Summary:

- AECOM is winning multi-billion dollar infrastructure projects, with a surge in new contract awards in recent months.

- The company’s revenue is growing, with a steady uptrend and a 10% YoY growth guidance for 2024.

- AECOM has a strong order backlog, low debt and cash on the balance sheet.

JHVEPhoto

Introduction

I have decided to start a position in AECOM (NYSE:ACM), the market leader in the Infrastructure Management and Advisory business. The specialist areas in which they operate have been resilient to the market gyrations occurring in the construction industry since the turmoil of 2020. With many major infrastructure projects deferred, in some cases by decades, as I discovered whilst researching for a recent article, the delay in these infrastructure works has created a surge in new contract awards for AECOM in recent months.

AECOM keeps winning new projects, not just any projects, multi-billion dollar projects, with project timescales ranging from months to years. Many are government-funded infrastructure projects and a varied list of private clients globally.

AECOM’s business revolves around two key factors: skilled labor and new contract awards; with the contract awards seemingly piling up, the next key factor is professional labor, of which there are 52,000 currently employed. Globally, the market is highly constrained for skilled labor, with high levels of competition from competitors for key workers. AECOM attracts and retains skilled workers through an array of incentives and support systems, which seems to pay off as the employee count has remained stable.

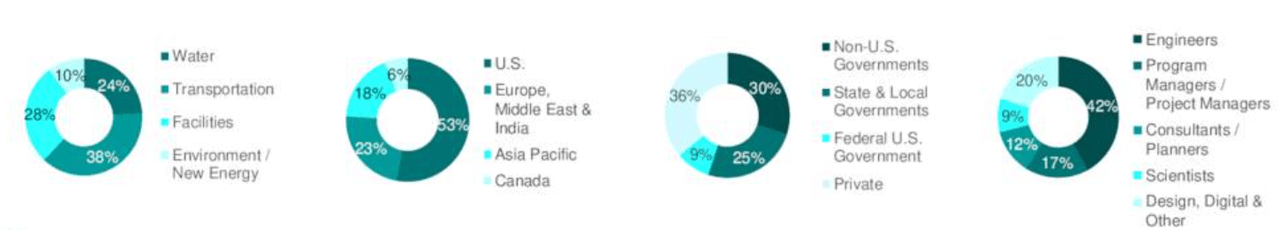

From an investment perspective, I believe diversification is one of AECOM’s best attributes; as demonstrated below from the Q2 presentation, labor is distributed across varied infrastructure segments, and with 55% of revenue derived from government-funded projects. Geographically, the US, at 53%, is the largest source of revenue.

AECOM Revenue Snapshot (AECOM Investor Relations)

Revenue

The Infrastructure business in which AECOM operates has seen significant project announcements, secular trends towards Infrastructure means that AECOM has released multiple contract award notices, which indicates good news for revenue in the coming months as these new projects start earning fees.

