Summary:

- Today, we will briefly review the Affirm Holdings, Inc. thesis.

- I use the world briefly because I find the thesis as simple and as compelling as ever, and there’s just not much that needs to be said.

- I have already delineated the thesis for Affirm in painstaking detail in past work, and that thesis remains as intact today as ever.

- We just have a few impediments presently that are hamstringing the business’ true potential. We will consider those impediments together today.

Bennett Raglin

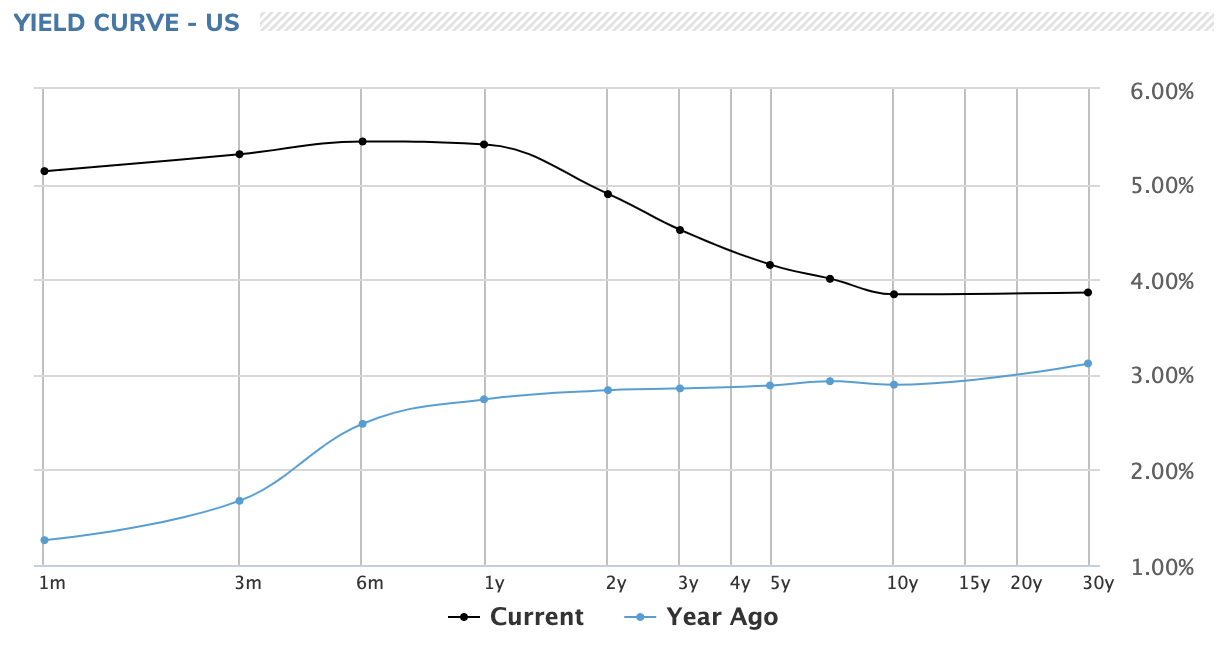

- With a substantial liquidity position of ~$2.9B, alongside ~$1B in 0% coupon convertible debt (due Nov. of 2026), we’re exceptionally well capitalized and well positioned to materially accelerate growth as the Fed ceases its fairly aggressive financial suppression activities, as communicated through the incredibly inverted yield curve. We will explore these ideas and more today.

- In short, I have never seen the Affirm Holdings, Inc. (NASDAQ:AFRM) thesis with greater clarity than I see it today. Nothing has changed since our original work on the business. It is still the highly differentiated, vertically integrated, data-preserving payments network that we originally bought that sits atop a giant net liquidity position.

- Eventually, the Fed will stop its aggressive operations that serve to suppress financial activity in the U.S. economy and globally; the yield curve will un-invert and Affirm will once again resume the hypergrowth to which it was accustomed prior to 2022.

