Summary:

- Affirm: How two-sided BNPL platform make money?

- The BNPL market’s growth, partnership with Apple, and upcoming profitability could shift sentiment towards Affirm’s stock.

- Is growth always the answer?

- Absence of a competitive advantage, a crowded market,dilution of shares, and the possibility of regulations are red flags for every long-term investor.

B4LLS

Summary

I rate Affirm Holdings (NASDAQ:AFRM) as a Hold. Affirm has a lot of upside potential, especially in the short term. With decreasing interest rates in the US, ongoing product innovation, and the expanding market for BNPL, Affirm is in a strong position to sustain its rapid growth. Furthermore, management has assured us that GAAP profitability is on the way. This will capture the attention of investors who had been enticed away by the company’s significant losses in recent quarters. However, intense competition, huge dilution of shares, and insufficient “moat” are red flags. In the long term, the absence of a competitive advantage will put pressure on profit margins and prevent Affirm’s stock from outperforming the market.

Affirm: One of the pioneers in the BNPL landscape

Americans need no introduction to the Affirm brand. Affirm is one of the most well-known Buy Now, Pay Later (BNPL) providers in the U.S. The San Francisco-based company has a 60% brand awareness among BNPL (Buy Now, Pay Later) users in the U.S. It is popular with 24 percent of users, and 22 percent have used it in the past 12 months. Affirm products are especially popular with Gen Z and Millennials. But since people from all over the world read these analyses, let’s take a look at what Affirm is all about.

Founded in 2012 by Max Levchin, co-founder of PayPal (PYPL), Affirm was one of the earliest entries in the BNPL space in the U.S. Affirm aims to provide customers with flexible financial products that allow them to purchase goods and pay them back in monthly installments without hidden fees or interest, depending on the plan chosen.

The aim of this service, called “buy now, pay later”, is to replace credit cards, where many users are unaware of the fees they pay for using them.

How do BNPL products from Affirm work?

Affirm as the two-sided platform offers multiple products and solutions aimed at both end consumers and merchants:

-

BNPL for consumers – Customers can purchase products from various merchants and pay them in installments over a specified period. Many of Affirm’s business partners offer customers interest-free plans, allowing them to pay for their purchases over a short period without incurring any interest.

-

Business integration – On the other hand, Affirm works with merchants to enable them to offer BNPL solutions on their platforms. Customers can see the Affirm payment option right at checkout and choose the installment plan that suits them best. Merchants benefit from increased sales and higher purchase conversions.

Affirm two-sided business model (Affirm Investor Relations)

Although Affirm offers interest-free repayments to consumers, the company hasmultiple revenue streams that allow it to generate revenue even when customers do not pay interest on their loans. Here are the main ways Affirm generates revenue:

-

Fees from merchants – Affirm charges merchants a fee for processing payments through their platform. These fees are usually a percentage of the transaction value. This model reminds us how Visa or Mastercard charges merchants for credit card processing. Merchants accept to pay Affirm these fees because BNPL options increase conversion rates and average order value. Affirm claims that merchants using Affirm reported more than 60% higher average cart sizes in calendar years 2022 and 2021.

-

Interest on long-term installments – Although Affirm offers many interest-free BNPL plans, part of their business also includes interest-bearing installments. For larger or longer-term loans, Affirm charges interest that ranges from 0% to around 30%, depending on the customer’s creditworthiness and the type of loan.

-

Brokerage fees and partnerships – Affirm works with financial institutions to broker financial products, for which it may collect fees. For example, they may partner with banks who buy their loan portfolio.

