Summary:

- Affirm benefits from Apple Pay’s BNPL exit and lower interest rates, boosting short-term growth prospects.

- Valued at around $47 per share, Affirm shows near-term potential but lacks a margin of safety for a long-term hold.

- Recommendation: Hold for a short-term increase, but consider selling due to rising competition and funding challenges.

Sean Anthony Eddy

Overview

Affirm Holdings, Inc. (NASDAQ:AFRM) is a fintech company offering consumers Buy Now, Pay Later (BNPL) options, allowing them to split purchases into installments. This week they are presenting results, and my expectations are that they will continue to grow as they have done in the last quarters. Apple Pay decided to exit the Buy Now, Pay Later (BNPL) service and Affirm is explicitly named as a provider, that will boost Affirm’s demand at least in the short term. Another tailwind for Affirm is the decrease in interest rates. I expect this event will drive demand for payment options offered by Affirm and will improve the client’s creditworthiness.

I expect short-term results will be in line with analyst expectations or even above. But I foresee a very competitive market in the long term with bigger players able to weather better, tougher financial conditions with more diversified and stronger balance sheets. I value the company in line with its current stock price, and I recommend holding, waiting for a short-term increase, and selling it for the long term.

The business model: more than a BNPL pure-play

Unlike typical BNPL companies like Afterpay, which primarily focus on small, interest-free loans for quick repayment, Affirm also charges interest on larger purchases, and depending on the consumer’s creditworthiness. In my opinion, it is a differentiated approach because it enables Affirm to finance high-value items, providing a model that sits between a pure BNPL service and a more traditional lender like SoFi. By earning from merchant fees, ranging from 3% to 6% per transaction, and income interest, Affirm has diversified revenue streams beyond the high-volume, low-fee model of most BNPL providers, which is apparently an advantage I see in its model.

Another characteristic I consider essential in its model is technology. Affirm’s technology enables integration with merchants and also enhances its analytic capabilities critical to evaluate credit scores. Affirm’s risk model captures data from 215 million loans with 150 data points for each loan, improving the accuracy of credit decisions and reducing fraud risk. This allows the company to offer more flexible terms than a pure BNPL player, including interest-bearing loans in higher-value purchases. This appeals to a broader customer base than traditional BNPL services that often bypass credit checks and focus on younger consumers with limited credit histories.

Affirm uses a diversified financing model to fund its operations, including warehouse credit facilities, securitizations, and forward flow agreements, which supports its ability to offer long-term installment options. These sources give Affirm access to quick, long-term funding, which allows it to compete in a market that used to belong to banks. Affirm’s flexibility, transparent terms, and an attractive no-fee policy for consumers have helped to grow in popularity as a viable option to traditional bank lending.

Diversified revenue streams

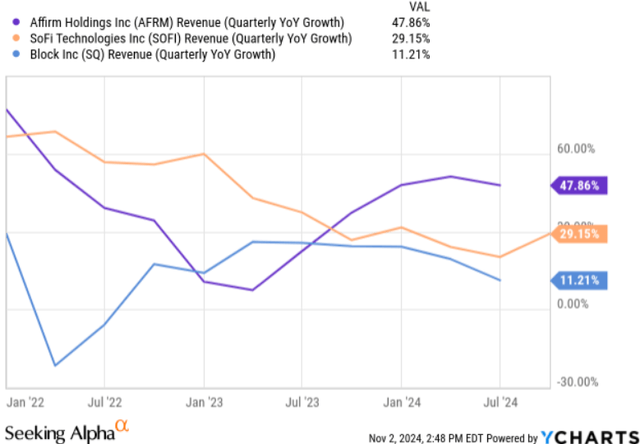

I think its product strategy is working because, operating a model with fees from merchants and interest income from customers, Affirm is growing its revenue base by 46% (Figure 1).