- Affirm CEO Max Levchin is only 47 years old. His grandmother studied physics in the USSR (implying he’s genetically predisposed to having a quantitative mind). He wanted to study cryptography in the 1990s, but, instead, built PayPal (PYPL) as one of its lead engineers (The Founders, the book, details these realities). I believe Mr. Levchin, like Mr. Green of The Trade Desk (TTD) or Mr. Musk of Tesla (TSLA), is arguably the leading mind in FinTech, which is a position we’ve always held, and I believe he has the capacity to evolve Affirm beyond what most can appreciate today. We’ve always believed these ideas; notwithstanding the fastest repricing of credit in the history of America, I maintain that these ideas are the case today.

Without further ado, let’s concisely review the Affirm thesis via mostly charts.

Clear As Day

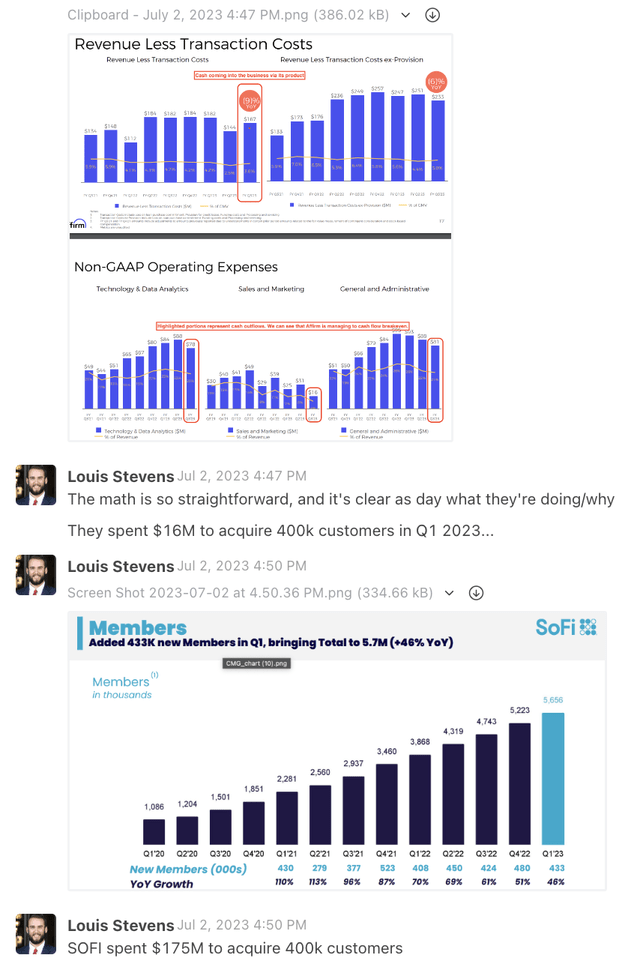

Below, we can see Affirm’s “gross profit generation,” i.e., revenue less transaction costs. Please feel free to review the footnotes should you want further granularity in understanding this number.

That said, it’s straightforward: it is the gross profit Affirm receives from its core set of products (e.g., point of sale lending, Affirm Card, Returnly, PayBright, etc.).

This is the money Affirm has to “play with.” It is the money its product generates for it with which it can spend on Research & Development or Sales and Marketing or Corporate Overhead.

I would invite you to study the charts below, and I will follow up with you on the other side.

Affirm Q1 2023 Earnings Presentation

Let’s now turn to an interpretation of the above data.

In this chart, we can see that Affirm is managing the core business to about free cash flow breakeven.

Operating expenses on a GAAP basis are distorted due to commercial agreements with AMZN/SHOP, and the recognition of the warrants as expenses. It appears AFRM is losing much more money than it actually is.

This is PLTR from its direct listing to today (where BTM, as of the day of direct listing, stated that fully diluted share count was 2.2B and we’d see exceptional dilution from the DL listing share count of 1.8B). Astoundingly, despite knowing this, the market still lamented it for years.

[Likewise, somewhat astoundingly, the market continues to state that Affirm is “losing more and more money,” but it just isn’t the case. It’s recognizing the dilution that we knew was coming, just as has been the case for our ownership of Palantir (PLTR) since late 2020.]

We’ve known that AFRM’s (gargantuan) cash balance has been stable, and the above metrics add more granularity to this.

[Affirm, as of today, $2.9B in total cash, equivalents, restricted cash, and “loans held for sale” (issued using cash on the balance sheet; not forward flow or warehouse); ~$1B in 0% coupon convertible debt due Nov. 2026. We’re incredibly, incredible well-capitalized at this juncture. We just need the yield curve to un-invert, and we will resume hypergrowth. More on this in a bit.]

