Summary:

- I argue that Affirm’s outlook for the next quarter will not positively surprise investors.

- Affirm’s business model is far from reaching self-sustainability, meaning that it’s far from being a profitable enterprise.

- Affirm’s business model has come home to roost.

Kevin Dietsch

Investment Thesis

Affirm (NASDAQ:AFRM) is about to report its Q3 2023 results next Tuesday, after-hours. I argue that investors are not too late to give this investment a miss or even to sell out of their holdings.

There’s a confluence of factors weighing on Affirm’s near-term prospects. Not only are credit markets tightening, which will lead to Affirm not succeeding in rolling off the credit from its balance sheet, but contemporaneously, the Buy Now Pay Later sector has become hyper-competitive.

Furthermore, Affirm is far from reaching GAAP profitability. Even though Affirm makes the case that it’s on the cusp of reaching non-GAAP profitability, I declare that is not the right metric to value this company on.

What Will be the Exit Rate From Q4 2023?

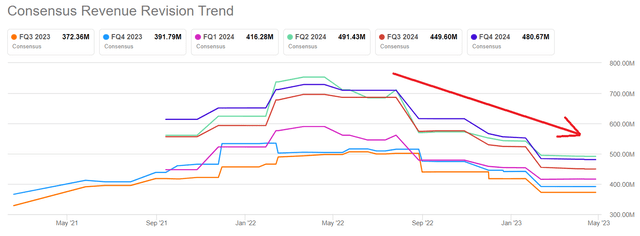

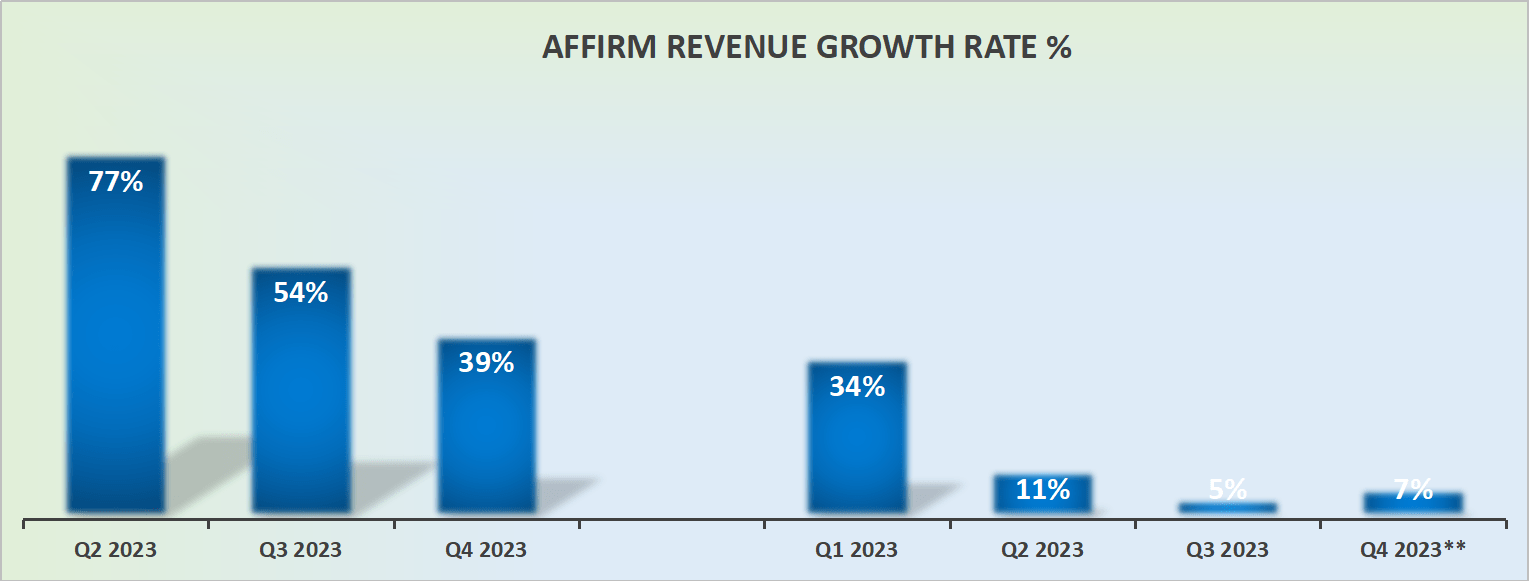

AFRM revenue growth rates

This is my core contention. I don’t believe that Affirm reports in Q3 2023 will change the investment thesis substantially either for the bulls or the bears. My argument is that investors will want to see whether or not Affirm’s Q4 2023 revenue growth rates are upwards revised, and by how much?

