Summary:

- AFRM is more attractive after the recent pullback, as the market also waits for the fintech to slowly grow into its premium valuations.

- FY2024 is set to bring forth the first year of adj operating profitability as the management focuses on healthy consumer and loan portfolio growth.

- With relatively reasonable delinquency rates compared to its peers and major credit card lenders, it appears that AFRM’s BNPL platform has worked as intended.

- With the Fed pricing in three rate cuts in 2024, there may be some pressure in its profit spread, albeit potentially balanced by rising loan originations as borrowing costs moderate.

- Here is where we believe there is immense opportunities for investors with higher risk tolerance, since the stock appears to be well supported at current levels.

Natali_Mis

We previously covered Affirm (NASDAQ:NASDAQ:AFRM) in January 2024, downgrading the stock to a Hold, due to the overly optimistic rally by +175.9% since the October 2023 bottom.

While the fintech continued to demonstrate profitable growth, we did not believe that the stock’s eye-watering premium was sustainable then. Combined with the elevated short interest, we believed that there might be a deep pullback in the near-term.

For now, with AFRM already pulling back by -19.7% since the previous article, we believe that there is an improved margin of safety here, based on the fintech’s improving margins and the management’s promising FY2024 guidance.

Combined with the stock’s consistently moderating FWD valuations, we believe that the fintech is slowly growing into its growth premium, with FY2025/ FY2025 likely to demonstrate its proof of concept as a prudent and successful BNPL fintech platform.

The AFRM Investment Thesis Is More Attractive After The Recent Pullback

AFRM has executed extremely well despite the uncertain macroeconomic outlook, attributed to the consistent growth in its annualized Gross Merchandise Volume to $30B (+33.9% QoQ/ +31.5% YoY) and its active consumers to 17.1M (+0.2M QoQ/ +2.4M YoY) by FQ2’24.

Most importantly, thanks to the management’s consistent cost optimizations, the fintech continues to grow its adj operating profitability to $93M (+55% QoQ/ +250% YoY) with adj margins of 16% (+4 points QoQ/ +32 YoY).

On the one hand, the Consumer Financial Protection Bureau reports that BNPL users typically record an average credit score in the sub-prime category of between 580 and 669, compared the non-users with consistently higher credit scores of near prime at between 670 and 739.

This is also partly why AFRM has been established, “because credit cards aren’t working,” with the fintech also opting for its own proprietary ITACs credit quality score to “analyze the characteristics of a consumer’s attributes predictive of both willingness and ability to repay loans.”

On the other hand, while we have been skeptical ourselves, it is apparent that the AFRM management has been relatively successful in managing its consumer and portfolio risks.

This is attributed to the fintech’s relatively reasonable 30+ days delinquency rate of 2.4% (inline QoQ/ YoY), 60+ days of 1.4% (inline QoQ/ -0.1 points YoY), and 90+ days of 0.7% (inline QoQ/ YoY) by FQ2’24, while below FY2019 averages.

This is compared to its other fintech peers:

- SoFi (SOFI), with 30+ days delinquency rate of 0.9% and overall delinquency rate at 2.5% as of FY2023.

- PayPal (PYPL) with 30+ days delinquency rate of 1.4%, 60+ days of 1%, and 90+ days of 2.2%,

- and other major credit card lenders at an average of 3.2% as of February 2024.

In addition, while AFRM’s net charge-off has been increasing to $151.31M (+131.7% QoQ/ +9.4% YoY), we are not overly concerned, since the same has been reported by multiple fintech and conventional banks as the macroeconomic outlook normalizes from the hyper-pandemic period.

These developments are proof that the management’s prudence in moderating the loan origination volume has worked as intended in lowering its loan portfolio credit risks.

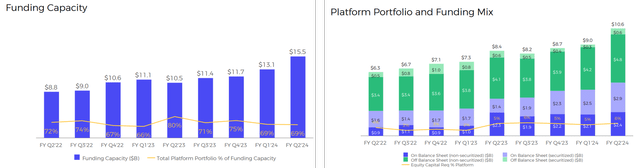

AFRM’s Funding Capacity & Loans Held On Balance Sheet

The same has been observed in AFRM’s ability to expand its external funding to $15.5B (+18.3% QoQ/ +47.6% YoY) by the latest quarter, demonstrating the fintech’s ability to sustainably grow its loan portfolio without having to overly rely on its balance sheet.