Affirm position in growing BNPL universe

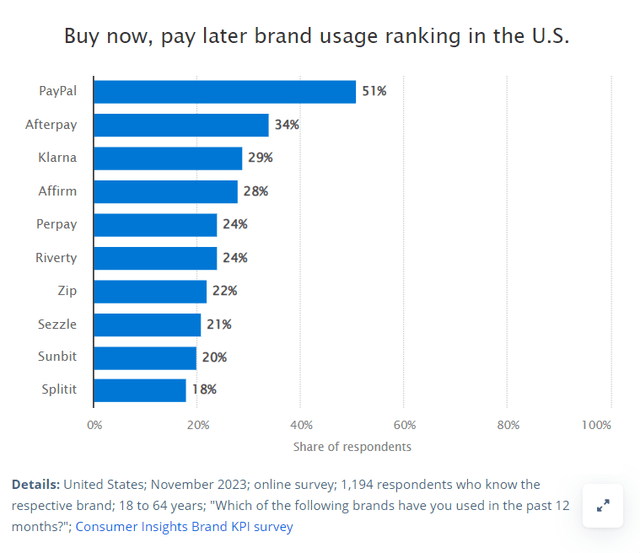

As I mentioned earlier, Affirm is a leader in the industry. Data from November 2023 indicates that in terms of recognition, Affirm belongs among the 4 biggest players in the U.S. market.

However, the absence of a competitive advantage means that despite Affirm being one of the first players in the market, the larger and much more well-known PayPal has become the leader. More than 90% of Americans are familiar with PayPal’s BNPL offering. This is even though PayPal only entered the industry in late 2020. More than half of people in the U.S. use PayPal’s interest-free “Pay in 4” option.

There are other significant players too. Block (SQ), former Square, bought Afterpay in 2021 for $29 billion and a third of US customers used its BNPL offer. Klarna (KLAR), the most valuable European fintech startup, is considering an IPO in the US market. The raised money could be used to gain market share. Currently, Klarna is No. 3 along with Affirm.

BNPL products used by U.S. consumer by company (Statista)

