Summary:

- Affirm Holdings’ stock price slid from $50 to $38 after earnings, making it an attractive investment opportunity.

- Affirm Holdings is experiencing growth and momentum with its Affirm Card and a partnership with Amazon.

- Lower short-term interest rates could greatly benefit Affirm Holdings’ buy now pay later business and lead to a re-rating in 2024.

Sviatlana Zyhmantovich

Affirm Holdings, Inc. (NASDAQ:AFRM) makes a solid value proposition for investors after the fintech’s stock price slid from $50 to $38 after the fintech’s earnings.

Affirm Holdings is growing, seeing ongoing momentum with its Affirm Card and in 4Q-23 announced a partnership with Amazon which saw the fintech’s buy now pay later (BNPL) product being included on Amazon’s shopping website.

I see re-rating potential for Affirm Holdings in 2024 primarily because lower short-term interest rates could be a powerful boon to the fintech’s rate-dependent BNPL business.

Affirm Holdings is enjoying robust business momentum across its core business metrics, including active customers and sales, and I think is good value at $38, in my view.

My Previous Rating

I discussed the Amazon-Affirm Holdings partnership in my last piece on the fintech in November of last year.

In addition, Affirm Holdings should be set to profit from lower key interest rates in the economy as lower costs for BNPL loans are poised to fuel the fintech’s loan origination and profitability.

All major KPIs for Affirm Holdings improved in the last quarter and I think that the fintech has an appealing valuation.

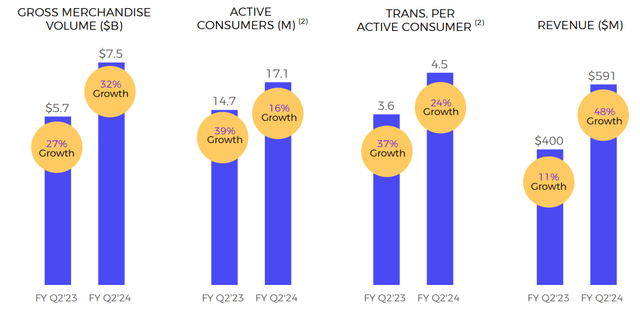

Growth In All Key Metrics

Affirm Holdings offers BNPL products to customers that are shopping mainly on eCommerce sites. The fintech’s last quarterly earnings showed that Affirm Holdings is making progress in all major areas of its business: The number of Affirm Card users kept rising drastically in the last quarter of the year, more merchants are using the fintech’s BNPL payment solutions and more transactions are done per customer, all of which led to strong sales growth.

Affirm Holdings had 17.1 million customers using its BNPL products at the end of December 2023, up 16% YoY. The fintech’s Affirm Card, a relatively new product, had more than 700K users in 4Q-23 compared to 400K active cards in September. The Affirm Card is a debit card where customers can make purchases and choose payment plans for purchases over $50.

In the last quarter, Affirm Holdings’ sales skyrocketed 48% YoY to $591 million and the company reported its third consecutive quarter of positive adjusted operating income.

Growth Metrics Overview (Affirm Holdings)

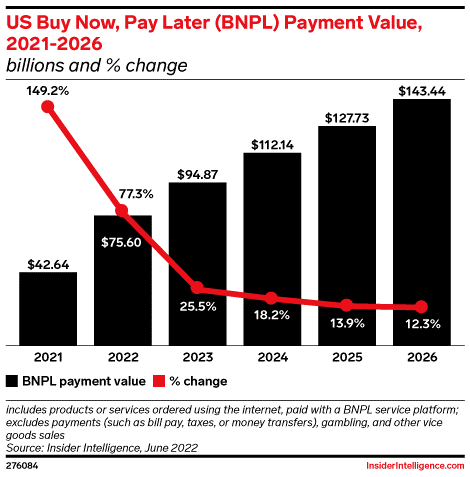

BNPL is an expanding market and offers Affirm Holdings long-term growth potential in active customers, merchants and sales.

Based on Insider Intelligence data, compiled in 2022, the BNPL market is anticipated to see substantial payment value growth in absolute dollar terms. The implied average growth rate in BNPL-related payment values, between 2023 and 2026, is 15% per year.

