Summary:

- Affirm Holdings surged 32% after surpassing profit targets and forecasting positive GAAP operating income, driven by 48% YoY sales growth in its BNPL platform.

- The fintech’s $659M in 4Q24 sales and $7.2B in Gross Merchandise Volume highlight robust demand for credit card alternatives and strong interest income growth.

- Affirm’s sales forecast of $640M-$670M for 1Q25 exceeds Wall Street expectations, with a market valuation reflecting a reasonable 3.6x sales multiple.

- Lower interest rates could further boost BNPL demand, supporting Affirm’s growth trajectory and validating my $50 stock price target with 17% upside potential.

I going to make a greatest artwork as I can, by my head, my hand and by my mind.

Affirm Holdings (NASDAQ:AFRM) skyrocketed on Thursday as investors digested the fintech’s strong quarterly earnings that were released after market close on Wednesday. Affirm Holdings, with its focus on buy now, pay later products, saw its sales surge 48% YoY amid robust demand for credit card alternatives.

The fintech is growing its buy now, pay later platform at scale and easily surpassed Wall Street’s profit targets. I think that Affirm Holdings has a long growth runway ahead and with the fintech now also targeting positive GAAP earnings in the next financial year, the risk/reward relationship is tilted to the upside.

My Rating History

A strong buy now, pay later growth story underpinned my stock classification of Buy for Affirm Holdings in my previous piece from June.

BNPL products are growing in popularity, and Affirm Holdings is one of the biggest fish in the pond in the BNPL market. The fintech reported skyrocketing sales in the last quarter and presented a strong forecast as well: Affirm Holdings is forecast operating profitability on a GAAP basis in the fourth quarter of the present financial year.

The central bank is also poised to lower short-term interest rates at its Fed meeting in September, potentially boosting demand for the fintech’s buy now, pay later products.

Robust 4Q24 Profit Beat, Stellar Results

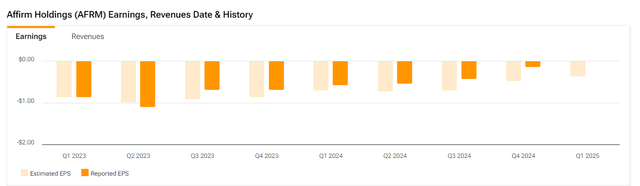

Affirm Holdings’ recorded a loss of $0.14 per share in the quarter ending June 30, 2024 compared to a Wall Street target of a $0.48 per share loss.

In addition to beating profit estimates by a big margin, the fintech is now finally guiding to achieve operating profitability, based on GAAP, in the fourth quarter of the present financial year.

Earnings And Revenue (Yahoo Finance)

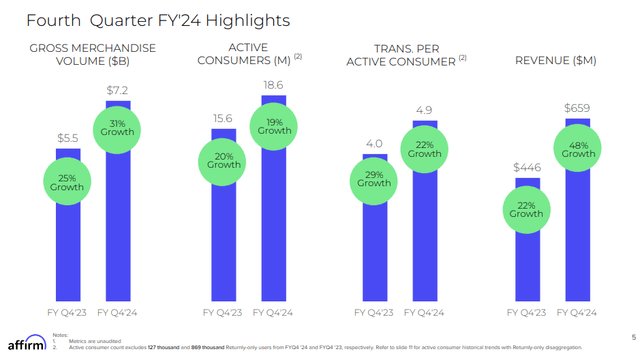

Affirm Holdings recorded $659 million in sales in 4Q24, reflecting a stunning 48% growth. This growth is underpinned by the fintech’s buy now, pay later products, which offer consumers the opportunity to pay consumer debt in installments. This relatively new industry is growing fast (as I illustrated in my piece in June) and buy now, pay later tools are replacing credit cards.

As a consequence, Affirm Holdings is profiting from sustained growth in Gross Merchandise Volume, a key figure that is used to quantify how many dollars are getting processed through a payment or commerce system. In 4Q24, Affirm Holdings produced $7.2 billion in Gross Merchandise Volume, reflecting a jump of 31% YoY.

Fourth Quarter FY-24 Highlights (Affirm Holdings, Inc.)

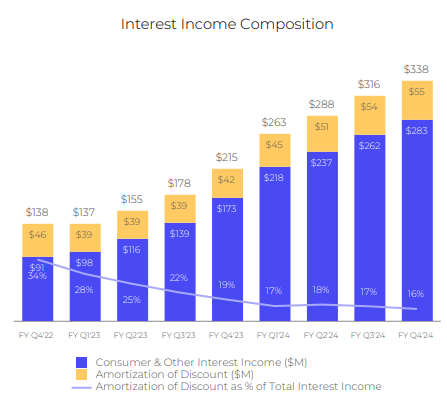

A considerable source of income for Affirm Holdings, obviously, is interest income. As the fintech grows the amount of loans on its books, it is also increasing the amount of interest income it collects from these loans.

