Summary:

- AECOM has reported good results and provided encouraging FY24 guidance, with a solid backlog and strong growth prospects.

- The company’s revenue growth is supported by robust demand in its Transportation, Environment, Water, and New Energy end-markets.

- AECOM’s valuation is attractive compared to its peers, making it a good buy at current levels.

JHVEPhoto

Investment Thesis

I previously covered AECOM (NYSE:ACM) in early September. While the company has reported good results, provided encouraging FY24 guidance, and increased its share buyback authorization, the stock price has mimicked broader markets declining in October and then posting a swift recovery in November after the recent inflation data resulting in flattish stock price compared to my previous article. Looking ahead, ACM’s revenue is set to experience good growth, supported by robust backlog levels that provide visibility into the company’s short-term revenue prospects. Additionally, the company is poised to capitalize on robust demand in its Transportation, Environment, Water, and New Energy end-markets, driven by megatrends such as sustainability, resilience, and the ongoing energy transition. Multiyear tailwinds from federal infrastructure funding, like IIJA, further contribute to the positive outlook.

On the margin front, the company is expected to benefit from high-margin projects within the backlog and improved efficiency resulting from the rationalization of its real estate footprint. The valuation is also attractive when compared to its peers Tetra Tech (TTEK) and Stantec (STN). Considering the good growth prospects and a reasonable valuation, TTEK stock is a good buy at the current levels.

Revenue Analysis and Outlook

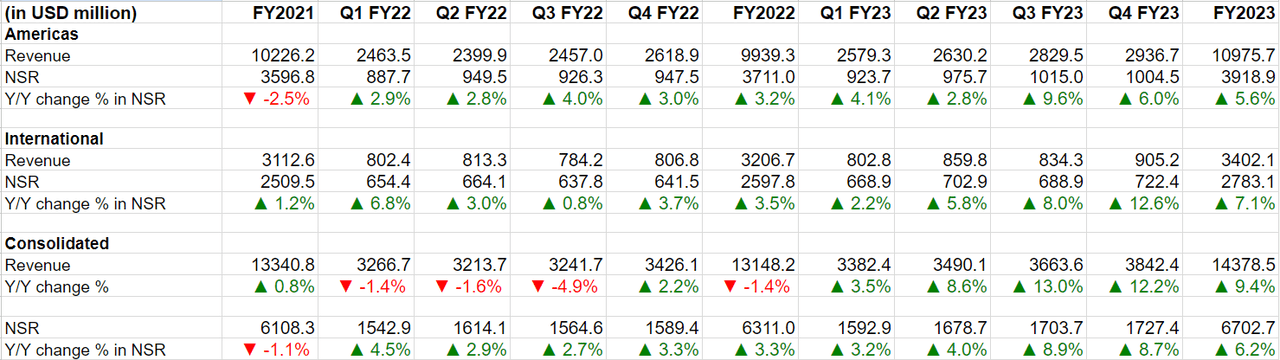

ACM has seen good growth in recent years driven by strong end-market demand. This trend continued in the fourth quarter of 2023. In Q4 FY2023, AECOM reported a 12.2% Y/Y increase in revenue to $3.8 billion with an 8.7% Y/Y growth in Net Service Revenue (NSR) benefitting from growth in its design business across all geographies. Organic NSR in the design business grew 10% Y/Y aided by strength in the Company’s global water, transportation, and environment businesses, which are gaining from increased investment in infrastructure, sustainability and resilience, and the energy transition.

Americas revenues came in at $2.9 billion, reflecting a 6% Y/Y growth in NSR. The Y/Y growth in NSR was led by 9% growth in the design business, which was attributed to strong growth in water, transportation, and environment markets. In the International segment, revenues stood at $905.2 million with a 12.6% Y/Y growth in NSR driven by double-digit growth in transportation and strong growth in the water market.

ACM’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, the company’s revenue growth prospects remain solid. The company’s design business, which accounts for ~92% of the NSR, saw its contracted backlog increase 15% Y/Y in FY23 led by 21% growth in Americas design business. In the Construction Management business, which accounts for ~8% of the NSR, the company has about four years of work in its backlog. A company’s backlog is a leading indicator of the company’s revenues and the company’s solid backlog levels give good visibility on ACM’s near to medium-term revenue growth prospects.