Figure 1

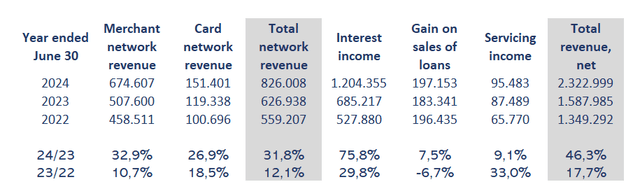

Total revenue for the 2024 fiscal year was $2.3 billion (Figure 2), up 46% from the last fiscal year. The rise is due to the increase in interest income and merchant revenue. The Merchant Network segment revenue has increased 33% to $674.6 million. The company keeps growing its transaction volume with an increase of 32% in Gross Merchandise Volume (GMV) especially with the largest merchants. The Average Order Value (AOV) has decreased by 8%, indicating that the expansion captures fewer value purchases. For me, it is the normal evolution; as the business grows mainstream, it will get lower purchases because those purchases are greater in volume.

As I have said before, Affirm is not a pure-play BNPL and finances most of its purchases with interest-bearing credit. This interest income is 52% of total revenue and has grown 76% year over year to reach $1.2 billion in the 2024 fiscal year. This is mainly due to a 49% increase in the average balance of interest-bearing loans and some strategic price increases.

Figure 2: Author

But the cost model is not working.

I worry that credit quality has been deteriorating in the last three years. Loss on loan purchase commitment and provision for credit losses over interest income has increased from 34% to 53%. This implies rising loan defaults and a pessimistic view from management regarding its client base, especially in the last year.

Funding costs have become more expensive. From 2022 to 2024, they increased from 7.7% of funding sources to 9.9%, and the net interest rate, measured as interest income over loans delivered less than the cost of funding debt, decreased from 14.8 percentage points to 12.6 percentage points.

Another issue of my concern is that Affirm is spending less on technology and marketing. Operating expenses (Processing, technology, sales and marketing, and general and administrative costs) have increased from 81.1% in 2019 to 134.4% in 2023. This is a clear sign that there are no economies of scale. Marketing went from 6.4% in 2019 to 40.2% in 2023. In the last year, those costs have decreased abruptly from 134.4% in 2023 to 84.1% in 2024. I interpret it as management pushing the brakes to get better results; it is not a consequence of the company’s strategy. This is another area of concern.

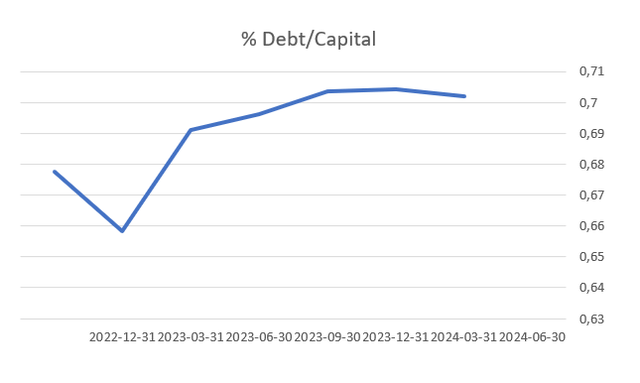

Funding sources with high-risk

Affirm’s warehouse credit facilities allow for a borrowing capacity of up to $5.0 billion in the U.S., with $1.4 billion drawn as of June 2024. Additionally, in Canada, the facilities provide a $665 million commitment with $387.9 million used. This structure allows Affirm to optimize costs based on available interest rates, apparently supporting lower-cost borrowing.

Asset-backed securitizations are also used, where Affirm sells loans and issues senior and subordinated securities. I consider that a dangerous practice in a non-regulated entity like a bank. This financing provides liquidity totaling $3.3 billion as of June 2024. Affirm’s securitization program provides direct liquidity from note issuances and ongoing servicing fees from retained interests, amounting to net assets of $308 million.

This funding structure is quite risky for Affirm in terms of competition from pure-play BNPL. In that sense, Affirm is more like a traditional bank than a new and disruptive fintech firm. However, the difference between Affirm and a bank is that the bank is regulated and has a more diversified source of capital.

