Summary:

- AECOM offers diverse infrastructure consulting services globally, with operations in the Americas, International regions, and AECOM Capital, which focuses on real estate development.

- It is well positioned in the infrastructure consulting industry, but currently has limited pricing power.

- AECOM’s profitability is recovering, supported by record revenue, strong cash flow, and a solid backlog, making it a Buy recommendation with a target price of $107.05.

JHVEPhoto

Investment thesis

Over much of the past decade, infrastructure consultant AECOM (NYSE:ACM) has chugged along, with its share price growing relatively steadily over the past five years.

Now, though, its earnings are picking up as it benefits from investments in its own growth, a robust backlog and pipeline, and several tailwinds. There’s a good possibility its share price may also grow more quickly.

I expect the share price to increase 11.72% in the next year and have rated it a Buy. But, there’s another firm in its industry that may be worth a look as well.

About AECOM

The company calls itself “a leading global provider of professional infrastructure consulting services for governments, businesses and organizations throughout the world.”, in its 10-K for fiscal 2023.

It lists its services as advisory, planning, consulting, architectural and engineering design, construction, and program management services. In addition, there are investment and development services.

It provides these services to clients in the public and private sectors worldwide, in end markets such as transportation, facilities, water, environmental and new energy.

Operations are conducted through three segments:

- Americas: the services listed above to public and private clients in the U.S., Canada, and Latin America.

- International: the same services, offered in Europe, the Middle East, India, Africa, and the Asia-Australia-Pacific regions.

- AECOM Capital: this segment invests in and develops real estate projects (the company said in the 10-K that it was exploring strategic options for the segment, which means looking for an opportunity to sell it – it was still listed in the latest quarterly report).

Its income comes mainly from billing of employee time spent on client projects, while AECOM Capital generates income on real estate development sales and management fees.

AECOM considers itself one of the industry leaders, and cites these rankings in its August 2024 investor presentation:

ACM rankings slide (investor presentation)

Its business is seasonal, with revenue normally running higher in the second half of the fiscal year (April through September) and highest in the fourth quarter (July through September). Economic cycles also are a factor.

Fiscal years end on the Friday closest to September 30, and fiscal 2023 refers to the year that ended over 11 months ago. It is now in fiscal 2024 and fiscal 2025 begins on September 30.

At the close of trading on September 11, it was priced at $95.82 and had a market cap of $12.74 billion.

Competition and competitive advantages

Given the nature of its business, with low barriers to entry, it competes with many regional, national and international companies in fragmented markets. Beyond that, competition varies depending on specific markets and geographical areas.

It stated in the 10-K that it considers itself well positioned in its markets, citing its reputation, cost effectiveness, long-term client relationships, extensive network of offices, employee expertise, and broad range of services.

Seeking Alpha lists the following companies as peers and/or competitors: Comfort Systems U.S.A., Inc. (FIX), Api Group Corporation (APG), Stantec Inc. (STN), EMCOR Group, Inc. (EME), and MasTec, Inc. (MTZ). AECOM is in the middle of this group when assessed by market cap.

As noted, the company claims to be a leader in many of the markets it serves, so we might expect it to be the one to beat when competing for jobs. It may also give it more pricing flexibility than at least some of its competitors.

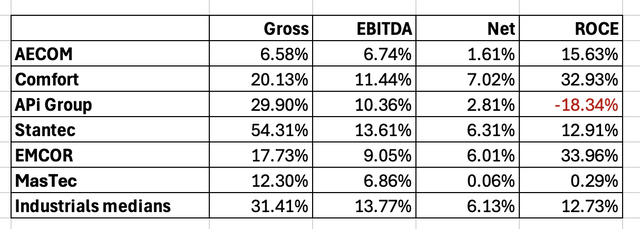

However, a comparison of margins leaves the appearance that AECOM might not have much pricing power:

ACM peer & competitor margins (author)

