake (45+ TOPS). This product superiority will likely attract more OEMs like Lenovo, Dell, HPE, and Asus to incorporate more Ryzen AI CPUs into their PCs and attract more end-customers to purchase laptops from AMD-based CPUs.

While some investors are worried about a potential slower than expected in AI PC deliveries in H1 2025, AI PC remains a secular growth opportunity. For instance, according to IDC, 2025 is expected to be a year of recovery for PCs, with growth anticipated at 4.3%, driven by commercial upgrades from Windows 10 to Windows 11, due to the end of Windows 10 support in Oct 2025. Furthermore, AI PC is expected to account for around 37%/53% of shipments in 2025/26, placing AMD at a sweet spot to harness the growth trend given AMD’s tech leadership within AI CPUs.

AMD – Financial Analysis

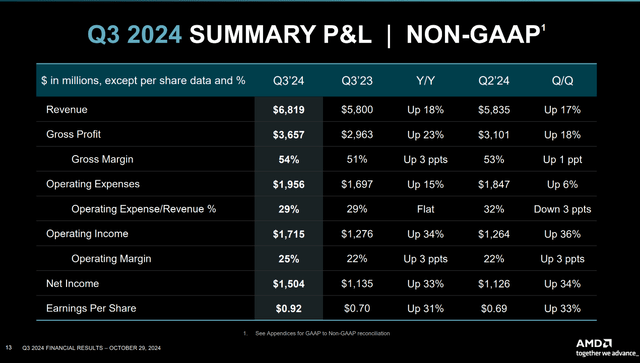

AMD Q3 2024 Financial Result (Investors Presentation )

In Q3 2024, AMD delivered a revenue of $6.8 billion, up 18% YoY, and a Non-GAAP Operating Income of around $1.7 billion, up 34% YoY (Operating Margin: 25%, up 3% YoY), underscoring greater operating leverage. Non-GAAP EPS also reached $0.31, up 31%. Overall, a decent quarter, but management revenue guidance of $7.5 billion fell short of Wall Street analysts’ expectations, causing a sell-off.

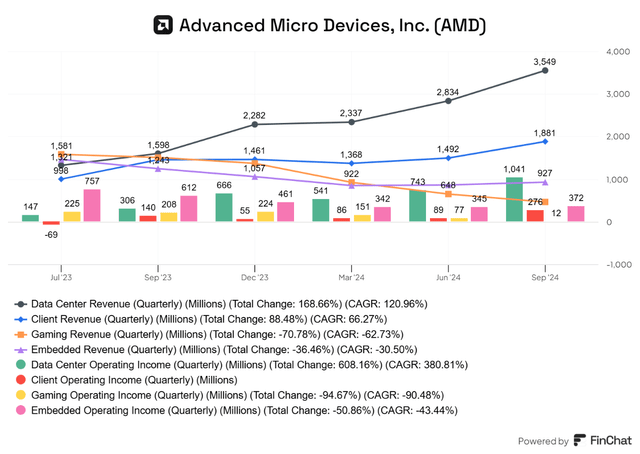

AMD Segment Revenue (Finchat)

By breaking down into smaller segments, AMD’s data center revenue has been soaring over the past few quarters, with Data Center revenue reaching $3.5 billion in Q3 2024, up a 122% YoY. Looking ahead, I expect AMD’s Q4 revenue to exceed $5 billion thanks to the shipment of MI325X GPUs commencing from Q4 2024 and continued robust demand for EPYC Server CPUs from hyperscalers in H2 2024.

Whereas for the Client PC segment, revenue reached around $1.88 billion in Q3 2024, up only by a modest 29% YoY. In the future, I expect Q4 AMD’s PC segment to reach above $2-2.1 billion (representing a 35-40% YoY increase), thanks to the increasing shipments of Ryzen AI Pro Zen 5 CPUs to OEMs.

Finally, I expect gaming revenue to continue its decline in Q4 2024 as we are still in an inventory correction cycle, while for embedded revenue, we should see meaningful stabilization in Q4 2024 due to increasing customized chip demands from aerospace & defense companies.