In 4Q24, Affirm Holdings’ interest income amounted to $283 million, reflecting 211% growth in the last two years. In the last year, the fintech produced 64% YoY growth in this key income metric.

Interest Income Composition (Affirm Holdings, Inc.)

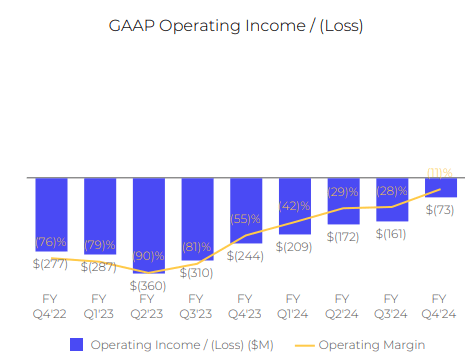

Affirm Holdings is also moving towards an important inflection point in its business: positive operating income based on GAAP. The fintech has guided for positive operating income for 4Q25.

Affirm Holdings has seen steadily narrowing losses in its operating income, and the company has now finally delivered some much-needed profit visibility.

GAAP Operating Income (Affirm Holdings, Inc.)

Sales Forecast For 1Q25 And Valuation Multiples

The fintech forecasts between $640 million and $670 million in sales for the next quarter, which was substantially better than the average Wall Street target of $625 million. The sales forecast and the anticipation of GAAP operating income profits catapulted Affirm Holdings’ stock 32% higher on Thursday.

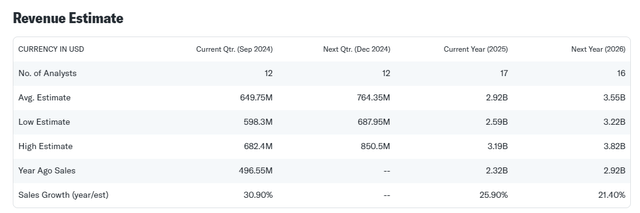

Affirm Holdings’ sales estimates have moved up considerably in the last couple of months as well and with the present 1Q25 sales outlook smashing the consensus view, there is a good chance that the market will further revisit the fintech’s sales projections.

The market presently models $2.92 billion in sales for this year, $160 million more than when I last revisited Affirm Holdings in June. For next year, $3.55 billion is now penciled in as consensus sales which, based on a market valuation of $12.9 billion, reflects back to us a leading sales multiple of 3.6x. This multiple is not an outrageous sales multiple at all, taking into account the aggressive sales growth that the fintech has put up for its last quarter.

SoFi Technologies, Inc. (SOFI) is selling for a 2024 sales multiple of 3.0x whereas Upstart Holdings, Inc. (UPST), which is providing AI technology to support banks and credit unions to make credit decisions, is selling for 5.3x leading sales.

At the start of the year, Affirm Holdings was selling for more than 5.0x leading sales, which implies an intrinsic value estimate of $50. This target leaves 17% upside on the table for investors.

Revenue Estimate (Yahoo Finance)

The big catalyst that, I think, could help Affirm Holdings support its momentum right now and rerate to $50 is the first rate cut that the central bank implicitly guided for in August. Lower short-term interest rates imply lower debt (re)financing costs, which makes BNPL debt more compelling for consumers.

A gradual decline in borrowing costs would probably give a substantial boost to fintechs like Affirm Holdings, which could push a higher volume of BNPL loans out the door.

Why The Investment Thesis Might Not Work Out

Affirm Holdings is poised to be a beneficiary from lower interest rates. After a delightful inflation report for July (prices rose only 2.9% YoY that month), the central bank is anticipated to start slashing interest rates at its next Fed meeting in September.

But there are risks as well, such as slowing BNPL adoption during a recession, which would probably hit cyclically positioned fintechs relying on credit products harder than more diversified banks.

A recession might also spur credit defaults, which would hurt Affirm Holdings as it holds origination BNPL loans on its books.

My Conclusion

Affirm Holdings just completed a fantastic quarter. The fintech’s BNPL sales are skyrocketing, and Affirm Holdings is clearly well-positioned to profit from lower interest rates in the market as it would probably spur demand for personal loans.

Affirm Holdings’ guidance and particularly the outlook with respect to positive operating income in 4Q25 are inflection points for the fintech and I think that investors are looking at many more years of super-charged growth for the buy now, pay later company as BNPL get more popular and act as credit card substitutes.

The valuation multiple also has room to expand, and I reaffirm my $50 stock price target for Affirm Holdings’ stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.