Summary:

- In my estimation, Affirm recently had its best quarter ever.

- The company delivered on a series of promises, including making Affirm Card generally available in 2023 and achieving positive adjusted operating income (ultimately, free cash flow).

- While the fastest interest rate hiking cycle in American history has served to compress margins, Affirm has navigated this cycle masterfully. They have seen around each and every corner.

- That said, objectively, relentlessly rising rates have compressed margins, and, should rates continue to rise, margins could compress further.

- Eventually, this rate hiking cycle will come to an end, and Affirm is brilliantly positioned, with $2.9B liquidity (again $1B in convertible debt), distribution of its unique credit product at 65% of U.S. ecommerce, and a rapidly scaling, differentiated financial product in the Affirm Card, which represents a rare, genuine innovation in finance.

Kevin Dietsch/Getty Images News

Our Best Quarter Yet

On Saturday, I reached out to a friend and shared,

Affirm’s best Q ever, no?

Still no competition for Affirm Card, and rewards will likely be very unique also as it won’t simply be a cut of MDR (merchant discount rate) nor simply one time cash back rewards like traditional debit… somewhere uniquely in the middle.

[Note that there’s nuance to my contention that there’s no competition. For instance, if we look at “attention TAM,” there’s quite literally infinite competition for Facebook (Old Blue, the app). If we look at “social media TAM,” there’s likewise lots of competition. But, if we look at “the app that is best suited for engaging with family, friends, and extended relatives,” Facebook has no competition. Perhaps, Instagram is competition to some degree, but it is not perfectly a competitor to Facebook. In these senses, there’s no competition for Facebook, and the same logic could be applied to Affirm Card, as I will demonstrate (by way of an explanation of the nature of the Affirm card) for you later today.]

As is my standard operating procedure, when the report was released, I examined it to independently assess its quality (ignoring the funds playing the quarters after hours and the corresponding price action); whereupon, I remarked,

Stellar report.

We’ve not had a bad report yet really.

Just getting bludgeoned endlessly by macro. Still going to be a 10 bagger on other side of bludgeoning.

Did we generate free cash flow?

We did!

Brilliant report across the board.

I then shared metrics related to the aforementioned Affirm Card.

