Summary:

- ACM reported its Q4 earnings that beat expectations.

- The company is benefiting from strong demand for its high-tech infrastructure design and engineering consulting solutions.

- An outlook for continued growth and higher margins can lift shares higher.

Nate Hovee/iStock Editorial via Getty Images

AECOM (NYSE:ACM) is recognized as a leader in infrastructure consulting services with a portfolio of iconic projects covering skyscrapers, stadiums, transportation, water, and clean energy sites. The company has leveraged its expertise in environmental and high-tech engineering to capture the strong demand for increasingly complex building requirements.

AECOM just reported its latest quarterly results, highlighted by continued growth and strong earnings, which is particularly impressive amid a challenging macro environment. Indeed, shares of ACM have outperformed in 2022 with a positive return as shares trade at an all-time high. The positive drivers here are company-specific, including an outlook for firming margins supporting higher earnings, with more upside in the stock.

ACM Earnings Recap

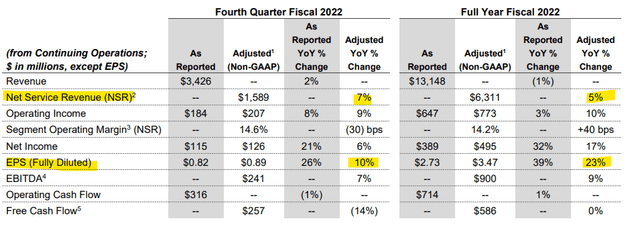

This was ACM’s Q4 fiscal 2022 report, capping off a record year with a climbing design backlog. Earnings per share this quarter at $0.83 was up by 10% from the period last year and also beat the market estimates by $0.17. Revenue of $3.4 billion was 2% higher than in Q4 2021, with some volatility based on the timing of some key projects. The result was above company targets.

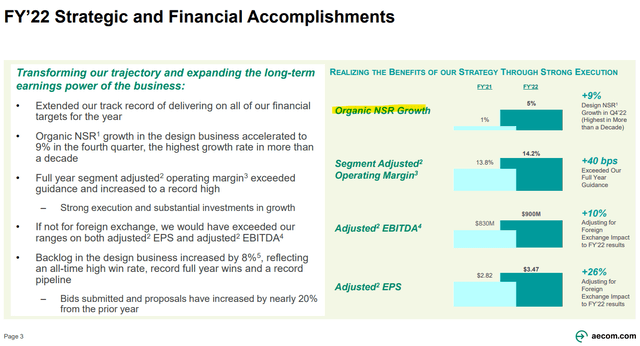

The big story is the momentum in net service revenue (NSR), up 7% y/y in Q4, which is the component of the business excluding sub-contract costs. The strength here is reflected in the company’s “win rate” at a record based on the number of bids and proposals accepted by clients. For the full year, the segment-adjusted operating margin at 14.2% increased from 13.8% in 2021. 2022 adjusted EPS increased 23% to $3.47.

Management believes that the company’s ability to continue investing in growth while maintaining industry-leading margins is a competitive advantage. For 2023, the guidance is to expect continued momentum and an accelerating NSR targeting 10% adjusted earnings growth. The goal is to have the adjusted operating margin reach 15% by fiscal 2024.

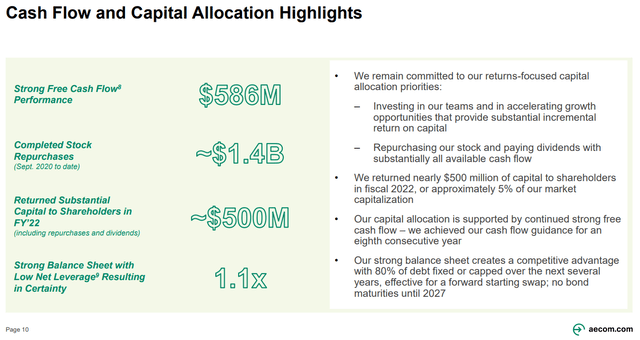

We’ll also note ACM ended the year with a solid balance sheet considering a cash position of $1.2 billion against $2.2 billion in total debt. With adjusted EBITDA reaching $900 million in 2022, the leverage ratio is comfortably at 1.1x. AECOM has been active with shareholder returns, including $500 million between the regular quarterly dividend and stock buybacks. On this point, the expectation is for annual dividend growth supported by underlying free cash flow as a strong point in the company’s investment profile. The current dividend yields about 0.8%.

