Summary:

- AFRM has finally reported positive FCF generation, thanks to the higher interest rate environment, increased APRs from its processed loans, and expanding GMV.

- The fintech also boasts highly sticky offerings, with the number of transactions per Active Consumer still growing and 90% comprising repeat consumers.

- Despite the eye-watering APRs, it is also interesting to observe AFRM’s relatively moderate delinquency rate of 0.6%, nearly inline to its fintech/ bank peers.

- However, the fintech may face top/ bottom line headwinds, due to the repayment of federal student loan debt from October 2023 onwards and the Fed’s potential pivot by 2024.

- Therefore, while we may rate the AFRM stock as a Buy, investors may want to wait for the exuberance to be moderated to between $13 and $15 for an improved margin of safety.

Aslan Alphan

The AFRM Investment Thesis Has Improved Moderately, Thanks To Its Positive Margins

We previously covered Affirm (NASDAQ:AFRM) in May 2023, discussing its mixed prospects from the underwhelming FQ3’23 earnings call, due to the intensifying competition in the BNPL space.

However, we had also been cautiously optimistic that the fintech might potentially execute a reversal by FQ4’23, attributed to its expanding interest income from the raised APRs and drastic restructuring in February 2023.

For now, it appears that we have been proven right, with AFRM reporting double beat FQ4’23 earnings, with revenues of $445.83M (+17% QoQ/ +22.4% YoY) and GAAP EPS of -$0.69 (inline QoQ/ -6.1% YoY).

Aside from the Provision For Bad Debts worth $331.86M (+47.3% YoY), its operating expenses have been further narrowed to $423.63M (-4.1% QoQ/ -8.1% YoY) in the latest quarter, down by -15.8% from the FQ2’23 peak of $503.72M.

Thanks to the Fed’s sustained rate hike thus far, AFRM’s Net Interest Income has also expanded to $151.81M (+19.4% QoQ/ +28.4% YoY) at the same time. This is likely attributed to the management’s two pronged approach.

Firstly, they raised the maximum APR for loans facilitated on its platform from 30% to 36%, while introducing merchant-subsidized low APR loans (4% to 9.99%) as an alternative to the previous monthly 0% APR programs.

Secondly, they also increased the interest bearing loans held on balance sheet to $4.44B (+16.5% QoQ/ +76.1% YoY), naturally contributing to the expansion in its overall long-term debts to $5.39B (+13.2% QoQ/ +32.4% YoY) in the latest quarter.

Despite the raised APRs, AFRM’s Active Consumers have further grown to 16.5M (+3.1% QoQ/ +17.8% YoY), with its GMV similarly accelerating to $5.5B (+18.7% QoQ/ +25% YoY) in FQ4’23, going against the uncertain macroeconomic cadence.

This demonstrates the fintech’s highly sticky offerings, since the number of transactions per Active Consumer has grown to 3.9 (+8.3% QoQ/ +30% YoY) by the latest quarter, with 90% comprising repeat consumers.

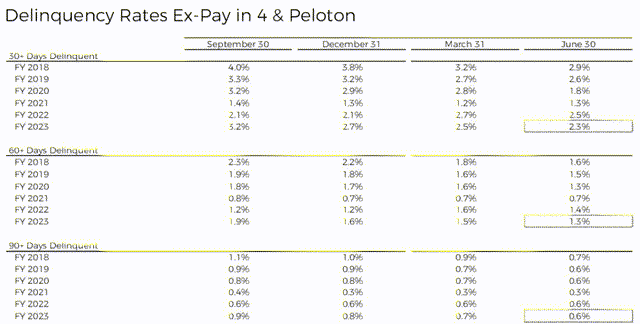

AFRM’s Delinquency Rates

Seeking Alpha

Despite the eye-watering APRs, it is also interesting to observe AFRM’s relatively moderate delinquency rate of 90 days or more delinquent at 0.6% (-0.1 points QoQ/ inline YoY) in FQ4’23.

This is compared to fellow fintech, such as Upstart (UPST), with a delinquency rate of 90 days or more delinquent at 0.25%, SoFi (SOFI) at 0.05%, and one of the big US Banks, Citigroup’s (C) consumer loans at 0.54% in the latest quarter.

As a result, it appears that AFRM’s risk management has been more than decent, despite the supposedly lower minimum FICO score of 550 compared to the widely accepted “good” scores of 670 and above.

However, with the repayment of federal student loan debt from October 2023 onwards and an average federal student loan debt of $37.33K per borrower, we may see the US consumers’ discretionary spending impacted in H2’23 and H1’24, consequently impacting the fintech’s GMV.

