Summary:

- AMD’s Advancing AI 2024 event on October 10 is crucial for showcasing next-gen accelerators and 5th Gen EPYC processors, pivotal for data center GPU advancements.

- The Q3 2024 earnings call is equally critical; strong MI300 sales are essential to sustain AMD’s recent stock rally and investor confidence.

- AMD’s competitive edge lies in offering more affordable GPU accelerators compared to Nvidia, appealing to cost-conscious companies investing in AI infrastructure.

- The long-term bullish outlook hinges on AMD’s ability to capture market share with cost-effective AI solutions, despite short-term volatility and competition from Nvidia.

JHVEPhoto

On October 10, Advanced Micro Devices (NASDAQ:AMD) will host what is possibly the most important watershed event in recent months. At the “Advancing AI 2024” event to be held on 10.10.2024 at 12 PM ET in San Francisco, California, AMD is expected “to showcase the next-generation AMD Instinct™ accelerators and 5th Gen AMD EPYC™ server processors, as well as Networking and AI PC updates, in addition to highlighting the Company’s growing AI solutions ecosystem”

There are several reasons why this event – and the subsequent earnings call for Q3 2024 – could play pivotal roles in cementing AMD as a force to reckon with in the data center GPU space. In my bullish analysis here, I present 2 of the most important reasons why these two events are crucial to AMD’s long-term success and short-term price gains for its stock, which has been moving sideways for the past six months, albeit with more than a touch of volatility (aka investors flip-flopping on their AMD bets) and even rallying quite a bit over the past month, as we’ll see.

Reason #1: The Set-up for Continued Advancements in Data Center GPUs Must Come from the Advancing AI 2024 Event

AMD’s move into the fabless side of semiconductors came about in 2006 when the company spun off its manufacturing division into what is now one of the leading chip manufacturers in the world: GlobalFoundries (GFS). According to an October 2023 report, GFS is the third-largest semi foundry by revenues, but what the divestiture meant for AMD was far more significant – it allowed the Santa Clara, CA-based semi giant to focus on designing and developing semiconductor chips rather than hammering them out in a foundry, so to speak. This was a seismic shift in priorities, and it allowed AMD to pivot its focus on data center GPUs.

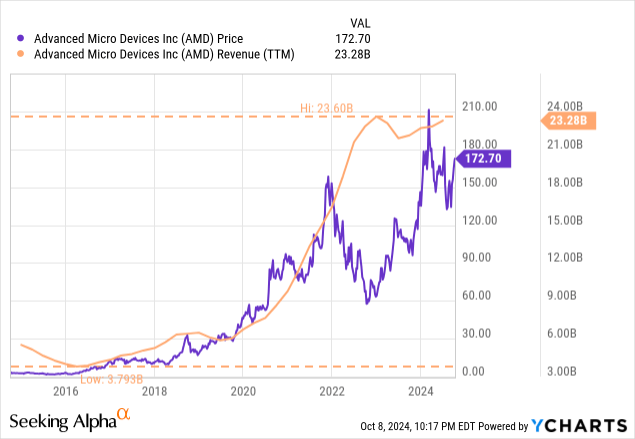

Of course, the timeline between the divestiture and AMD’s entry into the data center GPU space was admittedly long, stretching over 10 years. It was not until 2016, two years after CEO Lisa Su took the helm, that AMD started seeing significant revenue growth. Between 2016 and 2022, the company’s revenues grew by leaps and bounds, and its stock price followed.

Along the way, even though AMD continued to post strong revenue growth, 2022 set it back in terms of price return. From highs of over $150, the stock dropped to under $60, losing nearly a third of its market cap. One of the reasons for this drop – a major one, in my opinion – was the global chip shortage that affected nearly every chipmaker between 2020 and 2023.