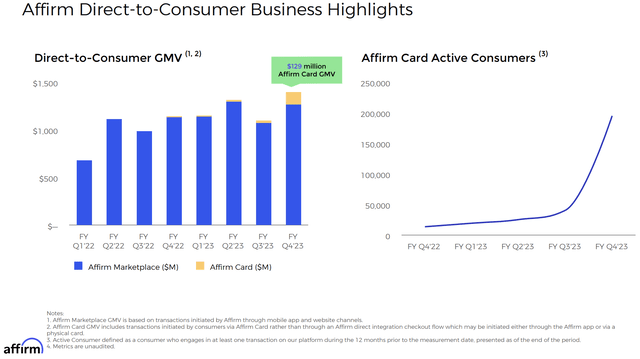

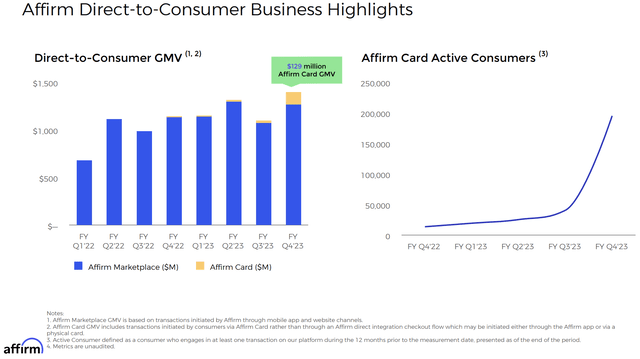

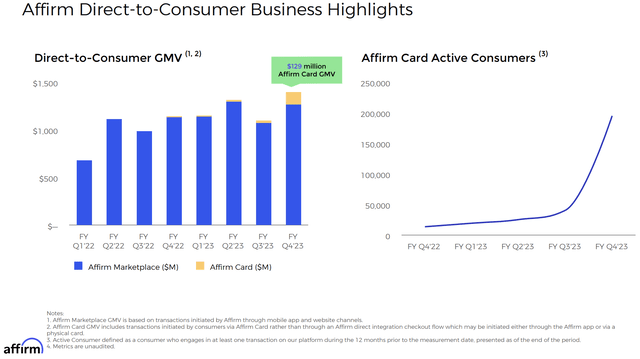

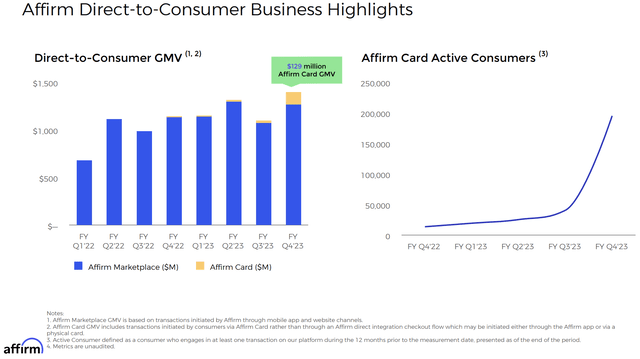

Affirm Card Experiences Hockey Stick Growth And Massively Grows GMV Sequentially

Q2 2023 Affirm Investor Presentation

Following Roku’s (ROKU) Q1 2023 earnings report, in response to which the market traded its shares down once again, I shared that, for the first time, I experienced a visceral sense that the gravity, or balance of power, in the TV OS industry shifted towards Roku noticeably.

[Of course, this is my pseudo-science perception after having tracked the Roku thesis since roughly ’18-’19.]

Following Affirm’s (NASDAQ:AFRM) recent report, I experienced the same sensation, and, today, we will examine the data that underpinned this sensation.

But, before we do that, let’s begin today by examining the importance of the growth of the Affirm Card. To do this, we will leverage one of my foundational investment frameworks to better understand the nature of Affirm and the significance of the Affirm Card.

[we as in you and me together, as a team]

Foundational Investment Frameworks

I recently edited and modified my articulation of our foundational investment frameworks slightly, so 1) I don’t feel too bad repeating these ideas (I’ve been sharing them routinely lately), and 2) I do think these ideas bear repeating ad nauseam as they are foundational to each investment I’ve made and will make in the future.

- Vertically integrated product capturing market share in stagnant mature industry: We target businesses that have created a vertically integrated product, within a fragmented, low NPS, and mature industry, whereby that vertically integrated product offers 10x better value; thereby, it captures significant market share rapidly. [As an example, monday.com’s platform has become more and more vertically integrated, as it’s added MondayCRM, MondayDev (for developers), and its app marketplace products in addition to its core work management product, all of which sit atop Monday’s proprietary, open, and configurable architecture. It’s a true, vertically integrated work operating system, which, with the creation of MondayDB, is more scalable than ever, the evidence of which can be seen in the company’s enterprise customer growth.]

- Businesses that will execute a leveraged recapitalization in the coming years or are extremely disciplined with capital allocation via routine, robust share repurchase programs: These are often fairly simple businesses that have fielded one or two products, which possess defensible moats that defend their stable cash flows as they gradually expand over a multi-decade period. The stable cash flows are not employed in the purchase of value accretive acquisitions; instead, they are channeled into capital return programs for shareholders, such as “free cash flow per share-accelerating share repurchase programs.” Notably, the capital return programs act as disciplinary forces that ensure management operates as efficiently as possible and does not engage in empire building [Examples here include Chipotle (Chipotle Mexican Grill, Inc. (CMG) Stock Price Today, Quote & News), Meta (Meta Platforms, Inc. (META) Stock Price Today, Quote & News), and, in the past, Google or Apple.]

- Quality cultures that breed innovation within the larger conglomerate: In some sense, this framework is the foundational framework of all America’s and earth’s most notable franchises, e.g., Tesla, Apple, Amazon, and Microsoft. This framework encapsulates a company’s ability to launch, or propagate, new successful line of business after new successful line of business, creating a nucleus of explosive, compounding sales and free cash flow growth. This framework is the idea that a business creates a culture in which its employees create new products, provide these products to the marketplace, and these products ultimately find product-market-fit. Upon finding product-market-fit, the product begins its climb on its S-Curve, which will vary in size and value for each product. With multiple products growing rapidly simultaneously, the business overall grows more rapidly and, importantly, more durably. Some of my favorite examples that fit within this framework are Axon (Axon Enterprise, Inc. (AXON) Stock Price Today, Quote & News), Monday (monday.com Ltd. (MNDY) Stock Price Today, Quote & News), Adyen (Adyen N.V. (OTCPK:ADYEY) Stock Price Today, Quote & News), Sea (Sea Limited (SE) Stock Price Today, Quote & News), Tesla (Tesla, Inc. (TSLA) Stock Price Today, Quote & News), Amazon (Amazon.com, Inc. (AMZN) Stock Price Today, Quote & News), and MercadoLibre (MercadoLibre, Inc. (MELI) Stock Price Today, Quote & News). Indeed, many of our businesses possess this incredible cultural structure, and that is why we’ve chosen to provide coverage of these companies.

