Summary:

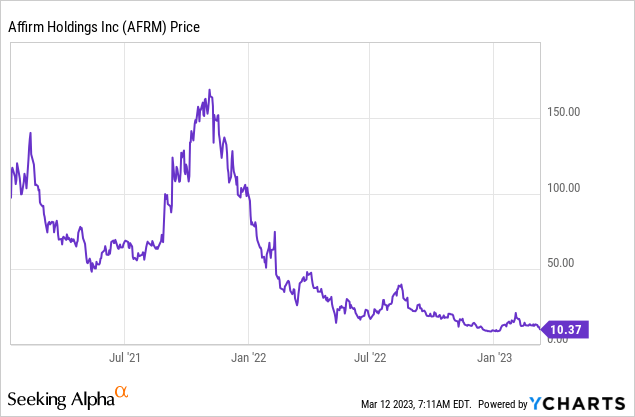

- Affirm has now plummeted over 90% from its all-time high.

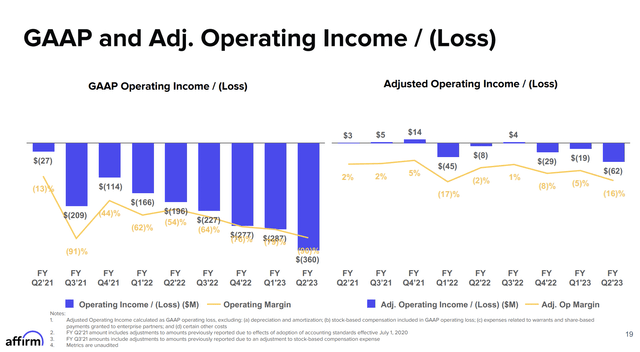

- The company’s financials are disastrous as loss continues to worsen substantially during the latest quarter.

- It is facing immense headwinds from increasing competition and the weakening economy.

- I rate the company as a sell.

FilippoBacci/E+ via Getty Images

Investment Thesis

Affirm Holdings (NASDAQ:AFRM) had an insane bull run during 2021 but is now down over 90% from its all-time high, as rising rates and soaring inflation spooked investors. Despite the massive drop, I still think it is best to avoid the company. The company has very weak operating leverage and is struggling to generate any income. The latest earnings showed revenue decelerating and net loss widening substantially as spending continues to be out of control. It is also facing tough headwinds from increasing competition and the weakening economy, which may further weigh on top-line growth. I believe there are still meaningful downsides, therefore I rate AFRM stock as a sell.

Disastrous Financials

Affirm announced its second-quarter earnings last month and the results are disastrous, as the bottom line worsened significantly. The company reported revenue of $399.6 million, up only 11% YoY (year over year) compared to $361 million. GMV (gross merchandising volume) grew 27% YoY from $4.46 billion to $5.65 billion, driven by the increase in active customers which were up 39% to 15.6 million. However, the growth in GMV did not translate to better revenue growth as the take rate declined 100 basis points from 8.1% to 7.1%, the lowest since going public.

The top line was underwhelming but the bottom line is way worse, as costs and expenses were out of control. As the economy weakens, provision for credit losses spiked 102.8% YoY from $52.6 million to $106.7 million. Funding costs were also up 147% from $17.7 million to $43.8 million. This resulted in gross profit dropping 21% YoY from $184 million to $144 million. The gross profit margin was 36% compared to 51%, down 1,500 basis points.

The company relies almost purely on spending for growth, rather than focusing on operating leverage. S&M (sales and marketing) expenses grew 31.2% from $143.5 million to $188.3 million, while technology expenses were up 65.1% from $94.9 million to $156.7 million. Yet, revenue was still only up 11%. S&M spending alone is now higher than gross profit, which is ridiculous. The management team said they will reduce expenses, but their own stock-based compensation expense actually increased 37.6% from $88.5 million to $121.8 million. The lack of discipline in spending resulted in the net loss worsening by 102% from $(159.7) million to $(322.4) million, or (90%) of revenue. Net loss per share was $(1.10) compared to $(0.57).

Immense Headwinds

Affirm is facing headwinds from increasing competition and the weakening economy. Due to low entry barriers, the BNPL (buy now pay later) space has become increasingly saturated, as more companies enter the space. For instance, Block (SQ) gained a significant presence through its $29 billion acquisition of Afterpay while PayPal (PYPL) launched its own BNPL product last year. Tech giant Apple (AAPL) is also getting into the mix as it recently expanded testing for its BNPL service, Apple Pay Later, which leverages the Mastercard (MA) network. I believe Affirm has very little competitive advantage in the market due to the lack of product breadth. It only specializes in BNPL while other companies also provide solutions for money transfers, payment processing, and more. Their integrated platform should be much more appealing to customers compared to Affirm.

The weakening economy is another substantial headwind. As inflation remains highly elevated, households now have to spend more money on essential items such as groceries. This results in lower spending on discretionary items as their budget shrinks. This significantly impacts the company as it relies heavily on transaction volume to generate revenue. The company is also very exposed as its GMV is mostly contributed by discretionary goods. For context, general merchandise and fashion/beauty products accounted for 39% and 18% of GMV in the latest quarter. I believe this will put immense pressure on growth moving forward.

Investor Takeaway

I believe investors should stay away from Affirm for now. Revenue growth has slowed significantly to just low double-digits and can barely be considered a high-growth company. Management tried to boost growth by increasing spending but it didn’t really work as operating leverage was extremely weak. The higher spending and increased costs only further dragged down the bottom line with the net loss doubling YoY. The increase in competition and the weakness in the economy should also continue to weigh heavily on its financials. I can’t find any reason to be optimistic until profitability and the macro environment starts to improve. I think the lows are still not in and I rate the company as a sell.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.