It’s also very important to note that AFRM has effectively stopped spending on S&M, yet it added 400k new users in its most recent Q!

It can do this because it has strategically achieved massive distribution via AMZN, WMT, SHOP, POSH, TGT, etc., where AFRM gets paid to acquire users. We explored this here:

Further, AFRM spends about $80M on R&D, which is massive. It has fashioned itself as a technology company through and through, and it’s able to do this while still growing users due to the aforementioned distribution. It’s really quite brilliant.

But, if everything is so brilliantly fashioned, why are we struggling? Because the next step down from the hand of God (U.S. Fed) is actively suppressing financial activity in the U.S. via “the fastest repricing of credit in the history of the United States.”

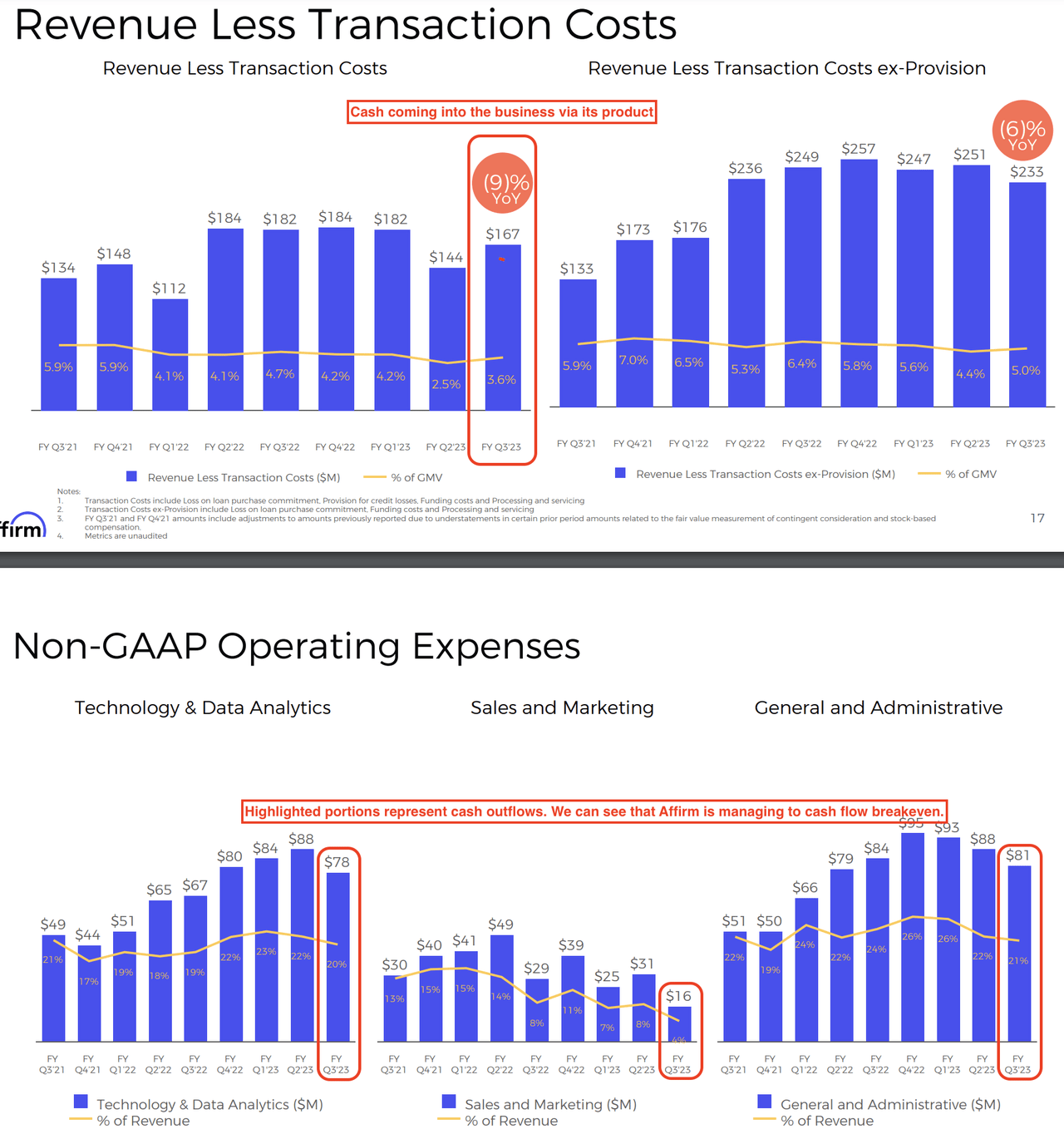

Coming back to the $16M in S&M spend that translated into 400k new customers, which is truly amazing, we can see this unique facet of Affirm’s business model via the comparison below:

Affirm Spent $16M To Acquire ~400k Customers In Q1 2023; Whereas, Sofi (which is a great business to be sure) Spent $175M To Acquire ~400k Customers In Q1 2023

This clearly demonstrates that Affirm has built a highly unique distribution system (and business model broadly), in which it often gets paid to acquire customers (suggesting it often has a negative CAC, which just doesn’t happen in the business world very often.).

Again, I believe it’s really quite brilliant, and it’s always been a key component of our thesis for Affirm.

So, if Affirm has this gargantuan cash hoard, brilliant business model, healthy unit economics, genius (by virtue of decades of experience) founder, why then has it struggled?

Let’s explore some data to answer this question.

