Summary:

- The company is benefiting from the increased infrastructure investments.

- The end market outlook continues to remain healthy as reflected by strong backlog levels exiting Q1 FY23.

- Healthy demand, support from federal fundings, and high-margin projects should help the company’s growth in 2023 and beyond.

monsitj

Investment Thesis

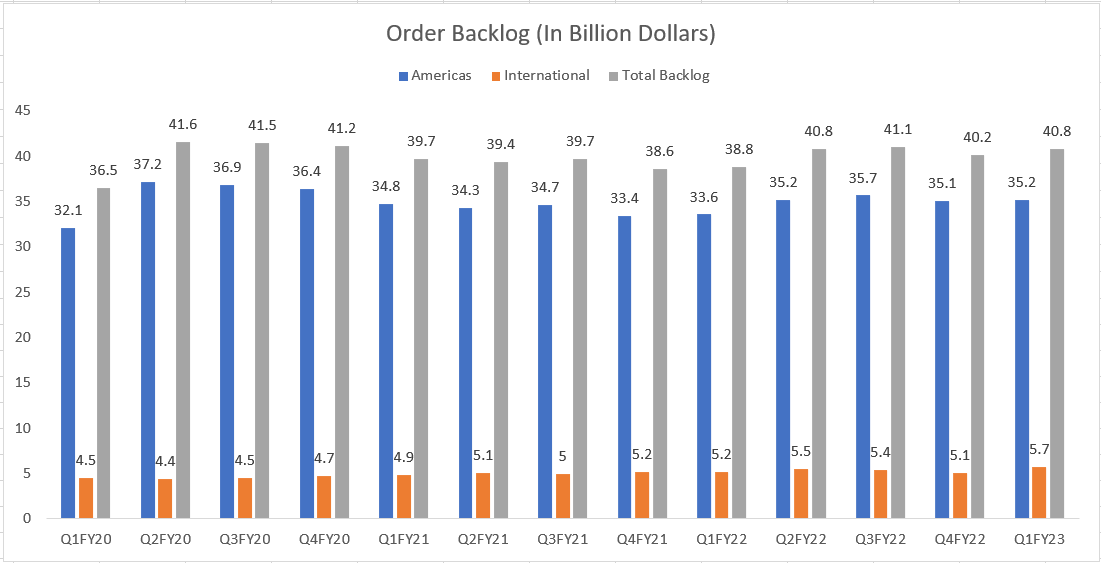

AECOM (NYSE:ACM) revenues should benefit from a healthy backlog (~$40.8 bn at the end of Q1 FY23), increased win rates, and a good pipeline of opportunities created by increased infrastructure funding levels from programs such as the Infrastructure Investment and Job Act (IIJA), Inflation Reduction Act (IRA), and other infrastructure investment initiatives globally. Management believes these infrastructure investments could continue for the next several years, creating a good long-term macro tailwind for the company’s growth.

The company margins should benefit from good execution and higher-margin projects in the backlog. Moreover, the margin should benefit from the company’s efforts to exit low-return projects as management focuses on prioritizing the highest-returning opportunities. The company’s good revenue growth and margin improvement prospects make it a good buy.