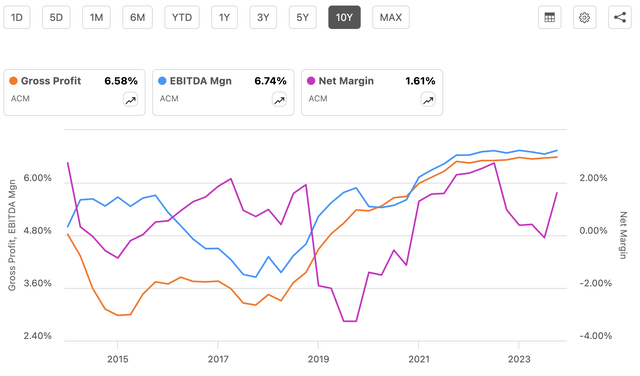

Judging by the net margins, it appears these firms are price takers, not price setters. From a longer-term perspective, the current net margin is close to AECOM’s 10-year highs:

ACM margins chart (Seeking Alpha)

There are several companies in this mix that have worthwhile returns on common equity.

I believe AECOM has a narrow moat.

AECOM’s Q3 results

The Q3-2023 results were released on August 5; the company beat estimates for revenue (by $206 million) and EPS (by $0.04) for the quarter that ended June 30. Key results included:

- Revenue was up by 13.3%, from $3.664 billion to $4.151 billion.

- Gross profit rose by 14.0%, from $250,078 to $285,044.

- Net income flipped from a loss of $125,521 last year to a profit of $129,477 this third quarter.

- Diluted EPS made a similar move, from a loss of $0.97 in Q3-2023 to a profit of $0.98 this year.

- Diluted shares outstanding fell from 138.741 million to 136.790 this year.

According to the income statement, the big difference in net income and diluted EPS was in last year’s $303.503 million loss in the earnings of joint ventures.

On the balance sheet, total assets increased from $11.426 billion in Q3-2023 to $12.047 billion in the same period this year. This year’s total included $1.645 billion in cash and cash equivalents, compared to $1.258 last year.

On the other side of the ledger, total liabilities came to $9.548 billion, up from $8.804 billion last year. Within that total is long-term debt of $2.415 billion this year versus $2.109 billion last year.

Stockholders’ equity decreased, from $2.455 billion last year to $2.298 billion this June 30th.

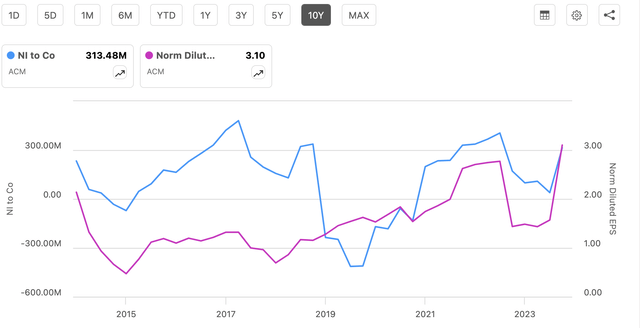

Here’s a 10-year chart that provides context for third quarter net income and normalized diluted EPS:

ACM net income and EPS chart (Seeking Alpha )

As the chart shows, net income and EPS are recovering from a profitability plunge that began in the second calendar quarter of last year.

CEO Troy Rudd said, “Our third quarter performance was highlighted by record revenue and margins, strong cash flow growth, and we increased our earnings guidance for a second time this year, which reflects our competitive advantages,”

Taking the data, statements, and inferences into account, AECOM is maintaining its profitability recovery.

Dividends and repurchases

The company pays a modest dividend, one that yield 0.93%, based on the September 11 closing price of $95.82.

Annually, the company pays $0.88, and it has a payout ratio of 19.72%.

According to the Q3 release, its policy is to first invest in organic growth, then buybacks and dividends. It added that it had returned $407 million to shareholders between the end of fiscal Q3-2023 and this year’s July dividend payment. It has another $700 million remaining in its current repurchase authorization.

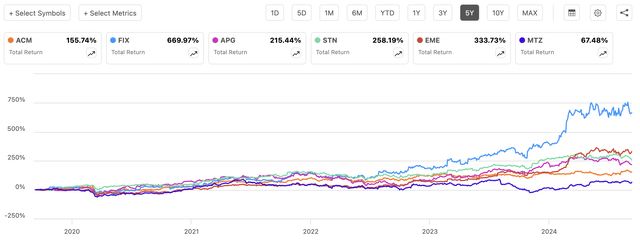

This chart shows total returns for AECOM, Comfort, APi Group, Stantec, and MasTec:

ACM peer & competitor total returns chart (Seeking Alpha)

AECOM, on the orange line, is currently second from the bottom, while Comfort is far and away the top performer on this metric. That leads to the conclusion AECOM has prioritized organic growth over shareholder returns.