Simply put, has Affirm’s revenue growth rates fizzled out and this is now a company that’s just about growing at double-digits on the top line?

And if that’s the case, this immediately forces the next question. What are Affirm’s revenue growth rates likely to stabilize in fiscal 2024 (starting September 2023)?

What you see above is that analysts following the company are steadily downwards revising their revenue outlook for Affirm. I make the case that as an investor, you don’t want to fight the sell side.

Even if there are times when the sell-side consensus view is wrong, those times are generally few and far between. Let me put it another way, that’s not the way to compound wealth, by attempting to bottom-pick a company on the cusp of turning around.

Focus on Affirm’s Balance Sheet

In the past 4 weeks, banks have rapidly tightened up their credit standards. This led Charlie Munger’s comment over the weekend to echo that statement when he said,

Every bank in the country is way tighter on real estate loans today than they were six months ago

While Munger was referencing commercial banks, I believe that this insight goes beyond commercial banks looking to lend to real estate.

Case in point, consider the fact that LendingClub (LC) which has already announced its recent results guided for loan originations in the upcoming quarter to be down from Q4 2022.

Therefore, I can conclude that the canary in the coal mine for Affirm’s results will be on its balance sheet, under a rapid rise in funding debt.

All Focus Moves Beyond the Topline

With time, Affirm’s shine is coming off. That will mean that investors are going to be moving beyond just the topline and be more closely inspecting Affirm’s bottom line profitability.

And that poses a problem for investors. Why? Because Affirm pays its executives with lavish stock-based compensation. But when Affirm’s market value is down more than 70% since last summer, top executives at the company will be eyeing up their take-home compensation and becoming dissatisfied that their compensation package isn’t worth as much as it previously was.

And that starts to weigh on corporate morale. And the only way to improve corporate morale is by highly incentivizing key talent. Otherwise, talented executives will seek to jump ship and move on to other more rewarding opportunities.

Case in point, I believe that Affirm’s prospects of moving towards GAAP profitability will be increasingly pushed back. Even though Affirm has in the recent past articulated its ambitions to reach non-GAAP profitability by the time it exits fiscal 2023, meaning the upcoming quarter.

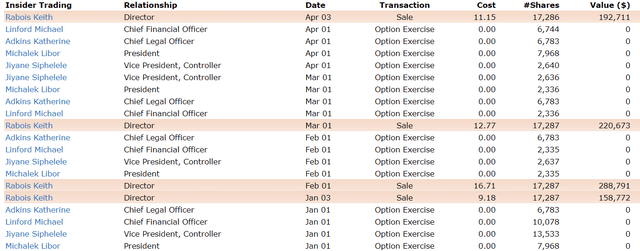

Perhaps, you may feel that my arguments that hold much water? Perhaps, the stock is so tremendously undervalued that asides from retail investors, management is actively purchasing stock in the open market?

The graphic above reveals that since the start of 2023, there’s been a noticeable absence of purchases by management. I’m not saying that management isn’t articulating that the stock is cheap. Only that they are not following up their assertions with their own capital.

The Bottom Line

I make the case that simply because the stock is down substantially in the past several months, as well as down more than 85% since its IPO, this does not mean that the stock is undervalued.

Affirm’s proposition is very compelling and alluring. The problem, in actuality, was that Buy Now Pay Later was too successful, which led to a rapid proliferation of competing products amongst companies that have better production distribution, including PayPal (PYPL) and Apple (AAPL).

With so much competition and a more restrictive credit market, I argue that investors should exit this stock now before it’s too late.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.