Summary:

- Affirm Holdings, Inc. is much more appealing below $20, but the fintech still spends too much, including stock-based compensation, for the limited adjusted revenues.

- The company has launched the Affirm card, which allows consumers to pay for purchases now or request a Buy Now Pay Later plan, expanding its transactions and potential growth.

- Affirm stock remains too expensive at 7x adjusted revenue.

Kevin Dietsch

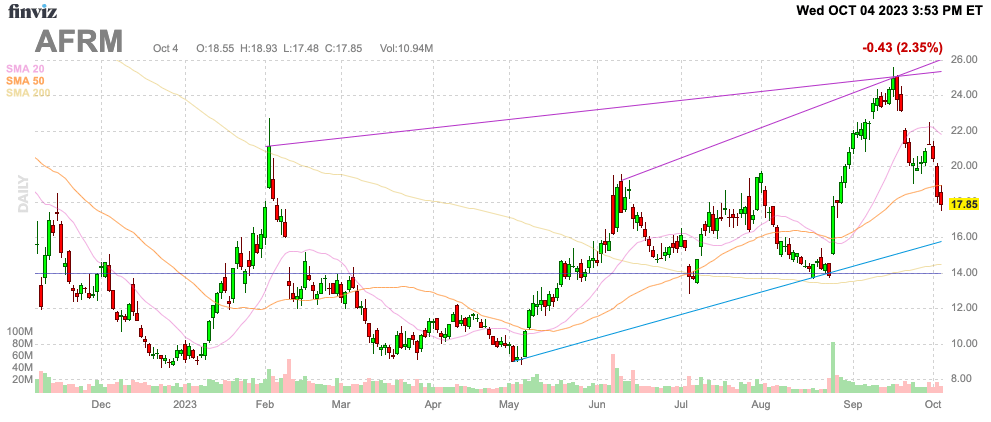

Affirm Holdings, Inc. (NASDAQ:AFRM) has always been an interesting fintech attempting to innovate in the area of issuing credit to consumers, but the products offered weren’t always as innovative as the stock price suggested. The new Affirm card has the ability to unlock further growth due to product innovation. My investment thesis is still Neutral on the stock following the complete valuation reset and the more positive technical setup, but the weak financials keep us from turning bullish.

Source: Finviz

Affirm Card To The Rescue

Affirm collapsed after a hot IPO due to investors finally realizing that the Buy Now, Pay Later, or BNPL, concept was neither innovative or new. The concept was just a newer version of assigning credit to consumers and one most people found cumbersome over using a traditional credit card.

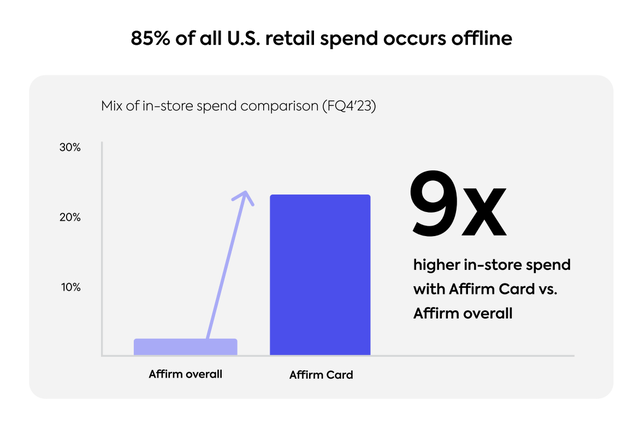

The fintech has now launched the Affirm card to allow consumers to either pay for purchases now via a linked bank account or request a BNPL plan from the Affirm app. In the process, the company greatly expands the transactions for the business with a 9x higher spend for Affirm Card users.

Source: Affirm Card fact sheet

Affirm only had ~300K active Affirm card consumers by mid-August, though up substantially from the end of FQ2’23 levels. The FY23 numbers saw minimal GMV tied to Affirm Card.

So not only is the stock down some 90% from the all-time highs, but also Affirm actually appears to have an innovative product giving consumers the ability to easily chose how to pay for a purchase. The product goes from a fringe offering for larger purchases, such as Peloton, to everyday purchases leaving Affirm in the middle of far more purchase decisions.

The Affirm card could grow accounts 10x and still be a rather small offering with only 2 to 3 million consumer accounts. In essence, Affirm has a large growth driver, but unfortunately the company still has to figure out a way to generate substantial profits from this business and reduce the large transaction costs limiting the profit picture.

Now Slightly Profitable

The company has spent the last year cutting costs to the point where Affirm is no longer producing large losses. For FQ4, Affirm produced an adjusted operating income of $15 million.

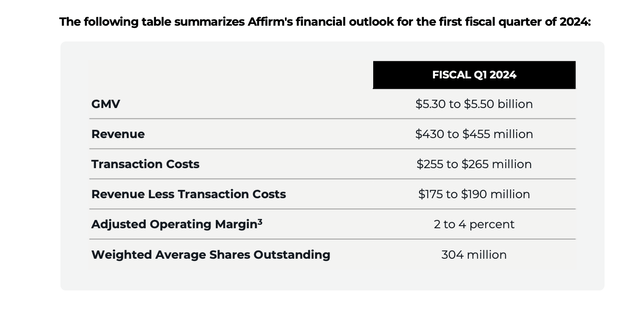

The major hiccup here is that adjusted revenues are only running at a quarterly clip of just up to $190 million. The forecast for FQ1’24 is for an adjusted operating margin of only 2% to 4%.

Source: Affirm FQ1’24 shareholder letter

The stock has a market cap of $5.5 billion, but adjusted revenues will only be in the $800 million range for FY24. Affirm might appear cheap on a gross revenue basis of ~3x sales forecasts of $2 billion, but the fintech has to pay the majority of those revenues via transaction costs leading to a much smaller revenue base.

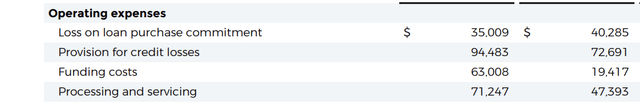

The transaction costs are mostly funding costs and credit losses. Naturally, a big concern heading into a potential recession is that the nearly $95 million in credit losses turns out to be much larger.

Source: Affirm FQ4’23 shareholder letter

The other major issue is the absurd level of stock-based compensation. Affirm spent nearly $1 billion on SBC during FY23 and the company was still running at a $214 million clip during the last quarter, though a lot of the amount is related to the Amazon deal.

The company spent over $450 million on SBC for employees amounting to over 50% of adjusted revenues. While the business has improved and the stock valuation has fallen dramatically, Affirm just isn’t generating the levels of adjusted revenues to account for the costs of building the business and to take on the risks of potentially higher credit losses in FY24.

Takeaway

The key investor takeaway is that Affirm Holdings, Inc. still isn’t an appealing stock. If the Affirm Card can boost sales faster than 24% this year while maintaining credit loss levels, the stock might become a Buy down the road. For now though, the new product is just too small to move the needle despite a relatively small adjusted revenue base.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.