Summary:

- Affirm is down by nearly 10% since posting an impressive Q3 FY 2024 report.

- Growing adoption of BNPL payment methods could boost GMV and revenue growth in the future.

- Potential rate cuts could help increase Affirm’s BNPL loan volumes.

- Affirm could leverage its partners’ penetration rate in the UK and top European markets to grow GMV and revenues.

- My price target for Affirm is $105 by 2030, representing a 225% upside.

hapabapa

Affirm Holdings, Inc. (NASDAQ:AFRM) has recently posted its Q3 FY 2024 earnings, showing impressive growth in GMV and revenues as well as more disciplined cost management. Despite this, Affirm’s shares are down by nearly 10% since releasing its earnings report. In my opinion, this drop could be attributed to Shopify’s (SHOP) soft guidance considering that Affirm is integrated into Shopify’s in-store POS. That said, I believe the drop in Affirm’s share price could be an opportunity thanks to the company’s growth potential due to the anticipated growth in BNPL spending, potential interest rate cuts, and its expansion into international markets, namely the UK. Based on this, I’m rating Affirm as a buy with a price target of $105 by 2030, implying 225% upside from current levels.

Q3 Overview

In Q3 FY 2024, Affirm reported GMV of $6.3 billion, up 35.7% YoY but down 16% QoQ due to seasonality, exceeding the guidance of $5.8 to $6 billion. As such, Affirm’s revenues grew by 51% YoY from $381 million to $576.1 million, but also declining 3% QoQ from $591 million due to the seasonality of Affirm’s business.

During the quarter, Affirm’s active consumers grew to 18.1 million, up 13.1% You and 2.8% QoQ, driven by increasing adoption of Affirm Card which surpassed 1 million cardholders right after the quarter end. At the same time, transactions per active consumer grew to 4.6 from 3.6 a year prior and 4.4 a quarter prior. Overall, transactions were 21.5 million in Q3, 93.5% of which were from repeat customers, up 49.3% YoY and 17.9% QoQ.

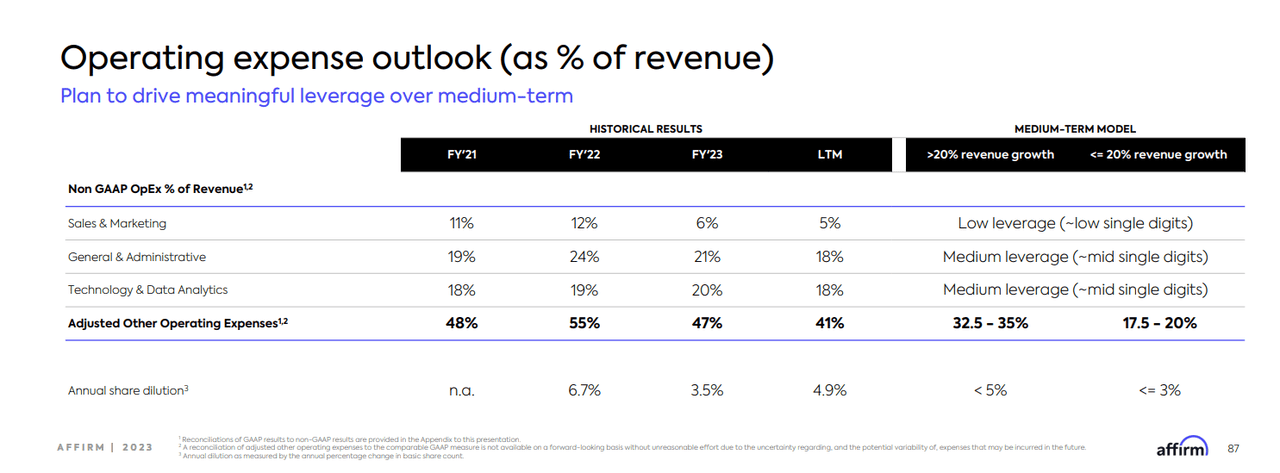

Looking into Affirm’s fixed costs, the company is showing more disciplined cost management compared to prior years. During the 9-month period ending March 31st, Affirm’s technology and data analytics costs declined YoY from $463.5 million to $377.6 million, leading to this cost representing 23% of Affirm’s revenues compared to 41% in the prior year.

