Summary:

- Affirm has an unsustainable business model and high costs, including stock compensation.

- Affirm’s current adjusted operating margin is negative 50%, and even in a bull case scenario, it is hard to see upside.

- Continued losses will erode book value and likely lead to a lower stock price.

Fokusiert/iStock via Getty Images

Introduction

A good starting point for finding short ideas is if a company doesn’t put out an earnings press release, but rather a shareholder letter. I’ll keep my opinion of management teams who do this to myself, but if you haven’t had enough of these, I recommend reading one of Affirm’s (NASDAQ:AFRM) reports.

A question I ask myself before shorting a stock that I think may go to zero is: Will anybody care if this company goes away? Invariably, it’s one that’s not providing a product or service that is valued by its customers at more than the cost to provide it. Or at least valued enough to allow the company to generate a profit.

A year ago, I published an article on WeWork (WE), recommending investors short the stock since the business model didn’t work, and the company was unlikely to ever be profitable. I said that bankruptcy was the most likely outcome, and put a $1 price target in order not to sound mean! In the year since, it is down 97% from $7.50 to $0.20. I believe Affirm will meet the same fate over the next few years, a time-frame that depends on the generosity of debt and equity holders.

In WeWork’s case, I said the company started with office space, and ended with office space with a foosball table thrown in. In other words, not much value-add. Sometimes there are silly business ideas with no economic basis, that get funding during periods of booming capital markets. With Affirm, you have a company that starts with credit, and ends with credit, ostensibly with no late fees. Except that there is a high interest rate (up to 36% a year), making it a weak value proposition. To investors and debt-holders, the company says that it has a superior credit scoring mechanism that allows it to quickly decide who to provide credit to. I believe this is just marketing fluff, as evidenced by the company’s huge losses. To its retail partners, it says that the company helps close sales that otherwise wouldn’t. Possibly true, but the retailer ends up paying a fee, sacrificing margin for an additional sale that could have occurred at a lower price. Affirm doesn’t have a better mouse-trap; it has an expensive one that doesn’t catch any mice.

Company background

Affirm is a digital financial services company that allows people to pay for purchases over a period of time. The company takes on the credit risk that would otherwise be borne by a credit card issuing bank. It offers what could be considered a freemium model: pay in 4 bi-weekly interest fee installments, or pay over a longer time-frame with interest. The selling point for consumers here is that there are no fees like late fees that a credit card company may charge. It is also arguably, easier to use, by splitting the purchase over a specific time-frame, rather than the consumer having to make a decision every month on what amount to pay towards their credit card bill. However, this comes at a cost of people making purchases they may not be able to afford, and paying a high interest rate on the credit they are using. It is also easy for a credit provider like PayPal (PYPL) to replicate.

Affirm was founded in 2012 and is headquartered in San Francisco, CA. It competes with other players in the space like Klarna (a private company) and Afterpay, owned by Block (SQ). The industry is referred to as Buy Now Pay Later or BNPL.

Affirm quarterly financial overview

It is not easy to wade through Affirm’s quarterly reports, separating the wheat from the chaff. The latest one begins “We had an excellent quarter.” If you make it to the income statement on page 21, you’ll see that objectively it was anything but. Revenue of $381 million got a boost from higher interest rates, but was up only 7% YoY. Revenue less transaction costs was $167 million, down 8% YoY. After operating expenses, operating loss was $310 million for a negative 81% operating margin. The share count at 297.2 million shares was up 4% from the prior year. Stock compensation at $106.8 million represented 28% of revenue. I would treat this as a valid and recurring expense that should not be ignored.

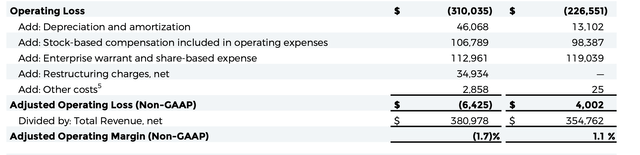

The one item I would give the company credit for is $113 million of warrant expense. This represents the cost of warrants issued to Amazon (AMZN) in order to become a provider on the company’s website. Some of the warrants have a $0.01 exercise price, while another tranche has a $100 strike. I will assume that Amazon will never be able to exercise the latter, while the economic cost of the former is much lower than what is being expensed, since the company’s stock price has fallen. Excluding the warrant expense, the company had an operating loss of $197 million, or a negative 52% operating margin. The company calculates its own adjusted operating loss by adding back depreciation and amortization, stock compensation, warrant expense and restructuring charges to arrive at a close to break-even figure. I would say that this is closer to an adjusted EBITDA figure, and it is certainly aggressive to add back depreciation to calculate a metric that is termed operating income or loss.