ACM Outlook

There’s a lot to like about AECOM which we’d put in a “blue-chip” category within industrials. The company is exposed to high-level macro trends facing the construction and infrastructure investment demand, but the variable cost structure that is driven by its own operating activity provides a measure of stability to revenues and cash flows.

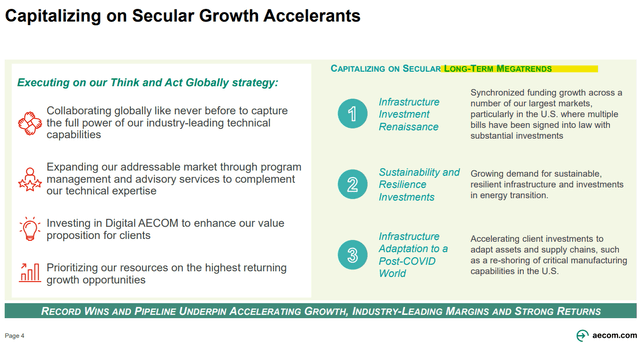

Three key “secular long-term megatrends” are seen as underpinning the growth runway. First, ACM benefits from government-funded infrastructure investment in several major global markets. For reference, Approximately 43% of the total business is from public sector clients worldwide. Legislation like the “Inflation Reduction Act” in the United States authorizing billions in spending toward clean energy infrastructure includes many end-markets ACM serves.

The company captures the growing demand for environmentally sustainable infrastructure as energy systems transition. Again, the technical complexity of these types of products is AECOM’s selling point. Finally, the company is also seeing a shift in global supply chains, including the theme of re-shoring back into the U.S. that supports new developments. One of the attractions of the business model is its asset-light profile based on the consulting services being technical based.

ACM Stock Price Forecast

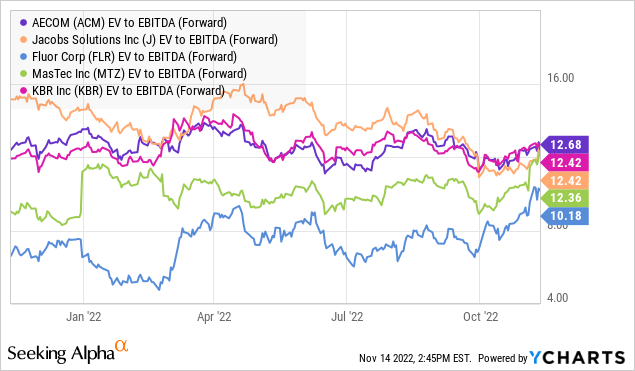

This type of fundamental quality can justify a premium valuation in a growth outlook. That’s the case with ACM trading at a forward P/E of 21x into management’s 2023 EPS guidance approaching $3.75. Comparables in the segment include Jacobs Solutions (J), and Fluor Corp. (FLR); recognizing that it’s difficult to make a direct comparison given each group focuses on different engineering and construction services for varying segments.

AECOM’s strong point is to focus on highly technical, environmentally sustainable infrastructure. Curiously, several industry players trade at a similar level to EBITDA around 12.5x as ACM. There is a case to be made that it deserves an even higher spread, given its premium positioning generally toward more complex projects as the company’s differentiator.

In the backdrop of an improving macro outlook where inflation is trending lower and interest rates stabilizing, ACM is well positioned to lead higher. The call here is that higher operating margins with financials gaining momentum can drive a valuation multiple expansion as part of the bullish thesis for the stock. We rate ACM as a buy and see shares trending higher towards a price target of $100 over the next year, representing a 27x multiple of management’s 2023 EPS guidance or a 15x the adjusted EBITDA target.

On the other hand, the risk to watch is that economic conditions deteriorate further with the possibility of a deeper recession undermining the growth opportunity. In this scenario, the $70 stock price level will be an important level of support the bulls will need to hold. Over the next few quarters, the strength in the NSR metric and operating margin will be key monitoring points.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ACM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.