SA

The shortage itself was the result of several factors that impacted chip production, including neon gas prices spiking by March 2022, the Russian invasion of Ukraine (which produces 90% of the neon used by lasers in the chip-manufacturing process), the 2021 drought in Taiwan that impacted chip production (ultra-pure water is used extensively in semiconductor manufacturing), the high demand for GPUs by crypto miners that affected availability for other users, the pandemic’s after-effects, the escalating China-U.S. trade war, and more.

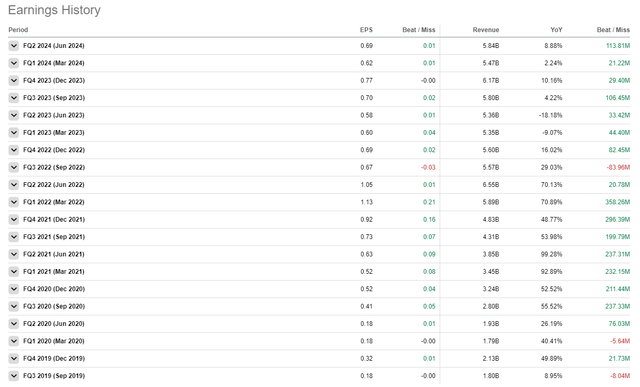

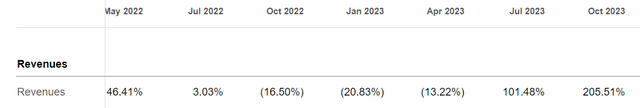

Specific to AMD, once its revenues started to dip in the third quarter of fiscal 2022, the stock began its precipitous descent. For the first time since the March 2020 quarter, AMD had missed consensus estimates on both the top and bottom lines.

SA

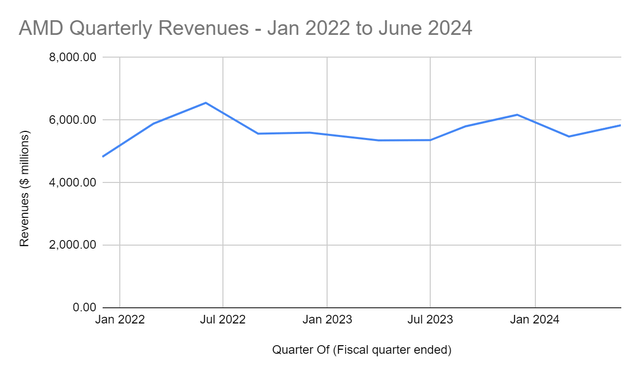

Since then, its revenues have largely been stable, but that’s just another way of saying they haven’t been growing.

SA Data, Chart by Author

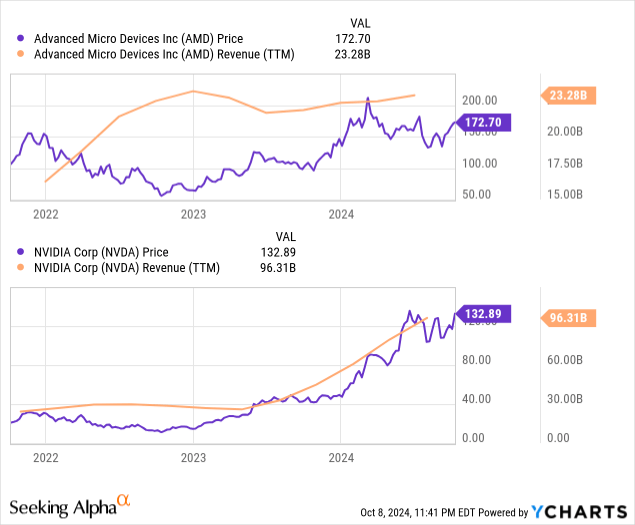

With the advent of the MI300 in Q4 2023, AMD once again found its place in the hierarchy of data center GPU majors; unfortunately, Nvidia Corp (NVDA), which, by then, had already exhibited two quarters of triple-digit YoY revenue growth, was far ahead in that regard.

NVDA Revenue Growth (Quarterly, YoY) (SA)

NVDA stock price naturally followed, and although that price appreciation lagged behind AMD’s, only realizing in the first quarter of 2024 and, thereafter, peaking in July 2024, it moved up significantly higher than AMD from a price return perspective.