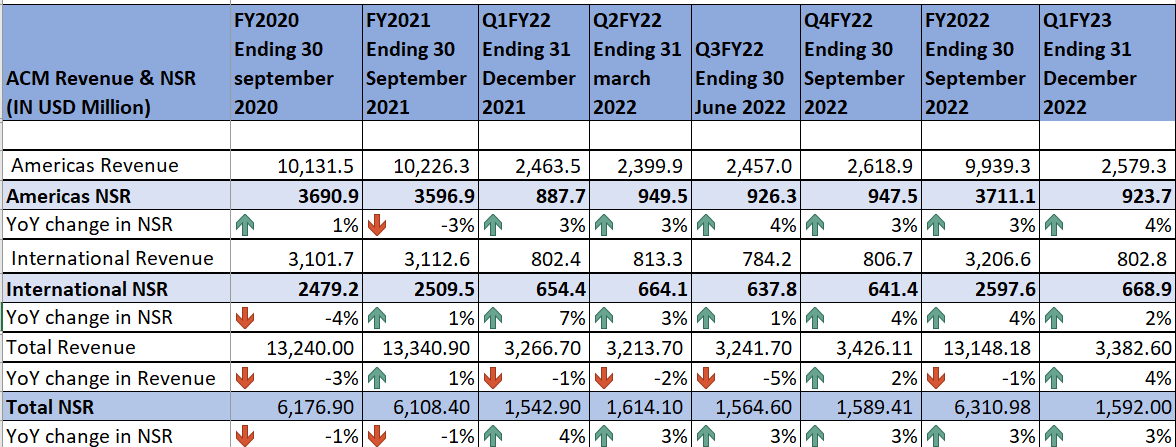

ACM Q1 FY23 Earnings

Earlier this month, AECOM reported better-than-expected results for the first quarter of FY23. While adjusted EPS of $0.86 was down 3% Y/Y, it was above the consensus estimate of $0.81. The decrease was a result of higher tax rates compared to the prior year period. Revenue increased by 4% Y/Y to $3.4 billion, and was above the consensus estimate of $3.3 billion. Net Service Revenue (NSR) grew by 8% YoY on a constant currency basis. Increased NSR resulted from growth in the Americas and International segment due to healthy end-market demand and increased backlog and win rates, partially offset by foreign currency headwinds. The segment-adjusted operating margin (excluding AECOM Capital) increased by 40 basis points (bps) Y/Y to 14.0%. The increase was due to high-margin projects in ACM’s backlog.

Revenue Analysis and Outlook

AECOM’s revenue growth has been benefiting from healthy demand across its end market in response to increased infrastructure investment initiatives (such as IIJA, and IRA), growing need for energy transition (ESG prioritization globally), and post-COVID investments to address supply chain challenges (such as reshoring manufacturing by the U.S.).

In Q1 FY23, revenue growth momentum continued. The strong backlog and healthy demand in the end-markets resulted in 4% Y/Y growth in revenue and 3% Y/Y growth in NSR. On a constant currency basis, NSR grew by 8% Y/Y.

AECOM’s historical Revenue, NSR and NSR growth (Company Data, GS Analytics Research)

Looking forward, I believe ACM should continue to post good revenue growth in the coming years. The growth should benefit from the company’s high levels of backlog, growth in the bid pipeline, increased win rates, and healthy end-market conditions.

The company exited Q1FY2023, with a strong backlog position. ACM’s backlog increased 5% Y/Y to $40.8 billion with growth in both Americas and International business. The design business which accounts for ~90% of the total net service revenue saw its backlog grow by 9% Y/Y to ~$19.9 bn and had a 1.3x book-to-burn ratio.

AECOM’s Order Backlog (Company Data, GS Analytics Research)

ACM’s pipeline of opportunities has remained robust, as evidenced by a ~30% Y/Y increase in proposals and bids submitted in Q1FY23, up from 20% Y/Y growth seen in Q4 FY22. The company has also improved its win rates for large projects. The win rate for projects worth over $25 million has increased to ~30%, up from 12-14% in previous years. The increased bid pipeline and improving win rates provide strong visibility for the company’s future backlog and revenue growth.

Furthermore, the end markets such as transportation, new energy, environment, and water are healthy across both the Americas and the International segment. The company has started experiencing the impact of U.S. federal funding such as the Infrastructure Investment and Job Act (IIJA), Inflation Reduction Act (IRA), and several other investments by the Australian, Canadian, and Saudi Arabian governments. Looking forward, management expects increased infrastructure investments to continue for at least the next 3 to 4 years with a possible peak around 2026-27 or even later providing a medium to a long-term tailwind for ACM.

