Summary:

- AECOM’s revenue growth is supported by a healthy backlog, increased win rates, and ongoing demand in end markets.

- The company’s margin growth is driven by good execution, higher-margin projects, and productivity gains.

- AECOM is trading at a discount to its peer Tetra Tech and has strong long-term growth potential, making it a buy.

JHVEPhoto

Investment Thesis

AECOM’s (NYSE:ACM) revenue growth should benefit from a healthy backlog ($41.6 bn at the end of Q3 FY23) and increased win rates. Moreover, the ongoing demand in end markets, driven by sustained investments like the Infrastructure Investment and Job Act (IIJA), Inflation Reduction Act (IRA), and similar infrastructure initiatives on a global scale, along with a focus on sustainability, resilience, and the ongoing shift in supply chains, should continue supporting revenue growth in the upcoming years. In addition, the long-term revenue growth of the company should also benefit from rebuilding Ukrainian infrastructure after the devastation caused by the Russia-Ukraine war.

On the margin front, the company should benefit from good execution and higher-margin projects in the backlog, and productivity and efficiency gains. So, I believe the company’s revenue and margin growth prospects remain encouraging. Moreover, the company is trading at a discount to its peer Tetra Tech (TTEK), which is exposed to similar end-market trends. A reasonable valuation combined with good revenue growth and margin expansion prospects makes AECOM a buy.

Revenue Analysis and Outlook

In my previous article, I discussed AECOM’s revenue growth prospects benefitting from a healthy backlog, secular demand trends, and federal funding like IIJA, and IRA. The company has reported earnings for its third quarter of fiscal 2023 since then and similar dynamics were seen there as well.

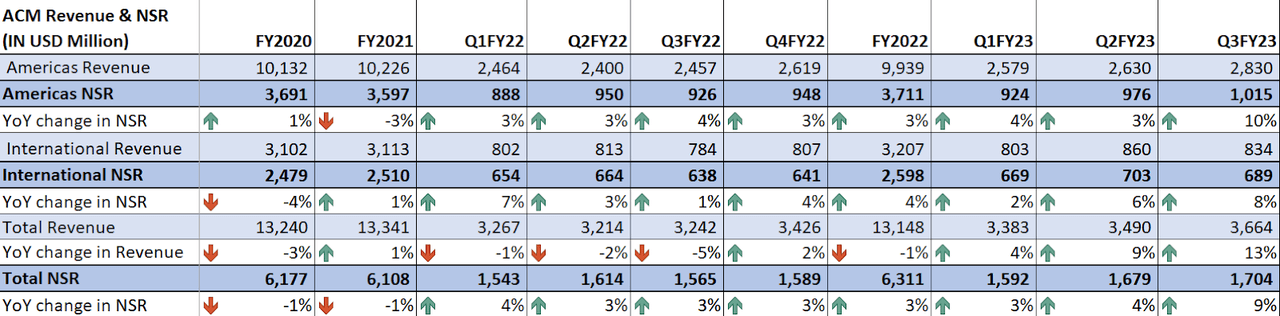

In the third quarter of fiscal 2023, the revenue growth was aided by a strong backlog execution in the Americas and the International markets. In addition, end market demand continued to increase as the rate of flow government funding accelerated, boosting win rates and order pipeline. As a result, revenue increased by 13% Y/Y to $3.4 billion, reflecting Net Service Revenue (NSR) growth of ~10% Y/Y on a constant currency basis. The NSR growth was supported by a ~10% Y/Y increase in the design business (representing 90% of the total NSR).

AECOM’s historical Revenue and NSR (Company Data, GS Analytics Research)

Looking forward, I am optimistic about AECOM’s revenue growth prospects. The company saw a strong ~10% Y/Y growth in its design backlog last quarter despite an increased backlog conversion rate. What is more interesting is management noted that the proposal and bids submitted outpaced backlog growth indicating the company’s backlog is poised for continued growth and, hence, I believe the company should continue to see good growth in the near to medium term.

The company’s end market remains strong with robust state and local infrastructure investments supported by federal stimulus from acts like the Infrastructure Investments and Jobs Act (IIJA) and Inflation Reduction Act (IRA). The company is seeing strength outside the U.S. as well with governments across the globe prioritizing infrastructure investments, energy transition, environment remediation, and sustainability. There is also a long-term potential growth opportunity from rebuilding Ukraine after the devastation caused by the Russia-Ukraine war. AECOM is working closely with Ukraine’s Ministry for Communities, Territories, and Infrastructure Development and signing MoUs to serve as its reconstruction delivery partner.

In addition to a strong end-market, the company is also executing well with over 50% win rates for the project it is bidding on. According to management, for larger and complex projects, the win rate is even higher which is a testament to the company’s good execution capabilities.

