Summary:

- AECOM reported earnings with impressive revenue growth.

- It is benefiting from the IIJA and increased fiscal spending.

- Infrastructure is again featuring in election pledges, and ACM should perform well with this as a backdrop.

Artur Debat/Moment via Getty Images

It’s election year and election promises are already being made. President Biden said on the 25th January, “Instead of infrastructure week, America is having an infrastructure decade.” This was both a pledge and a dig at Donald Trump who arranged several “infrastructure weeks” during his presidency with varying results.

I expect more pledges on infrastructure during the campaign trail as it is a popular subject. Trump has yet to unveil his proposed policies, but we know from his last campaign and Presidency that infrastructure and building key topics as he pledged $1 trillion in new infrastructure investment . I am therefore looking for good companies involved in this sector as not only could they benefit from extra fiscal spending, positive sentiment should also provide a tailwind.

Introducing AECOM

AECOM (NYSE:ACM) is a mid-cap company with a market capitalization of $12bn. It offers consulting services across multiple sectors, including transportation, water, environment, energy, facilities, and government services.

ACM is headquartered in Dallas, Texas and is a multinational firm with around 51,000 employees. AECOM works on projects of various scales and complexities, ranging from large-scale infrastructure developments such as highways, bridges, airports, and rail systems to environmental remediation, water resource management, and urban planning initiatives.

According to CEO Troy Rudd in the Q4 earnings call, “…about 94% of our business is in our design business, and that includes program management, about 6% relates to construction management.”

AECOM has spun off several of its divisions, including its Management Services, Power construction and Civil construction, all in the 2019-2021 period. This was, according to the company, to aid “transformation into a higher-margin, lower-risk Professional Services business”.

Growing Revenues and Margins

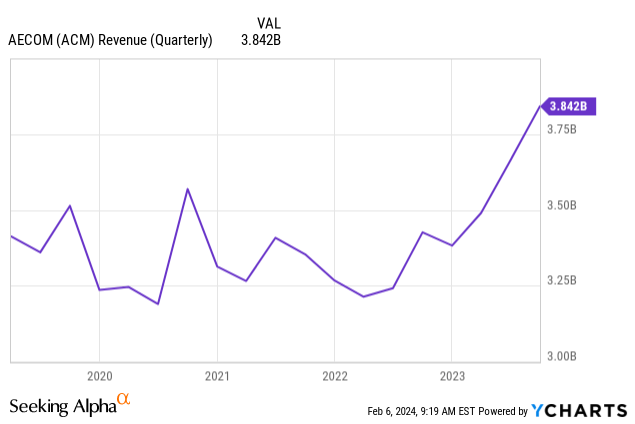

ACM reported Q1 earnings on the 5th February and posted some solid figures. Revenue of $3.9B (+15.4% Y/Y) beat expectations by $240M. The top line is showing a steady uptrend (recent earnings not shown).

Margins are also steadily rising and FY ’24 guidance is for a segment adjusted operating margin of approximately 15.6%, representing a 90 basis point increase from fiscal 2023.

Troy Rudd said in the earnings call,

…we outperformed on every key financial metric in both the fourth quarter and full year. Organic NSR growth and the design business was 10% in the fourth quarter and 9% for the full year. This was highlighted by the strength of our water, transportation and environment businesses, which are benefiting from strong secular growth trends and organic market share gains.

Benefiting from Fiscal Spending

President Biden’s Infrastructure Investment and Jobs Act (IIJA) was signed into law in November 2021. The IIJA “authorizes $1.2 trillion for transportation and infrastructure spending with $550 billion of that figure going toward “new” investments and programs.” ACM is well positioned to benefit from this spending, as Troy Rudd stated in the earnings call,

…investments in infrastructure, sustainability and resilience, and the energy transition are converging into a powerful cycle that plays to our strengths. Funding from the IIJA is beginning to flow into our markets, and commitments towards achieving ambitious net zero targets are driving our clients’ investment decisions.

Public spending is vital to ACM’s growth. Troy continued, “75% of our work in the America’s design business is for public sector clients, where funding is more predictable.” Lara Poloni, President of ACM added, “Large wins such as our selection to be the lead designer for the IIJA funded Brent Spence Bridge Corridor project in the U.S. are beginning to more materially contribute to our results.”

Reliance on fiscal spending and public projects is a two-edged sword, but in the run up to the election there are much more likely to be promises of increased spending rather than cuts. This should provide a tailwind for ACM and there is scope for continued growth.

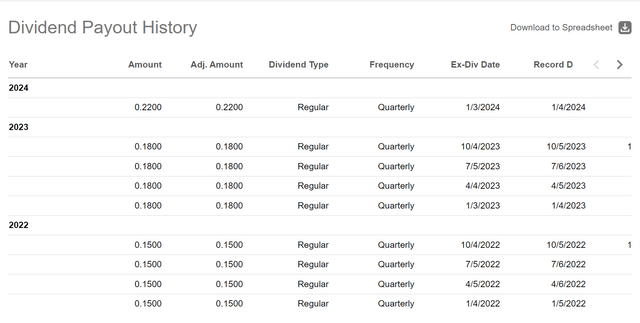

Growing Dividend

ACM’s dividend may be small, with a yield of just under 1%, but it is growing by around 20% per year and I take that as a good sign.

ACM dividend (Seeking Alpha)

ACM is also repurchasing shares, although with the stock near all-time highs, this free cash may be better spent elsewhere.

Technicals

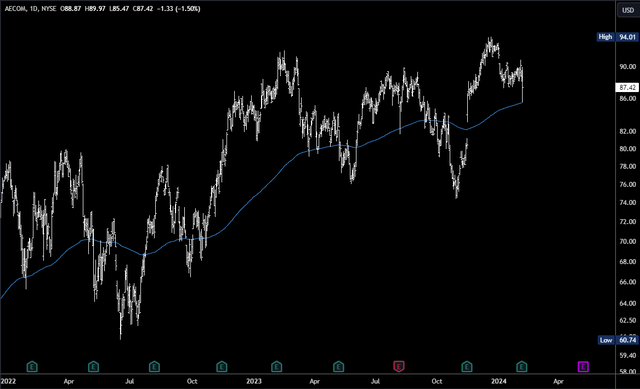

ACM is in a steady uptrend and made a new all-time high of $94.01 in December. The recent dip to $85.47 came after earnings and held the 200dma. This looks like strong support and provides a buying opportunity.

ACM Chart (TradingView)

Once $94 is cleared, AMC has a clear run higher and should target $100 this year. That is around +17% from today’s low.

Conclusions

ACM is exactly the kind of company that could benefit from infrastructure election promises in 2024 and increased fiscal spending in the years to come. It is already reaping the rewards of the IIJA and exhibiting solid growth in revenues. Its dividend is steadily rising and margins are growing. The current dip following earnings could be a good buying opportunity to position for a continued rally.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.