In contrast, AMD’s revenue cadence since mid-2023 had been showing a much gentler slope, so even though it kept growing its revenues at a steady pace, the market didn’t assign much confidence to the stock, and it’s been on the decline for a large portion of this year. That trend is changing as we exit Q3 and enter Q4 – with high expectations around the new MI325 series that will be showcased on 10/10 at the AI event alongside its successors and upcoming CPU products. The focus, however, is likely to be on how well AMD can showcase the MI325’s capabilities at the event.

That’s why the event itself is likely to be a major milestone in AMD’s stock price journey. I believe it will give investors the confidence they need to sustain the rally that AMD stock has been on over the past month.

SA

That being said, there’s a major gap in that argument because the event alone is not enough to lift investor sentiment in the long term, in my opinion. It might help sustain the stock at current levels for a while, but the next major catalyst will be equally important in ensuring the longevity of the rally, and that’s the earnings release for Q3 2024 that’s expected on 10/29. There’s no confirmation of the date yet on the company’s IR page as I write this, but I believe that’s a crucial catalyst for AMD longs. I’ll elaborate on why that is.

Reason #2: Data Center Revenues from MI300 Must Come in Strong in Q3 to Create a Floor for AMD Stock

AMD’s revenue reports from its data center GPUs as well as CPUs have been promising over the last few quarters, but they do leave a lot to be desired. If you look at the 10-Qs from Q2 2023 onwards, you’ll see that there was no mention of the MI300 accelerator in the first report. In Q3 2024, where we saw revenues starting to grow again (on a sequential basis, not YoY), we see the first mention of the MI300 series, but only in relation to a regulatory requirement for shipments to China. In Q4 2024, when AMD announced the availability of MI300X accelerators, it reported data center revenues of $2.3 billion, a 38% increase from the prior period.

SA

That’s also when we saw the strongest price action for AMD stock. The momentum was already there from the earlier quarter’s signs of revenue recovery in the data center segment, but despite the earnings miss in Q4, the stock managed to scale above the $210 mark to record a new ATH.

Sadly, that didn’t last, and the stock still languishes below the elusive $180 level. This despite the data center segment going from $2.3 billion in Q4 2023 to $2.8 billion in Q2 2024. By then, MI300 sales were on fire, pushing data center revenues up by 115% YoY. The market subsequently rewarded it with a very volatile price action that ultimately resulted in the 25% rally I mentioned earlier.

SA

That’s what makes Q3 2024 a pivotal quarter, and the October 10 event a critical bridge to Q4, when MI325 revenues will start to trickle in (hopefully.) Any delays with that could very well ruin the bull run, but in the interim, all that AMD has its arsenal in terms of bolstering investor confidence is the event and the press release.

My Bull Case for AMD Lives On

I first wrote about AMD in March 2024, where I called a Buy based on pairing your AMD holding with the YieldMax AMD Option Income Strategy ETF (AMDY), and the core focus of my bullish call was the fact that MI300 was showing the initial signs of strong of growth. We saw that in the discussion above. Unfortunately, since the stock has been on a general downslide since then, that thesis obviously didn’t pan out on the short term.

However, I’d like to reiterate that my calls typically have a long-term horizon, which is why I wrote another bullish piece on AMD in July lauding the Silo AI acquisition as a very strategic move on the part of CEO Lisa Su. That thesis failed to pan out in the short term as well, but I’m still holding on to my bullish long-term view, and this latest coverage on the October 10 event and the upcoming Q3 2024 earnings call at the end of the month (estimated) is very much a part of that ongoing story.

I don’t believe AMD will catch up to Nvidia any time soon, but I do believe that it is approaching the time when it’s going to be considered as close a rival as NVDA will ever have in the next 10 years. The MI325 might not fare well against Blackwell, but that’s not even the point. The point is that anyone that cannot afford an array of Blackwells to power their AI training and inference workloads are going to depend heavily on AMD’s more affordable products.

