Summary:

- Affirm Holdings, Inc.’s Q4 2023 results are approaching, but its prospects appear unappealing.

- The company’s high valuation does not align with its near-term offerings.

- Affirm Holdings’ success in 2024 hinges on easing monetary conditions, which may also benefit its competitors.

- Around 70% of its transactions being interest-bearing raises concerns about customer loyalty amid fierce Buy Now, Pay Later competition.

Sviatlana Zyhmantovich/iStock via Getty Images

Investment Thesis

Affirm Holdings, Inc. (NASDAQ:AFRM) is about to report its fiscal Q4 2023 results in two weeks’ time. I make the case that Affirm’s prospects are far from enticing. Furthermore, Affirm’s valuation is too high for what it offers near term.

Meanwhile, looking back to where Affirm’s valuation was last year is neither illustrative nor informative of what Affirm’s valuation could be valued next year. What matters to investors now is what its 2024 prospects look like.

And here I make the case that Affirm’s setup for 2024 isn’t alluring. In sum, I keep my sell rating on this stock.

Looking Ahead to 2024

The bet investors are making with Affirm is that monetary conditions ease in 2024. More specifically, the bet that is made, both implicitly and explicitly, is that the Fed will cut interest rates in 2024, thereby providing an easier macro environment for Affirm to accelerate its growth trajectory.

And while I believe that this is a very likely scenario that will benefit the Buy Now Pay Later (“BNPL”) industry, my contention is that easier financial conditions will not solely benefit Affirm, but will also stimulate its peers to gain traction too.

On top of that assertion, consider this.

AFRM Q3 2024

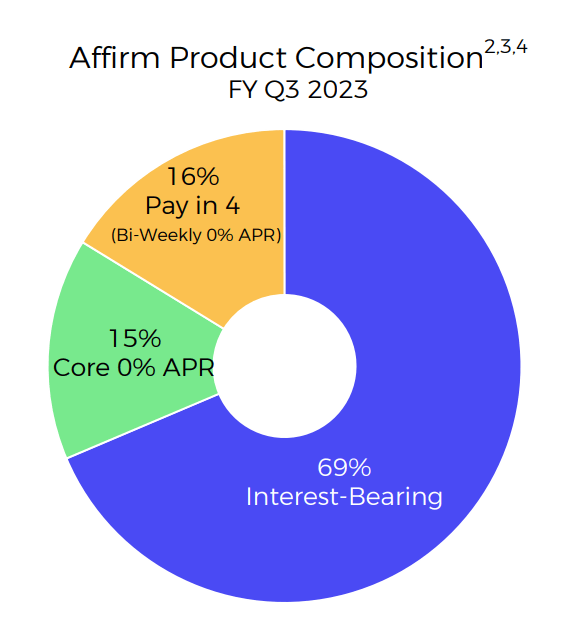

What you see above is that approximately 70% of Affirm’s transactions are interest-bearing.

Therefore, I ask readers why would a consumer be loyal to Affirm’s offering when there are countless competing BNPL offerings? I don’t believe that consumers are naive. With so many alternative options available, with a few swipes on their phone, consumers can switch to a different BNPL provider.

Mine are not inflated claims. Rather, the fundamental truth that Affirm will have to confront moving ahead. Next, note Affirm’s growth rates below if the argument about the fierce competition sounds hazy.

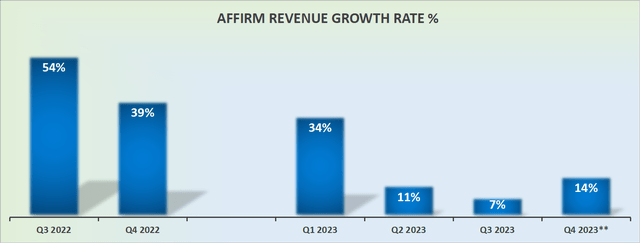

Revenue Growth Rates Have Matured

Affirm is no longer a rapidly growing company. Instead, it’s a company that is struggling to get back to +20% revenue growth rates. That’s the fact of the matter.

Affirm has positioned itself as a rapidly growing disruptive fintech, but a fairer appraisal points to Affirm’s sensitivity to the business cycle.

Indeed, this time last year Affirm’s revenue growth rates were increasing at close to 40% CAGR, while in Q4 of this fiscal year, investors would cheer, salute, gush, and trumpet if Affirm’s revenue growth rates were half of the same period a year ago.

No Pointing Looking Back

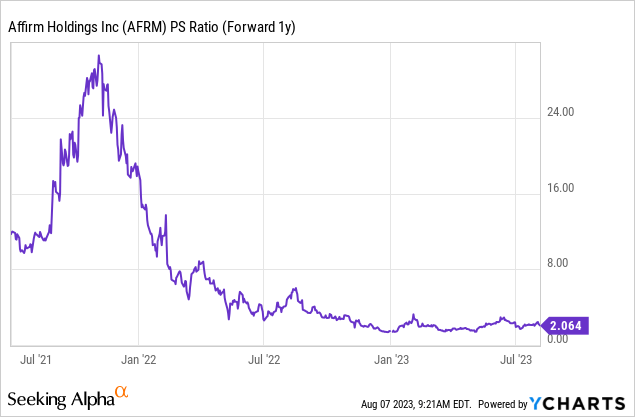

Many investors start their bull case by remarking that previously Affirm was priced at more than 20x forward sales and that today at approximately 2x forward sales, its valuation is a bargain, relatively speaking.

Another way to look at that insight is to observe that when Affirm was ”the shiny” object on the block, its narrative gripped investors, analysts, and even its peers.

But with the passage of time, the whole community has reconsidered the prospects of BNPL. In fact, it’s worth noting that even PayPal (PYPL) has now sought to divest its European BNPL offering.

The time when investors were more than willing to buy into a disruptive growth story, with only a substantially adjusted profitability, are now in the rear view. Investors wanted to get paid now and buy into a narrative later on.

The Bottom Line

In my assessment of Affirm’s fiscal Q4 2023 results and its prospects for 2024, I find the company’s valuation to be too high for its near-term offerings.

The bet on Affirm’s future growth relies heavily on the assumption that monetary conditions will ease in 2024, leading to an improved macro environment for Buy Now Pay Later companies like Affirm.

However, I believe that this favorable scenario won’t solely benefit Affirm but also its competitors, making it challenging for the company to maintain consumer loyalty.

Around 70% of Affirm’s transactions are interest-bearing, raising questions about its ability to retain customers when faced with numerous competing BNPL options.

Additionally, Affirm’s growth rates have slowed down significantly, signaling its sensitivity to the business cycle rather than being a rapidly growing fintech disruptor.

I maintain my sell rating on Affirm’s stock as we approach its earnings results.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.