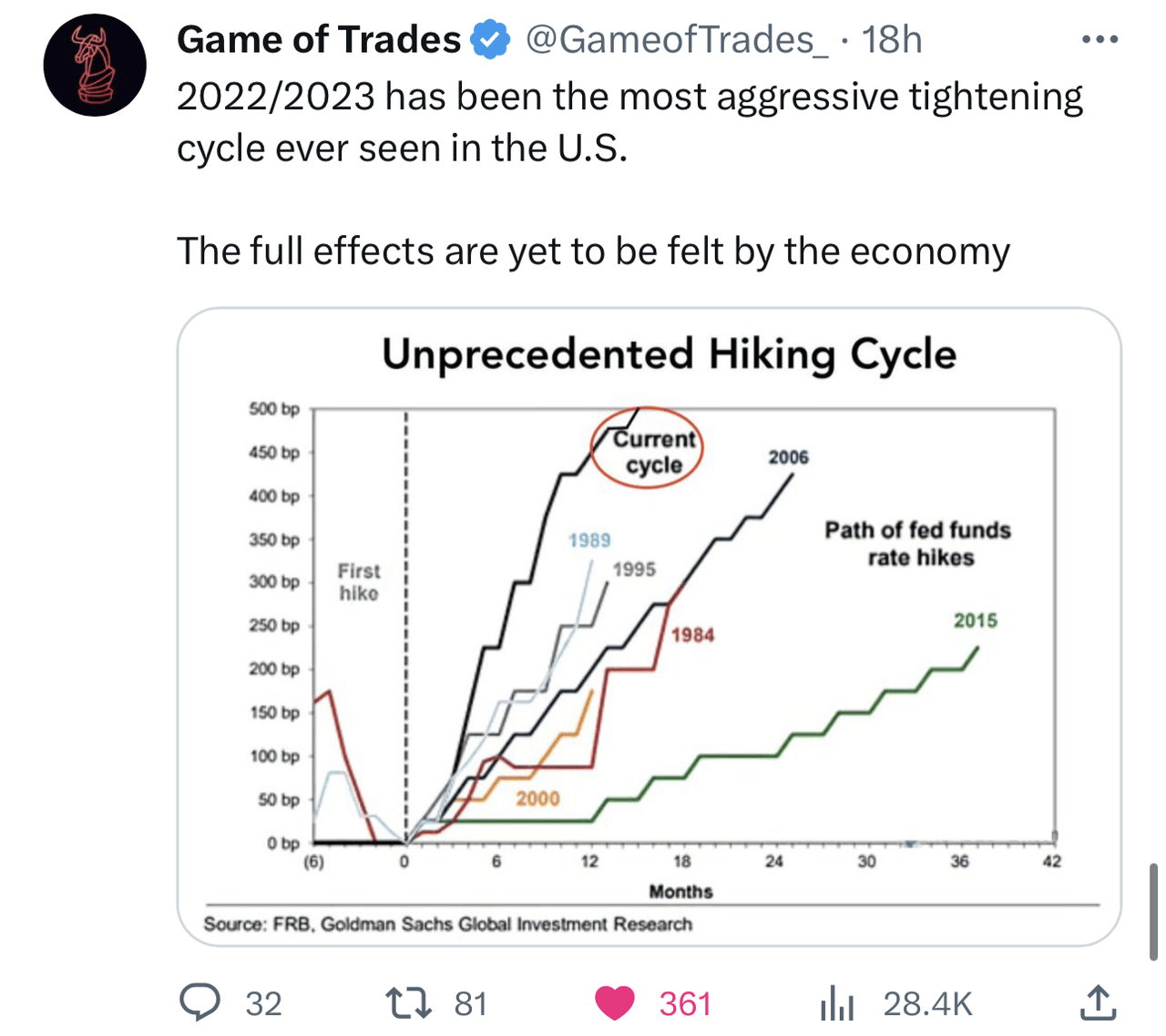

The U.S. Central Bank Is Actively Suppressing Financial Actively; The Pace Of This Suppression Is Unprecedented

Below, we can see that we have experienced the fastest repricing of credit in American history:

Game of Trades Twitter

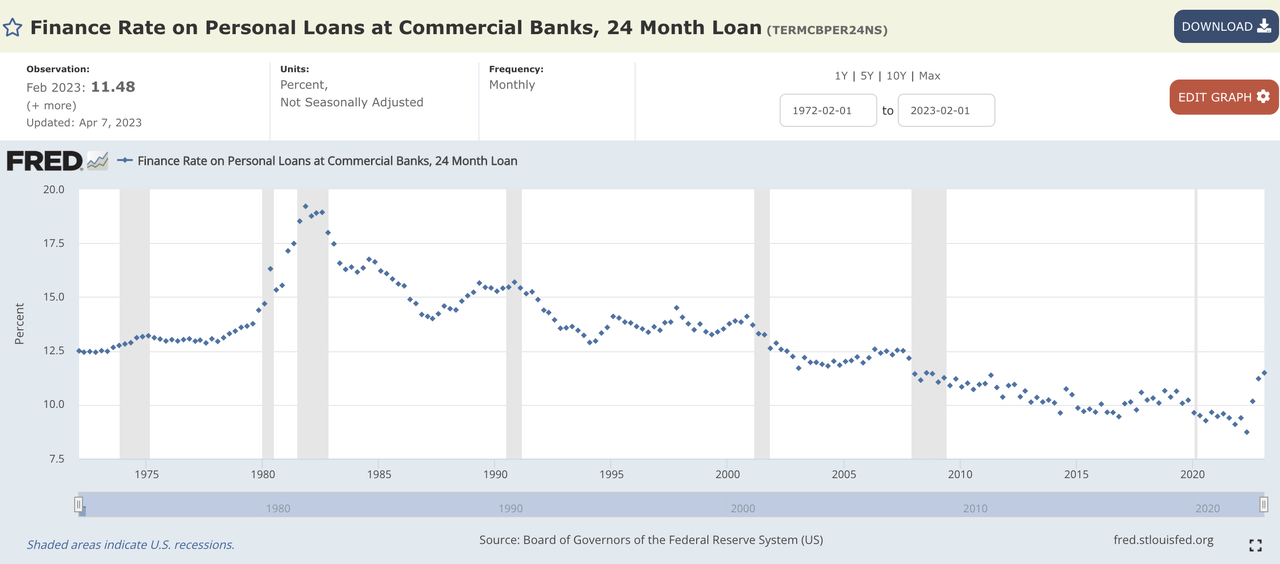

And this has made consumer and auto lending wickedly expensive relative to the last 5-10 years.

FRED

To be sure, it’s not that Affirm needs 0% rates; not at all. But when we ask, “Why isn’t Affirm experience hypergrowth as it should in light of its massive distribution of its product?” This data answers that question.

The rate of increase has created very challenging year over year sales “comps”; however, we will eventually lap these comps, and growth will return to elevated levels.

If we get a decline in rates, then this will doubly be the case.