In conclusion, to finance the rapid expansion of interest-bearing loans, the company has to assume a greater risk with asset-backed securitization that is outside the balance sheet.

Figure 3: Author

Traditional banking and credit card providers are the main risk

Traditional banking and credit card providers are the main risk. I have outlined that Affirm uses a hybrid model between a BNPL player and a traditional payment/banking company. I consider Affirm to have an advantage over pure BNPL players because Affirm can access more types of clients and more types of purchases; on the other side are companies that have more experience and reach in the payments world, such as American Express (AXP), Visa (V), and Mastercard (MA). Those companies can compete face-to-face on a greater scale and with more resources. Traditional banks can compete better with a more diversified balance sheet and greater scale.

Visa and Mastercard are a significant threat to Affirm because they are expanding into Buy Now, Pay Later (BNPL) with similar payment options, taking advantage of their vast networks of banks and merchants. Their established infrastructure and strong brand enable them to roll out BNPL features easily and at scale, potentially attracting merchants and consumers who might otherwise use Affirm.

Valuation

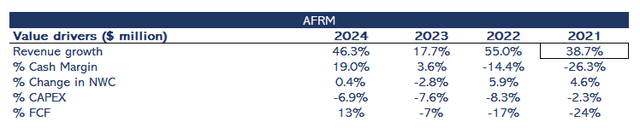

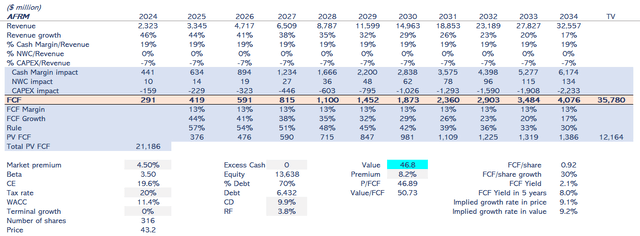

Figure 4 shows the company’s value drivers, considering a year as the last four quarters to capture the latest information. Regarding margins, I utilize a measure I call Cash Margin, which involves adjusting net income for non-cash items such as amortization and depreciation, stock-based compensation, and deferred income tax.

Figure 4: Author

As I outlined, the company enjoys a growing and diversified revenue stream, and I expect it to continue growing in the short term. In the next quarter’s results, I expect revenue to increase by 40% to reach $695 million, which is higher than analyst expectations and slightly below last quarter’s growth. In my valuation model, this revenue growth rate decreased until it reached 17% in 2034. Risks due to high-intensity competition described in the last section are weighted in my model with a terminal value growth rate of 0%.

Margin rate is an area of uncertainty in my analysis. Cash margin has been growing, but earnings per share (EPS) are negative. In the last quarter, EPS improved for the reasons I outlined, management discretion, and I expect $-0.34 per share in line with analysts for the next quarter in the coming week. That is slightly worse than last quarter’s because I expect sales, marketing, and technology expenses to rise even when funding costs could improve slightly.

I project networking capital and CAPEX based on the historical ratio over revenue. Cash flows will be discounted at an 11.4% WACC because the beta is 3.5. The risk-free rate is 3.8%. The company’s leverage is 70% of total capital, and the cost of debt is based on the current 9.9% that the company gets to fund its operations.

Figure 5: Author

As shown in Figure 5, my value estimate is $47 per share, an 8% premium over its current stock price. For me, it doesn’t have the required margin of safety, and I don’t consider a buy recommendation.

Conclusion

Affirm Holdings, Inc. operates in the BNPL market, with tailwinds from Apple Pay agreement and lower interest rates likely driving demand and enhancing customer credit profiles. In the short term, these factors position Affirm to meet or exceed revenue expectations, especially as interest income and merchant fees rise. However, longer-term challenges from larger financial players add risk.

Valued at approximately $47 per share—an 8% premium over its current price—Affirm’s stock aligns with its growth outlook but lacks a sufficient margin of safety for a strong buy. I recommend holding to benefit from a potential short-term increase but consider selling over the long term, as Affirm faces sustained competition and potential financial pressures.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.