Lastly, the management has also offered a promising FY2024 outlook, with GMV of over $25.25B (+25% YoY) and adj operating margins of over 11% (+15.6 points YoY), implying its improved monetization and operating scale moving forward.

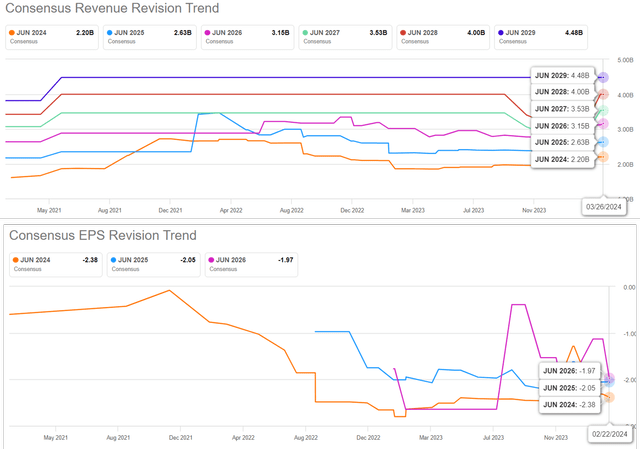

The Consensus Forward Estimates

Perhaps this is why the market remains largely optimistic about AFRM’s prospects, attributed to the relatively stable top line growth estimate at a CAGR of +25.7% through FY2026, with positive Free Cash Flow generation from FY2024 onwards.

So, Is AFRM Stock A Buy, Sell, or Hold?

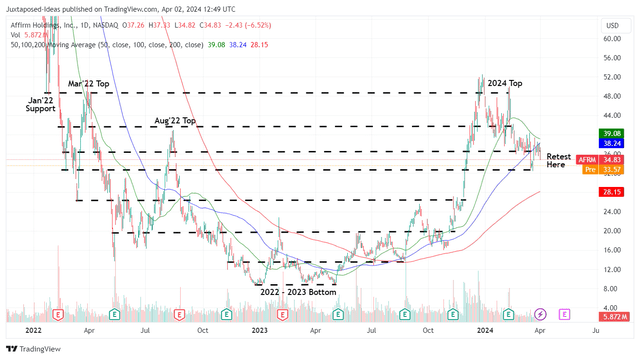

AFRM 2Y Stock Price

For now, AFRM has dramatically retraced by -31.9% since the 2024 peak, with the stock now appearing to retest the previous support levels of $30s.

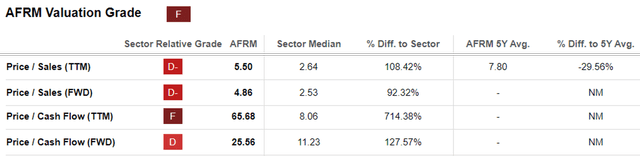

AFRM Valuations

Based on the stock’s inability to sustain the upward momentum and the moderation observed in AFRM’s valuations to FWD Price/ Sales of 4.86x and FWD Price/ Cash Flow of 25.56x, compared to the previous article of 7.32x/ 49.14x and the 3Y Price/ Sales mean of 10.98x, it is apparent that the market is waiting for the fintech to grow into its premium valuations

The same has been observed in its fintech peers, including SOFI at FWD Price/ Sales of 3.16x and UPST at 3.93x, compared to their 3Y mean of 5.38x and 8.05x, respectively.

Much of AFRM’s headwind is probably attributed to the uncertain macroeconomic outlook and the unlikely GAAP profitability in the near-term.

At the same time, with the Fed already pricing in three rate cuts in 2024, we may see further pressure in the fintech’s profit spread, albeit potentially well-balanced by the rising loan origination as borrowing costs moderate, further aided by the robust labor market.

As a result of the AFRM’s nascent BNPL platform and the uncertain soft landing, we can understand why the stock has pulled back as it has since the hyper-pandemic peak and the 2024 top.

However, here is where we believe there is immense opportunities for investors with higher risk tolerance, since the stock appears to be well supported at current levels, offering interested investors with an improved margin of safety.

At the same time, we believe that the headwinds may lift over the next few quarters, as AFRM deliver the first year of adj operating profit, further cementing its reversal over the next few years as the macro outlook normalizes.

As a result, we are upgrading AFRM as a Buy for investors with a long-term investing trajectory, especially made attractive by the recent pullback.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.