Answering a question about the timing of the acceleration for the federal funding on its earnings call, the company’s CEO Troy Rudd commented,

… So if you think about how the IIJA funds or other funds from the investment — the federal investment offers build, have been put in place that it would slowly start. And so we’re starting to see the impact in the marketplace today, but we think we’ll see the more significant impact of the funding from IIJA when matched with the state and local funding in 2024, but we see that going well through 2026 and 2027.

In fact, what we’re forecasting is the peak of that money being in the market and infrastructure project is probably in 2026 and 2027, and again, moves out to 2028 and 2029. But that’s when we’d see that peak. So we see those opportunities extended for quite a long period of time.”

The healthy end-market demand and a favorable funding environment have helped ACM win large projects in Q1 FY23. In Southern California, the company won a significant water program management contract, while in San Diego, it secured a contract for Padre Dam’s advanced water purification program. These wins reflect planned investments in infrastructure to address drought and water supply challenges. Additionally, ACM won a multiyear NAVFAC Clean Water contract in the Pacific area, following its NAVFAC Atlantic win in Q4 of the previous year. These projects are expected to run for at least 5 years. On the international front, the company secured a design contract for a highway tunneling project in Australia and a project for the Melbourne airport rail link. These recent wins, combined with support from infrastructure funding, should bolster revenue growth in the years ahead.

Lastly, ACM’s growth strategy, which I discussed in a previous article, should continue to bolster the company’s revenue growth prospects. The strategy centers around expanding market share, investing in digital AECOM, and pursuing the most profitable opportunities. The company’s strong win rates in project management and advisory services, coupled with its technical expertise, have helped it broaden its market size, as evidenced by the large project win discussed above. In addition, ACM’s investment in digital AECOM is driving growth, with clients increasingly using its AI-powered tool, PlanSpend, a Fund Navigator, to optimize their bidding around the Federal government’s infrastructure funding related projects. The company’s focus on capital allocation and investment in the most profitable opportunities is also bearing fruit, as demonstrated by the increase in its order pipeline. This growth is a result of the increased business development investment in Q4 FY22, which has led to significant growth in win rates and new orders.

So, I am optimistic about the company’s revenue growth prospects in 2023 and beyond.

Margin Analysis and Outlook

ACM’s margin profile has improved in recent years, thanks to its focus on winning high-margin projects. In Q1 2023, the segment’s adjusted operating margin expanded by 40 basis points year-over-year to reach 14%, driven by strong execution and a high-margin/low-risk backlog composition. The margin expansion was supported by growth in both the Americas and International segments. In the Americas segment, the adjusted operating margin increased by 50 basis points year-over-year to 18.3%, while in the International segment, the adjusted operating margin rose by 10 basis points year-over-year to 8.3%.

Looking ahead, I am optimistic about ACM’s margin expansion prospects in the coming years. According to management, the margin profile in the company’s backlog has increased by a few percentage points compared to where they were a couple of years back. This should continue to support margin growth in 2023. In addition, the company is focused on exiting its low-returning projects. In Q1, it divested parts of its Southeast Asia business, as the risk and return of those businesses did not align with ACM’s long-term goals. This move should further improve the margin profile of the backlog and help support margin expansion in 2023 and beyond. Therefore, I believe ACM has good potential for margin growth in the coming years.

Valuation and Conclusion

ACM is currently trading at 24.05x FY23 consensus EPS estimate of $3.75 and 20.39x FY24 consensus estimate of $4.43. If we look at the current sell-side estimates, the company is poised to deliver strong earnings growth over the next few years which makes sense given the continued strength in infrastructure orders. The company is trading relatively cheaper than its peer Tetra Tech (TTEK), which has a P/E of multiple of 29.66x based on an FY23 consensus EPS estimate of $4.99 and 26.51x based on an FY24 consensus EPS estimate of $5.58. Given ACM’s long-term growth prospects, positive outlook for federal infrastructure funding, healthy end-market demand, high win rates, and strong levels of high-margin backlog, I believe ACM is a good buy at the current levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written by Saloni V.