The same could be said about sales and marketing costs, which declined during the same period from $493.1 million, representing 43% of revenues, to $441 million, representing 27% of revenues. G&A costs also declined during the same period to $401.8 million, representing 24% of revenues, compared to $458.8 million, representing 40% of revenues, in the prior year.

These cost reductions are a step in the right direction, as they show that Affirm is on track to achieve its medium term adjusted operating costs forecast. The company shared its targets in its latest investor day presentation, targeting sales and marketing to represent low single digits as a percentage of revenue, with technology and G&A costs representing mid-single digits as a percentage of revenue.

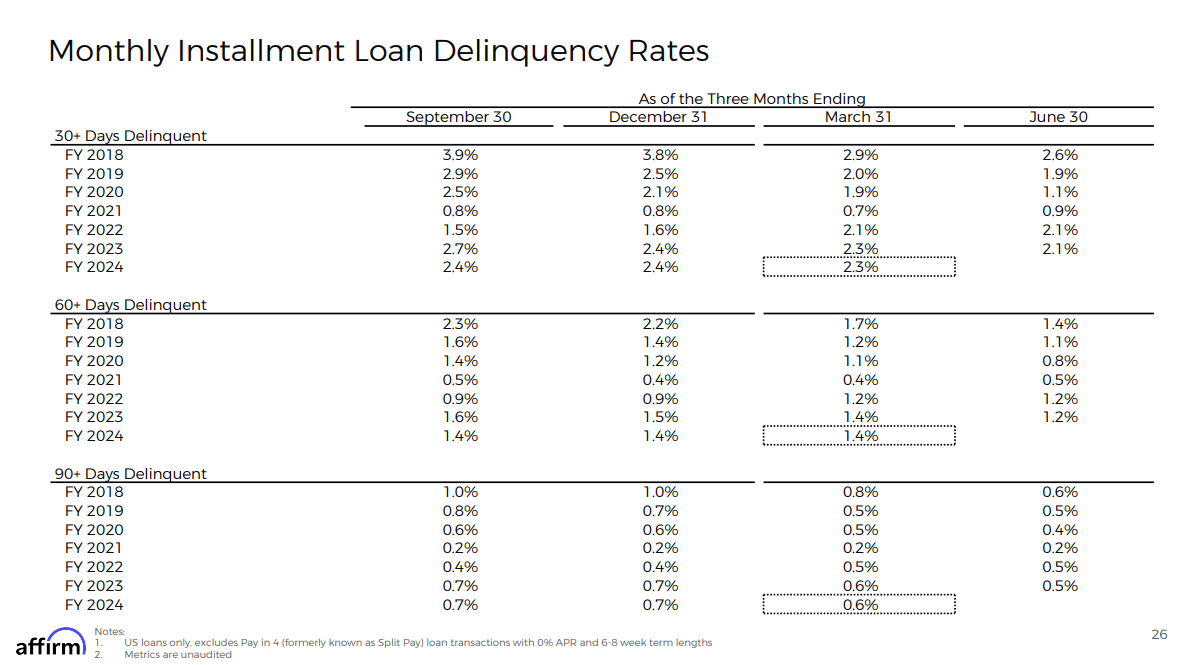

As for delinquencies, they remained flat YoY, while showing slight improvement QoQ in the 30 and 90 day cohorts.

