Summary:

- Affimed’s cash and cash equivalents stand at $166.7 million, sufficient to support operations until 2025, but the company faces potential delisting from Nasdaq due to non-compliance with the minimum bid price rule.

- The company’s clinical trials, including the Phase 2 study of AFM13 and AB-101 NK cells and the AFM24 monotherapy data at ASCO, are crucial to its success and should be closely monitored by investors.

- Despite the innovative potential of Affimed’s research, investors should adopt a cautious approach due to the company’s financial health, Nasdaq non-compliance risk, and uncertainty of trial outcomes.

Laurence Dutton/iStock via Getty Images

Introduction

Affimed (NASDAQ:AFMD) is a clinical-stage biotech company specializing in immuno-oncology. Using its proprietary ROCK platform, Affimed creates unique innate cell engager [ICE] molecules to combat various hematologic and solid cancers. The company, headquartered in Heidelberg, Germany with offices in New York, is a leading developer of clinical-stage ICE.

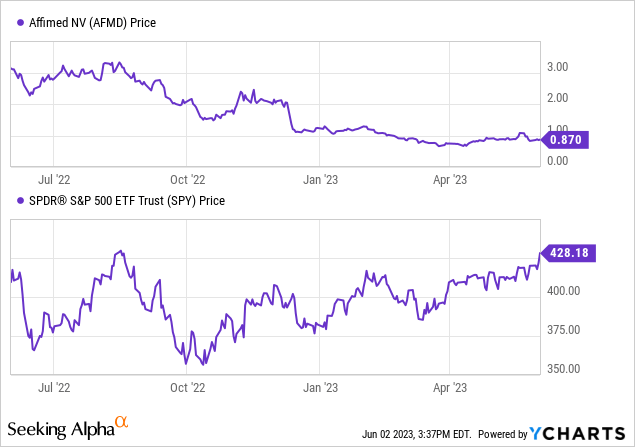

In my previous examination of Affimed, I observed their strategic transition from monotherapy to a more complex combination therapy in treating peripheral T-cell lymphoma, specifically to enhance AFM13’s success rate. This approach, though promising, involves strenuous clinical trials and regulatory approvals. I perceived the success of AFM13 and AB-101 NK cells against Adcetris and chemotherapy as uncertain. Considering the limited resources and the necessity to bring AFM13 to market readiness, I acknowledged investor wariness. It was estimated that Affimed might lean towards dilutive capital raising and debt, with an expected annual expenditure of $75 million. Following my “Sell” suggestion in February, Affimed’s shares have declined by 12%, while the S&P has appreciated by 5%.

Q1 2023 Financials

Let’s first review Affimed’s most recent financial report. As of March 31, 2023, the company’s cash and cash equivalents were $166.7 million, down from $203.7 million at the end of 2022, yet sufficient to support operations until 2025. Operating activities in Q1 2023 used $35.5 million, an increase from Q1 2022’s $30.3 million. Revenue for Q1 2023 was $4.8 million, a decrease from $8.6 million in Q1 2022, primarily from Genentech and Roivant collaborations. Research and development expenses rose by 60.7% to $31.6 million due to costs associated with the AFM13 and AFM24 programs. General and administrative expenses slightly reduced to $7.4 million. The shift in net finance costs from a gain of $0.54 million to a cost of the same amount was due to US dollar foreign exchange rate fluctuations. Net loss for Q1 2023 was $34.2 million, or $0.22 loss per share, an increase from Q1 2022’s $17.9 million or $0.15 loss per share. Note: The preceding values have been converted from EUR to USD.

Per Seeking Alpha, Affimed has a market capitalization of $127.48 million, total debt amounting to $18.14 million, and cash reserves of $169.05 million. Consequently, the enterprise value, considering these factors, stands at a negative $23.68 million.

Affimed at Risk of Delisting from Nasdaq

Affimed, with its current trading price at $0.88 per share, faces the risk of non-compliance with the Nasdaq’s minimum bid price rule. This rule mandates that companies maintain a minimum closing bid price of $1 per share. Affimed has been notified by Nasdaq due to this breach of regulation.

Nevertheless, Affimed has a 180-day grace period, ending on October 2, to regain compliance. To achieve this, Affimed’s closing price must exceed $1.00/share for ten consecutive business days. One of the potential measures Affimed could consider is conducting a reverse stock split to help meet the compliance. It’s a technique where a company decreases the number of its outstanding shares to increase the share price. However, a reverse stock split comes with its own risks, like decreased stock liquidity and negative market perception.

If Affimed is unable to meet the minimum bid price requirement within this grace period, it may be confronted with potential delisting from the Nasdaq exchange. Delisting bears significant implications, such as diminished liquidity and curtailed access to capital. These outcomes are particularly consequential for a biotech firm like Affimed, where capital is vital for ongoing research and development. Thus, regaining compliance is a matter of utmost priority for the company and should be treated with the gravity it deserves.