Overall, the company is well-positioned for multi-year growth driven by secular trends like global Infrastructure investments, environmental sustainability, and resilience, as well as energy and supply chain transition. Further, the strong backlog and bid pipeline driven by the U.S. Federal government stimulus from IIJA and IRA provides good visibility for near-term growth. Last quarter, the company increased its full-year guidance based on strong year-to-date performance in the business, and, looking forward, I expect this momentum to continue.

Margin Analysis and Outlook

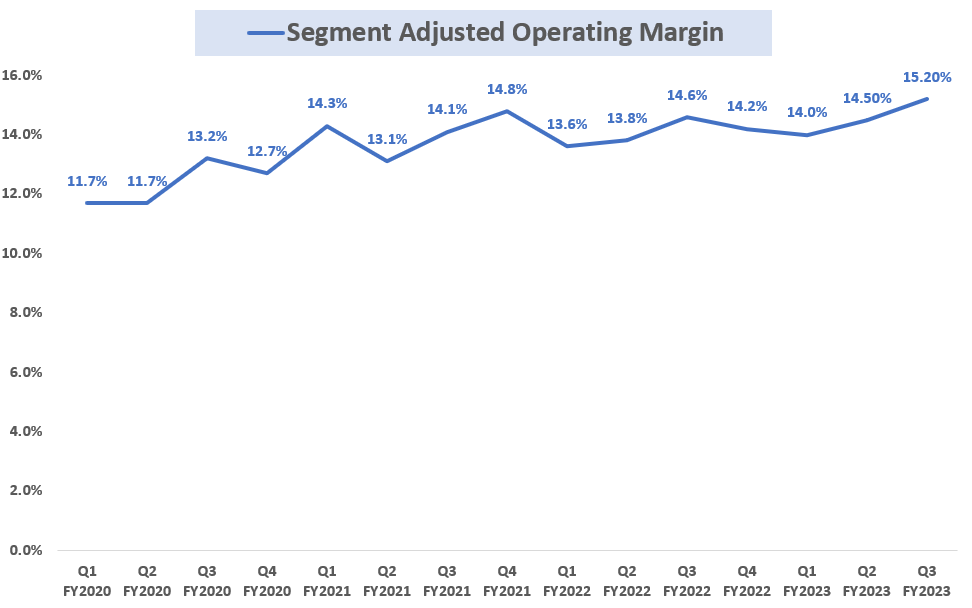

In the third quarter of fiscal 2023, the company’s margin growth was supported by productivity and efficiency gains, volume leverage, strong backlog execution, and high-margin backlog composition. This resulted in a 60 bps YoY increase segment-adjusted operating margin to 15.2%. On a segment basis, the adjusted operating margin increased by 20 bps YoY to 18.8% in the Americas segment and by 110 bps YoY to 9.9% in the International segment.

AECOM’s Historical Segment Adjusted Operating Margin (Company Data, GS Analytics Research)

Looking forward, the company should benefit from its high-margin backlog. Over the past few years, the company has been selective in terms of bidding and has focused on high-margin projects with relatively lower risk profiles. This has started getting reflected in the company’s margin growth as AECOM posted above 15% segment operating margin (on NSR) for the first time ever last quarter.

Management has set a longer-term margin target of 17% and, in addition to high margin backlog, the company’s profitability should benefit from initiatives like real estate foot-print reduction, improved sharing of resources and workload across the globe, investment in digital tools to automate some functions and improve efficiency, etc. Management plans to share the details of these initiatives on their Investor Day in December and it certainly will be interesting to hear their commentary.

Meanwhile, the near-term margin trajectory of AECOM is positive. On its last earnings call, management commented that the company’s “backlog is more profitable than ever” indicating a potential for continued margin improvement in the coming quarters supported by higher margin projects in the backlog.

Valuation and Conclusion

ACM is currently trading at 24.05x FY23 consensus EPS estimate of $3.68 and 20.21x FY24 consensus estimate of $4.38. The company is trading relatively cheaper than its peer Tetra Tech which is trading at a P/E of 30.3x FY23 consensus estimate of $5.24 and 27.07x FY24 consensus estimate of $5.87 despite similar growth prospects and end-market dynamics. The company has good long-term growth potential due to several factors. These include strong backlog levels, higher win rates in securing projects, an improved backlog consisting of high-margin projects, sustained demand trends, federal funding for infrastructure projects, and efforts to reconstruct Ukrainian infrastructure after the Russia-Ukraine war. Furthermore, enhancements in backlog quality and operational efficiency should contribute to margin expansion. Therefore, I believe that ACM should maintain its strong performance, and as a result, I continue to rate AECOM as a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.