Q3 FY 2024 Earnings Supplement

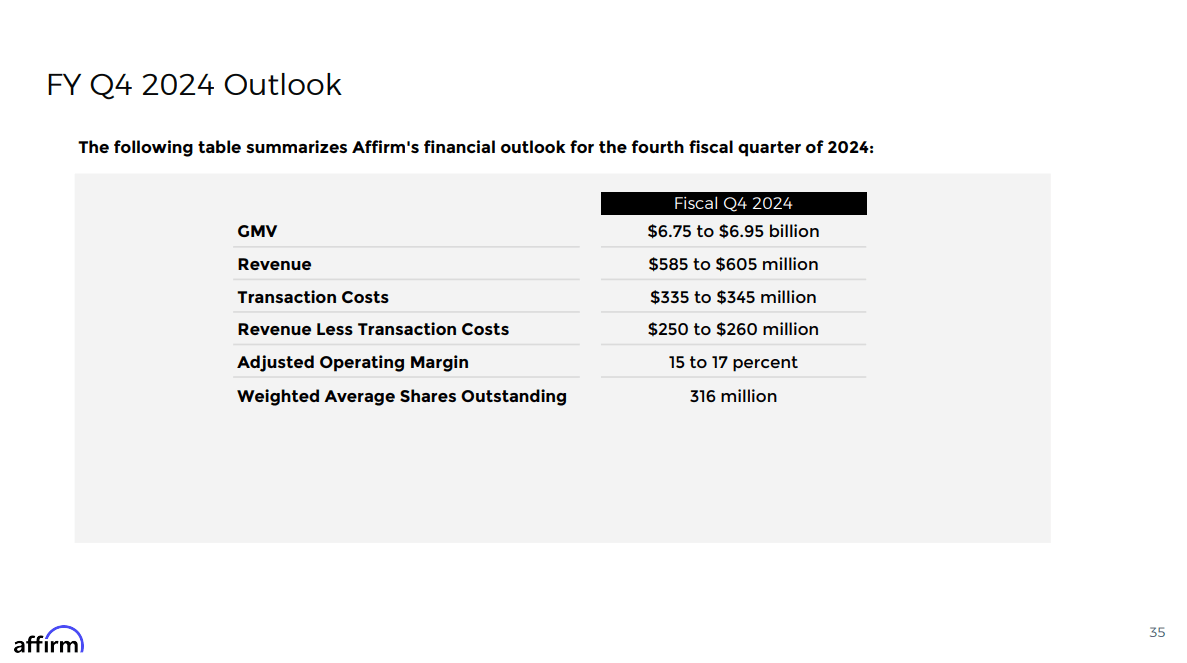

For Q4 FY 2024, Affirm is guiding GMV between $6.75 to $6.95 billion, implying full-year GMV between $26.1 to $26.3 billion, and revenues between $585 to $605 million, implying full-year revenues between $2.25 to $2.27 billion, compared to analyst estimates of $2.26 billion. At the midpoint of the company’s guidance, full-year revenues are on track to grow 42% YoY, in line with management’s forecast of more than 20% revenue growth in the medium term, as shared in the investor day presentation.

Q3 FY 2024 Earnings Supplement

BNPL Market Growth

The main driver to Affirm’s future growth in my opinion is the growing adoption of BNPL payment methods. In a previous article covering Pagaya (PGY), I shared that by the end of 2023, 82.1 million US consumers had used BNPL for their spending and lending needs, and that figure is forecasted to reach 112.7 million by 2027. During that period, BNPL sales volumes are expected to grow from $71.9 billion to $124.8 billion by 2027 at a CAGR of 14.8%.