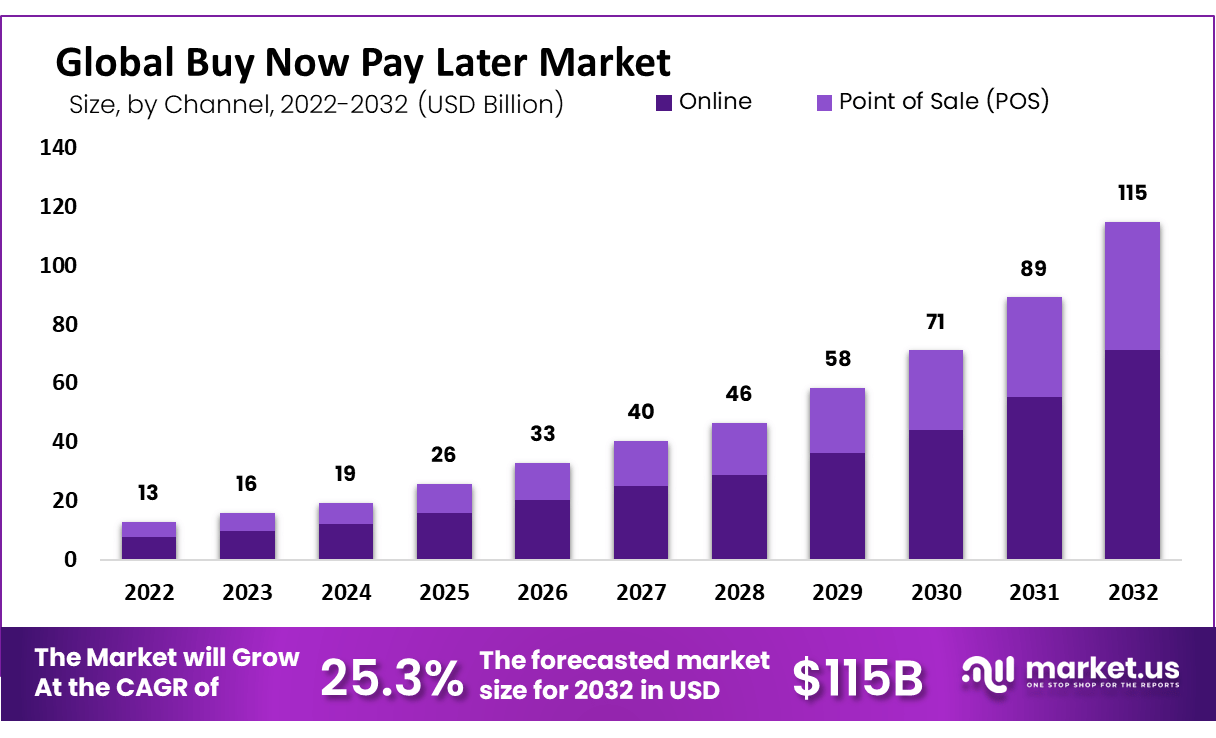

Big fintech players are attracted by the size and potential of the BNPL market. Future Market Insights estimates that the size of the BNPL market is USD 9.1 billion. On the other hand, Fortune Business Insights is up to $30.4 billion. Research and Markets predicts a global market size of $11.7 billion and a Market.US of $16 billion. These numbers do not match. Despite that, the consensus among all the research organizations is that the BNPL market will experience rapid growth. This is good news for one of the biggest players on the market – Affirm. Between 2032 and 2033, organizations expect a CAGR of 20 to 25%. Ten years from now the market may be worth $70 billion or more.

BNPL market growth forecast (Market.US)

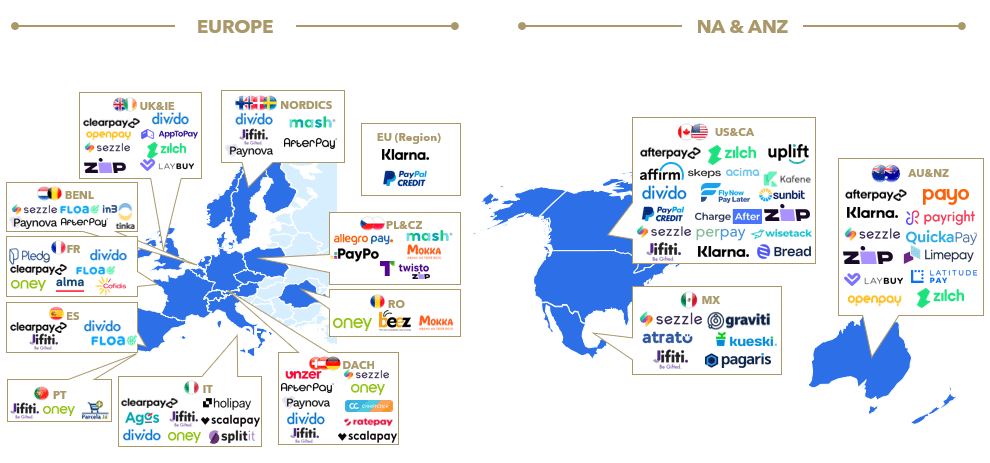

The BNPL market is rapidly expanding, but this fact also attracts competition. Established players such as Affirm, Afterpay, Klarna, and PayPal are not the only ones fighting for customers. The market is budding with new players. Consumers now have a wide array of options for choosing a BNPL provider, making it challenging for companies to retain their existing customer base.

BNPL providers (The PayPers)

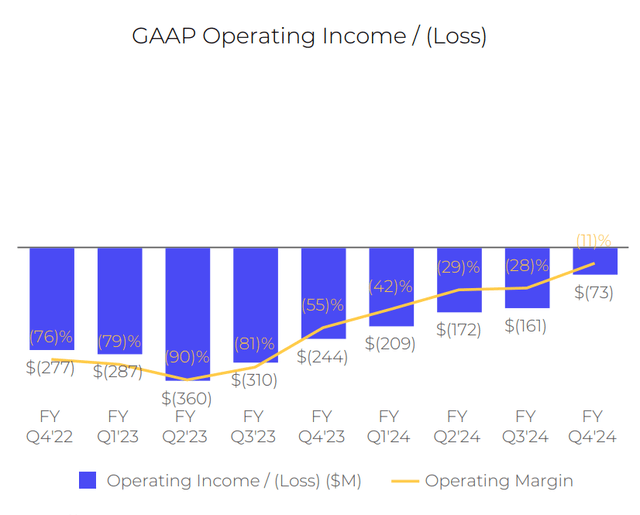

Lack of competitive advantages and intense competition will lead to a price war and constant pressure for innovation, resulting in significant financial costs for Affirm. And let’s not forget that Affirm is not profitable. In fact, over the last nine quarters, Affirm generated a loss of more than $2 billion.