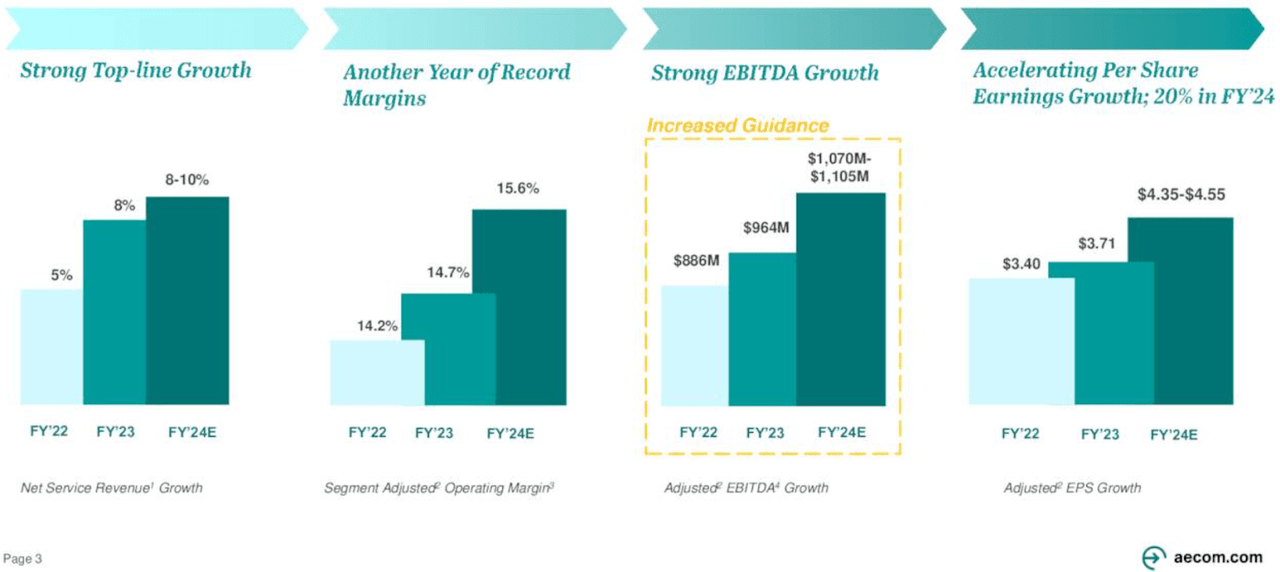

On May 6th, AECOM announced their Q2 quarter, revenue in the US grew 10% while international growth was 6%. I believe this is a good performance in a shaky macro environment, particularly for large capital expenditure projects due to elevated interest rates.

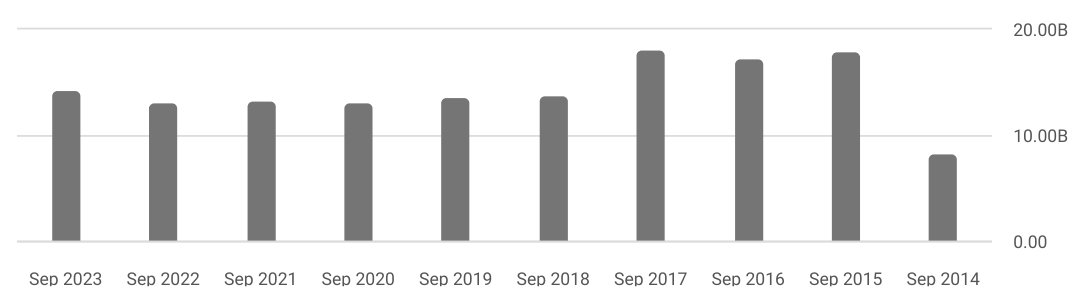

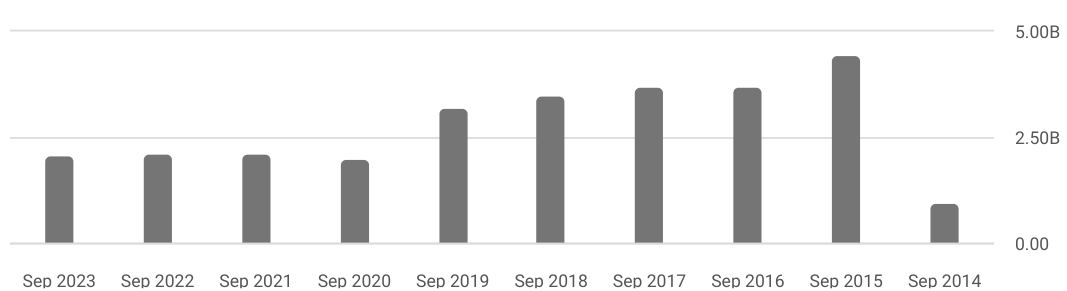

AECOM’s 10-year revenue has been in a steady uptrend in recent years; I expect this trend will continue with revenue guidance for 2024 10% YoY growth. I believe the revenue guidance will be achieved given the order backlog and secular trends in the infrastructure business. AECOM’s 10-year revenue has been in a steady uptrend in recent years; I expect this trend will continue for years to come.

AECOM Revenue 10Yr (Seeking Alpha – ACM Financials)

Order Backlog

The Infrastructure business in which AECOM operates has seen significant project announcements, and AECOM has released multiple contract award notices. The focus for AECOM’s projects span transportation, buildings, water, energy and the environment. Many of these sectors are seeing strong demand, with buildings being the lagging segment.