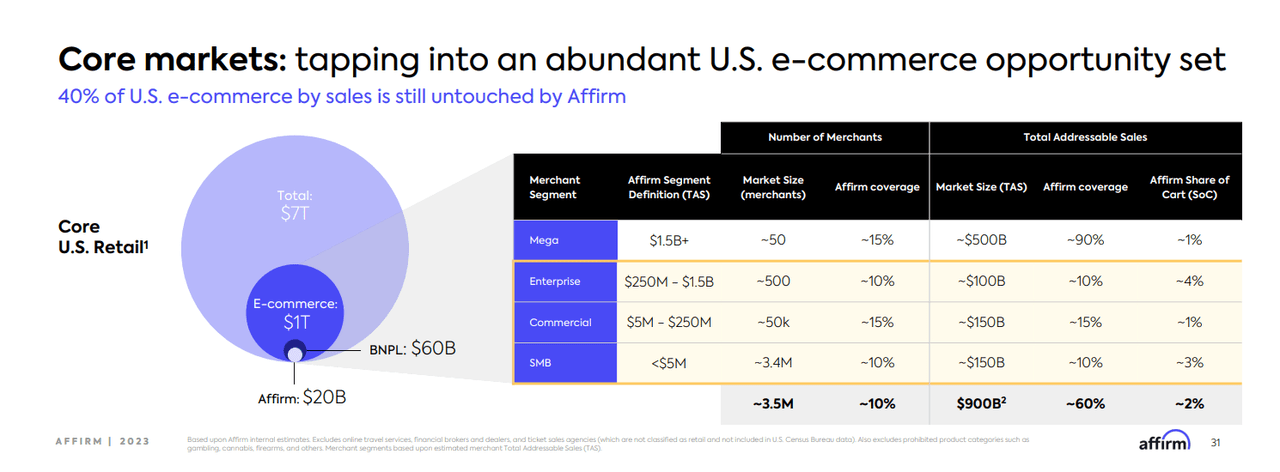

The anticipated growth in BNPL spending bodes well for Affirm’s growth potential, since it currently covers around 10% of US e-commerce merchants. At the same time, its coverage of the total addressable e-commerce sales is around 60%. As such, the forecasted growth in US BNPL spending will reflect on Affirm’s GMV in the future, and in turn, its revenues.

Affirm’s Investor Day Presentation

Another tailwind to Affirm’s growth potential is possible interest rate cuts this year. Currently, Affirm offers payments at interest rates between 0% for pay in 4 purchases and 36% based on consumers’ credit scores, meaning that consumers with a lower credit score are more likely to receive an interest rate near the 36% cap.

Since Affirm isn’t a bank, it relies on its funding partners to provide its BNPL loans to consumers at POS. These partners are Cross River Bank, Celtic Bank, and Lead Bank. That said, when interest rates are lower, banks’ risk appetite is generally higher as they loosen their lending standards. As such, Affirm could be in a position to offer loans to more consumers who would be denied BNPL loans at the current lending standards. At the same time, Affirm could offer lower interest rates to consumers with lower credit scores which could boost its transactions, and in turn, its revenues.

With that in mind, interest rate cuts could be approaching following April’s CPI print which showed inflation pressures easing following a 3-month streak of hotter than expected CPI readings. In April, core CPI, which strips out food and energy prices, increased 3.6% YoY. That was in line with expectations, and it cooled from the 3.8% increase seen in March. Monthly core prices increases were 0.3%, in line with expectations, and down from 0.4% in the prior 3 months.

Thanks to April’s encouraging CPI print, investors are now anticipating two 25 basis point cuts this year in September and December, bringing interest rates to a range between 4.75% to 5%, compared to the current range between 5.25% to 5.5%. In addition to boosting loan volume, lower interest rates will also benefit Affirm by reducing its funding costs.

In Q3 FY 2024, Affirm’s funding costs increased 77% YoY as a result of higher benchmark interest rates on the loans Affirm receives to fund its BNPL loans as well as higher coupon payments on the loans it securitizes. Therefore, a low-interest rate environment could be a major tailwind to Affirm’s profitability prospects.

