Summary:

- Affirm shows bullish price action with a series of higher highs and lows, trading above an upward sloping 30-week EMA.

- Momentum, measured by PPO, is both short-term and long-term bullish, indicating strong upward movement.

- Institutional investors are accumulating AFRM shares, suggesting they believe the stock is undervalued.

- AFRM’s relative strength is outperforming the SP 500 index, with a potential price target of $96, but consider stop losses.

blackred

Affirm Holdings, Inc. (NASDAQ:AFRM) is a company in the financial sector of the economy operating in the transaction and payment processing services industry. It is in the same industry as PayPal Holdings (PYPL) which I wrote about last week. Like the PYPL article, AFRM looks bullish to me. In this article, I will outline my investment thesis using the technical analysis elements of price action, momentum, volume, and relative strength. I also offer a price target and two stop losses in case my analysis is faulty.

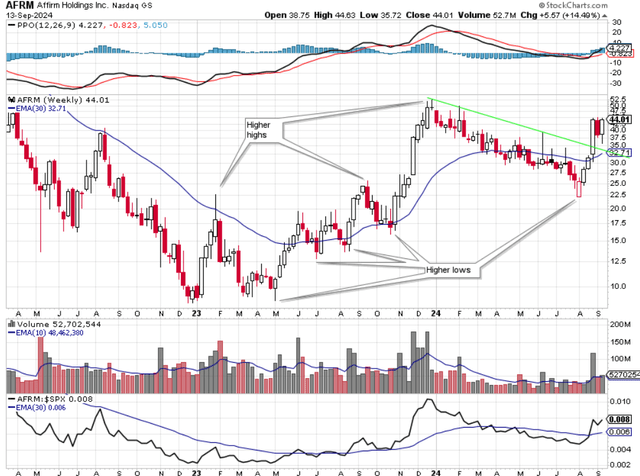

Chart 1 – AFRM Weekly with Momentum, Volume, and Relative Strength

The price action is the first thing I look at when I consider buying a stock. I want to buy stocks that are in uptrend. These are stocks that are making a series of higher highs and higher lows. Another price action feature I look for is an upward sloping 30-week exponential moving average (EMA). The 30-week EMA allows me to find the medium to long-term trend of the stock. Chart 1 shows that AFRM has made a series of higher lows and higher highs since its bottom in late 2022 at $8.62. From that low, AFRM rallied up to $22.50 and then gave up almost all of that gain when it fell back to $8.80 in May 2023. Notice that AFRM wasn’t able to stay above the downward sloping 30-week EMA during that advance and decline. From there, AFRM began its upward ascent in earnest. It rallied again over the next eight months, making a series of higher highs and higher lows, reaching a high of over $52 late in 2023. Then AFRM gave back a portion of those gains while losing the 30-week EMA. While AFRM did manage to lose the 30-week EMA during this pullback, it did manage to rally back above the 30-week EMA. That was a bullish sign. Then AFRM had the large bullish candle that coincided with its earnings release on August 28th. This large bullish candle cleared the down trendline shown in green. The following week, AFRM gave up some of the previous week’s advance, which is not unusual after such a large advance. Last week, AFRM closed higher after initially heading lower. AFRM is trading above its upward sloping 30-week EMA and its weekly candles have been large bullish candles. I like the price action I see in AFRM.

The next thing I want to see price do is trade above the highs of $52.48 registered in late 2023. If price can clear that high, then AFRM can continue its advance toward $96 per share. This potential price target is based on the difference between the price low of $8.62 in late 2022 and the high of $52.48 in late 2023. The difference of $43.88 is added to the high price of $52.48 to give a price target of just over $96.00. This is not a guarantee or a prediction of where price will go. It is simply a price target based on generally accepted techniques used in technical analysis.

Momentum is the next element I consider when examining a stock. The Percentage Price Oscillator (PPO) is the indicator I use to measure momentum. The PPO is easy to understand. When the black PPO line is above the red signal line, that is an indication of short term bullish momentum. Conversely, when the black PPO line is below the red signal line, then PPO shows short term bearish momentum. Right now, PPO shows short term bullish momentum. Another way that PPO shows momentum is dependent upon the black PPO line being above or below zero. When the black PPO line has a reading above zero, that is an indication of long term bullish momentum. Conversely, if the black PPO line has a negative reading, then PPO is showing long term bearish momentum. With a reading of 4.227, PPO is showing long term bullish momentum. I want a stock that is long term bullish with momentum. The reason I say long term is because the black PPO line doesn’t normally oscillate above or below zero. It normally spends a long time above or below zero before changing. Right now, AFRM shows momentum to be both short-term and long term bullish.

Volume is a factor in my analysis of any stock. I want a stock that is being accumulated by institutional investors. This can be determined by looking at the big black volume bars. This shows the shares being purchased during a stock’s advance for that week. Retail investors don’t buy millions of shares over a period of weeks. Looking at the volume pane in Chart 1, there have been numerous big black volume bars going back for months. This tells me that institutional investors are still accumulating shares of AFRM. The only reason they would be accumulating shares is that they think AFRM is undervalued at current prices. Volume is bullish in my opinion.

Relative strength is the last technical element I consider when evaluating a stock to buy. I want to own stocks that are outperforming the SP 500 index. That is the only way to beat the major index as an investor. The relative strength price line is easy to understand. The line is a price ratio of AFRM to the SP 500 index. When the black line is rising, that means that AFRM is outperforming the major index. When the black line is falling, then AFRM is underperforming the major index. Overall, AFRM has outperformed the major index since AFRM bottomed out in late 2022. AFRM’s relative strength has underperformed the major index for most of 2024, but it has recently turned that around. The relative strength line has advanced and has even retaken the 30-week EMA. Additionally, the 30-week EMA of relative strength has turned upward which is also bullish. I like what I see regarding AFRM’s relative strength.

My analysis could be faulty for numerous reasons. Earnings could disappoint, interest rates could remain higher for longer, or there could be some geopolitical event that could cause a market decline. Because this analysis could be wrong, it is important to have a stop loss if you decide to buy shares of AFRM. My first stop loss would be right below the low of last week’s candle at $35. If price got there, I would at least sell some of my shares, knowing that I can always buy back in later if price action improves. Another stop loss could be a close below the 30-week EMA. Again, you can always buy back shares if price action improves.

In summary, AFRM is a stock displaying bullish price action. It has been making a series of higher highs and higher lows, and now trades above an upward sloping 30-week EMA. Momentum as measured by PPO is both short-term and long-term bullish. It appears that institutional investors have been accumulating shares of AFRM which is bullish. The relative strength of AFRM shows that it has been outperforming the SP 500 index, and the relative strength line is now above its upward sloping 30-week EMA. There is a potential price target of $96, but this analysis could be wrong, so it is best to consider a stop loss if you choose to buy shares of AFRM.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AFRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.