We can see this unprecedented act of financial suppression by the Fed (U.S. central bank) via the yield curve inversion, which portends recessionary conditions begotten by tighter credit (note that we may need to rumble through a recession before things get much better for Affirm and all businesses which have been experiencing decelerating growth as of late).

The Yield Curve Is Extremely Inverted Presently

MarketWatch

Affirm’s credit products are specifically priced based on the shorter end of the curve (the lefthand side). Eventually, in the next 12-24 months, the shorter end will fall to roughly where it was (the blue line), and Affirm’s growth and profitability will improve.

An Illustrative Exchange

Yesterday, community member Waterman101 shared this tweet with me:

Interestingly, each and every one of Waterman’s statements were matters of indisputable data; yet, the gentleman stated that he “didn’t believe” they were true… Which is odd when we’re talking about hardcore, stone-cold data that we can all review for ourselves.

For instance, we already covered “minimal S&M” early today.

We’ve already delineated the idea of “negative CAC” in painstaking detail in this note and in “The Betas Are Booming.”

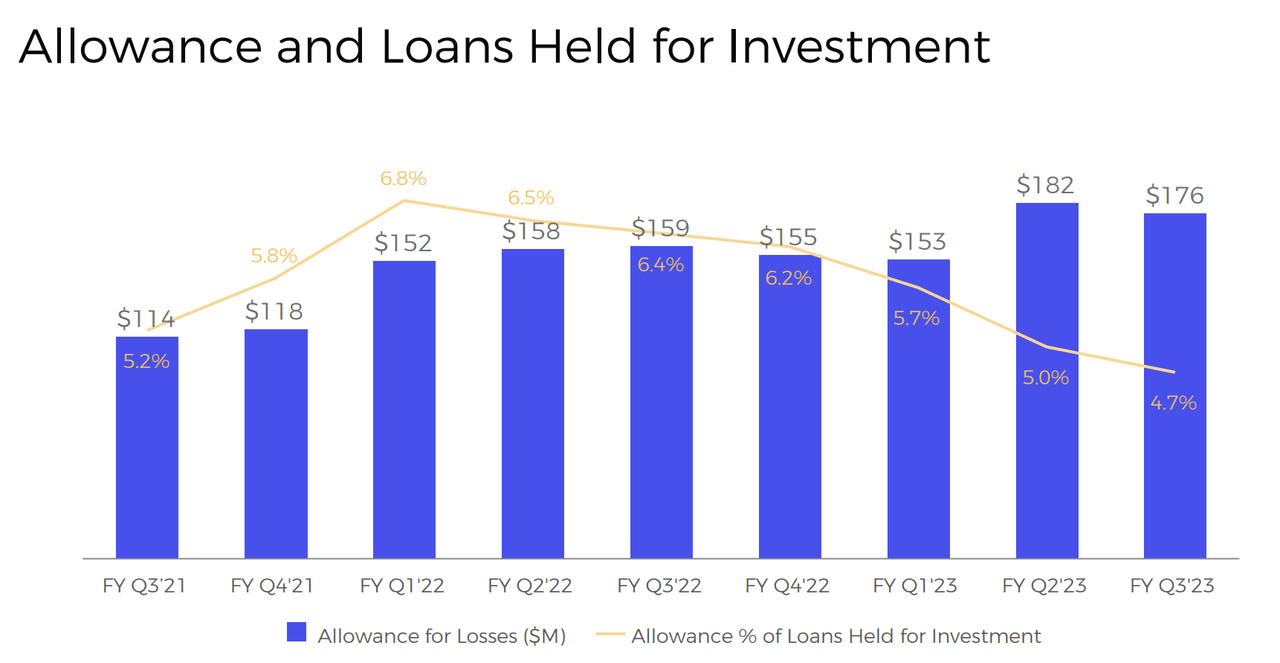

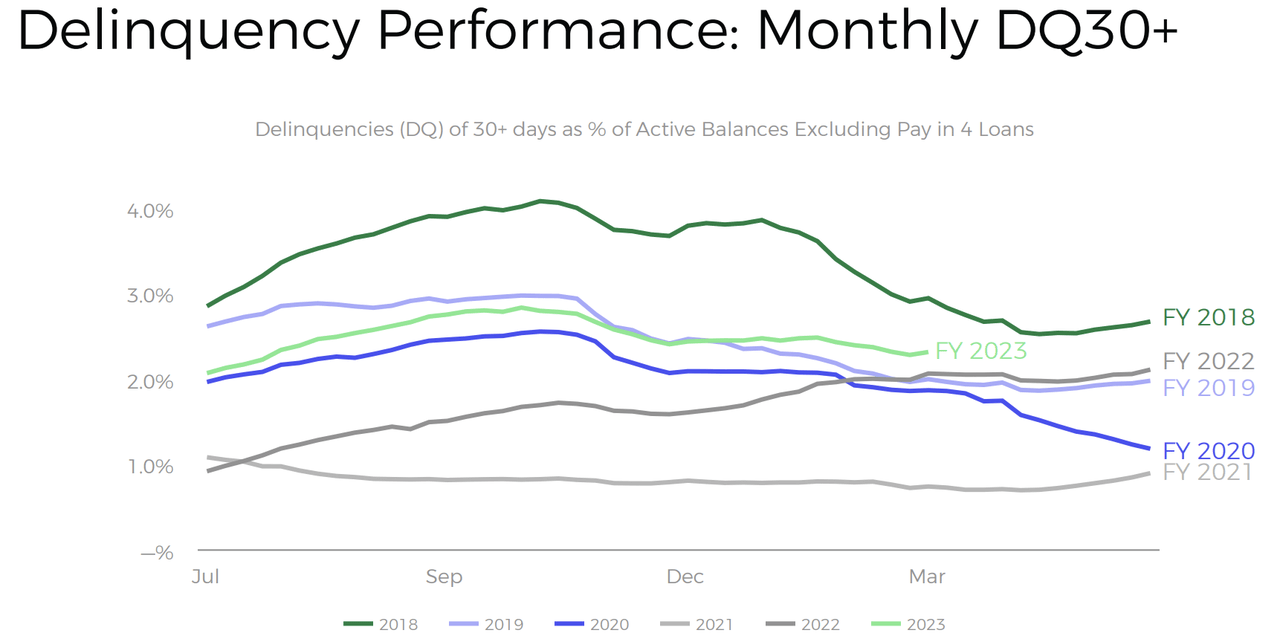

Below, we can see Affirm’s credit metrics, which are better than peers such as COF or Synchrony:

Affirm Q1 2023 Earnings Presentation Affirm Q1 2023 Earnings Presentation

Broadly speaking, Affirm’s credit metrics are extremely healthy.

Waterman101 shared the tweet with me to illustrate how misunderstood and almost, curiously, despised Affirm is. Meanwhile, interestingly, it’s arguably the best thing to ever have happened to consumers who use credit!

