Summary:

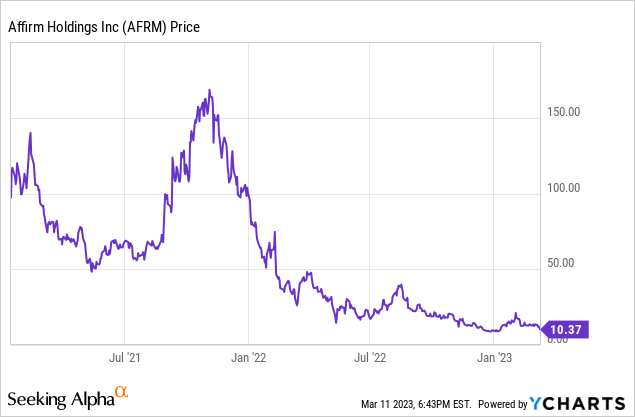

- Affirm Holdings stock has seen a precipitous decline since its 2021 peak.

- That being said, we still do not view this as an opportunity to buy the dip.

- Growing operating losses and slowing revenue growth are a toxic combo. In addition to this, the dollar amount of loans held on their balance sheet is increasing.

- BNPL is a difficult business to be in during benign economic environments and even worse during economic downturns.

- We do not like the risk/reward in Affirm at this time.

Ekahardiwito Subagio Purwito/iStock via Getty Images

Thesis

Affirm Holdings (NASDAQ:AFRM) has ballooning operating losses at a time of declining revenue growth. BNPL is a challenging business to be in during periods of economic difficulty. The company has a rapidly growing loan book, suggesting they are having difficulty selling these loans to other investors. These factors make the stock one to avoid for the time being.

Operational Difficulties

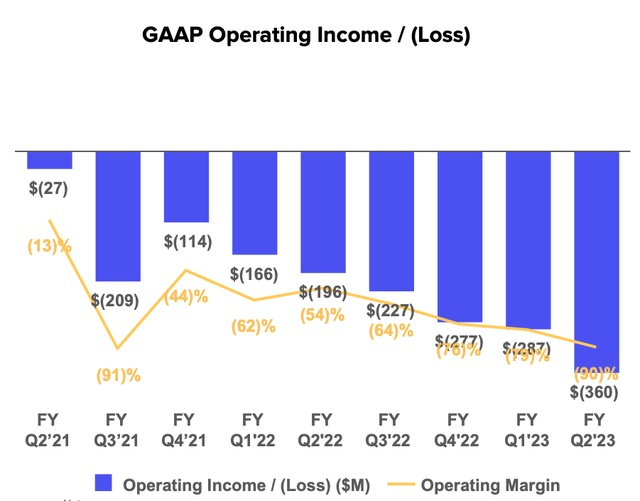

Affirm reported growing operating losses and slowing revenue growth in their fiscal second quarter. Of particular interest is how much their operating losses increased from just last quarter. This nosedive might signal more difficulties in the immediate future.

Their operating margin has always been abysmal but is now tracking towards almost -100%. This does not bode well and suggests that the economics of the business are either broken or unable to function in this economic environment.

Affirm Fiscal Q2 Earnings Presentation

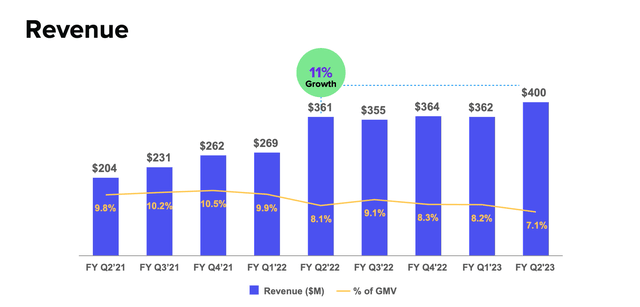

Revenue showed modest growth year over year, but investors will note that for the past few quarters there has been no revenue growth at all. This is despite operating losses continuing to grow QoQ during that period.

