Summary:

- Affirm Holdings is a fintech startup experiencing impressive growth, driven by its Affirm Card that combines instant payment capability with pay later functionality.

- The company’s gross merchandise value (GMV) is steadily increasing, supporting its value proposition and pushing it towards profitability.

- The technical situation of Affirm Holdings is positive, with the stock recently breaking out above the 50-day moving average line, indicating potential for further growth.

Tanankorn Pilong

Affirm Holdings, Inc. (NASDAQ:AFRM) is a well-managed, growing fintech startup with considerable growth momentum and a large and expanding customer base. The fintech is seeing impressive growth for its Affirm Card that connects instant payment capability with pay later functionality.

Affirm Holdings profits from healthily growing gross merchandise value (GMV) growth which is supporting the underlying value proposition for this fintech company and which is pushing the fintech towards operating income profitability.

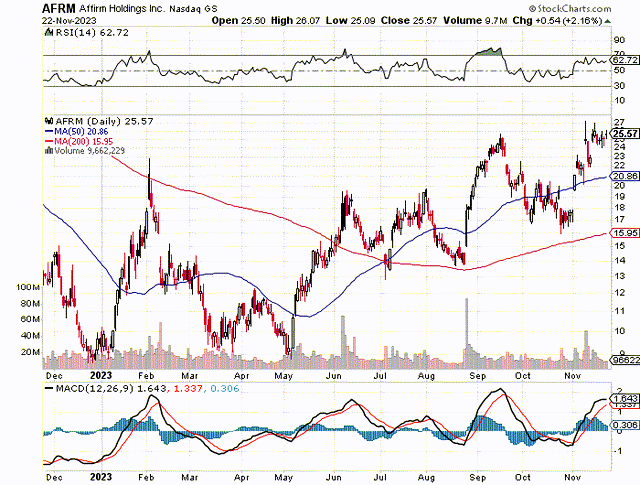

Furthermore, the technical situation of Affirm Holdings is positive and bullish, with the stock recently breaking out above the 50-day moving average line, which could signal a broader breakout for the stock moving forward.

My Rating History

Amazon and Affirm Holdings announced a partnership that laid out plans for U.S. merchants using Amazon Pay to gain access to the fintech’s buy now, pay later payment tools. The deal was likely to boost Affirm Holdings’ GMV and sales, and led to a Buy rating. Relatively new products like the Affirm Card are making a positive GMV growth impact and the fintech appears on the brink of sustained profitability.

Double digit GMV and sales momentum

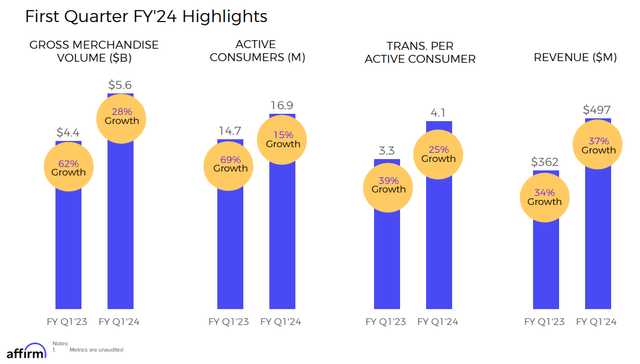

Affirm Holdings, in November, reported quarterly earnings for its first quarter of its 2024 financial year, which I quickly want to touch on. The startup’s customers produced $5.6 billion in GMV, reflecting solid 28% growth on a YoY basis, while sales, which directly flow from Upstart Holdings’ gross merchandise value, rose 37% YoY to $497 million.

Most importantly, Affirm Holdings continued to grow its active customer base in the last quarter. The fintech’s customer count rose 15% YoY to 16.9 million and the number of transactions is also on the rise. This means that platform engagement is growing and that customers overall seem to find a lot of value in the fintech’s buy now, pay later products.

First Quarter FY-24 Highlights (Affirm Holdings)

Affirm Card And Rapid Customer Growth

I said that the fintech is growing its customers at double-digit rates in the last quarter, but one product has particular potential, in my view: The Affirm Card.

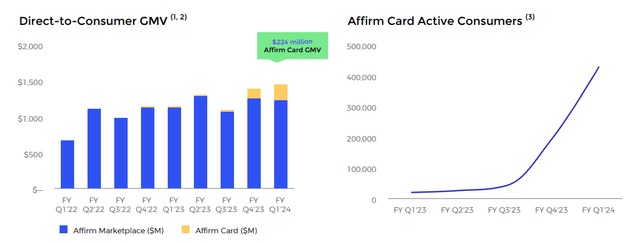

The Affirm Card was announced in 2021 and was branded as a credit card alternative, combining debit card functionality with access to the fintech’s suite of pay-later products. The Affirm Card has had a slow start, but adoption has been skyrocketing lately, leading to more than 400K customers already using the Affirm Card at the of the last quarter.

The impact on GMV should also not be underestimated as the Affirm Card contributed $224 million to the fintech’s GMV compared to $8 million in the year ago period. Growing Affirm Card adoption is one way in which I see Affirm Holdings grow both its GMV and sales, and it could be a catalyst to push the fintech’s adjusted operating income further upwards.