- Growth through quality, moat-building acquisitions: Lastly, we will briefly explore the capital allocator framework by way of an exploration of Meta’s (Meta Platforms, Inc. (META) Stock Price Today, Quote & News) business. In this investment framework, a very large business materializes through prudent and judicious uses of shareholder capital via acquiring quality businesses and growing them over time within the larger conglomerate. Meta has acquired Instagram and WhatsApp, both of which have solidified its global monopoly. Microsoft has also made employed this framework masterfully, and, of course, the CPG companies, such as Unilever or Proctor & Gamble, have been quintessential examples of this framework, creating pricing power in low barrier to entry industries through industry consolidation.

Affirm Card Begins Its Ascent On Its S-Curve (The Top Of The S Forms When Adoption Levels Out/The Product Matures In Its Industry)

Q2 2023 Affirm Investor Presentation

I hope that, as you read through the frameworks, you organically chose the one that would best fit Affirm.

In my view, in light of the hockey stick growth Affirm Card has experienced, the third framework would be most befitting.

In a recent note, I shared that Affirm would likely evolve substantially in the decade ahead, releasing products possibly beyond what we can imagine today.

I believe Mr. Levchin, like Mr. Green of The Trade Desk (The Trade Desk, Inc. (TTD) Stock Price Today, Quote & News) or Mr. Musk of Tesla (Tesla, Inc. (TSLA) Stock Price Today, Quote & News), is arguably the leading mind in FinTech, which is a position we’ve always held, and I believe he has the capacity to evolve Affirm beyond what most can appreciate today. We’ve always believed these ideas; notwithstanding the fastest repricing of credit in the history of America, I maintain that these ideas are the case today.

With the recent Affirm Card data, I believe we have greater tangible data with which this assertion can be substantiated.

Having been founded only about a decade ago, Affirm has brought to market:

- Its Adaptive Checkout product (which indexes all of the information between merchant, product manufacturer, consumer, and payments infrastructure and leverages that data to produce a tailored credit product that satisfies the interests of all aforementioned interested parties) (And which Amazon, Walmart, Target, Shopify, and countless other merchants have adopted),

- Its Shopping App, which includes a 4%+ savings account. (1.3M reviews with average rating of 4.9 stars on Apple App Store),

- And, as of today, Affirm Card, which is a genuine innovation that is unprecedented. I will explain precisely what I mean by this in a moment (I have been discussing it for years now, but we only now have the data underpinning the realities I’ve been communicating through what has been a tough macroeconomic environment).

In this vein, we could add Affirm the list of companies that fit within the aforementioned third foundational investment framework:

The “giants of the future” will necessarily be those that successfully layer on new business after new business, akin to:

Sea’s (Sea Limited (SE) Stock Price Today, Quote & News) Garena -> Shopee -> Sea Logistics -> SeaMoney -> Future products

Or Adyen’s (Adyen N.V. (OTCPK:ADYEY) Stock Price Today, Quote & News) ecom API -> point of sale API -> unified commerce API -> issuing platform -> Future products

Or Tesla’s (Tesla, Inc. (TSLA) Stock Price Today, Quote & News) EV -> FSD -> Tesla Energy -> Optimus robot? Data centers? Who knows?!

[And that’s the key element here. When NVDA was down 90% in 2002, nobody foresaw what it would create in the mid 2010s. Well, some did, including Jensen who has been saying NVDA would be a $1T company for a long time now.]