In addition, market analysts have priced in a rate freeze in the upcoming FOMC meeting in September 2023 and a potential Fed’s pivot by 2024, potentially triggering moderate headwinds in its net interest income.

This is important, since interest income comprises 43.1% (+4 points YoY) of AFRM’s overall revenues in FY2023. It also remains to be seen how the fintech may perform in a decelerating interest rate environment over the next few quarters.

As a result, investors may want to temper their expectations, while keeping their portfolio well balanced according to their risk tolerance.

So, Is AFRM Stock A Buy, Sell, or Hold?

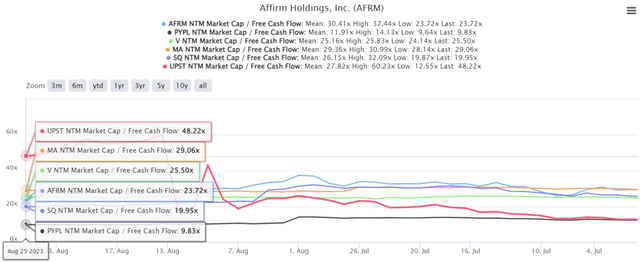

AFRM 3M Market Cap/ FCF Valuation

S&P Capital IQ

For now, since AFRM remains unprofitable on an adj/ GAAP EPS basis, we will be referring to its NTM Market Cap/ FCF valuations of 23.72x, since it has recently reported Free Cash Flow generation of $18.93M and margins of 4.2% in FQ4’23.

The management also “expects to deliver annual profitability on an adjusted operating income basis going forward,” suggesting that this valuation may be well deserved, especially since it is still near the Diversified Financial Services mean NTM Market Cap/ FCF of 22.43x.

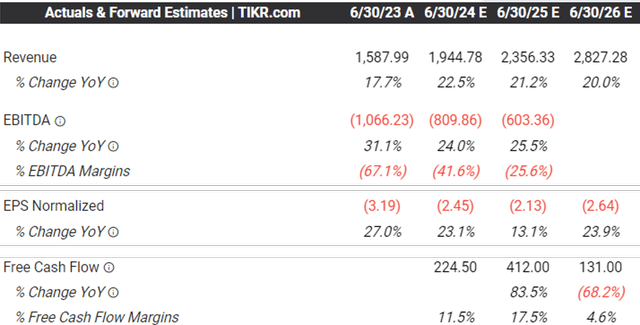

Consensus Forward Estimates

Tikr Terminal

The consensus estimates already bullishly projects FY2024 FCF generation of $224.5M (+306.7% YoY) with FCF margins of 11.5% (+18.3 points YoY), likely allowing AFRM to sustainably scale its business without having to rely on expensive financings.

Based on the consensus FY2024 FCF estimates and the latest share count of 299.64M in the latest quarter, we are looking at the next fiscal year’s FCF generation per share of $0.97. Based on its NTM Market Cap/ FCF valuation, we are also looking at a near-term fair value of $23.

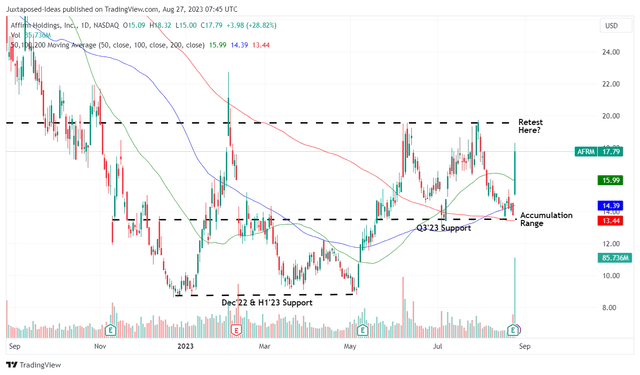

AFRM 1Y Stock Price

Trading View

This number implies that there is still an acceptable +29.2% upside potential from current levels, despite the recent rally by +28.8%. However, AFRM investors must also note that the stock still boasts an elevated short interest of 16.99% at the time of writing.

Combined with the potential retest at the June/ August 2023 resistance level of $19s, we believe there may be moderate volatility ahead, with traders likely opting to take profits.

Therefore, while we may rate the AFRM stock as a Buy, investors may want to wait for the exuberance to be moderated first, while adding at its previous Q3’23 support levels of between $13 and $15 for an improved margin of safety.

Combined with the potential risks discussed above, we do not recommend anyone to chase this rally now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.