Payment Value (InsiderIntelligence.com)

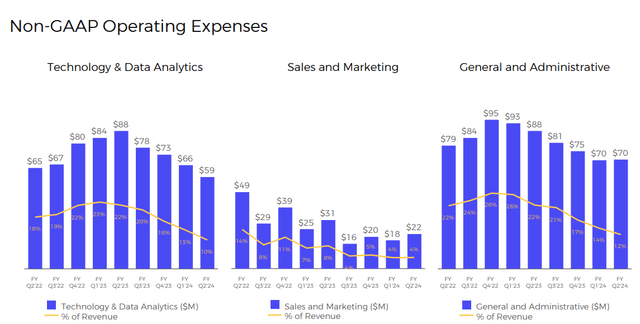

Affirm Holdings, as a major company proving BNPL products, is poised to profit from this market growth. Furthermore, because high inflation and higher short-term interest rates curtailed the fintech’s business in 2023, Affirm Holdings was laser-sharp in its focus to slash operating expenses last year. These cost reductions are poised to lead to an improved profit profile once the central bank starts to cut rates and the fintech’s BNPL originations grow.

Non-GAAP Operating Expenses (Affirm Holdings)

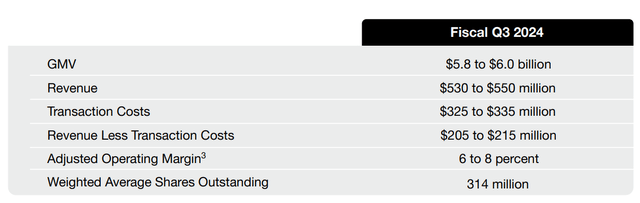

Outlook for 3Q-24

The fintech’s last earnings presentation included an outlook for 3Q-24 which is based on $530-550 million in sales. The growth forecast reflects a YoY growth rate of 39-44% which means management anticipates its sales growth to slow from 48% in 2Q-24.

This growth slowdown is probably related to seasonal factors as consumers tend to spend a lot more money during the holiday season in 4Q than in 1Q.

With that being said, with the central bank poised to lower short-term interest rates this year, Affirm Holdings could soon see a catalyst emerge for its sales growth.

Fiscal Revenue Q3-24 (Affirm Holdings)

Affirm Holdings Is Selling For A More Attractive Sales Multiple Again

Affirm Holdings is not profitable and only reports profits on an adjusted operating income level. Thus, my preferred way to value Affirm Holdings is by considering the fintech’s sales.

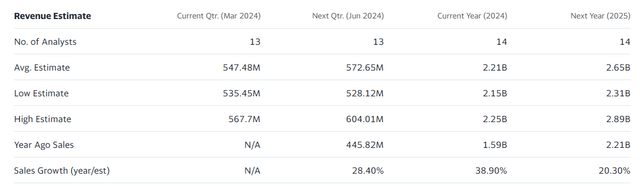

The market presently models $2.65 billion in sales for 2025 which implies, taking into account a market valuation of $11.7 billion, a sales multiple of 4.4x.

Upstart Holdings, Inc. (UPST) is selling for 3.1x next year’s sales, whereas SoFi Technologies Inc. (SOFI) has a sales multiple of 3.0x, also based on next year’s sales.

I chose those three fintechs to compare as they all operate large fintech businesses, though there are differences in operating models.

Upstart Holdings is behind an AI lending platform, whereas SoFi Holdings operates a one-stop online personal finance company. Taking into account the rate-dependency of the personal loan/BNPL origination business, I think that Upstart Holdings and Affirm Holdings are both compelling investments before the Fed starts to cut rates.

Revenue Estimate (Yahoo Finance)

Why My Investment Thesis Might Be Off

I mentioned slowing Affirm Card adoption as a potential headwind for the fintech in my last piece on the company a while back. This, as Q2’24 earnings affirmed, is not something to worry about.

More importantly, consumers in the BNPL market are very sensitive to interest rates. The central bank has implied in comments in December that it is prepared to lower short-term interest rates if inflation cools down.

However, a hotter-than-anticipated inflation report from January has caused new doubts about the central bank’s rate cut timeline. Higher inflation in the short-term and new delays with regards to rate cuts could hold Affirm Holdings’ stock back from a re-rating in 2024.

My Conclusion

Affirm Holdings is growing quickly due to broad acceptance and usage of BNPL products, a higher number of active accounts as well as Affirm Card adoption.

The fintech also has a partnership with a key strategic ally, Amazon, a giant in the eCommerce market, which should support growth in transactions and sales moving forward.

I see a big catalyst for Affirm Holdings’ BNPL business in 2024 as interest rates are anticipated to finally come down. Lower interest rates could lit a fire under Affirm Holdings’ BNPL business, lead to growing demand, higher sales, improving profitable and cause the fintech’s stock to re-rate higher in 2024 also.

Furthermore, the fintech’s focus on trimming its operating costs in 2023 could accelerate Affirm Holdings’ path toward sustainable profitability once the Fed starts cutting rates.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.