Summary:

- Affirm’s share price jumps nearly 10% premarket, signaling optimism about the company’s operations as an economically viable enterprise.

- There are reasons to believe that Affirm could surpass analysts’ revenue estimates for the coming year.

- However, the stock’s valuation is expensive at over 65 times forward non-GAAP operating profits, and competition in the buy now, pay later space is increasing.

Tanankorn Pilong/iStock via Getty Images

Investment Thesis

Affirm (NASDAQ:AFRM) has seen its share price jump nearly 10% premarket. Investors have for a long time been waiting for the moment went Affirm could declare that the business had turned a corner and would be able to point to its operations as an economically viable enterprise.

Not only that, but there are reasons to be optimistic that Affirm could end up positively beating analysts’ revenue estimates for the year ahead.

Nevertheless, I remain bearish on this stock as I find it too expensive for it offers at more than 65x forward non-GAAP operating profits. Even without having to ponder too long about that, what Affirm offers is a highly commoditized payment solution.

Putting aside my bearishness for the stock’s valuation, I’ll admit that there were many aspects of this earnings report that positively impressed me, so let’s get to it!

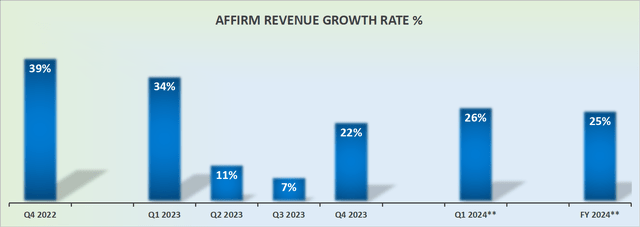

Revenue Growth Rates Positively Impress

Affirm’s revenues have demonstrably turned around. I don’t believe many investors expected Affirm’s fiscal Q4 2023 to have reported nearly a 10% beat to analysts’ revenue consensus estimates. I’ll admit that I did not.

This size of a beat, when combined with its guidance for fiscal 2024 inspires a lot of confidence that Affirm’s operations may now have regained their footing.

In the graphic above, I’ve taken the highest end of what I believe Affirm could deliver in fiscal 2024. Allow me to explain my thoughts on these estimates.

I’ve taken Affirm’s revenue as a percentage of GMV of 7.9% and extrapolated it to fiscal 2024, which is what Affirm points for the year ahead. This implies around 19% y/y increase in GMV being translated into approximately 19% y/y revenue increase.

I’ve then added to this figure a significant figure for the event that Affirm may be superconservative with its guidance, to allow them to positively impress investors through fiscal 2024, similar to how they just impressed the investment community with their strong fiscal 2023 revenue beat of 10%.

Furthermore, looking back to fiscal 2022 (calendar 2021), Affirm’s revenues as a percentage of GMV was 8.7% for that year, meaning that approximately 8% of GMV translating into revenues for the year ahead sounds plausible. But at the time, not only were there a lot more stimulus packages still sloshing around households, but also, and perhaps more crucially, the competition hadn’t gained much traction. And that’s what we now turn our attention towards.

How Much Loyalty Is There for Buy Now, Pay Later?

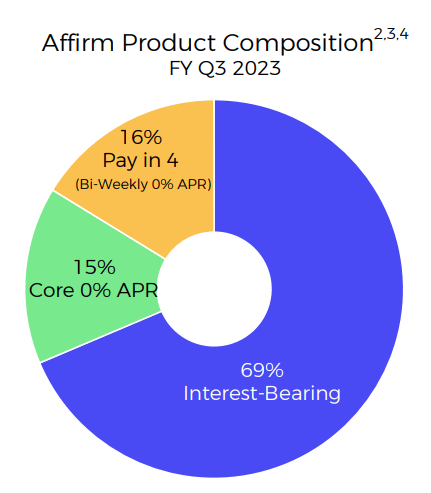

Before attempting to answer this question, let’s get some context. There was a substantial shift in the composition of Affirm’s revenues this quarter. In the previous quarter, fiscal Q3 2023, this was the breakdown of Affirm’s revenues:

AFRM FQ3 2023

You can see that 69% of Affirm’s revenues carried interest-bearing payments.

And now? The composition has changed dramatically so that only 51% of its GMV carries interest-bearing payments. Indeed, it appears that Affirm’s Pay Now (previously described as Core 0% APR) went from 15% of transactions to 42%. This is a massive shift in a 90 period.

The rollout of Affirm Card (formerly Debit+) has dramatically taken over the composition of Affirm’s revenue model. And this product carries significantly lower margins.

Consequently, one has to question whether Affirm will be able to become a highly profitable business or whether consumers have started to become more attuned to having to pay high fees for merchandise? Or perhaps, consumers are more attuned, inflation is tightening their purse strings, and the competition has also played a role?

Profitability Swings Into Positive Territory

Affirm’s guidance for the year ahead delivers its highly anticipated adjusted operating profits.

Assuming that Affirm’s adjusted operating margins come out at approximately 3%, this would see Affirm delivering somewhere close to $65 million of adjusted operating profits.

For a business with a market cap of $4 billion, I find that having to pay approximately 68x forward adjusted non-GAAP operating profits to be too rich a price tag.

After all, as readers will be very aware already, Affirm faces some stiff competition in the world of “buy now, pay later” (BNPL) services. Not only from one of its main rivals Afterpay (part of Block (SQ)), which is known for its popularity among consumers and its widespread presence in the retail space. Another key player is Klarna, a Swedish company that offers BNPL options and has gained popularity for its smooth checkout process. PayPal, a well-established digital payment giant, also jumped into the BNPL game with its service called “Pay in 4,” providing strong competition.

Furthermore, Affirm competes with traditional credit card companies like Visa and Mastercard, as well as financial technology firms including Block. These competitors are constantly innovating to attract consumers who want flexible payment options. In this competitive landscape, Affirm must continue to differentiate itself through its unique features, merchant partnerships, and user-friendly experience to maintain its position in the market.

On the other hand, I can see that for many investors, they’ll be quick to note that fiscal 2024 is only the start of Affirm’s profitability journey. And that I should be more inclined to consider that the year just ended, Affirm just reported negative $72 million of adjusted non-GAAP operating profits, meaning that this is a tremendous swing in profitability.

The Bottom Line

I find myself somewhat uncertain about Affirm’s current situation. On one hand, there seems to be optimism in the air with a nearly 10% premarket increase in its share price. There’s also the possibility of Affirm surpassing analysts’ revenue estimates for the coming year, which suggests a positive trajectory.

However, my skepticism arises from the stock’s valuation, which stands at over 65 times forward non-GAAP operating profits. This seems rather expensive, especially for what essentially boils down to a standardized payment solution. While Affirm’s recent revenue growth rates are impressive, it’s unclear how much loyalty exists for buy now, pay later services, given the shifting composition of its revenues and the emergence of formidable competitors like Afterpay, Klarna, and PayPal.

Despite Affirm’s move into profitability, with projected adjusted operating profits, the question lingers about whether the stock justifies its current price tag. With such fierce competition in the “buy now, pay later” space and shifting consumer preferences, the path ahead for Affirm remains uncertain, making it a challenging investment to buy into. Now or later.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.