Growth prospects

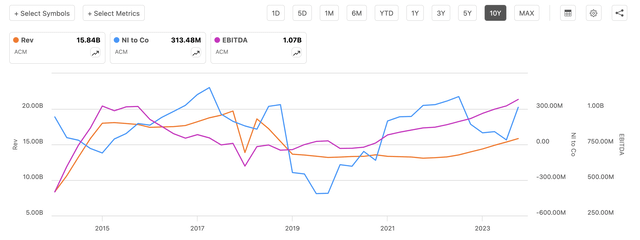

So, what has AECOM’s growth been? Essentially, it has been flat over the past 10 years:

ACM revenue, EBITDA, net income chart (Seeking Alpha )

EBITDA and net income are close to where they were a decade ago. What’s ahead?

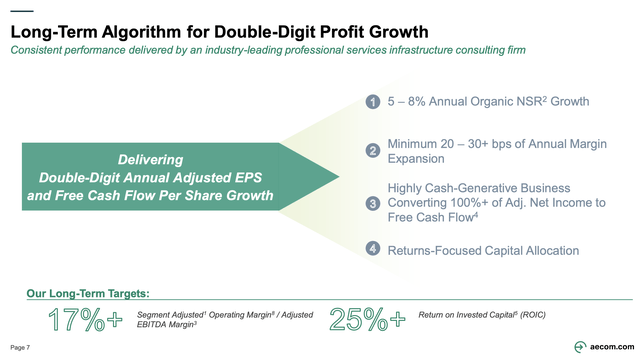

This slide from the investor presentation points to profitable growth, including double-digit increases in adjusted EPS and free cash flow:

ACM growth targets slide (investor presentation)

Note, the firm intends to grow its margins by 20 to 30 basis points per year, which should improve its bottom line significantly over multiple years.

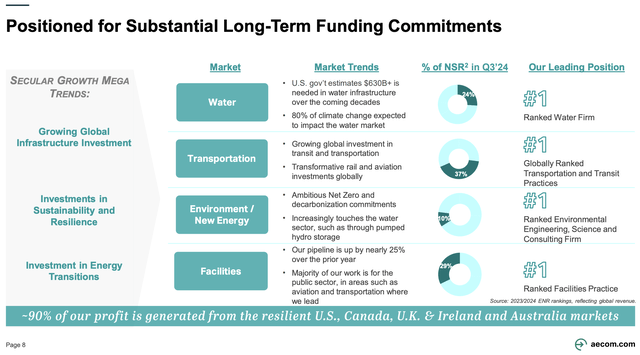

In addition, it points to four long-term tailwinds that should help it grow:

ACM infrastructure tailwinds slide (investor presentation)

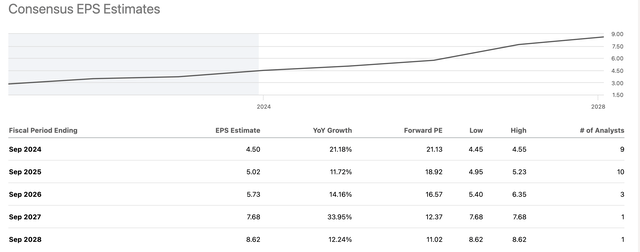

Wall Street analysts see double-digit earnings growth for the rest of this year and then the next four years:

ACM EPS Estimates table (Seeking Alpha)

Revenue should grow as well. In addition to existing business and new business from capital expenditures, it also has a solid backlog and pipeline. CEO Rudd said during the Q3 earnings call,

“We also delivered strong cash flow in the quarter and on a year-to-date basis, free cash flow has increased by 32%. Importantly, our backlog is strong and our pipeline is at a record high. This provides us with significant visibility and is consistent with our view that we are in the early innings of a multi-decade secular growth cycle across our markets.”

If his expectations pan out, AECOM could finally be looking at sustained profitable growth. And the analysts’ EPS estimates forecast the same trajectory.