Monday’s (monday.com Ltd. (MNDY) Stock Price Today, Quote & News) project management -> CRM -> Dev -> app marketplace -> proprietary underlying infrastructure -> Future products

Axon’s (Axon Enterprise, Inc. (AXON) Stock Price Today, Quote & News) taser -> body came -> fleet cam -> Sign In – Axon [saas] -> justice -> Future Products

MercadoLibre’s 1P -> 3P marketplace -> payments -> logistics and shipping -> acquiring platform -> credito -> Future Products

And, of course, Amazon’s (Amazon.com, Inc. (AMZN) Stock Price Today, Quote & News) 1P -> 3P marketplace -> Prime -> AWS -> shipping and logistics -> ads -> Future Products

The really, really big businesses of tomorrow will surprise everyone… Well, they won’t surprise BTM because we’re studying the evolutionary process of how they’re created very intimately, but my point is that the products that create these businesses are yet to really hit the hockey stick portion of their S curves

I think Meta (Meta Platforms, Inc. (META) Stock Price Today, Quote & News) does $300B to $500B in sales one day by virtue of this evolutionary process. META’s Facebook -> Messenger -> Marketplace -> Instagram -> Reels -> WhatsApp -> WhatsApp for Business -> Oculus -> LLMs and AI infrastructure -> Future Products

Affirm’s Adaptive Checkout -> Affirm Shopping App + Savings Account -> Affirm Card, which is genuinely an unprecedented financial product

Likely not done yet!

And, indeed, Affirm, at just 10 years old, is likely just getting started in its evolutionary process.

As others have remarked, we likely cannot fully appreciate what Affirm will look like in 2030. With both Adaptive Checkout and Affirm Card gliding upward on their S-Curves, Affirm is very likely not done building new and innovative products for earth. And these future new and innovative products will add to Affirm’s sustained elevated growth rate, which it will likely experience in the decade ahead, especially once rates stop rising at the fastest pace in American history.

Understanding Affirm Card

Formerly known as Debit+, the Affirm Card is, like Affirm’s original no fee, simple interest credit product which has been distributed through Adaptive Checkout, unprecedented (please feel free to engage with me about this contention in the comments section. I understand it is controversial).

Here’s a short vignette that details the nature of the product:

There is nothing else like the card in consumer finance.

It is both a debit and credit card simultaneously.

Here’s an example of the product in the real world:

You are at Walmart, and you want to buy a $800 baby crib, and you’d actually like to use credit.

You swipe the card at checkout, and leave the store.

You then receive a notification on your phone that asks you if you’d like to split the purchase over a variety of different timeframes.

Notably, the cost of credit here is usually lower than revolving on a line of credit from COF and, importantly, there’s simple interest and no hidden fees (COF uses compounding interest, higher rates, and will snipe you with hidden fees from time to time).

You select from a menu the timeframe on which you’d like to amortize the $800 purchase, and retroactively the purchase is divided into, for instance, 12 installments over a year.

Again, there is no threat of hidden fees of any kind, and Affirm uses simple interest, which no credit card uses.

Or, if you just want to use Debit, you can use debit and charge that $800 to your account by simply doing nothing after paying at point of sale in Walmart.

This unique combination of credit and debit will open a new version of rewards, which Affirm will release in the coming year(s).

It’s a genuinely new innovation in finance. It’s quite fascinating.

I, with the help of my former FinTech analyst Jared Simons, have granularly detailed the unique nature of this financial product since 2021, and I personally have used the product as my daily driver payments card since May of 2022 (when I first received the product).

When I first received the product, I could only retroactively split purchases into four installments over eight weeks. It was very much a “beta program” product.

Today, I can split them based on a menu of amortization schedules Affirm presents to me following my purchase. From eight weeks to twelve months, I can retroactively split my larger purchases in a variety of unique ways, and only Affirm Card offers this feature with simple interest and no hidden fees (including late fees or capitalizing interest expense) of any kind.

Notably, I usually receive APR offers on these installments that are dramatically lower than the APR that Affirm’s nearest legacy peer offers, making the use of Affirm’s credit far more attractive than that of Capital One (COF).

In the year or so ahead, Affirm will likely rollout its unique rewards program, which, like the Affirm Card, will likely be unprecedented in its configuration. I am genuinely excited for this rollout. As I shared earlier,

Still no competition for Affirm Card, and rewards will likely be very unique also as it won’t simply be a cut of MDR (merchant discount rate) nor simply one time cash back rewards like traditional debit… somewhere uniquely in the middle.

