Summary:

- AAPL’s exit from the BNPL scene provides massive opportunities for other fintech lenders, such as AFRM and other credit/ debit card providers.

- AAPL users may be more likely to adopt AFRM’s BNPL platform ahead, with it potentially influencing “customer decisions on which cards to spend on, or where to set up credit.”

- With AAPL’s users typically reporting higher incomes, we may see AFRM benefit from the reduced lending risks and delinquency rates, building upon the latter’s risk management thus far.

- Therefore, while the AFRM management “does not expect this partnership to have a material impact in fiscal year 2025,” we believe that this guidance has been overly prudent.

- With AFRM still reporting robust double digit growths and the consensus quietly upgrading their forward estimates, we believe that the stock remains a compelling Buy here.

Maksim Labkouski

We previously covered Affirm (NASDAQ:AFRM) in April 2024, discussing why we had upgraded the stock to a Buy, thanks to the improved margin of safety from the stock’s pullback. This was on top of the fintech’s profitable operating margins and the management’s promising FY2024 guidance.

Combined with the consistently moderating FWD valuations, we believed that the fintech was slowly growing into its growth premium, with FY2025/ FY2025 likely to demonstrate its proof of concept as a prudent and successful BNPL fintech platform.

Since then, AFRM had further retraced by -8.8% underperforming the wider market at +5% over the same time period.

Even so, we are reiterating our Buy rating here, attributed to its renewed growth tailwinds as Apple (AAPL) exits the Buy Now Pay Later [BNPL] market while providing opportunities for other fintech lenders, such as AFRM and other credit/ debit card providers.

With AFRM still reporting robust double digit growths and the consensus quietly upgrading their forward estimates, we believe that the stock remains a compelling Buy here.

AFRM’s High Growth Investment Thesis Remains Tempting

AAPL’s Exit From BNPL

AAPL

AAPL’s WWDC 2024 conference has brought forth new opportunities for BNPL fintechs indeed, AFRM included, since the former has decided to terminate the Apple Pay Later program previously launched in March 2023.

With AAPL directly highlighting AFRM as one of the key partner banks/ lenders in the US moving forward, we believe that the latter’s Gross Merchandise Volume and top/ bottom-lines growth may accelerate from here.

For one, we believe that AAPL users may be more likely to adopt AFRM’s BNPL platform as a result of the deeper partnership in the US, with it potentially influencing “customer decisions on which cards to spend on, or where to set up credit.”

This is especially since the Apple Pay platform has already reported 60.2M users in the US, with it commanding 92% of the US digital wallet market share as of 2024. This is on top of the robust Apple Pay usage for online payments at 38% and at POS at 60%.

Secondly, with 58% of US Millennials using iPhones while boasting higher median salaries of $53.25K, it has been observed that younger consumers are more likely to use alternative forms of credit borrowing.

This trend has been highlighted by PYMNTS with only 42% of Gen Z/ 62% of Millennials using credit cards as opposed to 71% of Gen X/ 74% of Baby Boomers in 2023, and by the eMarketer with 33.6M of US Millennials projected to use BNPL platforms in 2024.

As a result, while the AFRM management “does not expect this partnership to have a material impact on revenue or gross merchandise volume in fiscal year 2025,” we believe that this guidance has been overly prudent. This is since the higher earning base comes with the added benefit of potentially reduced lending risks and delinquency rates.

This will also build upon AFRM’s robust FQ3’24 30+ days delinquency rate of 2.3% (-0.1 points QoQ/ inline YoY), 60+ days of 1.4% (inline QoQ/ YoY), and 90+ days of 0.6% (-0.1 QoQ/ inline YoY), relatively inline compared to FY2019 averages of 2.32%, 1.32%, and 0.62%, respectively.

The management’s competency in managing consumer and portfolio risks has been exemplary indeed, particularly when compared to other major credit card lenders at an average of 2.89% as of May 2024 (-0.68 points MoM/ +0.41 YoY).

AFRM’s FQ3’24 Performance Metrics

Seeking Alpha

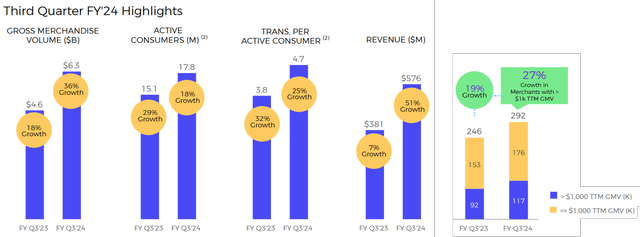

At the same time, the growing AAPL partnership may also deliver the much needed boost to AFRM’s performance metrics as well, since we are starting to see consumer acquisition and transaction per active consumer growth decelerate on a YoY basis in FQ3’24.