Operating results of Affirm in last quarters (Affirm)

Turning point?

The good news is that profitability is gradually improving and next year could be a turning point when Affirm reaches GAAP profitability. Max Levchin in a Shareholder letter stated:

“It is therefore only appropriate that we set another public goal today: we intend and expect to be profitable on a GAAP basis in our fourth fiscal quarter, and plan to operate the business while maintaining GAAP profitability thereafter.”

I do not doubt that the company will be able to achieve profitability next year. I am concerned with what profit margins Affirm can sustainably do business in the long term. I think given the intense competition it could be somewhere between 7% and 12% depending on the economic cycle. From my point of view, however, in most cases, above-average profit margins are an indicator of business quality. For comparison, the (blended) net profit margin for the S&P 500 for Q1 2024 is 11.5%, which is in line with the year-ago net profit margin and the 5-year average.

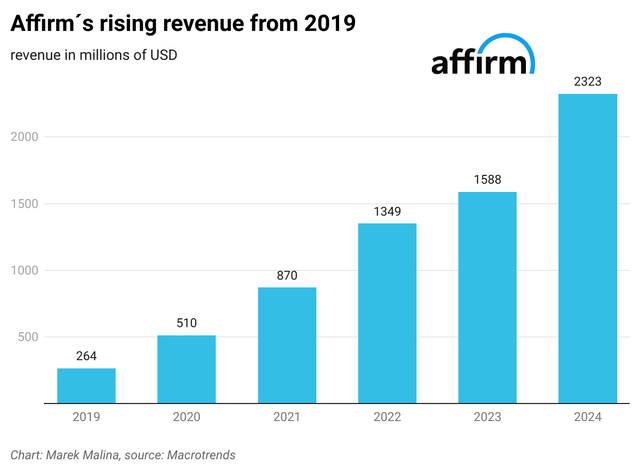

Growth is always the answer

Levchin also expressed the opinion that growth is always the answer, and he picked up excellent numbers the company reached in Q4´24. At the end of the year, Affirm reported a 48% YoY growth of revenues to $659 million in Q4´24. Active consumers excluding the discontinued Returnly business increased 19% YoY to 18.6 million as of June 30, 2024. GMV increased a solid 31% to $7.2 billion and transactions per active consumers are also rising.

Revenue trend (Author)

Active merchant count increased 19% year over year to 303,000 and among them, you will find names such as Amazon (AMZN), Shopify (SHOP), eBay (EBAY), and most recently even Apple (AAPL).

At its Worldwide Developers Conference in June, Apple announced a partnership with Affirm that will launch at the end of this year. Affirm’s payment products are expected to be available to Apple Pay users in the U.S. Shortly after, Apple scrapped its own BNPL service barely a year after its debut.

Investors believe this cooperation with the most valuable company in the world could be a game-changer. Apple Pay is used by more than 500 million users worldwide. Affirm’s CEO said about the deal with Apple that it won’t have a material impact on revenues in fiscal year 2024, but then there is a huge opportunity. If Affirm were to capture at least 1% of the transaction volume on Apple Pay, it could represent billions of dollars in total transactions. If the revenue from these transactions brought the company, for example, a 3% margin (which is the approximate margin of BNPL providers), Affirm could receive hundreds of millions of dollars in revenue.

Huge dilution and risk of regulations

Another red flag for me represents a dilution of shares. Of the $73 million operating loss in Q4´24, $114 million was attributable to enterprise warrant and share-based expenses associated with warrants granted to two enterprise partners, and $65 million to employee stock-based compensation (SBC) expense.