Affirm Fiscal Q2 Earnings Presentation

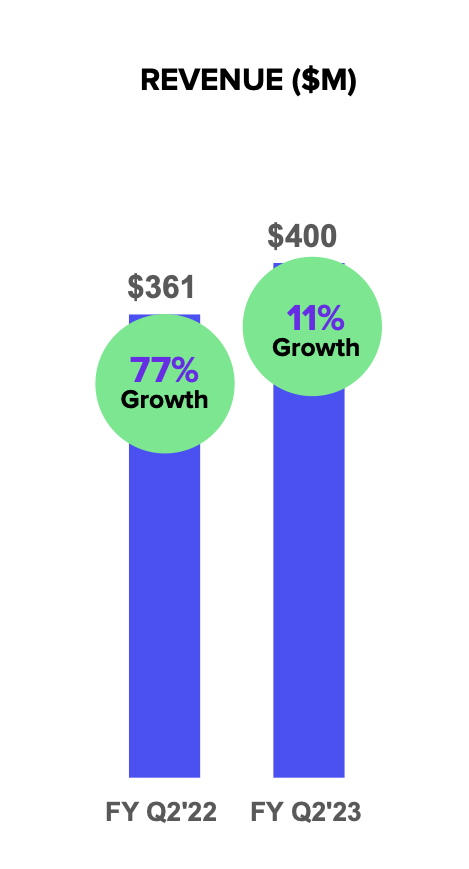

The revenue growth rate at Affirm has slowed dramatically. While some of their growth last year can be attributed to pent up spending, a decrease in the top line growth rate is a death sentence for the valuation given to unprofitable companies. Investors have been quick to punish Affirm and will likely behave that way for the foreseeable future.

Affirm Fiscal Q2 Earnings Presentation

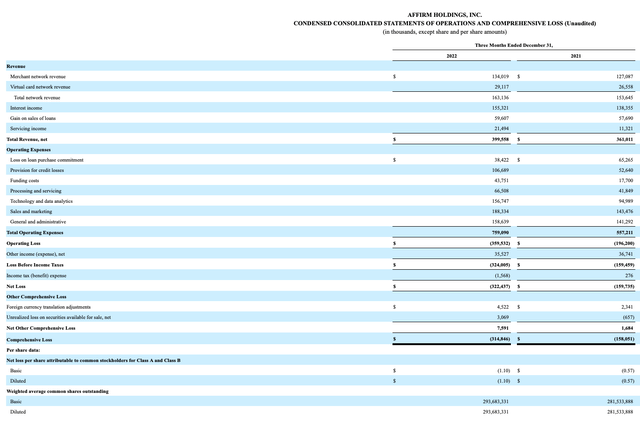

Increasing operating losses can be justified if a business is growing revenue at a high rate. The problem is that this is not the case at Affirm. Operating losses grew by 83.24% year over year when revenue grew by just 10.67% over that same timeframe.

Affirm Fiscal Q2 Earnings Report

The combination of rapidly increasing operating losses and slowing revenue growth shows that the business may be unsustainable, at least in this economic environment.