Q1 2023 Earnings Call Review

During Affimed’s recent earnings call, the management team enlightened shareholders on the current progress of their clinical trials. Their enthusiasm was palpable as they announced their anticipation of FDA clearance for a Phase 2 study involving AFM13 and Artiva’s AB-101 NK cells. This optimism is fueled by promising data from preliminary studies, boosting confidence in the potential of the AFM13/AB-101 combination to echo these positive outcomes while also satisfying important commercial demands. Their new trial, charmingly christened ‘LuminICE-203,’ will prioritize safety and effectiveness as it scrutinizes varying dosage patterns across diverse patient groups. The wheels of progress are set to roll in Q3 2023, and by 2024, we could be privy to safety data, an important milestone.

In another update, Affimed revealed its plans to debut initial data from two expansion cohorts of the AFM24 monotherapy study at the upcoming ASCO meeting. This revelation will involve preliminary findings from cohorts of patients with EGFR mutant non-small cell lung cancer and colorectal cancer. The ASCO meeting will also serve as the venue for the release of updated data from these groups, leading to an engaging financial community call to dissect the findings and plot the future course for AFM24. Their pursuit of innovation doesn’t stop there – Affimed is actively working on an AFM24-atezolizumab combination study, with results anticipated towards the end of 2023. Moreover, they’re investigating the possible benefits of coupling AFM24 with SNK01, NKGen Biotech’s ex vivo expanded and activated autologous NK cell product. We can look forward to results from this exciting endeavor around the same period. Lastly, Affimed provided a snapshot of the AFM28 Phase 1 study, which targets CD123 positive myeloid malignancies patients, and confirmed that they’re energetically recruiting for the second dosage cohort.

My Analysis & Recommendation

In assessing the current situation, it’s apparent that Affimed navigates a complex landscape fraught with both risks and opportunities. The looming issue of non-compliance with Nasdaq’s minimum bid price rule presents a significant challenge, but it’s vital to recognize the strength of Affimed’s scientific foundation and the potential of its pipeline projects. Affimed’s management of this predicament will offer valuable insights into its strategic capabilities and adaptability.

Achieving Nasdaq compliance before the October deadline will require a significant uptick in Affimed’s share price. It’s worth noting that positive updates from their clinical trials, especially the AFM13 and AB-101 NK cells Phase 2 study and the AFM24 monotherapy data at ASCO, could naturally drive up the company’s share price, alleviating the non-compliance issue.

As potential investors, you must remain cognizant of Affimed’s position. The company’s fate is closely tied to the successful progression of its clinical trials. Keep a vigilant eye on updates from their various studies and monitor the company’s cash burn rate, as well as any capital raising efforts, as these factors will significantly influence Affimed’s financial stability. Affimed’s operating expenses are certainly substantial and despite having a cash runway that stretches into 2025, the company’s current low market valuation presents a considerable challenge. Should they need to raise significant capital from the market at this point, it may lead to substantial dilution for the existing shareholders, a scenario which needs careful consideration.

Investment in biotech entities like Affimed always carries a degree of risk, but also a possibility for significant gains, reflecting the innovative underpinnings of its research, embodied in its unique ICE molecules and the ROCK platform. Given favorable outcomes from the clinical trials, there exists a considerable growth potential for the stock. However, due to the company’s financial status, the Nasdaq non-compliance risk, and the inherent uncertainty of trial outcomes, it’s advised to exercise caution and maintain a “Sell” stance at present. Investors may wish to await more definitive results from Affimed’s clinical trials and the company regaining Nasdaq compliance before contemplating substantial investments.

Risks to Thesis

When the facts change, I change my mind.

There are several key risks to my “sell” recommendation for Affimed.

-

Positive Clinical Trials Results: If the results of the company’s clinical trials come out positive, this could significantly boost investor confidence and increase the demand for its shares.

-

Successful Capital Raising: Should Affimed be successful in its capital-raising endeavors, this could potentially increase the financial stability of the company, making it a more attractive investment. Additionally, if these capital raising efforts are non-dilutive (such as partnerships, licensing agreements or non-dilutive grants), the upward pressure on the stock price could be significant.

-

Regaining Nasdaq Compliance: If Affimed is able to regain compliance with Nasdaq’s minimum bid price rule within the 180-day grace period, the threat of delisting will be removed. This would potentially enhance investor sentiment and could stimulate demand for the company’s shares, leading to an increase in its stock price.

-

Positive Regulatory Approvals: The company’s shift to combination therapy for AFM13 may lead to successful regulatory approvals. This could act as a catalyst for the company’s shares to appreciate, thus invalidating the sell recommendation.

-

New Partnerships or Collaborations: New partnerships or collaborations could also lead to an increase in the share price. For example, if Affimed enters into a strategic collaboration with a major pharmaceutical company, this could increase investor confidence and stimulate demand for its shares.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content only and should not be construed as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. Any predictions made in this article regarding clinical, regulatory, and market outcomes are the author's opinions and are based on probabilities, not certainties. While the information provided aims to be factual, errors may occur, and readers should verify the information for themselves. Investing in biotech is highly volatile, risky, and speculative, so readers should conduct their own research and consider their financial situation before making any investment decisions. The author cannot be held responsible for any financial losses resulting from reliance on the information presented in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.