International Expansion

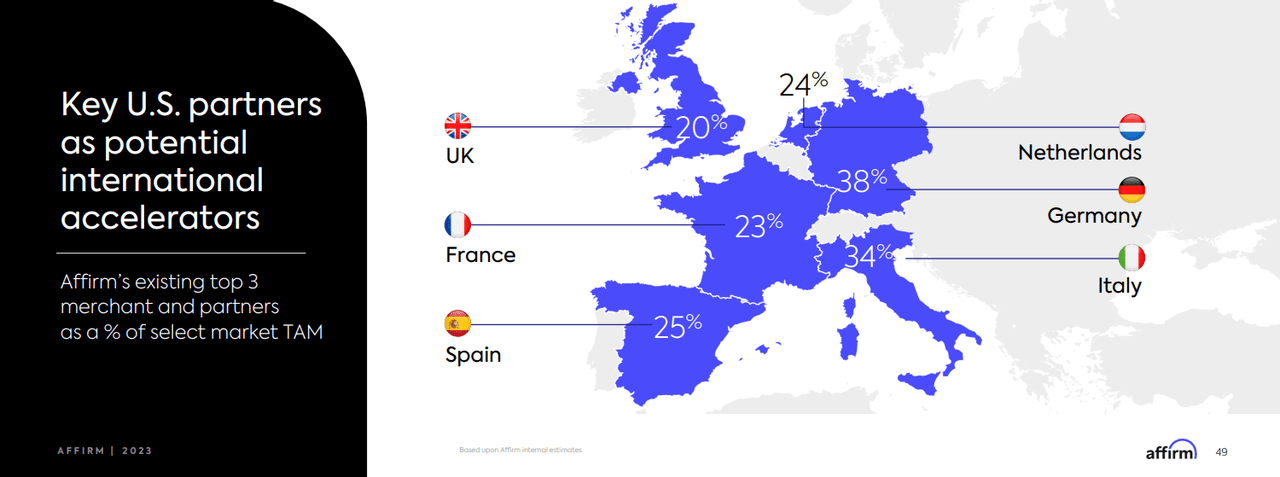

Another tailwind to Affirm’s future growth is its planned global expansion. While the company’s main markets are in the US and Canada, there is a large untapped global market since 60% of global e-commerce, excluding China, is outside North America. The next market Affirm intends to enter is the UK. The total addressable market in the UK is worth $133 billion and Affirm’s existing top 3 partners already have a 20% penetration rate in the UK market. This means that Affirm could have access to a $26.6 billion market once it goes live in the UK, without even considering the potential to secure more partnerships with merchants in the UK.

Affirm also has opportunities in top European market since its top 3 existing partners have a penetration rate of 25% in Spain, 23% in France, 24% in the Netherlands, 34% in Italy, and 38% in Germany.

Affirm’s Investor Day Presentation

In my opinion, Affirm’s expansion into these markets, in addition to the UK, positions it to grow GMV beyond its medium term target of $50 billion. Therefore, I’m confident Affirm could keep growing its topline by more than 20% for the foreseeable future.

Valuation

Given Affirm’s growth potential driven by the expected growth in the BNPL market, potential interest rate cuts, and global expansion, I believe it could be a bargain at its current valuation. I’m using P/S ratio to value Affirm since the company is still unprofitable on a GAAP or non GAAP basis, and is yet to post a positive adjusted operating income on a full year basis. Therefore, I believe P/S ratio is the best metric to value Affirm at this stage given that my bullish thesis on its stock is its revenue growth potential in the coming years.

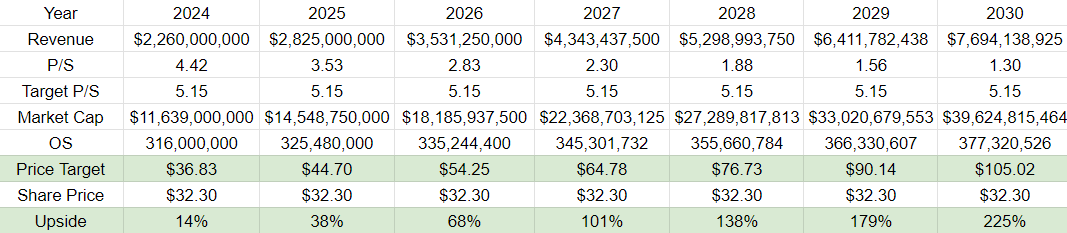

Since Affirm is guiding revenues to grow 42% at the midpoint of its guidance this fiscal year, I expect its revenues to grow by 25% in FY 2025 and 2026. Meanwhile, I expect revenue growth to start decelerating starting from FY 2027 until FY 2030 due to Affirm potentially becoming mature in its new markets. Based on this, my forecast for Affirm’s revenues until FY 2030 are as follows.