The company continues to benefit from favorable end-market demand driven by investments in infrastructure and megatrends like sustainability and resilience, and the energy transition. According to management, the funding from IIJA is beginning to flow in its markets and ACM’s largest states and local clients are projecting double-digit growth in fiscal 2024. The company is well poised to benefit from this increased funding and its recent large wins from this funding like the lead design contract for IIJA funded Brent Spence Bridge Corridor project are expected to contribute more materially in the coming quarters. In addition to transportation projects, IIJA is also expected to benefit water infrastructure project demand where ACM has sizable exposure.

On the environment side, AECOM saw a double-digit Y/Y increase in backlog last quarter driven by a sizable win to support San Diego Gas and Electric’s strategic undergrounding program, which is reducing wildfire risk by moving overhead power lines underground. The company’s environment business is also benefiting from the sustainability and energy transition megatrend. Further, PFAS remediation work is gaining momentum given continued regulatory clarity and should be a good driver in the coming years.

While rising interest rates have resulted in some concerns around the commercial real estate business, it is only 3% of the company’s total NSR including both construction management and the design business. This is much smaller compared to transportation (~35% of NSR), water (~24% of NSR), and environment (over 10% of NSR).

So, overall the company’s growth outlook remains solid. Management has guided the company’s organic Net Service Revenue (NSR) to grow between 8% and 10% in FY24. I believe this is achievable given the solid backlog levels and strong end-market demand.

