Summary:

- Affirm Holdings’ partnership with Amazon Pay is a game changer, offering potential for sales and profit growth as the fintech leverages Amazon Pay’s scale.

- The deal could lead to higher conversions and order values for merchants, creating a win-win situation for all parties involved.

- With improving sentiment and high short interest ratio, Affirm Holdings could be a potential short squeeze target.

witsarut sakorn/iStock via Getty Images

Affirm Holdings, Inc. (NASDAQ:AFRM) announced a partnership with Amazon in recent weeks which means the company’s core Buy Now, Pay Later (BNPL) product, Adaptive Checkout, is being added to Amazon Pay, opening up a path for strong growth moving forward.

While Affirm Holdings has suffered a brutal valuation decline in the last two years amid higher interest rates and inflation, I think that the company’s partnership with Amazon Pay could give a crucial boost to the embattled BNPL provider and that the risk/reward has drastically improved.

Taking into account that Affirm Holdings is still highly shorted, the fintech could also profit from a potential short squeeze.

Affirm/Amazon Partnership Is A Game Changer

After a string of disappointing quarters, including Affirm Holdings warning of slowing sales growth, the BNPL company finally had some very good news to share.

On June 7, Affirm Holdings announced in a press release that merchants in the United States who currently accept Amazon Pay will now also accept Affirm Holdings’ Adaptive Checkout product.

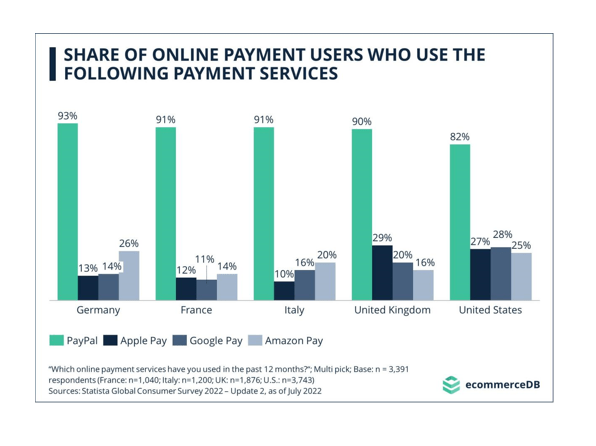

The news is very encouraging because Amazon Pay is Amazon’s own payment processing service, which offers Affirm Holdings BNPL solution unique growth potential. PayPal is still by far the most popular online payment service, but Affirm Holdings large size may help it regain some of its lost sales momentum.

Online Payment Service Providers (ecommerceDB)

Affirm-Amazon Partnership Could Boost Fintech’s Market Share

Affirm Holdings’ Adaptive Checkout was launched in 2021 and offers customers personalized and flexible stretched-out payment options. The fintech has said that merchants who used Adaptive Checkout during a testing period have seen a 20% increase in sales and a 26% increase in conversions.

Last year, the fintech also brought its pay-over-time solution to eCommerce company Big Commerce, a Shopify competitor.

Affirm Holdings also recently expanded its partnership with Stripe to bring its payment options to Canadian users. One key advantage Affirm Holdings has over other BNPL competitors is that the fintech doesn’t charge late fees.

While the Amazon deal is not fixed in terms of deal duration, it provides the fintech with a strong opportunity to catch up to other BNPL competitors.

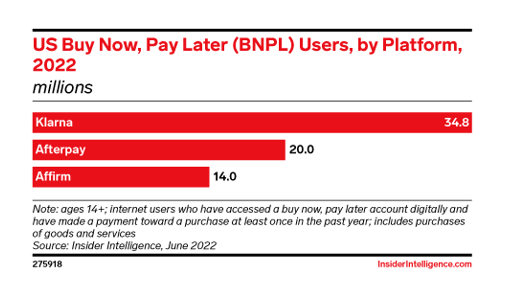

Affirm competes with other BNPL providers such as Afterpay and Klarna, both of which have higher market shares in the industry than Affirm Holdings. With that said, however, by leveraging Amazon’s scale, Affirm Holdings’ partnership deal could translate into market share gains for the fintech which in turn could drive strong sales growth for the company moving forward.

U.S. BNPL Users By Platform (Insiderintelligence.com)

Affirm Holdings Sales Picture Could Be Improving, Valuation Continues To Have Upside

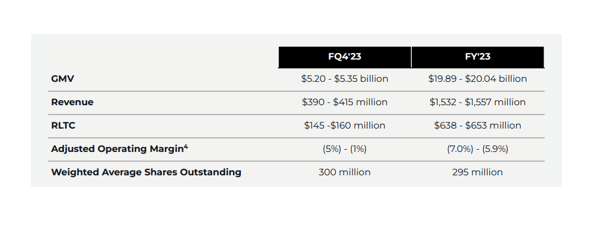

According to Affirm Holdings most recent guidance for the fiscal year 2023 (which ends on June 30, 2023), the BNPL company expects $1,532-$1,557 million in sales but expects to remain unprofitable on an adjusted operating income basis. However, this could change in the coming fiscal year if Affirm Holdings partnership with Amazon begins to impact the fintech’s financial results.