|

Year |

Revenue |

Growth |

|

2024 |

$2,260,000,000 |

|

|

2025 |

$2,825,000,000 |

25% |

|

2026 |

$3,531,250,000 |

25% |

|

2027 |

$4,343,437,500 |

23% |

|

2028 |

$5,298,993,750 |

22% |

|

2029 |

$6,411,782,438 |

21% |

|

2030 |

$7,694,138,925 |

20% |

According to my forecast, Affirm would be trading at the following P/S ratios.

|

Year |

Revenue |

P/S |

|

2024 |

$2,260,000,000 |

4.42 |

|

2025 |

$2,825,000,000 |

3.53 |

|

2026 |

$3,531,250,000 |

2.83 |

|

2027 |

$4,343,437,500 |

2.30 |

|

2028 |

$5,298,993,750 |

1.88 |

|

2029 |

$6,411,782,438 |

1.56 |

|

2030 |

$7,694,138,925 |

1.30 |

Meanwhile, my forecast implies that dilution would be less than 3% annually as shared in the latest investor day presentation.

Affirm’s Investor Day Presentation

Given that Affirm shared that it expects its outstanding shares to reach 316 million at the end of FY 2024, and assuming 3% dilution afterwards, I expect Affirm’s outstanding share count until FY 2030 to be as follows.

|

Year |

OS |

Dilution |

|

2024 |

316,000,000 |

|

|

2025 |

325,480,000 |

3% |

|

2026 |

335,244,400 |

3% |

|

2027 |

345,301,732 |

3% |

|

2028 |

355,660,784 |

3% |

|

2029 |

366,330,607 |

3% |

|

2030 |

377,320,526 |

3% |

While Affirm is the only pure play BNPL public equity, I believe its valuation could be compared to other fintech startups Upstart (UPST) and Marqeta (MQ), both of which are growth stage fintechs. Having said that, Upstart and Marqeta are trading at forward P/S ratios of 4.66 and 5.64, respectively, meaning that the average P/S ratio between both companies is 5.15. Using this multiple, my price targets for Affirm until FY 2030 are as follows.

Own Calculations

Risks

Risks to my bullish thesis include Klarna’s potential IPO in Q1 2025, as reported by Sky News. According to the report, Klarna has secured backing from shareholders and regulators to establish a UK-registered holding company in preparation for an IPO in New York. Since Affirm is currently the only pure play BNPL investment in the market, Klarna’s potential IPO could offer investors the opportunity to diversify their exposure to the BNPL market which could reflect negatively on Affirm’s valuation.

Another risk to consider is competition. Competition in the BNPL industry is intense with low barriers to entry, which has allowed many startups to enter the market. At the same time, several large banks are jumping into the arena, including heavyweights such as U.S. Bancorp (USB), Citigroup (C), and JPMorgan Chase (JPM), not to mention card issuers like American Express (AXP). These institutions have an advantage over BNPL providers since their credit card networks have extensive reach and could offer services to merchants at lower rates compared to BNPL providers like Affirm.

Conclusion

With its stock down 10% since posting strong Q3 FY 2024 results, I believe the current dip is an attractive entry point into Affirm. The BNPL provider continued to post impressive GMV and revenue growth despite the current high-interest rate environment, and is showing more disciplined cost management.

With that in mind, I expect Affirm to continue posting strong revenue growth for the foreseeable future due to the growing adoption of BNPL payment methods and potential interest rate cuts that could start as soon as this year. Meanwhile, Affirm’s international expansion in the UK and potential expansion into Europe could drive more GMV growth since its existing partners already have high penetration rates in these markets. In light of this, I’m rating Affirm as a buy with a price target of $105 by 2030, representing 225% upside from current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.