To that point, I believe the market for reasonably priced GPU accelerators is actually far bigger than what NVDA can capture at the much higher price point. Let’s try and validate that.

Companies that are exploring AI use cases are already spending heavily on AI infrastructure, manpower, and other related resources. We know that because the world’s top companies in every sector have started to leverage the power of generative AI. That’s evident from the way the AI market is growing across multiple sectors. Here’s an excerpt from the latest IDC Spending Guide released this August:

The industry that is expected to spend the most on AI solutions over the 2024-2028 forecast period is financial services. With banking leading the way, the financial services industry will account for more than 20% of all AI spending. The next largest industries for AI spending are software and information services and retail. Combined, these three industries will provide roughly 45% of all AI spending over the next five years. The industries that will see the fastest AI spending growth are Business and Personal Services (32.8% CAGR) and Transportation and Leisure (31.7% CAGR). In addition, 17 of the 27 industries included in the Spending Guide are forecast to have five-year CAGRs greater than 30%.

It stands to reason that the first movers in each sector will be the ones with the deepest pockets, the strongest cash flows, and/or the healthiest balance sheets. But what about those that are struggling with the high cost of debt that is likely to persist over the next year and a half, at the very least?

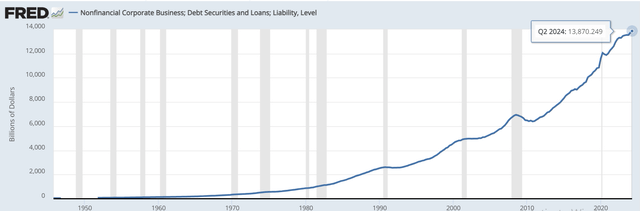

FRED

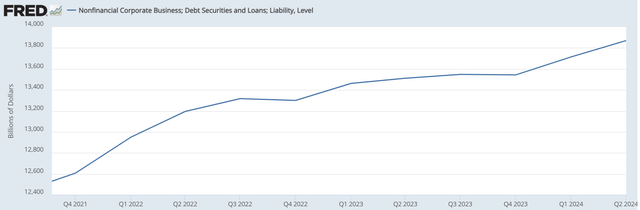

What the graph above tells us is that Corporate America is up way beyond its eyeballs in debt. With the figure almost touching $13.9 trillion as of Q2 2024, companies have been forced to issue debt or refinance existing debt at increasingly higher interest rates and coupons; pointedly, during the period after the Fed started hiking its EFFR (Effective Fed Funds Rate), we see that debt issuance slowed down a little, but then resumed again once peak EFFR was achieved at the top of the rate-hike cycle.