AFRM pro-forma add-backs (AFRM earnings report)

Looking at the balance sheet, loans held for investment jumped to $3.8 billion from $2.5 billion nine months ago, indicating the company has either made a decision to hold more on its balance sheet or is having trouble offloading them. The company’s accumulated deficit of losses was $2.4 billion, which is available to shield future profits, if any, from corporate taxes. Stockholders’ equity was $2.5 billion or $8.41 per share. The company reported $585 million in goodwill and intangible assets, so tangible equity would be $1.9 billion or $6.48 per share.

On the cash flow side, the company bought back $207 million of its zero coupon convertible debt at a discount. This was a timely issuance during the pandemic, with a conversion price over $200 per share. The company is benefiting from the losses that the bond buyers are taking due to a rise in interest rates and a fall in the price of AFRM stock.

The company guided to $390 to $415 million in revenue for the coming quarter (up about 11% YoY), at a similar operating loss to this quarter.

AFRM stock valuation and recommendation

Affirm is currently losing 50c on every dollar of revenue. In my opinion, it is stretch for investors to focus on non-GAAP “profitability”, ignoring major cost elements like stock compensation and depreciation. I do not believe there is a path to GAAP profitability here. In my view, it is a business model that does not work and provides little value (in relation to cost) to anybody. I expect the share count to keep increasing, and book value per share to keep decreasing. At some point, debt holders are likely to notice the increased leverage, and may pull the company’s credit or decline to roll it over. At that point, the company will be done, unless it can raise sufficient equity to cover the deficit. I will treat this as the bear case, with the equity being near worthless.

For the base case, I will assume that Affirm can one day get to a 3% GAAP operating margin. A 3% margin on current annual revenue of $1.6 billion would result in normalized annual operating profit of $48 million. In recognition of the company’s huge net operating loss carry-forwards, I will assume that it will never pay taxes. Thus, it would have $48 million in after-tax operating income or $0.16 per share. Companies that provide credit usually trade at low multiples given the ticking time-bomb of defaults if there is a recession. For instance, Synchrony Financial (SYF) trades at 7x EPS and Ally Financial (ALLY) at 8x. However, given Affirm’s higher growth prospects, I will be generous and apply a 25x multiple to arrive at a per share value of $4 for the business. For financial firms, I do not make any further adjustments for cash or debt, as the interest income and expense is already captured in operating income. A $4 share price would be 60% of current tangible book value, but I believe the book value is set to keep declining as the company generates losses, and it will never be able to generate an adequate return on capital. Thus, I believe there is 80% downside from the current $19 share price.

For a bull case, I will assume the company gets to a 10% operating margin. This would result in normalized annual operating profit of $160 million or $0.54 per share. I will apply a 30x multiple to get to a value per share of $16 for the business. So it is hard to get upside even if the company improves its operating margin from -50% to +10%.

I recommend that investors sell any positions in AFRM stock or short it. I see very little fundamental risk in a short position, with huge downside to fair value. I would caution that the short interest is moderately high at 20% of float. The stock is easy to borrow, with a minimal cost. A lower risk option would be to buy puts, at the $15 or $20 strike.

External ratings

Seeking Alpha’s quantitative rating system gives AFRM a composite rating of 3.1, equating to a hold, with a D- for valuation, F for profitability, B for growth, and A- for momentum. Wall Street analysts surprisingly have a similar view, with a hold rating of 3.1. Their price targets have followed the stock down over the last year.

Upside risks are moderate

The main risk for any mid-cap company like Affirm with a $5 billion market cap is acquisition risk. I believe that the losses here are high enough to scare away private equity firms. A financial services firm could look to acquire Affirm if it ignores the poor economics, but I believe the acquirer’s stock will take a big hit and its shareholders will vote down the deal if they have the chance. An acquirer may be able to derive some benefit from the company’s net operating loss carry-forwards, though the realizable value will be limited.

On a fundamental basis, the company could greatly increase its revenue, cut costs and become more profitable than I have forecast.

AI, AI, AI – I’m sure there’s some angle here!

Conclusion

Affirm is not a technology firm with some profitable algorithms. It is a pedestrian provider of credit, and a pretty bad one at that. The company has high costs, generously compensates its employees, and is struggling to grow. Its continued losses are likely to make the stock keep going down over time. Investors who buy now will end up paying a price later!

Pre-emptive disclosure

Writing a short thesis on a stock on a public forum is an invitation for blowback from employees and holders of the stock. I welcome respectful comments from eponymous readers. If you are a holder or employee, you would be better off directing your energies towards having your company become profitable.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.