Assuming so, we may also see AFRM report accelerated Merchant Adoption growth as well, as more merchants try to appeal to AAPL users’ deep pockets.

AFRM’s Growing Profitability

Seeking Alpha

Combined with the AFRM management’s raised FY2024 revenue guidance of $2.25B at the midpoint (+42.4% YoY), compared to the consensus estimates of $2.24B (+41.7% YoY) and accelerated compared to FY2023 levels of +17.7% YoY, we believe that the fintech remains well positioned to generate robust growth ahead.

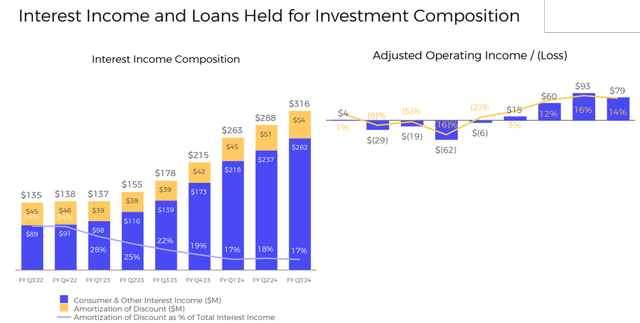

This is on top of the growing adj operating margins of 14% in FQ3’24 (-2 points QoQ/ +20 YoY) and raised FQ4’24 margin guidance of 16% (+2 points QoQ/ +13 YoY) at the midpoint, implying its ability to grow at scale and profitably moving forward.

These feats further underscore why AFRM’s prospects remain highly promising indeed.

So, Is AFRM Stock A Buy, Sell, or Hold?

AFRM 2Y Stock Price

Trading View

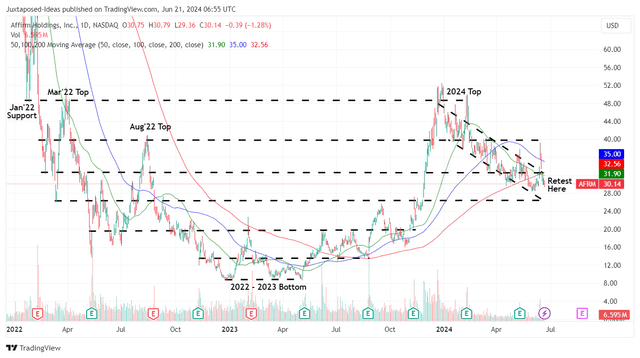

For now, AFRM continues to chart lower lows and lower highs since the 2024 top, with it currently retesting the next support ranges of $28s and $32s.

It is apparent from these developments that bullish support has yet to materialize with it remaining to be seen if the current floor may hold, despite the promising metrics discussed above.

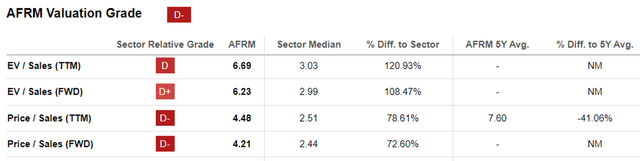

AFRM Valuations

Seeking Alpha

Even so, AFRM continues to be trading rather attractively at FWD Price/ Sales of 4.21x compared to its fintech peers.

The list includes Block (SQ) at 1.55x, PayPal (PYPL) at 1.97x, SOFI (SOFI) at 2.82x, Upstart (UPST) at 3.66x, Mastercard (MA) at 14.97x, and Visa (V) at 15.10x, with AFRM placed right in the middle.

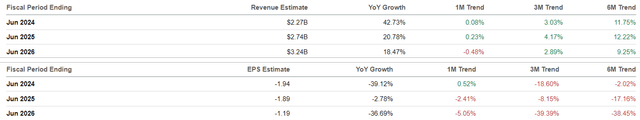

The Consensus Forward Estimates

Seeking Alpha

This is especially since the consensus forward estimates that AFRM may chart an excellent top-line growth at a CAGR of +26.9% through FY2026 (up from previous estimates of +20.3%), compared to SQ at +11.6%, PYPL at +8%, SOFI at +18%, UPST at +16.7%, MA at +12%, and V at +10.2%, implying that the former is reasonably valued for its accelerated growth prospects.

This is on top of the potential upgrade in its top-line estimates due to AAPL’s exit from the BNPL scene, further made attractive by the consistent improvements in the fintech’s positive adj operating incomes over the last twelve months.

Based on the consensus’ FY2026 revenue estimates of $3.24B (expanding at a reasonable CAGR of +26.9%), we believe that the stock is priced very attractively at FY2026 Price/ Sales of 2.93x as well

As a result, we are maintaining our Buy rating for the AFRM stock, though with no specific entry point since it depends on individual investor’s dollar cost average and risk appetite.

Interested investors may consider observing its stock movement for a little longer and adding once a floor has formed.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.