Affirm Card GMV (Affirm Holdings)

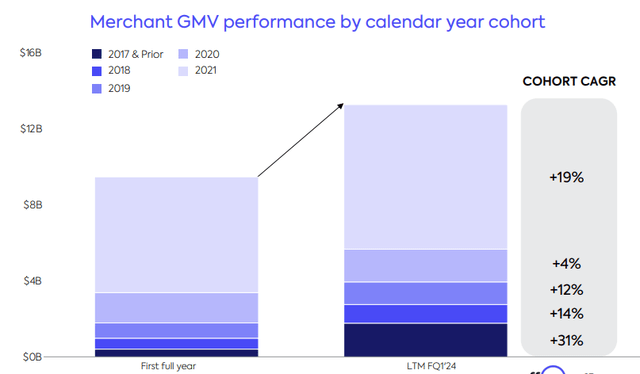

There is another trend on the platform that I find interesting. Newer customers tend to ramp up their spending much more rapidly than older cohorts. The 2021 cohort, for instance, grew its spending 19% YoY compared to 4% YoY growth rate for the 2020 cohort and 12% for the 2019 cohort. This is a favorable trend and could benefit Affirm Holdings’ monetization path.

Merchant GMV Performance By Calendar Year Cohort (Affirm Holdings)

Catalyst And Inflection Moment

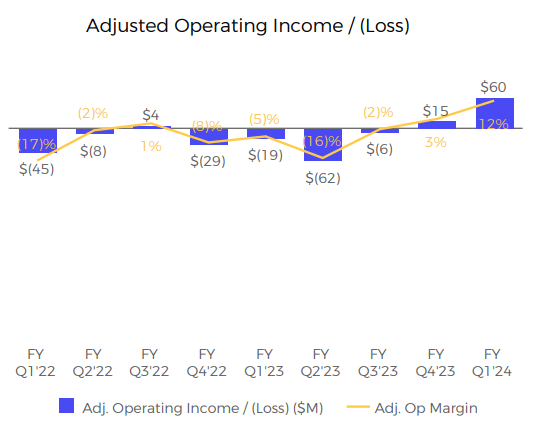

From a business perspective, Affirm Holdings also has a catalyst: It is just about to become (sustainably) profitable on an adjusted operating income basis.

Only in the last two quarters did Affirm Holdings produce positive operating income, but profit growth is accelerating for two reasons:

- Affirm Holdings is growing quickly in terms of customers and products.

- The fintech has cut a lot of fat off of its cost structure.

In FQ1-24, Affirm Holdings’ adjusted operating income soared 4x to $60 million. With the company seemingly on the brink of generating some serious profitability, I think a stock breakout could fundamentally be justified as well.

Adjusted Operating Income And Loss (Affirm Holdings)

Affirm Holdings: Technical Situation Points To Sustained Breakout

Affirm Holdings’ recent earnings breathed some new life into the fintech’s stock and AFRM broke out above the 50-day moving average line, a positive and bullish signal that could drive the stock price much higher, in my view, particularly as the stock gathers momentum.

I think that the 200-day moving average line provides some decent support here and though the stock is not yet overbought, the momentum and the trend lines point in the right direction.

Moving Averages (Stockcharts.com)

Why Affirm May Be A Steal

Fintechs have destroyed a lot of value in recent years, primarily because their valuations were inflated during the pandemic. Right now, however, valuations look much better and juicier for investors that want to get a long-term entry into Affirm Holdings, for instance.

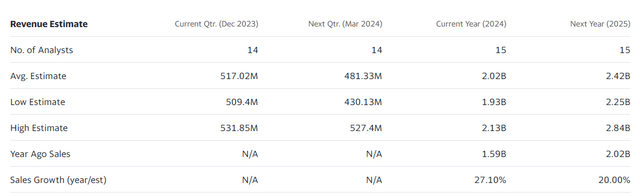

With 20% estimated sales growth for Affirm Holdings next year, we are being led to a sales multiple of 3.2x. In the fintech peer group, this is not a particularly outrageous multiple since investors expect a lot from Affirm Holdings in terms of GMV growth and new products such as the Affirm Card.

Sales growth is slowing, however, and since Affirm Holdings is not profitable, a P/E ratio is presently not useful. Despite slower growth, I think that Affirm Holdings is a compelling fintech investment, primarily due to growth in Affirm Card customers and the changing profit trajectory (on an adjusted OI basis).

Revenue Estimate (Yahoo Finance)

Upstart Holdings, Inc. (UPST), an AI-focused lending start-up offering banks and credit unions the outsourcing of credit decisions, is selling at a sales multiple of 3.1x. Sofi Technologies, Inc. (SOFI) is selling at a sales multiple of 2.6x and is expected to see 24% sales growth next year.

Short Squeeze Risk And Investment Headwinds

Affirm Holdings is a volatile stock, and one that is highly shorted (based on Marketbeat info, Affirm Holdings has a 20% short interest based on float). This makes Affirm Holdings a volatile investment in the fintech industry and investors must expect high levels of volatility to persist moving forward.

Slowing Affirm Card adoption and an inability to transfer GMV momentum into adjusted operating income growth would put a dent into the investment thesis, as far as I am concerned.

With that being said, though, the present trajectory of Affirm Card accounts and positive customer growth/transaction trends suggest that management is executing the fintech’s growth plans well.

My Conclusion

Affirm Holdings is on the right track and buying the stock is a no-brainer for me. The fintech is growing its GMV, its sales and its operating profits.

It is also showing a propensity for innovation with the Affirm Card which provides instant payment functionality with access to the fintechs buy now, pay later products.

Overall, I am seeing a well-calibrated, growing fintech business with momentum in all major key metrics.

The sales multiple, when taking into account Affirm Holdings’ double-digit GMV and sales growth, is not excessive. I see more upside ahead, based on both fundamental as well as chart considerations.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.