Projected Revenue (Affirm Holdings Inc)

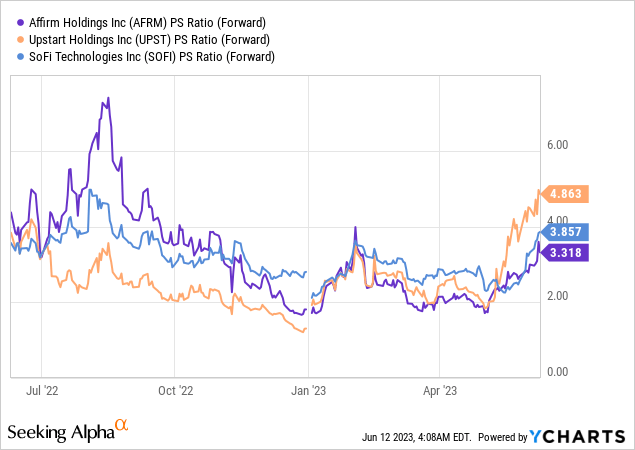

Since Affirm Holdings is not profitable, the fintech can only be valued based on its future sales potential. The fintech is presently valued at a forward P/S ratio of 3.3x while Upstart Holdings (UPST) is valued at a forward P/S ratio of 4.8x. Fintech SoFi Technologies, Inc. (SOFI) has a P/S ratio of 3.8x.

According to current analyst estimates, Affirm Holdings sales prospects will improve next year due to market expectations of lower interest rates and lower inflation. The market is currently forecasting $1.9 billion in sales, representing a 22.7% increase YoY. The Affirm/Amazon deal could fuel this sales growth rebound even further, resulting in even stronger sales growth next year.

Affirm Holdings Has Short Squeeze Potential

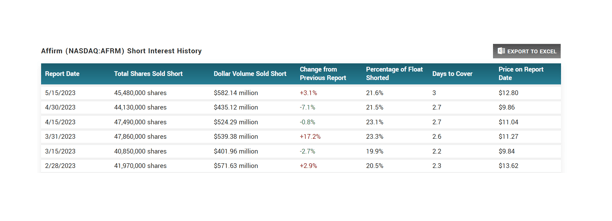

Affirm Holdings is a heavily shorted stock, with a short ratio of 21.6% based on float (data from Marketbeat as of May 15, 2023). New partnership agreements with other large-scale retailers, as well as guidance for positive operating margins next year, could be catalysts for short position unwinding.

Short Interest History (Marketbeat)

Affirm Holdings Must Achieve Profitability Or Face Valuation Headwinds

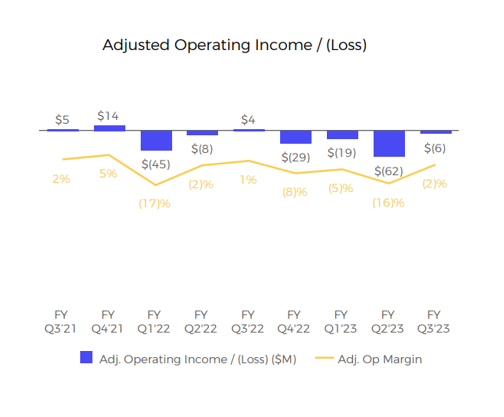

Affirm Holdings is not yet profitable, either under GAAP or under non-GAAP. Having said that, profitability is just around the corner, as the BNPL provider’s operating losses narrowed in the last quarter, and the partnership with Amazon could accelerate the fintech’s race to profitability.

Affirm Holdings is on the verge of reporting positive adjusted operating income, and a partnership agreement with Amazon to offer Affirm’s BNPL product to U.S. customers has the potential to push the BNPL provider over the finish line.

Operating Losses (Affirm Holdings Inc)

Why Affirm Could See A Lower Valuation

Consumers are feeling the effects of high interest rates and high inflation, which has resulted in a number of revisions to Affirm Holding’s sales guidance in recent quarters.

The most recent forecast assumes only a 14% YoY increase in sales, compared to a 55% YoY increase last year. In other words, Affirm is still expected to experience significant growth slowdown this year, and any positive effects from the Affirm/Amazon BNPL deal are likely to be postponed until the fintech’s 2024 fiscal year.

Slowing sales growth, as well as the company’s inability to generate profits, are both issues for Affirm. If the fintech’s losses worsen and/or the Affirm/Amazon deal fails to generate incremental growth for Affirm’s sales, the fintech’s investor expectations may be reset.

My Conclusion

The Affirm/Amazon transaction in the BNPL segment is a game changer for the challenged fintech and should be a catalyst for sales and profit growth as the fintech can leverage Amazon Pay’s scale.

By making BNPL products available to U.S. merchants who accept Amazon Pay, merchants may see higher conversions and order values, creating a win-win situation for all parties involved.

The obvious benefit for Affirm Holdings is that it can leverage Amazon’s large eCommerce footprint and the widespread availability of Amazon Pay, which may result in a strong rebound in the fintech’s sales growth.

With sentiment toward Affirm Holdings improving and the short interest ratio being high, AFRM could be a potential short squeeze target.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AFRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.