Concluding Thoughts

In summary:

- Affirm’s business model is as attractive as ever, and the SoFi comparison alongside our brief financial analysis substantiates as much.

- Affirm has a truly gargantuan cash hoard of ~$2.9B, alongside about $1B in 0% coupon convertible debt due in November of 2026 (a long time out).

- Affirm has robustly positive unit economics, with which it can reinvest in the business.

- Affirm faces hurdles related to the fastest repricing of credit in American history, as seen in the inverted yield curve, but this will abate, and the yield curve will un-invert eventually.

- Atop Affirm’s attractive business model, gargantuan cash hoard, and a normalized yield curve, the business will once again resume hypergrowth.

- Atop all of this, Affirm will continue to evolve as a platform and business in the years and decades ahead, shepherded by the young Founder-CEO who has decades of experience in FinTech, having built PayPal.

I have never felt better about the Affirm thesis, and that is simply a data-based assertion.

Could it be going better? Sure… But Affirm has seen around every corner (for instance, it had massive committed funding heading into this period).

We could not ask for more from the Affirm team. At $15/share, I think Affirm, over the next 10-20 years, will prove to be a fairly easy 10-20 bagger.

I think Affirm Holdings, Inc. will evolve materially beyond what it currently is, and it will have the latitude to do so via the above-delineated, robust foundation.

As always, thank you for allowing Beating The Market to serve you in building your business of owning businesses!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM, TSLA, PLTR, TTD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.