Growth firms often use SBC to attract top talent to their team. Part of the employee’s salary consists of company shares to motivate them to contribute to the company’s success. In this way, the company also saves money regarding cash flow since money does not go out of the business. Even here, however, limits should be set because excessive SBC is not in the interests of shareholders. It has a dilutive effect so existing shareholders lose their stake in the business.

In the case of Affirm, the shares outstanding increased in Q4´24 YoY by 5.3%. SBC decreased by more than a third year-over-year to $65 million but it still accounted for 36% of revenues. At this rate, your stake as a shareholder in the company would be reduced by 30% within 5 years. If the company is profitable, the EPS will be lower due to more shares. At the same time, you can expect that the valuation of shares will also be lower.

Investors should be cautious in the case of the BNPL market also due to possible regulation. As this market grows fast, governments are struggling to respond and protect consumers from potential unfair practices, but the system is stable.

The Consumer Financial Protection Bureau on May 22, 2024, issued an interpretive rule that imposes some of the same regulations on BNPL providers that apply to conventional credit card providers. Specifically, the rule applies to digital user accounts used to access credit, including to those providers that market loans as BNPL. The interpretive rule clarifies that the business practices of providers marketing their loans as BNPL will typically trigger the consumer protections in existing federal law and regulation that apply to traditional credit cards, including those related to billing disputes, refunds for returned products or canceled services, and disclosures such as periodic billing statements.

Some state rules go beyond the federal framework, such as in California. But in general, we can expect to see more regulation in the coming years as BNPL grows in popularity. It is being discussed not only in the USA but also in the UK and Australia.

In my opinion, the regulatory authorities could require BNPL companies to share the evaluation of the creditworthiness for customers, limiting the approval of loans and the obligation to state all relevant information about the risks associated with using BNPL services directly in advertising materials.

While the new market regulations may benefit consumers, they could raise compliance costs for BNPL companies, impacting their profitability. Increased regulatory requirements may also force some companies to change their business models or reduce the availability of interest-free installments. More complex administrative processes and increased regulatory requirements will slow the consumer adoption of BNPL services.

What about the Affirm stock?

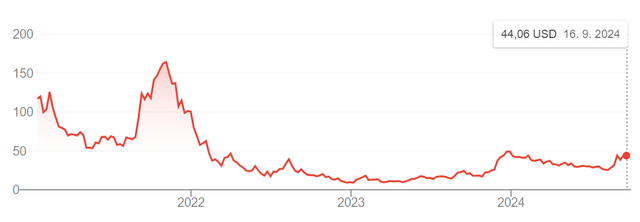

From the all-time high of 164 USD in 2021, the stock is down 70% and -5.5% YTD. It makes them more interesting for investors who consider buying a dip.

Affirm stock trend (Google Finance)

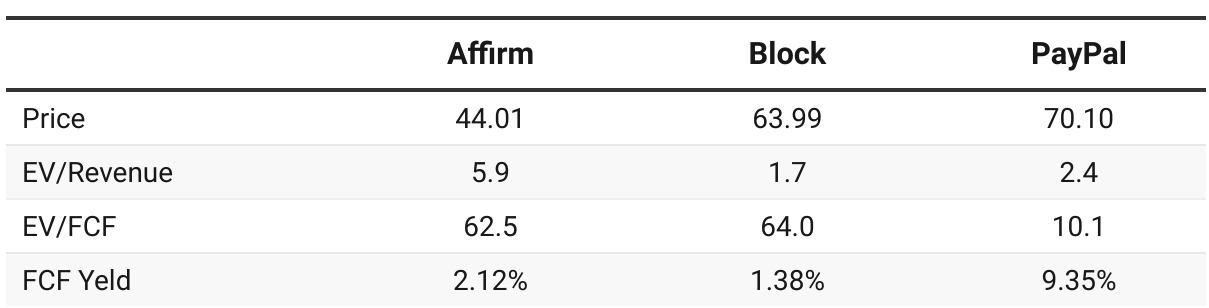

In terms of valuation for smaller growth companies, I’m not a fan of the DCF model because they’re just so inaccurate. I believe it makes much more sense to look at qualitative parameters such as management, market position, product quality, competitive advantage, and development of sales and margins.