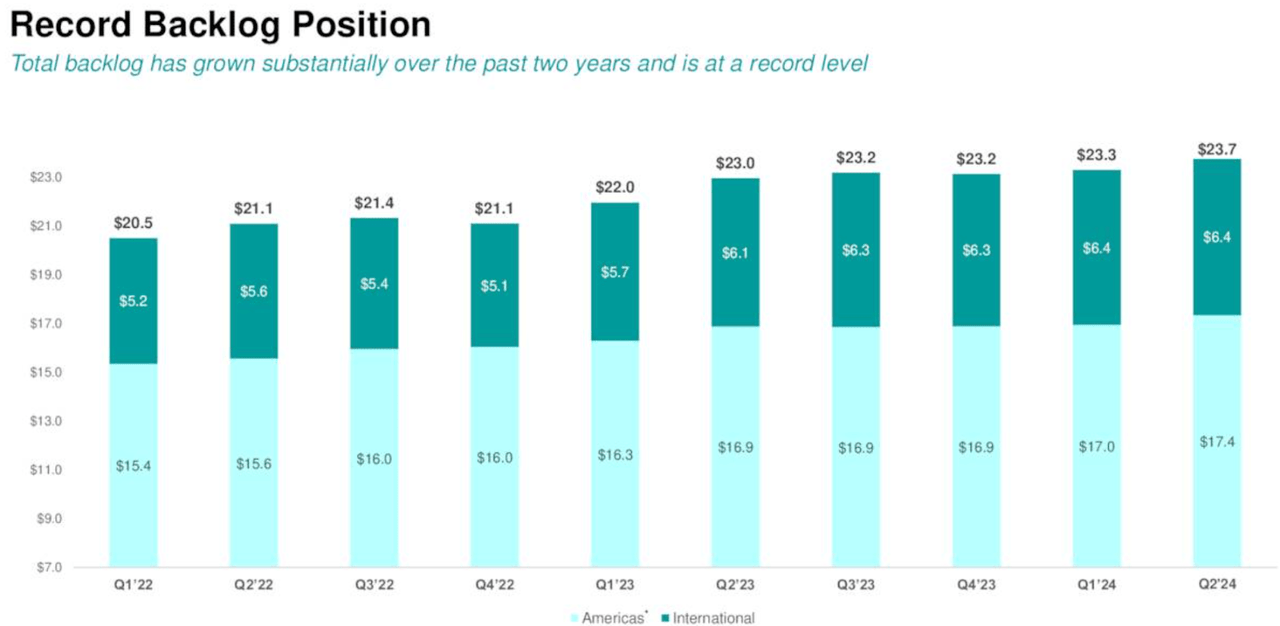

The order backlog has never been higher, with 45% growth in order book. The transportation, water and energy sectors are the key drivers of this growth. The Americas order book is particularly impressive at over $17 billion, with another $6 billion internationally diversifying the order book.

Order Backlog (Q2 Earnings Report)

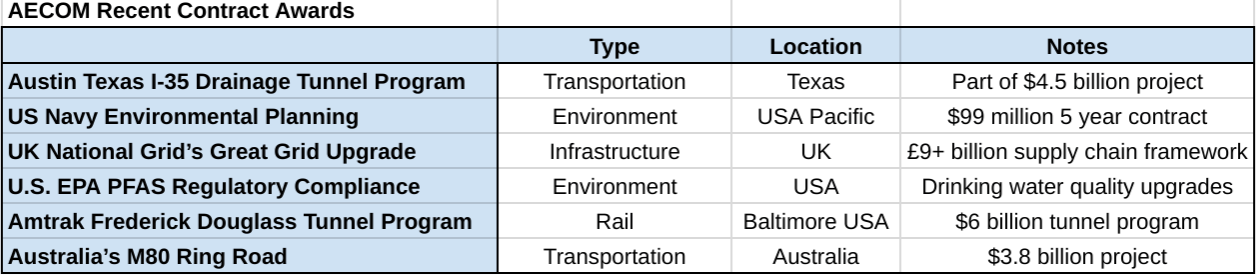

AECOM has continued to find success in the bid to expand their infrastructure projects, over the past few months. Some of the more recent contract awards are summarized below:

Recent Contract Awards (Author, Data from AECOM Press Release)

These projects provide a snapshot of the caliber of projects in which AECOM operates; large contracts, with programs running for years, somewhat of an ideal scenario where labor can become subject-matter experts within the advisory service, facilitating repeat business.

