Summary:

- Despite the recessionary pressures, the company’s revenue growth should benefit from the infrastructure funding environment across the globe.

- The orders from the U.S. IIJA funding are expected to start flowing in FY23 and beyond.

- I believe the stock can continue its outperformance.

JHVEPhoto

Investment Thesis

AECOM’s (NYSE:ACM) stock has outperformed the S&P 500 (SPY) since our previous article, gaining over 12%, and we expect this outperformance to continue. In the near term, the company’s revenue should benefit from its strong order backlog across the Americas and International segments. Despite the recessionary pressures, ACM’s end markets remain strong with the ongoing infrastructure funding environment across the world. In the U.S., the IIJA (Infrastructure Investment and Jobs Act) funding is expected to start benefiting the company’s order book in FY23 and beyond. The company is focusing on high-value orders and is restructuring its business to improve its margins. The stock is trading at 19.88x FY23 (ending September) consensus EPS estimates, and we believe it can continue to outperform.

ACM Q3 FY22 Earnings

AECOM recently reported mixed financial results for Q3 FY22, with lower than expected sales and better than expected earnings. The net sales in the quarter were down 5% Y/Y at $3.24 bn (vs. the consensus estimate of $3.49 bn). The EPS was up 18% Y/Y to $0.86 (vs. the consensus estimate of $0.82). Net Service Revenue (NSR), which is a better parameter to understand the company’s growth compared to net sales growth, grew 6% organically due to the growth in the Americas and International segments. The adjusted operating margin in the quarter improved 50 bps Y/Y to 14.5% due to the strong execution and high-quality backlog. The margin improvement and the lower share count compared to Q3 FY21 benefited the adjusted EPS in Q3 FY22.

Good Revenue Growth Prospects

AECOM’s backlog in the design business, which accounts for 90% of the Net Service Revenue and profit, increased 10% Y/Y in Q3 FY22. The Think and Act Globally strategy, which prioritizes innovation, investing in people, and extending client relationships, has led to a record strong win rate, backlog, and pipeline of opportunities.