Affirm’s stock seems to me to be fairly valued, perhaps even slightly undervalued given the rapid growth in sales and the advised GAAP profitability. Affirm’s enterprise value to revenue ratio is 5.9, which is significantly higher than PayPal and Block, but Affirm has a projected three times higher revenue growth in the next 3 years. Considering the profit margins, and the ability to generate cash flow and profit, I think PayPal is a better choice. PayPal´s FCF yield is 4.4x bigger and don’t forget PayPal is a market leader with a more diversified portfolio.

Valuation of BNPL stocks (Author)

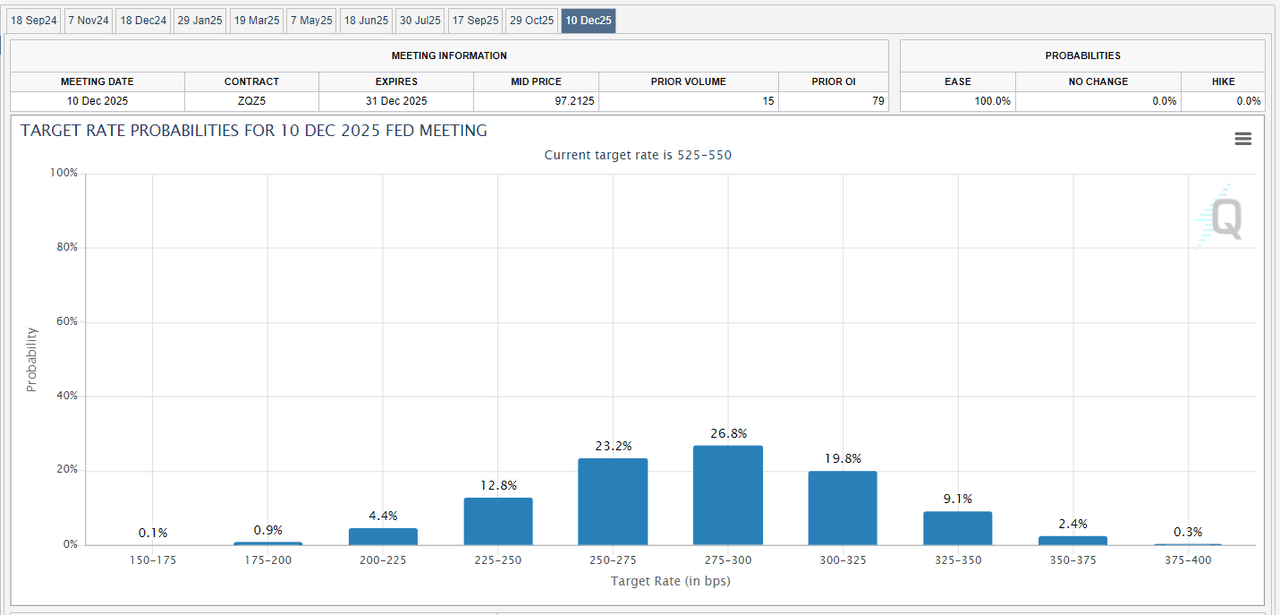

However, Affirm shares may see better times in the short term as the Fed will start to decrease interest rates. At the end of next year, it is most likely that the key interest rate in the US will be somewhere between 2.5% and 3%. Lower interest rates will make business financing cheaper, and it can result in improved profit margins. Cheaper money should be reflected in higher consumer purchases, making sales growth accelerate.

U.S. interest rates forecast (CME Group)

Conclusion

I wouldn’t be surprised if Affirm stock outperforms the market in the following months. However, the absence of a competitive advantage, a crowded market, dilution of shareholders, and the possibility of increasing regulations make Affirm a company that does not fit into my long-term investment strategy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.