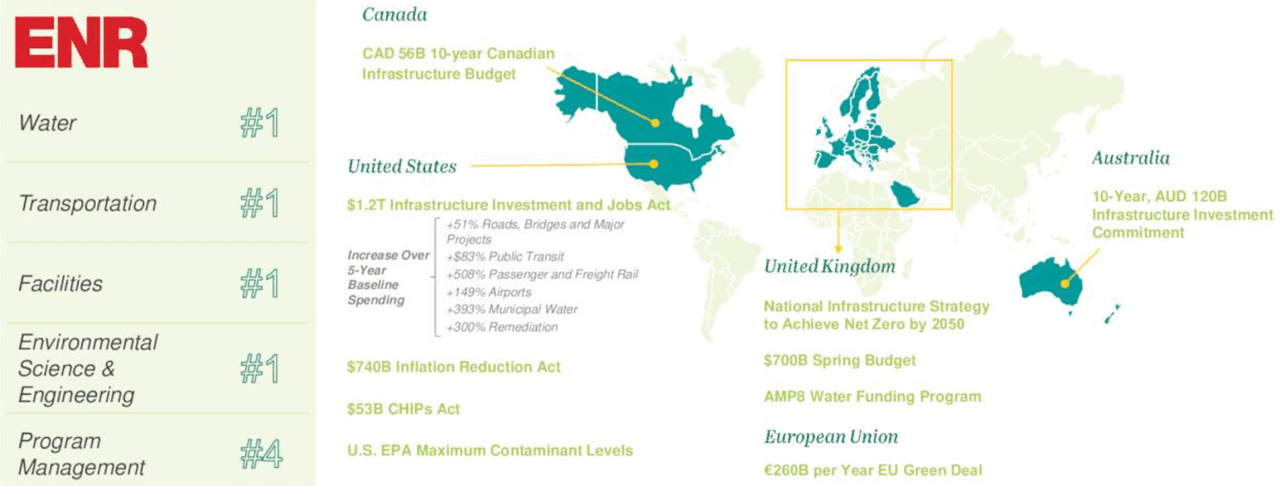

From a global macro perspective AECOM is well positioned as the number one project advisory in the Infrastructure business to expand with the demand for upgrade works across developed economies like the USA ($1.2T), Canada ($56B), UK (£700B), Europe (€260B) and Australia ($120B). Each of these major economic regions have already vast infrastructure plans in place, many of which AECOM is already involved with.

AECOM Market Leader (Q2 Earnings Presentation)

Financials

AECOM reported in early May that they had $1.2 billion of total cash and cash equivalents, and $2.2 billion of total debt on the balance sheet.

I believe there is no reason to be concerned about the debt, with the next major debt due in 2027 ($997m) and thereafter 2029 ($750m) and a further ($700m) from 2031. This could be advantageous if the debt can be refinanced in a lower interest environment. I believe debt is at a reasonable level and well under control for repayment.

ACM Debt 10 Yr (Seeking Alpha – ACM Debt)

The $1.2 billion of cash on the balance sheet is reasonable and could easily cover any upcoming debt repayments. Cash holdings over the past 10 years have grown substantially, and I speculate we may see further acquisitions of smaller competitors.

Q2 Presentation Highlights (Q2 Earnings)

Risks

Being in the construction business has some risks; for AECOM those risks exist, but I believe the biggest risk to AECOM is skilled labor. Skilled labor is proving difficult to find across the construction industry, and this shows no signs of abating. Ongoing efforts are being made by professional bodies to encourage more young and female employees to join the construction industry. Apprenticeships, placement terms during college, and inward migration of skilled labor are all being actively pursued to gain those elusive skilled workers; fortunately for AECOM their global reach enables intercompany transfers for skilled workers were needed. Inward migration is a risk on its own due to difficulties and changing regulatory requirements.

Economic downturns remain a significant issue for AECOM; once project funding is withdrawn this immediately affects AECOM; however, this is somewhat mitigated by the long duration contracts awards.

Share Repurchases and Dividends

The share repurchase program in place since September 2020, has repurchased shares totaling $1.9 billion, with $930 million remaining of the authorized program, that is 7.4% of the market cap, a not so trivial amount when combined with a dividend growing at 20%.

At present, the dividend yield stands at just under 1% with a low 20% payout ratio. Going forward, I expect double-digit dividend growth, following a 21% average annual increase over the past two years.

So what is my stance on an investment in AECOM?

I believe shares are still attractively valued at a PE of 20x. Shareholder returns are a small but welcome addition to the share price growth I expect over the coming years. The order backlog reaching its highest ever level provides a level of confidence that the business is still advancing forward, gaining market share and most importantly, that the business is profitable. My expectation is that the share price will continue to rise, providing a total return CAGR of 12% going forward.

Conclusion

In summary, I rate the ACM a Buy on the basis of secular growth in Infrastructure demand, a market-leading company at a reasonable valuation, and a short but very positive history of shareholder returns through share repurchases and dividends. I believe an investment in ACM will make shareholders pleased as they continue to demonstrate their dominance in the industry, winning new work and focusing the business towards profitable program management and advisory services. My recent purchase is small within a diversified portfolio, I will assess further purchases based on valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.