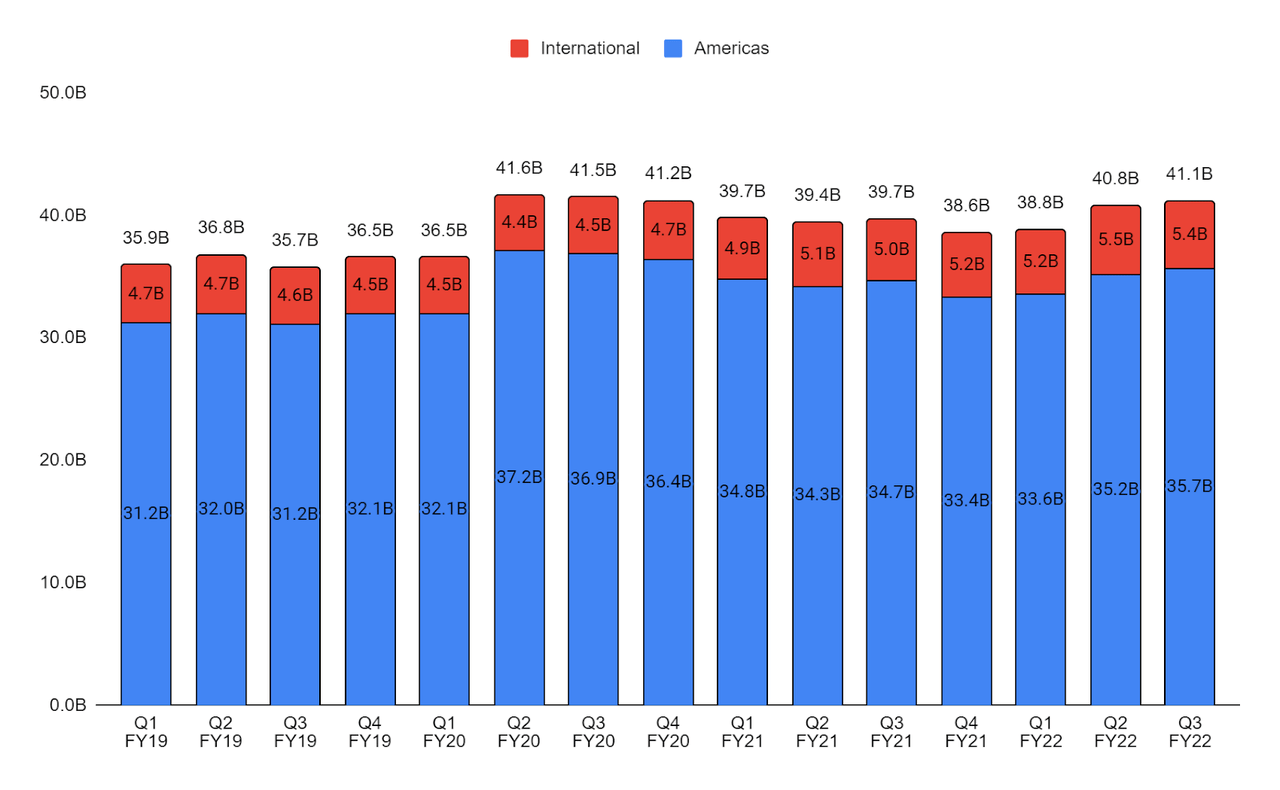

The total backlog of the company was $41.1 bn at the end of the quarter. The book-to-burn ratio was 1.2x, led by a 1.5x book-to-burn ratio in the Americas segment. The contracted backlog, which is a leading indicator of the company’s future growth, grew 15% Y/Y to $22 bn. The contracted backlog in the Americas segment grew 19% Y/Y to $17.9 bn whereas it grew 3% Y/Y in the International segment. The awarded backlog in the International segment grew by double digits Y/Y due to the wins in Europe, the Middle East, and Australia. Other than the contracted backlog, the order pipeline also indicates the future trajectory of the business. The order pipeline has been increasing by mid-single digits over the last three quarters. Some parts of this pipeline are moving towards the later stages, and the company is experiencing a significant increase in the projects that it is expected to bid on in the near future. The combination of a strong contracted backlog and an order pipeline should drive the company’s growth in the near term. The company is forecasting 6% NSR growth on a constant currency basis in FY22 which looks easily achievable.

ACM’s order backlog (Company data, GS Analytics Research)

The markets in which ACM operated remained strong despite the recessionary pressures. The global investment renaissance, investments in the environment, sustainability and resilience, and adaptation to a post-COVID new normal are secular trends that are creating opportunities over the next few years for the company. The funding from IIJA is expected to start benefiting the company from FY23 and beyond. The identified opportunities from this funding have increased by 40%, and the bid submissions are expected to accelerate in the coming months. The company recently won a project to design a PFAS treatment system for the city of Madison, Wisconsin. ACM plans to design this project as per the IIJA requirements to better position itself for future project wins related to the IIJA funding. The company’s proprietary IIJA digital tool, developed especially for its clients to position themselves for the funding, is helping ACM to engage with its clients earlier.

The strength in federal spending is coming at a good time, with ACM’s state and local clients, which represent 23% of the NSR, being also in a strong position. Record high budgets at all levels create a good backdrop for predictable market growth for the company against the broader market volatility.

In the International market, the company should benefit from the infrastructure investments in the U.K. and large multi-year program management and design contracts in the Middle East, which we discussed in our previous article. The company should also benefit from the $120 bn in transport infrastructure under the Infrastructure Investment Program in Australia. While the company is facing headwinds in Mainland China due to the uncertainties related to COVID, I believe the situation should eventually return to normal. The company is also investing in digital tools to take advantage of the infrastructure funding environment and better position itself amongst its peers. The company’s order backlog and pipeline should benefit from the infrastructure investments across the world in the medium to long term.

One of the good things about AECOM is that its end market strength is expected to continue despite a recession, and it should feel much less pinch compared to many other companies. Talking about the company’s resilient characteristics, its CEO Troy Rudd made the following comment on the last earnings call,

… So again, first of all, say that when there is a recession, everybody’s impacted by the recession. But I would describe us as not being as impacted as others and for a couple of different reasons. One is I think even within a recession or recessionary trend that we see a lot of funding that is coming into infrastructure and it’s coming in to continue to transform the world in terms of environmental and social improvement.

And frankly, there are some longer-term trends post-COVID. And so even if there is a broad recession, we look at this and say, well, with inside that recession, the things that we do are going to receive funding and funding for the long term. So that bodes well for the long-term health of the business even in a recession.

But then I look at as you described, right, there’s some attributes to the business that put us in a very good position to work our way through that. One is our backlog. We have long, live backlog in the business. We also have an asset-light business, and a business that can be made all agile to react to shorter-term market volatility.

And then the other thing that happens is, again, just sort of being where we are in the number one position in our industry is customers typically coalesce around the number one company in terms of a recession. So the recession usually hits the smaller organizations or in organizations that don’t sort of sit at the top of a particular industry.

And then I’ll just point out that we certainly have had experience with this in the past. But if you go back to 2008, there was a recession, and it was fairly dramatic. The AECOM business at that time was a consulting business, and a design business, and we grew 2009 through 2012. So I think that’s threw a proof point to the resiliency of the business for recession.”

So, I believe the business will do well in the near to medium term despite the recessionary concerns which are on the minds of many investors.