Overall, for margins, I think AMD should see greater operating leverage in 2025 due to cost optimizations. I thereby expect AMD’s non-GAAP gross margin to reach around 55% in 2025 and around 28-29% Non-GAAP Operating Margins.

AMD Valuation – Looks Undervalued

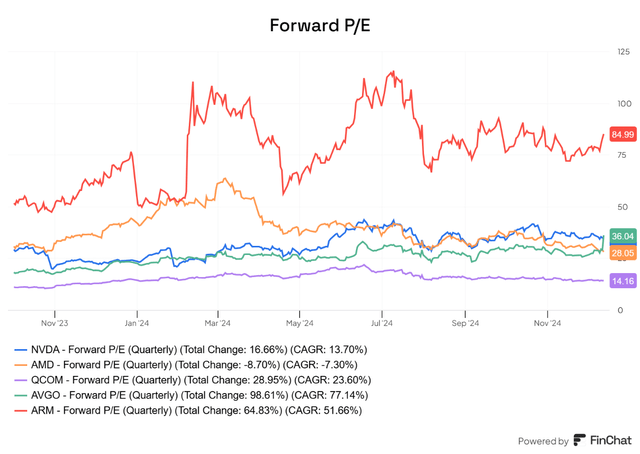

AMD Forward P/E (Finchat)

Currently, AMD trades at a forward P/E of around 28x FY25 earnings, which is lower than its competitors like Nvidia (34x), Broadcom (36x) and Arm (85x), which could indicate potential undervaluation compared to peers.

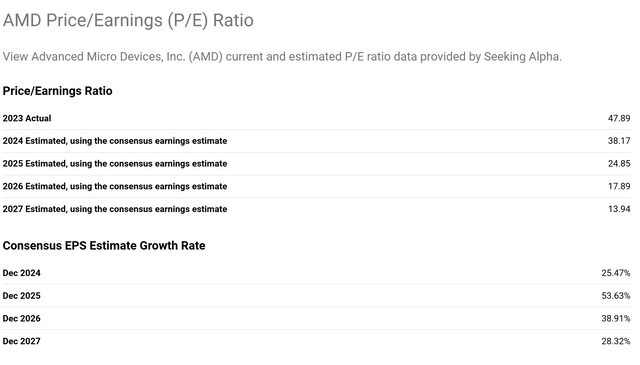

AMD Forward Valuations (Seeking Alpha)

If we zoom out a little bit, AMD is trading at a forward P/E of 17.8x and 13.9x FY26/27 earnings, which is quite cheap considering that AMD is expected to grow its EPS by around 53% next year, 39% in 2026, and 28% in 2027. This gives AMD a non-GAAP PEG of around 0.91x, suggesting that the stock is now undervalued.

Currently, analysts are assuming that AMD’s EPS will be around $5.11/$7.1 in 2025/26, respectively. Assuming the market turns positive again on AMD and re-rates the company to around 22x forward 2026 forward P/E, which, I think, is superconservative compared to Nvidia’s 24x, Broadcom’s 30x and Arm’s 74x FY26 earnings. AMD’s fair value should be at least $156-160/share, implying a minimal 27% upside from current levels.

Conclusion

Overall, I remain confident about AMD and Lisa Su’s ability to grow within the AI data center space and compete against Nvidia, thanks to the strong product cadence of their Instinct GPU series and EPYC series CPU processors.

Furthermore, its diversified product portfolio across CPUs, GPUs, and NPUs spanning servers and PCs, alongside additional tailwinds like the gradual recovery of AI PC markets and the Windows upgrade cycle in H2 2025, should provide to catalyze AMD’s growth in the future.

The recent decline in AMD’s share price offers pockets of opportunity for long-term investors to accumulate shares at current price levels. I believe investors should capitalize on short-term Wall Street pessimism, which has nothing to do with AMD’s underlying fundamentals. Right now, I am continuing to build a position on AMD. Thanks, Santa, for this early Christmas gift!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, AVGO, TSM, QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.