Margin Analysis and Outlook

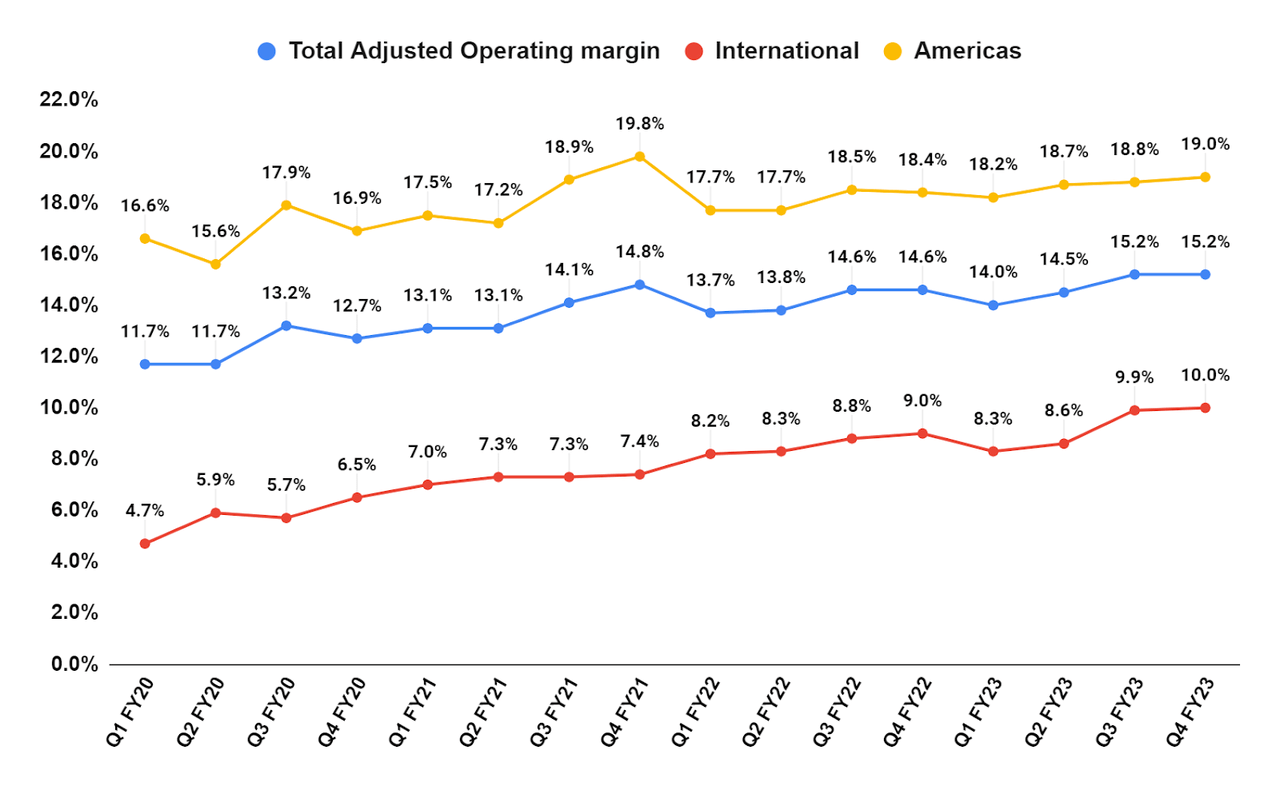

In Q4 2023, the adjusted operating margin on NSR expanded by 60 bps Y/Y to 15.2% driven by the acceleration of the company’s margin expansion initiatives, including the optimization of office real estate and Y/Y increase in organic revenue. Segment Wise, adjusted operating margin (NSR) increased 60 bps Y/Y and 100 bps Y/Y in the Americas and International segments, respectively.

ACM’s Segment Wise Adjusted Operating margin (Company Data, GS Analytics Research)

Looking forward, the company’s margin outlook remains solid. The increase in end-market demand is helping the company win projects at higher margins and as this high-margin backlog gets converted to revenue it should lift the overall company’s margins. The company is also focusing on rationalizing its real-estate footprint over the next few years which should benefit its margin in the medium term. After a good 60 bps improvement in FY23, management has guided for another 90 bps increase in the segment adjusted operating margin to 15.6% in FY24 driven by these factors. The company has given a target to reach ~17% segment adjusted operating margin by FY27, but given the recent improvement, it looks like it should be able to achieve the target before that. Management is planning to give more details about its margin improvement opportunity during its upcoming investor day and I believe there is a possibility of positive revision in long-term margin expansion targets.

Valuation and Conclusion

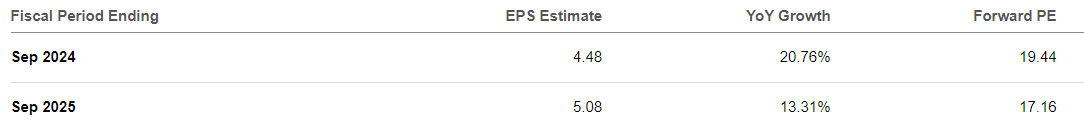

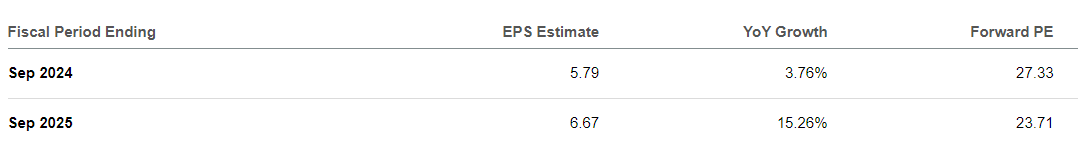

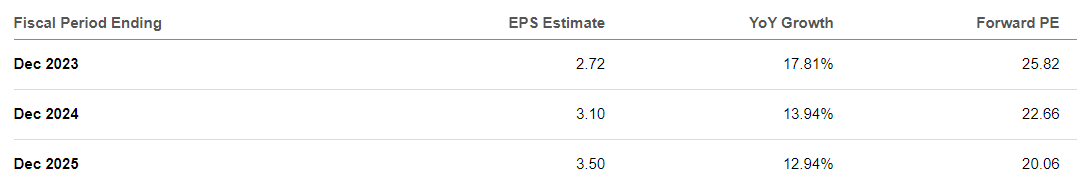

AECOM is currently trading at a 19.44x FY24 consensus EPS estimate of $4.48 and a 17.16x FY25 consensus EPS estimate of $5.08. Compared to its peers Tetra Tech and Stantec which are trading between 20x to 30x P/E on forward earnings, the stock is trading at a discount despite similar or better growth prospects.

ACM P/E based on consensus estimates (Seeking Alpha) TTEK P/E based on consensus estimates (Seeking Alpha) STN P/E based on consensus estimates (Seeking Alpha)

I like the company’s strong near-term as well as long-term growth prospects benefiting from solid backlog levels, favorable end-market demand, federal infrastructure investments, good exposure to megatrends like sustainability and energy transition, high-margin projects in backlog, and real estate footprint rationalization. The company’s strong growth prospects coupled with an attractive valuation make me positive about the stock and hence, I continue to maintain a buy rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.