And, of course, this unprecedented rewards engine will be built atop the cloud-native Marqeta (MQ) platform, and, like Affirm, I believe Marqeta will prove to be a fairly easy 10 bagger in the decade ahead (a 20 bagger is well within the realm of possibilities as well).

MQ remains quite attractive to me.

Visa/Coatue bought in at $2B in 2019.

MQ has 7-8x’d its business since that time.

It currently trades at $1.5B in enterprise value.

$1.4B cash; no debt; robust healthy unit economics.

Affirm just revealed that it is experiencing something akin to a Square Card Moment, and this unique, unprecedented financial product (Affirm Card) is powered by MQ.

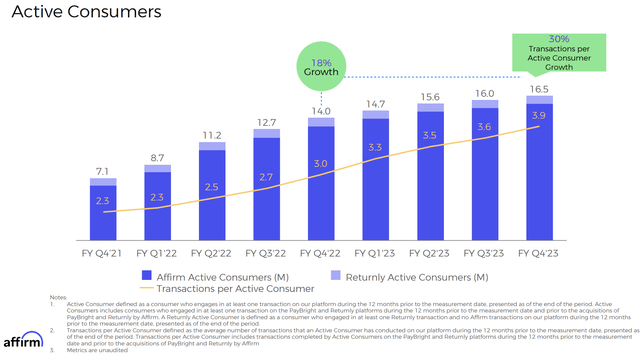

Affirm added 150k card users in its most recent Q, and this may scale into the millions in the years ahead.

Again, MQ powers this product.

I believe MQ could be a 10-20 bagger next 10-15 years from these levels.

Affirm Card Scales Parabolically In Calendar Year Q2 2023

Q2 2023 Affirm Investor Presentation

With lower cost of credit, no junk fees, no late fees, and simple interest, alongside the ability to simply debit, coupled with a unique rewards program powered by Marqeta, I believe the Affirm card, as I’ve believed since 2021, will continue to experience parabolic growth in the years ahead, scaling into the millions and tens of millions of active users over time.

The attractiveness of the Affirm Card is compounded by the attractiveness of the overall Affirm business model.

In some sense, the Affirm Card as a product would not be nearly as attractive without the foundational innovation of Adaptive Checkout, used by Amazon, Walmart, Target, and 65% of all of U.S. ecommerce, which affords Affirm that ability to acquire customers, oftentimes, at a negative CAC [customer acquisition cost]. Let’s explore this together in the next section.

A Brilliant Business Model Atop A Giant Net Liquidity Position

As I shared earlier, I published a note to the main Seeking Alpha site entitled:

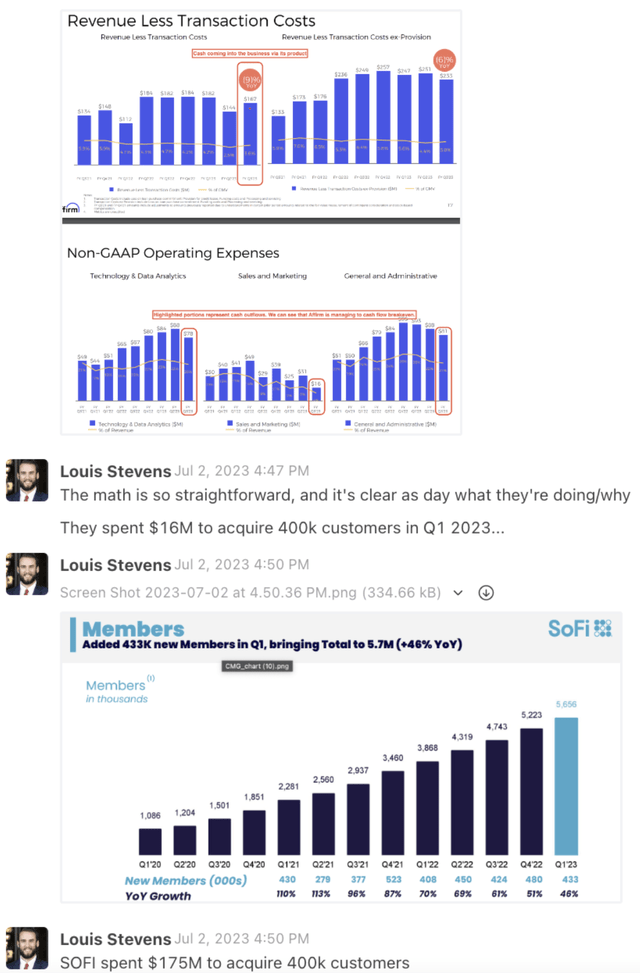

In that note, I highlighted that Affirm paid only $16M to acquire 400K+ customers in calendar year Q1 2023; whereas, SoFi (SOFI), which I believe has a very strong position in student loan refinancing and is broadly a fantastic business (though its issuing/processing platform has spent the last handful of years trying to catch up to Marqeta’s cloud-native leadership in the space), spent a ~$175M to acquire the same number of customers.

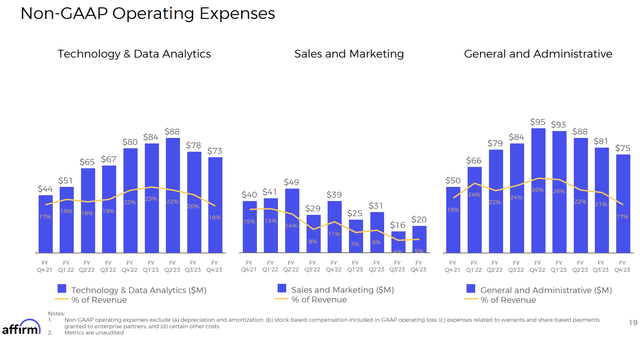

Affirm’s CAC

In calendar year Q2 2023, Affirm acquired 500K active consumers for just $20M.

So Affirm acquired nearly 1M active consumers in two quarters while spending just $36M in sales & marketing. Stunning.

Affirm can do this because of its unique business model:

At present, Affirm’s core offering is its Adaptive Checkout platform used by earth’s largest merchants such as Walmart.

As I’ve discussed often recently, Adaptive Checkout indexes the large volume of information between merchant, consumer, product manufacturer, and payments infrastructure (i.e., Visa or Stripe) and creates tailored credit products for consumers on merchant’s product pages (in the same way Google indexes information and creates search results). By indexing this information and creating a tailored credit product that ultimately serves to convert the consumer at point of sale for the merchant (leading to higher AOV and higher conversions for the Affirm partner merchant), Affirm provides a service to the merchant, which the merchant pays for via what’s called an MDR, or merchant discount rate (a small % of the total order value).

After the consumer checkouts using Affirm at the merchant’s point of sale, the consumer must then manage their loan with Affirm. The consumer does so by downloading the Affirm app and connecting their bank account.

In this process, Affirm acquires a new user without any marketing. And not only did it acquire a new user without marketing, Affirm was actually paid by the merchant, via the MDR, to acquire the user, thereby creating a negative CAC.

Incredible.

This is what has allowed Affirm to acquire nearly 1M customers for just $36M in marketing spend, and Affirm is just getting started in this regard.

Once the user downloads the Affirm app and begins serving their installment loan, Affirm then presents the Affirm card to that user, which, as we’ve explored, is a genuinely unique financial product.

With Affirm card now GA (generally available), Affirm locks consumers into its ecosystem and dramatically increases its LTV/(often negative CAC).

Affirm Acquired Nearly 1M Consumers Based $36M On Marketing Spend

Q2 2023 Affirm Investor Presentation

Illustrating $36M In Marketing Spend Last Two Quarters

Q2 2023 Affirm Investor Presentation

And, as we’ve seen in charts presented earlier in this note, the business model is working.

Both active Affirm Card users and Affirm Card GMV have begun scaling parabolically in Affirm’s most recent quarter.

Affirm Card Scales Parabolically In Calendar Year Q2 2023

Q2 2023 Affirm Investor Presentation

I and Jared forecasted this quarter about eight quarters ago, though, of course, we were a bit early, and, as they say, “Being early and right is indistinguishable from being wrong.”

I think it’s noteworthy that Affirm Card GMV scaled to the degree that it did in fiscal year Q4.

Between Affirm’s brilliant business model and Affirm Card’s differentiated, unprecedented nature, it’s likely that the pace of this GMV scaling will continue in the quarters and years ahead.

Thank you for reading and have a great day.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thanks for sharing this great piece of content.