Margins

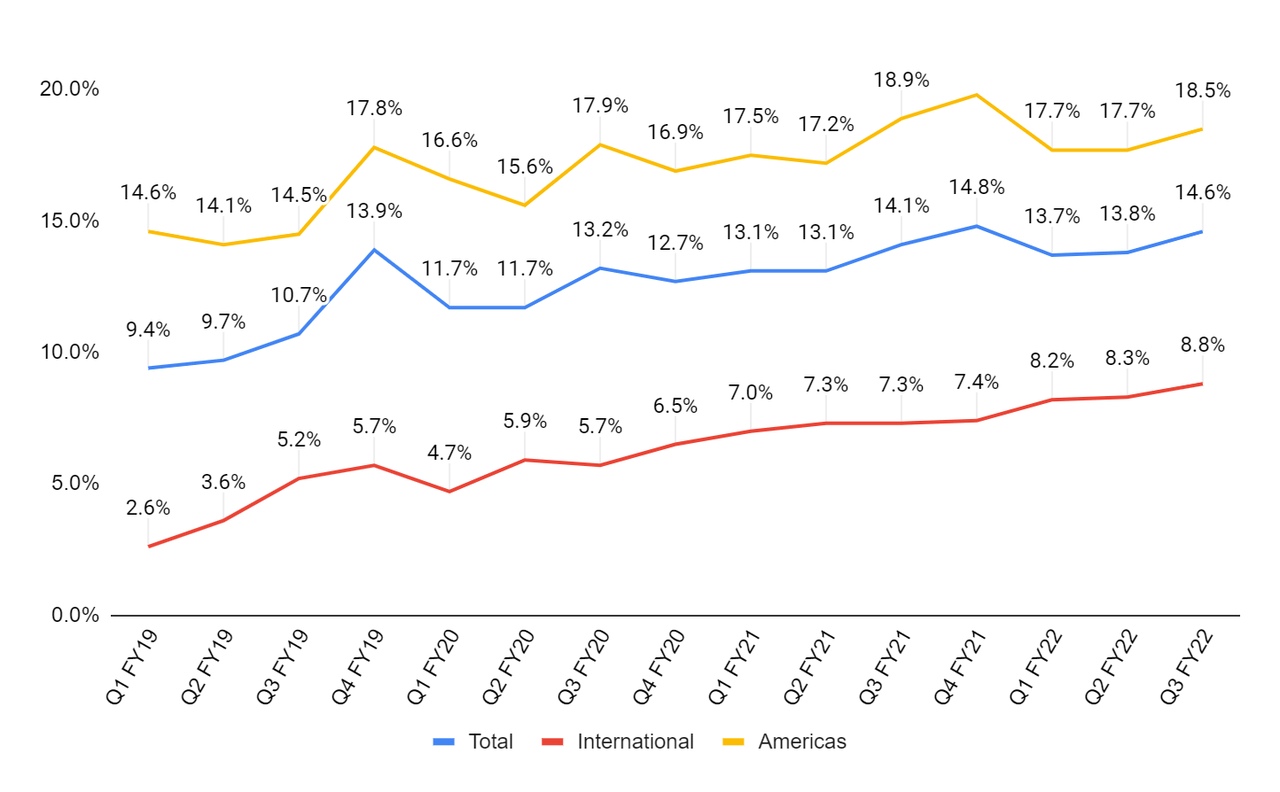

The adjusted operating margin of the company has improved since pre-COVID levels due to an improvement across both segments. In Q3 FY22, the Americas segment adjusted operating margin was down 40 bps Y/Y to 18.5%, whereas in the International segment was up 150 bps Y/Y to 8.8%. The decline in the Americas segment margin was due to NSR growth and the ongoing investment in growth and innovation. The International segment margin improved for eight consecutive quarters and reflects continued progress toward achieving a double-digit margin.

ACM’s adjusted operating margin (Company data, GS Analytics Research)

AECOM is focusing on high-value projects to improve its margins along with restructuring and reorganizing its business. The company has maintained its 14.1% adjusted operating margin target for FY22, over 15% in FY24, and 17% in the long term. I believe this should be achievable as the company has been investing in program management and advisory opportunities and digital initiatives over the past few years.

Valuation & Conclusion

The company’s revenue prospects look strong in the near term and long term as the order backlog remains at record high levels and the infrastructure funding environment across the globe should drive the future order backlog of ACM. The margins of the company should also improve with restructuring activities across the business and high-value projects. The stock is currently trading at ~19.88x FY23 consensus EPS estimate of $3.85. This is a significant discount to its peer Tetra Tech (TTEK) which is trading at ~31.53x FY23 consensus EPS estimates. With the company’s execution improving, I believe AECOM’s P/E multiple will continue to re-rate higher. This coupled with good growth prospects makes it a good buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.