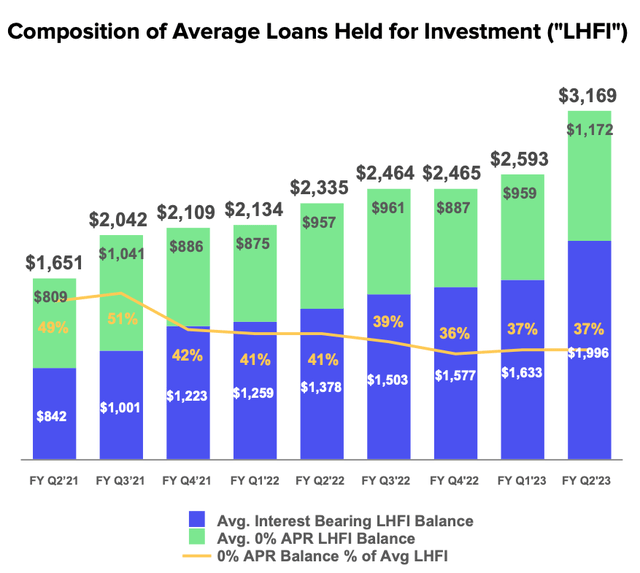

Growing Loan Book

The growing “loans held for investment” on Affirm’s balance sheet suggests they are having difficulty selling these loans. Readers may recognize this trend from Upstart Holdings (UPST), as they are having similar issues.

Affirm Fiscal Q2 Earnings Presentation

Most notable of their LHFI balance is how quickly it increased in their fiscal second quarter. Up until that point the balance had grown at a more moderate pace.

This rapid increase suggests that Affirm ran into a wall in Q2 and was unable to offload as many loans to other investors, and thus had to either retain them on their balance sheet or stop making them in the first place.

The recent growth in LHFI balance and ballooning operating losses point towards their fiscal Q2 as being when things really started getting bad for their business. For this reason, investors should probably wait until trends begin to improve before making an investment here. Their fiscal situation could deteriorate much faster than expected.

Additionally, the more loans that Affirm holds on their balance sheet the less likely investors are to give them a tech-like multiple.

Price Action

Affirm is still well below their 2021 highs. We still do not view this as an opportunity to buy the dip. Their operational challenges will likely get worse in the foreseeable future. That being said, if an investor believes that an improvement in economic conditions will happen sooner rather than later they may consider this as a buying opportunity.

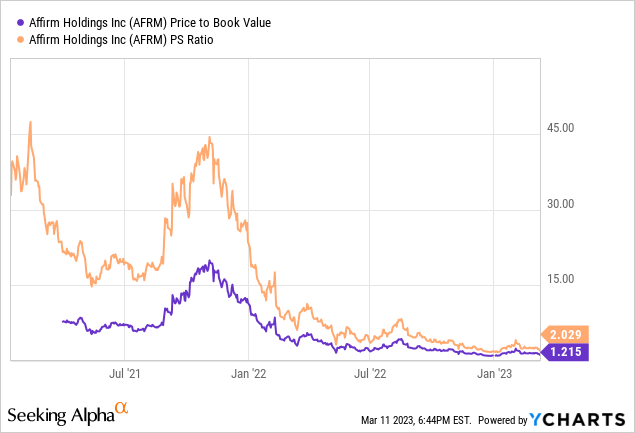

Valuation

Affirm does not currently make a profit and is not expected to make a profit for a while, making it difficult to value on that metric.

The P/S and P/B multiples have come down well off the highs, but each metric has a caveat. Using P/S seems flawed because their revenue is unlike that of a SaaS company with recurring revenue streams. P/B ratio is flawed because the value of their assets, specifically their “loans held for investment” is in question.

We view Affirm as being in the “too hard pile”. It seems unlikely that their business will become profitable any time soon, and the increase in loans held on balance sheet makes a future write-down more likely. Until the macroeconomic environment improves and Affirm is able to show that their business model can be profitable it is probably best to stay away.

Risks

A risk to this bearish thesis is the potential for the economy to rapidly improve. This would increase the amount of consumer spending and reduce the likelihood that the loans Affirm is holding on their balance sheet are of poor quality.

Another risk is that Affirm is able to efficiently cut costs and engage operating leverage in their model in order to become profitable much earlier than anticipated.

We find both of these scenarios as being unlikely and view the risk/reward in Affirm to be unfavorable.

Key Takeaway

Affirm had an awful fiscal second quarter and will likely have another bad quarter. Their financial situation is rapidly deteriorating and their business economics appear flawed. The growth in loans held on their balance sheet increases risk and damages the valuation multiple given to the company. Affirm seems like a stock to avoid until something drastically changes within their operations.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.