Valuation and target price

Although the firm’s revenue, EBITDA, and net income have looked flat over the past decade, the share price has shown solid growth in the past five years:

ACM 10 year price chart (Seeking Alpha)

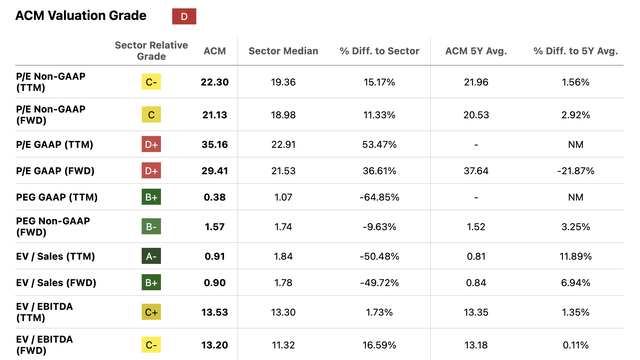

The share price has grown consistently, while EPS has not and is currently digging itself out of a recent dip, suggesting AECOM may be overvalued. That’s backed up by this excerpt from the Seeking Alpha system’s valuation table:

ACM valuation table (Seeking Alpha )

Within the table, note that the PEG ratios, which factor in growth, receive higher grades than the P/E ratios. If the company hits its earnings growth target for this year, the PEG ratios should be much better.

My conclusion is that AECOM is currently overvalued, but not significantly.

As for a one-year price target, we will start with a chart of the share price and normalized diluted EPS:

ACM share price & earnings chart (Seeking Alpha )

That’s a very close relationship over the past decade, and interestingly, investors kept the faith through the earnings plunge in 2023 and early this year.

To set a one-year price, I will tie it to the projected earnings growth for fiscal 2025, which begins in about three weeks. As shown in the EPS estimates table above, Wall Street analysts are predicting year-over-year earnings growth of 11.72%.

Adding 11.72% to the September 11 closing price of $95.82 produces a one-year price target of $107.05. That’s not far off the analysts’ average one-year target of $105.89, which represents an increase of 10.51%.

Based on the way it has been recovering from the previous slump, its solid backlog and pipeline, and tailwinds, I think an 11.72% estimate is reasonable. In addition, the stock’s chart exhibits a peaks-and-valleys pattern and is currently in a valley, as shown in this 6-month chart:

ACM 6-month price chart (Seeking Alpha )

I rate AECOM a Buy, as has the other Seeking Alpha analyst who posted a rating in the past 90 days. The Quant system also gives it a Buy, while the Wall Street analysts have an overall Strong Buy rating, made up of seven Strong Buys, two Buys, and one Hold.

Risk factors

Management pointed out in the 10-K that a “substantial” amount of its revenue (43% in fiscal 2023) comes from long-term government contracts. However, budgetary approval is given annually, so the company is exposed to potential funding disruptions.

Some 29% of its fiscal 2023 revenue originated outside of the U.S., so there are geopolitical and currency risks. Among them are logistical and communication challenges, as well as currency exchange rates.

AECOM often takes on fixed-price contracts, requiring it to do all specified work for a specified lump-sum or other mutually agreed payments. When it enters into longer-term contracts, it is exposed to potentially higher costs and lower returns. To some extent, this risk is easing as inflation ticks down.

About 14% of fiscal 2023 revenue came from operations through joint venture entities. Differences of views with third parties in the JV may delay decision making, and in some cases, AECOM has no control over decisions involving the other parties.

Because of the nature of its business, it is “subject to numerous environmental protection laws and regulations that are complex and stringent.” The firm is involved with nuclear facilities, hazardous waste, Superfund sites, and similarly dangerous locations. Failure to comply with these laws and regulations may lead to serious penalties.

Conclusion

Over the past decade, the earnings of AECOM have fluctuated between about $3.00 and minus $1.00. It now may break out of that range. Wall Street analysts expect EPS of $4.50 for fiscal 2024, which will close at the end of this month. And over the next four years, EPS could reach $8.62.

If earnings pull up the share price, as they normally do, then shareholders could enjoy some serious capital gains. That’s why I’m comfortable giving it a Buy recommendation and forecasting a higher price in a year’s time.

But potential investors would be advised to also look at Comfort Systems USA, Inc., which has been turning in excellent total returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.