FRED

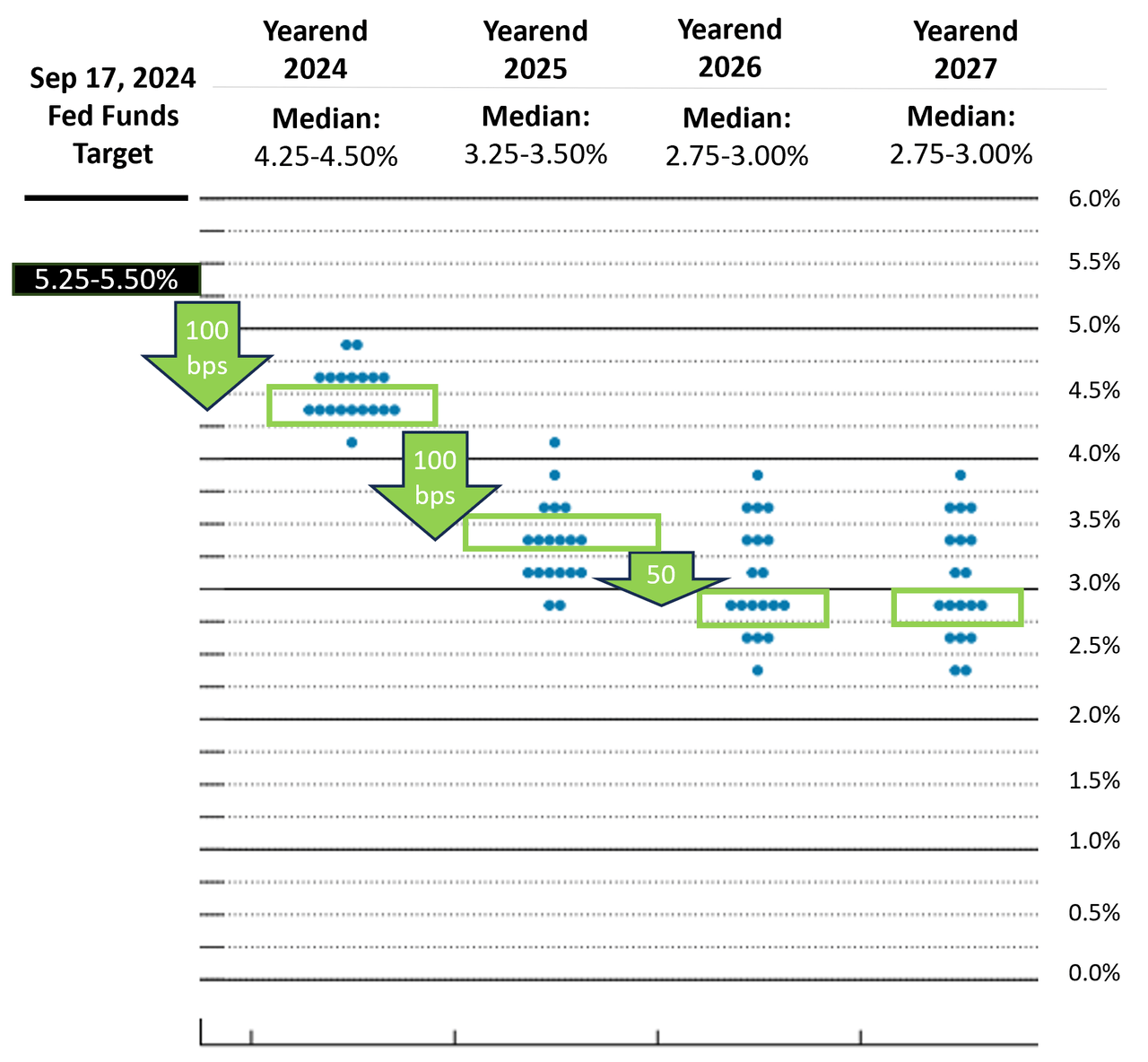

The current reality is that Corporate America is still hungry for debt, and that’s going to come at a hefty price while interest rates remain at above 3%. Per the latest dot-plot, FOMC members don’t expect target rates to drop below that until 2026.

Bondsavvy

Look at this from the point of view of a CEO or a CFO. You need to spend on AI to stay ahead of your competitors; you need to cut spending on other areas to save cash for capex; you need to find cost-friendly hardware to run your workloads; so, are you going to spend beyond your means and buy expensive NVDA hardware, or are you going to go with the next best thing at a more reasonable price point? I think you know my answer. It’s AMD that these companies will be looking to, and with the MI325 on the verge of general availability, that’s a major catalyst for the company in the coming quarters.

That being said, in the meantime, the only way AMD can keep its stock moving up is with these two interim events – the Advancing AI 2024 extravaganza on October 10 and the Q3 earnings call, where MI300 sales must necessarily show strong YoY growth. Anything less than that will unravel my bullish thesis in the short term – dare I say, again? And that’s also the biggest risk facing AMD longs right now. If things don’t materialize as expected, we could be in for a period of sideways movement; at least, until MI325 starts showing up at the top line in Q4, which we’ve only just entered.

Based on that analysis, where AMD stock is concerned, I’m still as stubborn as a… well, bull.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.